Global Defence Spending Market Size, Share, and COVID-19 Impact Analysis, By Spending Type (Personnel Expenditure, Operations & Maintenance, Procurement & Equipment, Research & Development (R&D), and Infrastructure & Facilities), By Application (Land Forces, Naval Forces, Air Forces, Cyber & Electronic Warfare, and Space-based Defence Systems), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Aerospace & DefenseGlobal Defence Spending Market Insights Forecasts to 2033

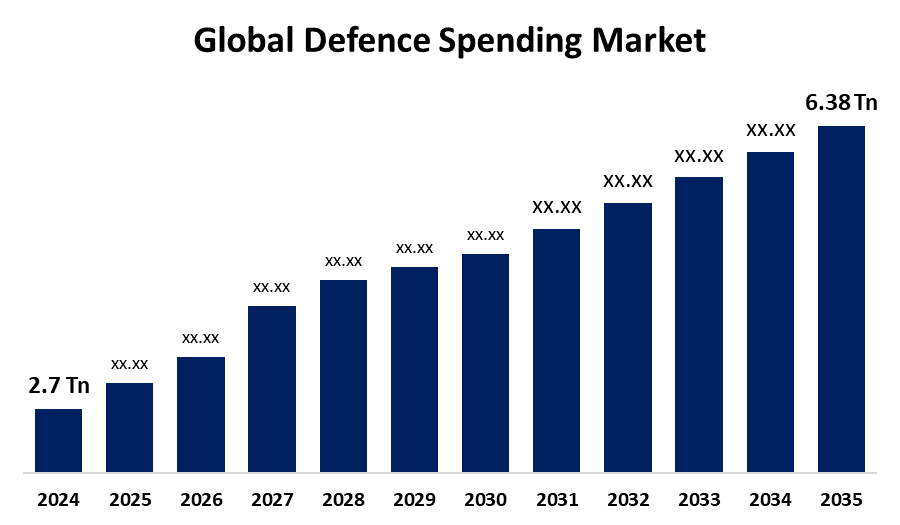

- The Global Defence Spending Market Size Was Estimated at USD 2.7 Trillion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.13% from 2025 to 2035

- The Worldwide Defence Spending Market Size is Expected to Reach USD 6.38 Trillion by 2035

- North America is Expected to Grow the Fastest during the Forecast Period.

Get more details on this report -

The Global Defence Spending Market Size is Expected to cross USD 6.38 Trillion by 2035, Growing at a CAGR of 8.13% from 2025 to 2035. Global defense spending is driven by geopolitical tensions, military modernization, and emerging security threats. Nations are increasing investments in cybersecurity, space-based defense, and AI-driven warfare to enhance strategic capabilities.

Market Overview

The Global defense spending market refers to the total financial expenditures allocated by governments worldwide for military operations, defense technology, and security infrastructure. The rise of regional wars, such as the Israel-Hamas conflict, Russia's war in Ukraine, and the recent geopolitical tensions between India and Pakistan, has prompted nations to bolster their military readiness. Governments are being pressured to prioritize defense budgets to upgrade and enhance military capabilities as a result of these growing threat perceptions. Higher tariffs and legislative support for defense self-reliance in nations like India are also encouraging the production of defense equipment domestically, which is speeding up spending growth as governments turn their attention to indigenization and lowering their reliance on foreign suppliers. These combined reasons have led to the large and ongoing rise of the global defense spending market.

Report Coverage

This research report categorizes the defence spending market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the defence spending market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the defence spending market.

Global Defence Spending Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.7 Trillion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.13% |

| 2035 Value Projection: | USD 6.38 Trillion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Spending Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Lockheed Martin, BAE Systems, Northrop Grumman, Boeing, Raytheon Technologies, General Dynamics, L3Harris Technologies, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the main driving factors behind the surge in global defence spending is the escalating geopolitical instability and resurgence of regional conflicts. Additionally, global defense spending increased by 7.4% in real terms from USD 2.24 trillion in 2023 to USD 2.46 trillion in 2024 in response to growing geopolitical instability and threats to global security. Increased military modernization efforts in strategic regions like Asia, Europe, the Middle East, and North Africa (MENA) are evident in this growth, which is faster than in prior years (6.5 percent in 2023 and 3.5% in 2022). Global defense spending increased to 1.9% of GDP on average in 2024, up from 1.8% in 2023 and 1.6% in 2022. The main causes of this dramatic rise are the worsening international security landscape, the recurrence of local conflicts, and rising threat perceptions, which are pushing countries to make greater investments in bolstering their military readiness and capabilities.

Restraining Factors

Legislative restrictions, financial restraints, and geopolitical changes are some of the causes that limit global defense spending. Budgetary restrictions enforced by the U.S. Fiscal Responsibility Act of 2023 have reduced defense spending in the biggest military market in the world. Governments have also had to reevaluate military spending due to inflationary pressures and economic downturns, giving domestic welfare a higher priority than defense expansion.

Market Segmentation

The defence spending market share is classified into spending type and application.

- The procurement & equipment segment held a significant share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the spending type, the defence spending market is divided into personnel expenditure, operations & maintenance, procurement & equipment, research & development (r&d), and infrastructure & facilities. Among these, the procurement & equipment segment held a significant share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because of ongoing modernization initiatives, geopolitical tensions, and the demand for advanced military capabilities, this market segment is dominant. In order to preserve combat readiness, improve strategic deterrence, and incorporate cutting-edge technology like artificial intelligence (AI), hypersonic weapons, and cyber security systems, nations give procurement top priority.

- The air forces segment accounted for the majority of the share in 2024 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the application, the defence spending market is divided into land forces, naval forces, air forces, cyber & electronic warfare, and space-based defence systems. Among these, the air forces segment accounted for the majority of the share in 2024 and is estimated to grow at a remarkable CAGR during the projected timeframe. High expenditures on fighter jets, unmanned aerial vehicles (UAVs), and sophisticated missile defense systems are what propel this market. Because of its strategic value in contemporary combat, its ability to be deployed quickly, and the development of stealth and hypersonic aircraft, nations place a high priority on air superiority. Furthermore, growing border security worries and geopolitical tensions have spurred ongoing improvements in air combat capabilities.

Regional Segment Analysis of the Defence Spending Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold a significant share of the defence spending market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold a significant share of the defence spending market over the predicted timeframe. The United States continued to be the world's greatest defense spender in 2024, spending $997 billion, or 36.7% of all military spending worldwide. Compared to the combined defense expenditures of the next eight biggest military spenders, this expenditure was far higher. Because of U.S. military modernization initiatives, strategic alliances, and geopolitical responsibilities, North America accounted for the majority of global defense spending on a regional basis. The budget addressed staff costs, space-based defense systems, cybersecurity improvements, and the acquisition of modern weapons. The Pentagon's financial audit also emphasized continuous initiatives to enhance operational preparedness and fiscal efficiency.

Asia Pacific is expected to grow at the fastest CAGR in the defence spending market during the forecast period. Asia-Pacific is the region with the quickest rate of growth, driven by increased defense budgets in China, India, and Japan. Defense spending has increased significantly as a result of China's military buildup, India's modernization initiatives, and worries about regional security. The area is the fastest-growing market due to the quick developments in space-based defense systems, cybersecurity, and AI-driven military applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the defence spending market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lockheed Martin

- BAE Systems

- Northrop Grumman

- Boeing

- Raytheon Technologies

- General Dynamics

- L3Harris Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the defence spending market based on the below-mentioned segments:

Global Defence Spending Market, By Spending Type

- Personnel Expenditure

- Operations & Maintenance

- Procurement & Equipment

- Research & Development (R&D)

- Infrastructure & Facilities

Global Defence Spending Market, By Application

- Land Forces

- Naval Forces

- Air Forces

- Cyber & Electronic Warfare

- Space-based Defence Systems

Global Defence Spending Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the defence spending market over the forecast period?The Global Defence spending Market Size is Growing at 8.13% CAGR from 2025 to 2035.

-

2. What is the market size of the defence spending market?The Global Defence Spending Market Size is expected to cross USD 6.38 trillion by 2035, growing at a CAGR of 8.13% from 2025 to 2035.

-

3. Which region holds the largest share of the defence spending market?North America is anticipated to hold a significant share of the defence spending market over the predicted timeframe.

Need help to buy this report?