Global Debt Arbitration Market Size, Share, and COVID-19 Impact Analysis, By Type (Consumer Debt Arbitration and Business Debt Arbitration), By Service Provider (Law Firms, Debt Arbitration Companies, and Financial Institutions), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Banking & FinancialGlobal Debt Arbitration Market Insights Forecasts to 2035

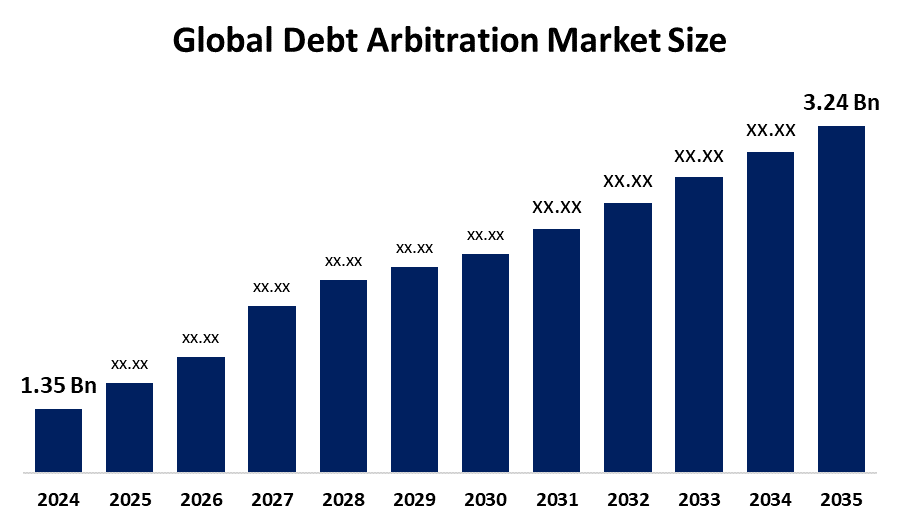

- The Global Debt Arbitration Market Size Was Estimated at USD 1.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.28% from 2025 to 2035

- The Worldwide Debt Arbitration Market Size is Expected to Reach USD 3.24 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Debt Arbitration Market Size was worth around USD 1.35 Billion in 2024 and is predicted to grow to around USD 3.24 Billion by 2035 with a compound annual growth rate (CAGR) of 8.28% from 2025 to 2035. The growing complexity of business and consumer debt, the growing complexity of financial transactions, and a changing legal environment that supports alternative dispute resolution procedures. The need for arbitration services is growing as people and organizations seek effective ways to manage and settle debt disputes, given the ongoing rise in debt loads.

Market Overview

The global debt arbitration market includes an industry that resolves disputes between debtors and creditors through impartial arbitration processes, offering faster and less expensive alternatives to litigation for resolving financial and contractual debt issues. The global debt arbitration business is expanding rapidly due to changing consumer demands and technology breakthroughs. Arbitration is changing due to advancements in digital platforms, blockchain, and artificial intelligence (AI), which increase accessibility, efficiency, and transparency. The arbitration industry is changing quickly; in order to increase efficiency, AAA-ICDR intends to introduce an AI arbiter for construction disputes in November 2025. Blockchain protects records and makes smart contracts possible for smooth enforcement, while AI automates case management and document inspection. Arbitration is becoming more convenient and economical thanks to the growth of Online Dispute Resolution (ODR) platforms, which enable distant participation. Innovation is being promoted, and platform capabilities are being increased through strategic partnerships between tech companies and arbitration businesses.

Leading companies like Freedom Debt Relief and National Debt Relief are leading the way in innovative solutions to improve customer experience with quicker, clearer, and less expensive dispute resolution processes. The debt arbitration market presents opportunities for growth as it becomes more accessible and efficient due to the introduction of blockchain, AI, and digitisation. There is increasing global recognition of arbitration as a more cost-effective alternative to litigation, along with legislation facilitating that process, which fosters partnerships and potentially further growth into unserved areas and new clients. The U.S. Securities and Exchange Commission (SEC) published a guideline in 2025 that permits businesses to include mandatory arbitration clauses in their governing papers, including for cases involving federal securities. The authority of the Federal Arbitration Act and the absence of congressional exemptions have been upheld by legal interpretations. The Securities Act of 1933 and the Exchange Act of 1934's anti-waiver provisions do not apply to current issuers, the SEC confirmed.

Report Coverage

This research report categorizes the debt arbitration market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the debt arbitration market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the debt arbitration market.

Global Debt Arbitration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.35 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.28% |

| 2035 Value Projection: | USD 3.24 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Type, By Service Provider and By Region |

| Companies covered:: | National Debt Relief, Freedom Debt Relief, ClearOne Advantage, Pacific Debt Inc., New Era Debt Solutions, CuraDebt, Accredited Debt Relief, DMB Financial, Century Support Services, DebtWave Credit Counseling, Consolidated Credit Counseling Services, GreenPath Financial Wellness, InCharge Debt Solutions, American Consumer Credit Counseling, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The increasing number of insolvency and bankruptcy cases has highlighted the need for effective debt resolution processes. There has been an increased number of disputes related to debt, a result of increasing consumer debt levels fueled by easy access to credit and changing economic circumstances. This trend has created the need for specialized services to deal with the complexities of modern debt issues. The growth of the market has been assisted by the increased acceptance of arbitration as a legitimate and efficacious method to resolve disputes. Many jurisdictions have established beneficial regulatory environments supporting the arbitral forum based on the advantages of speed, cost efficiency, and confidentiality. An increase in the use of debt arbitration services has also occurred due to the growing industry and consumer recognition of arbitration as a superior process compared to traditional litigation.

Restraining Factors

The lack of knowledge among prospective clients about the availability and advantages of arbitration is a major barrier to the debt arbitration business, which results in underutilization. Another significant issue is the high cost of services, which can be unaffordable for small enterprises and people, even though they are less expensive than litigation. In order to improve accessibility and market acceptance, removing these obstacles calls for focused education, marketing, and creative pricing or financial aid structures.

Market Segmentation

The Debt Arbitration market share is classified into type and service provider.

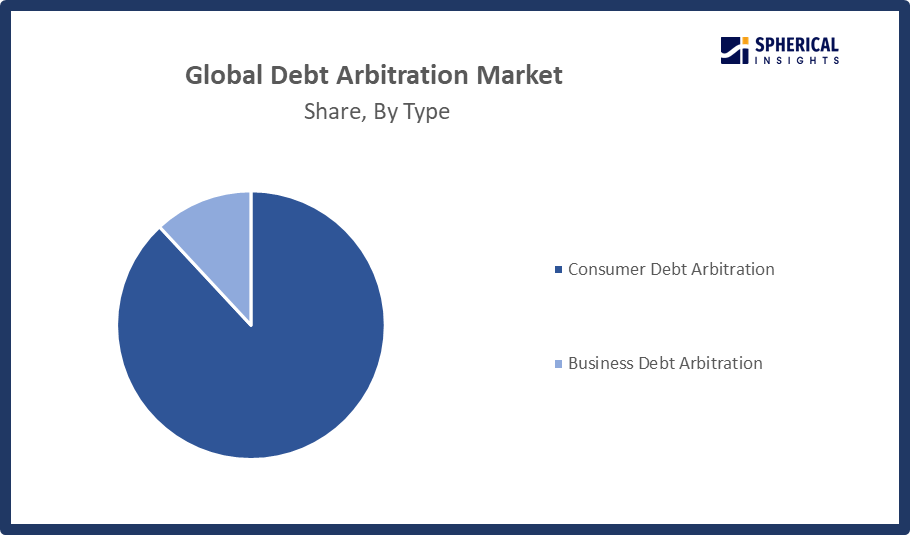

- The consumer debt arbitration segment dominated the market in 2024, approximately 88% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the debt arbitration market is divided into consumer debt arbitration and business debt arbitration. Among these, the consumer debt arbitration segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Consumer debt arbitration provides a workable option for those who want to settle their financial commitments without going through the drawn-out litigation process. It handles disputes about credit card debts, hospital expenses, and personal loans. Increased consumer debt and financial distress among people, which are made worse by economic downturns and increased living expenses in many areas, are the main causes of the growth in consumer debt arbitration.

Get more details on this report -

- The law firms segment accounted for the largest share in 2024, approximately 65% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the service provider, the debt arbitration market is divided into law firms, debt arbitration companies, and financial institutions. Among these, the law firms segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Law firms are important players in the industry because they use their legal knowledge to provide arbitration services that are firmly based on compliance and legal frameworks. These firms are favoured by customers with sophisticated financial problems because they frequently manage difficult situations that call for a detailed understanding of legal precedents and laws.

Regional Segment Analysis of the Debt Arbitration Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share with approximately 38.5% of the Debt Arbitration market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the debt arbitration market over the predicted timeframe. The debt arbitration market's regional outlook shows that different geographic regions have varied dynamics, each impacted by unique regulatory frameworks, economic conditions, and cultural perspectives on debt resolution. The market is well-established in North America, propelled by high consumer debt levels and a robust judicial system that encourages the use of alternative dispute resolution techniques. It is anticipated that the area will continue to grow steadily. Given its thriving financial sector and the growing use of arbitration services by both consumers and corporations, the United States, in particular, has played a significant role in this rise.

Asia Pacific is expected to grow the fastest market share with approximately 29.3% at a rapid CAGR in the debt arbitration market during the forecast period. With the region's fast economic development, increasing financial literacy and the growth of financial services, the debt arbitration market has substantial growth potential in the Asia Pacific region. In developing economies, such as China, India, and Southeast Asian countries, where consumer and commercial debt are increasing, arbitration services are rapidly gaining popularity. More individuals and businesses are looking for quick and inexpensive alternatives to resolve their debts. The growth of digital infrastructure in the region will support the development and widespread use of online arbitration platforms. This will add to the potential for market expansion.

Europe is expected to grow at a rapid CAGR in the debt arbitration market during the forecast period. The region's varied financial systems and complicated economic environment, the European market is distinguished by a high demand for arbitration services from both individuals and businesses. Leading the way are nations like the UK, Germany, and France, where a variety of arbitration services are provided by financial institutions and legal businesses. It is anticipated that the area will increase moderately.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the debt arbitration market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- National Debt Relief

- Freedom Debt Relief

- ClearOne Advantage

- Pacific Debt Inc.

- New Era Debt Solutions

- CuraDebt

- Accredited Debt Relief

- DMB Financial

- Century Support Services

- DebtWave Credit Counseling

- Consolidated Credit Counseling Services

- GreenPath Financial Wellness

- InCharge Debt Solutions

- American Consumer Credit Counseling

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Mandatory arbitration clauses for federal securities claims were adopted by the U.S. Securities and Exchange Commission (SEC), enabling businesses to expedite dispute resolution procedures. It is anticipated that this regulation change will increase the use of arbitration in the debt and financial industries nationwide.

- In September 2025, Presolv360, an online dispute resolution (ODR) platform, launched an AI-assisted debt arbitration module, enabling remote filings, automated document review, and faster settlement for cross-border debt disputes. This development reflects the growing trend of digitalization in debt resolution services.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the debt arbitration market based on the below-mentioned segments:

Global Debt Arbitration Market, By Type

- Consumer Debt Arbitration

- Business Debt Arbitration

Global Debt Arbitration Market, By Service Provider

- Law Firms

- Debt Arbitration Companies

- Financial Institutions

Global Debt Arbitration Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Debt Arbitration market over the forecast period?The global Debt Arbitration market is projected to expand at a CAGR of 8.28% during the forecast period.

-

2. What is the market size of the Debt Arbitration market?The global Debt Arbitration market size is expected to grow from USD 1.35 Billion in 2024 to USD 3.24 Billion by 2035, at a CAGR of 8.28% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Debt Arbitration market?North America is anticipated to hold the largest share of the Debt Arbitration market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Debt Arbitration market?National Debt Relief, Freedom Debt Relief, ClearOne Advantage, Pacific Debt Inc., New Era Debt Solutions, CuraDebt, Accredited Debt Relief, DMB Financial, Century Support Services, and DebtWave Credit Counselling.

-

5. What factors are driving the growth of the Debt Arbitration market?The need for quicker and more affordable debt resolution, the rise in consumer and business debt, the growing use of arbitration clauses in contracts, the growing awareness of alternative dispute resolution, and the supportive legal frameworks in major markets are some of the major factors propelling the debt arbitration market.

-

6. What are the market trends in the Debt Arbitration market?Rising corporate preference for arbitration over litigation, the expansion of Asia-Pacific as an arbitration hub, the growing complexity of sovereign debt restructuring driving demand for specialised dispute resolution, the growing adoption of AI for efficiency, and the growth of online arbitration platforms are some of the key trends in the debt arbitration market.

-

7. What are the main challenges restricting wider adoption of the Debt Arbitration market?Wider acceptance of debt arbitration is hampered by a number of issues, including poor awareness among individuals and businesses, expensive service fees, restricted access for small firms, complex legal issues, and doubts about the impartiality of arbitration.

Need help to buy this report?