Global Decoy Flares Market Size By Type (Pyrotechnic Flares, Pyrophoric Flares, Others), By Application (Fixed Wing, Rotary Wing), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Decoy Flares Market Insights Forecasts to 2033

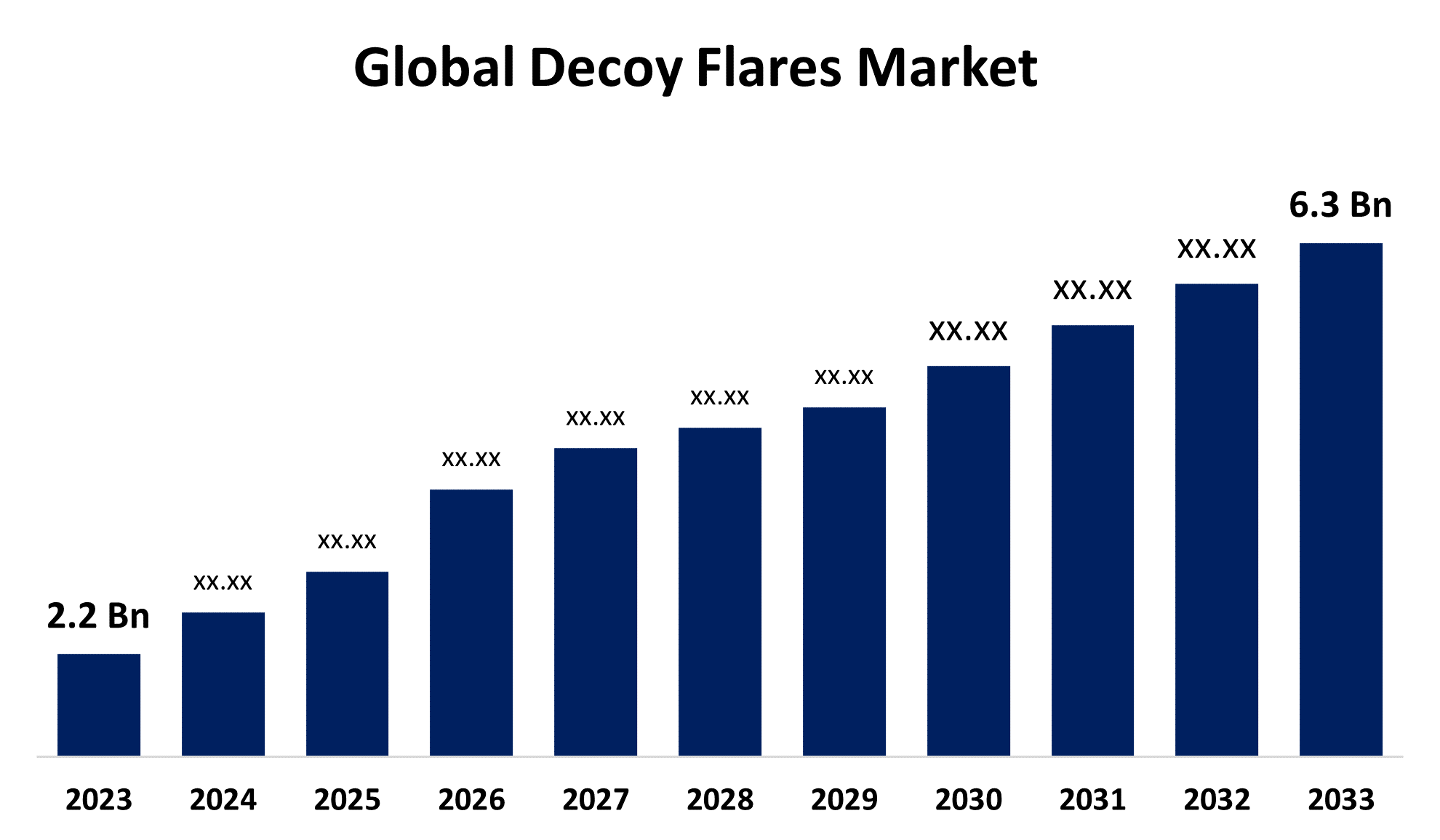

- The Global Decoy Flares Market Size was valued at USD 2.2 billion in 2023.

- The Market Size is Growing at a CAGR of 11.09% from 2023 to 2033

- The Worldwide Decoy Flares Market Size is Expected to reach USD 6.3 billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Decoy Flares Market Size is expected to reach USD 6.3 billion by 2033, at a CAGR of 11.09% during the forecast period 2023 to 2033.

A crucial defensive countermeasure against heat-seeking missiles, the market for decoy flares is predominantly focused on the defence and military sectors. A number of nations have defence modernization programmes that include provisions for updating and outfitting aircraft with cutting-edge self-defense systems, such as decoy flares, in an effort to improve their military prowess. Decoy flare systems are becoming more and more necessary because to the growing threat of infrared-guided missiles, especially from highly technologically capable enemies. The market for decoy flares is anticipated to see ongoing innovation, with an emphasis on creating systems that are more portable, lightweight, and effective at fending off threats from modern missiles. One major trend that is predicted to occur is the integration of decoy flare systems with other electronic warfare (EW) and self-protection systems to give aircraft a complete defensive suite.

Decoy Flares Market Value Chain Analysis

Manufacturers of decoy flares create, develop, and manufacture decoy flare systems. This entails putting electronic parts, structural components, and pyrotechnic materials together to create completed flare products. Decoy flare systems may be integrated onto aircraft platforms after they are manufactured. To guarantee correct installation and integration with aircraft avionics systems, flare manufacturers and aircraft integrators must work together. The storage, shipping, and delivery of decoy flare systems to end users—which can include aerospace contractors, military branches, and defence agencies—fall under the purview of distributors and logistical firms. Decoy flare systems are used by aircraft manufacturers, defence contractors, and military organisations. Decoy flare systems are purchased by military branches and defence agencies to increase military aircraft survivability against threats posed by infrared-guided missiles.

Decoy Flares Market Opportunity Analysis

A major concern to both military and civilian aircraft is the spread of infrared-guided missiles. As a useful countermeasure, decoy flares deflect heat-seeking missiles away from the aircraft that is being targeted. Decoy flare systems are becoming more and more in demand as infrared-guided missiles become more advanced and accessible. To improve their defence capabilities, many nations are funding military modernization initiatives. To lessen the threat presented by missiles, this involves improving aircraft self-protection systems. Modern aircraft self-defense suites are incomplete without decoy flare systems, which presents potential for vendors and manufacturers. Geopolitical tensions, regional conflicts, and the need to improve air defence capabilities are the main drivers of the global demand for decoy flare systems.

Global Decoy Flares Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.09% |

| 2033 Value Projection: | USD 6.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region, By Geographic Scope |

| Companies covered:: | Mil-Spec Industries Corporation, Rheinmetall AG, Owen International, Ordtech, TARA Aerospace AD, LACROIX, Premier Explosives Limited, Elbit Systems Ltd., Armtec Defense Technologies, Rosoboronexport, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Decoy Flares Market Dynamics

A rise in the purchase of air defence systems

Aircraft are seriously threatened by air defence systems, such as man-portable air defence systems (MANPADS) and surface-to-air missiles (SAMs). Enhancing aircraft protection measures, such as the use of decoy flare systems, is necessary in tandem with the rise in air defence system purchases. The increase in the acquisition of air defence systems forces aircraft operators—military and civilian—to make investments in efficient countermeasures to lessen the threat these systems offer. Decoy flares are a crucial part of aircraft self-defense kits because they offer a crucial line of defence against infrared-guided missiles, which are frequently employed in air defence systems. Numerous nations are engaged in military modernization initiatives that encompass the procurement of sophisticated air defence systems.

Restraints & Challenges

Advanced decoy flare systems that are more dependable and effective need a high level of technological know-how. System design, testing, and validation are complicated when pyrotechnic, electronic, and mechanical components are integrated. It can be costly to develop, produce, and maintain decoy flare systems. Advanced decoy flare systems may not be purchased due to cost restrictions in defence budgets, particularly for nations with constrained financial resources or conflicting defence priorities. Systems for decoy flares need to work with current aircraft operations and mission profiles. Decoy flare system efficacy in real-world circumstances can be affected by various factors, including deployment techniques, timing, and environmental conditions. Therefore, operational training and careful planning are necessary.

Regional Forecasts

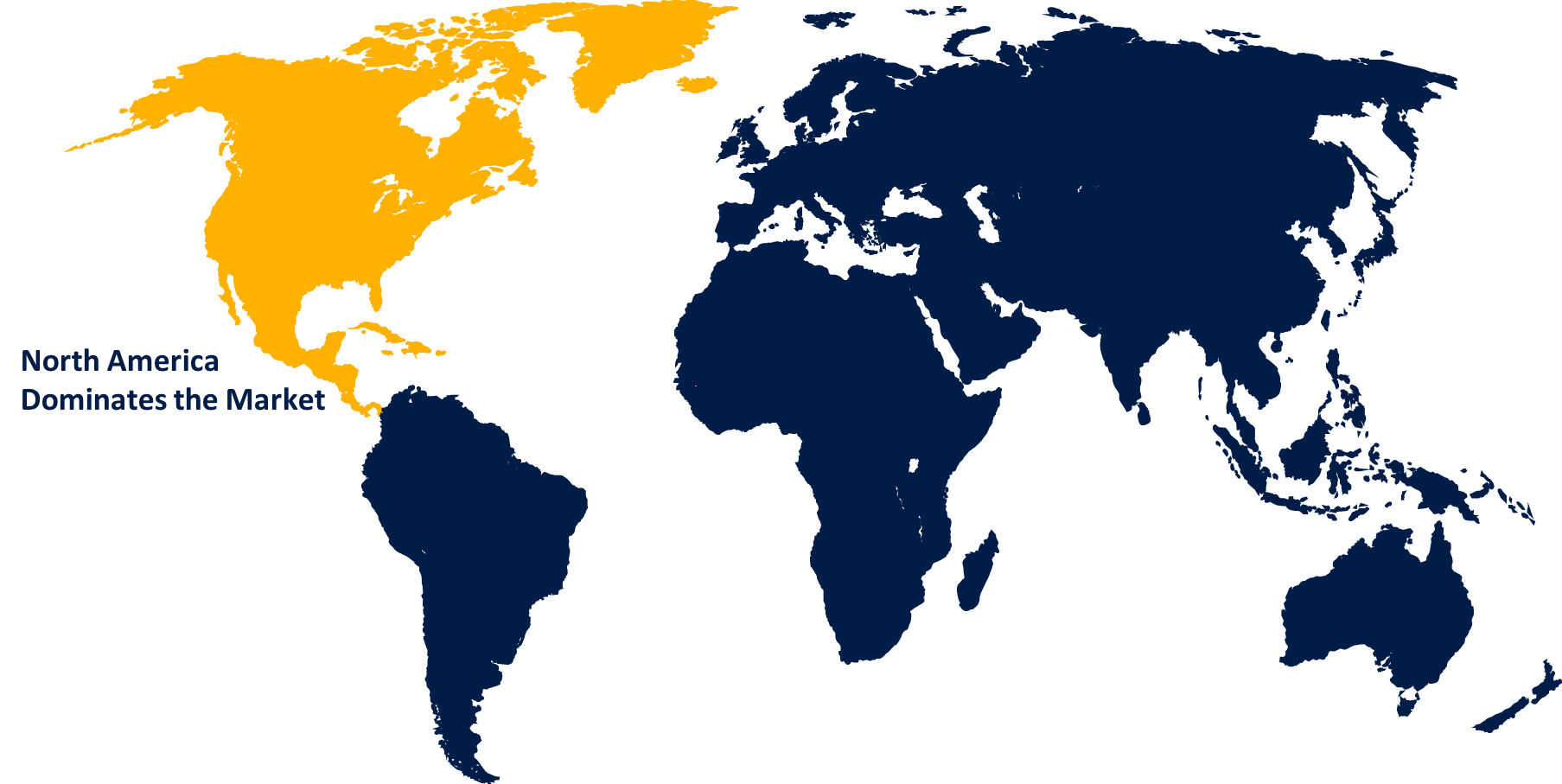

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Decoy Flares Market from 2023 to 2033. The defence budgets of North America, and especially the United States, are among the highest in the world. Funding for defence modernization initiatives includes expenditures in cutting-edge self-defense equipment, such as decoy flare systems, to increase military aircraft survivability against missile threats. Decoy flare technology is being driven by top enterprises and research institutions in the region, which is a hotspot for technological innovation in defence and aerospace. Research and development (R&D) expenditures help to create next-generation decoy flare systems that are more dependable and effective. The armed forces of North America carry out a variety of tasks, including as peacekeeping, training exercises, and combat missions. To deter threats, decoy flare systems are used on a variety of aircraft platforms, such as cargo planes, fighter jets, and helicopters.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. A number of Asia-Pacific nations are engaged in military modernization initiatives aimed at improving defence capacities and tackling new security threats. Included in these modernization efforts to strengthen air defence capabilities are investments in sophisticated self-protection devices, such as decoy flares. Defence budgets in the Asia-Pacific area have increased significantly as a result of rising economic growth and security concerns. Decoy flare providers and manufacturers have prospects because the main defence spending nations in the region are China, India, Japan, South Korea, and Australia. Asia-Pacific nations are looking to increase their market share in the global defence industry. This is especially true for newly developing defence exporters like South Korea and India.

Segmentation Analysis

Insights by Flares Type

The pyrotechnic flares segment accounted for the largest market share over the forecast period 2023 to 2033. In air defence systems, thermoelectric flares are a highly effective countermeasure against heat-seeking missiles. Pyrotechnic flares increase survivability by deflecting incoming missiles' attention from the targeted aircraft with their conspicuous infrared signature. Military aircraft have been using pyrotechnic flares as a regular countermeasure for many years. The market for pyrotechnic flare solutions is driven by their preference for aircraft self-protection systems because to their effectiveness and dependability in deflecting heat-seeking missiles. Many nations have military modernization programmes that include provisions for replacing antiquated pyrotechnic flare solutions in aircraft self-defense systems. The need for pyrotechnic flares to outfit military aircraft rises in tandem with defence budgets' allocation of funding for modernization projects.

Insights by Application

The fixed wing segment is dominating the market with the largest market share over the forecast period 2023 to 2033. For the purpose of modernising and acquiring fixed-wing aircraft for their navies, air forces, and special operations units, numerous nations are making investments in this regard. These aircraft are used for a variety of purposes, such as transport, fighter jet, attack, and reconnaissance platforms. Modern avionics, sensors, and defensive systems are frequently added to fixed-wing aircraft as part of global military modernization programmes. Decoy flare systems are installed onto fixed-wing platforms as part of these programmes to increase their survivability in contested airspace settings. Producers of decoy flare systems and fixed-wing aircraft can export their goods to foreign clients looking to improve their air force capabilities. Global demand is anticipated to surge for fixed-wing aircraft outfitted with cutting-edge self-protection technologies as geopolitical tensions and regional conflicts continue.

Recent Market Developments

- In March 2019, TransDigm Group Incorporated paid USD 3.9 billion to acquire Esterline Technologies Corporation.

Competitive Landscape

Major players in the market

- Mil-Spec Industries Corporation

- Rheinmetall AG

- Owen International

- Ordtech

- TARA Aerospace AD

- LACROIX

- Premier Explosives Limited

- Elbit Systems Ltd.

- Armtec Defense Technologies

- Rosoboronexport

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Decoy Flares Market, Type Analysis

- Pyrotechnic Flares

- Pyrophoric Flares

- Others

Decoy Flares Market, Application Analysis

- Fixed Wing

- Rotary Wing

Decoy Flares Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the Market Size of the Decoy Flares Market?The Global Decoy Flares Market is expected to grow from USD 2.2 billion in 2023 to USD 6.3 billion by 2033, at a CAGR of 11.09% during the forecast period 2023-2033.

-

2.Who are the key market players of the Decoy Flares Market?Some of the key market players of the market are Mil-Spec Industries Corporation, Rheinmetall AG, Owen International, Ordtech, TARA Aerospace AD, LACROIX, Premier Explosives Limited, Elbit Systems Ltd., Armtec Defense Technologies, Rosoboronexport.

-

3.Which segment holds the largest market share?The fixed wing segment holds the largest market share and is going to continue its dominance.

-

4.Which region is dominating the Decoy Flares Market?North America is dominating the Decoy Flares Market with the highest market share.

Need help to buy this report?