Global Data Center Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Data Center Infrastructure Management Software, and Services), By Data Center Type (Colocation, Hyperscale, Edge, and Others), By Tier Level (Tier 1 and Tier 2, Tier 3, and Tier 4), By Data Center Size (Small, Medium, and Large), By Industry (BFSI, IT & Telecom, Healthcare, Government, Manufacturing, Retail & E-commerce, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Data Center Market Insights Forecasts to 2035

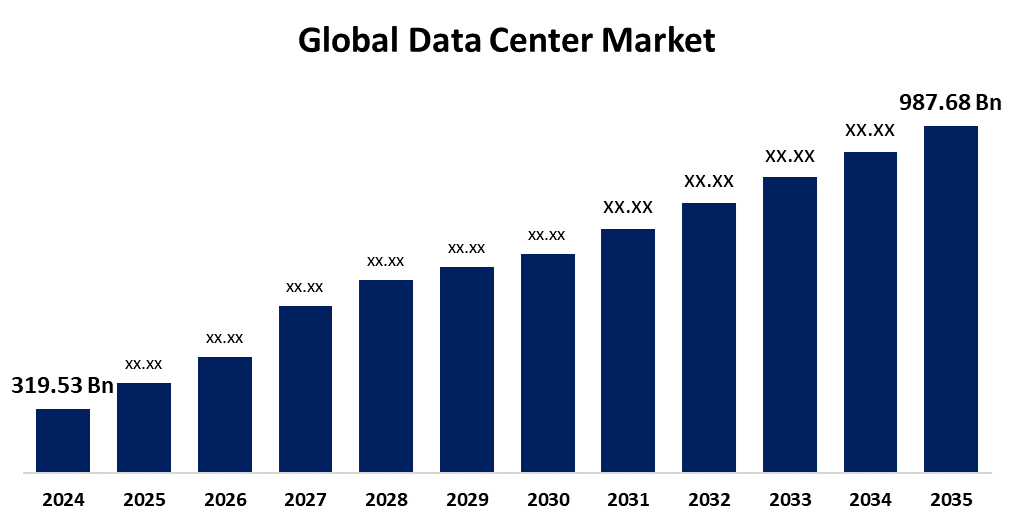

- The Global Data Center Market Size Was Estimated at USD 319.53 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.80% from 2025 to 2035

- The Worldwide Data Center Market Size is Expected to Reach USD 987.68 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global data center market size was worth around USD 319.53 billion in 2024 and is predicted to grow to around USD 987.68 billion by 2035 with a compound annual growth rate (CAGR) of 10.80% from 2025 and 2035. The rapidly evolving to meet the demands of digital transformation and emerging technologies. With strong investments and 5 G-driven edge expansion, it is set to become a global data infrastructure hub.

Market Overview

The data center market refers to the location where businesses gather, process, store, and distribute vast amounts of data. It is furnished with networked computers, storage systems, and associated infrastructure. The data center supports business applications, data storage, and communications by acting as a central location for essential IT processes and services.

To meet the increasing demand from e-Government projects and citizen-centric digital services, the National Informatics Centre (NIC) has built a strong network of National Data Centers (NDCs) and State Data Centers as part of India's drive toward digital governance and infrastructure modernization. With its ability to support services in e-governance, corporate IT, cloud computing, social media, streaming, and AI/IoT platforms, data centers are the foundation of India's digital revolution. With the help of robust infrastructure, government incentives, and growing demand, India is currently becoming a global data center hub due to its rapid digital transformation.

Data centers are essential pieces of infrastructure for the digital age since the AI boom is creating an unprecedented demand for processing power. It is estimated that global capital expenditures for compute power would reach $6.7 trillion by 2030, of which $5.2 trillion will be needed to handle workloads related to artificial intelligence. Rapid advancements in chip design and AI efficiency are expected to be counterbalanced by growing experimentation and scalability requirements. Investment in data center infrastructure will rise in tandem with the demand for AI-powered apps, posing risks as well as possibilities for all parties involved in the compute value chain.

Rapid digital usage, attractive pricing, and government initiatives for data localization and sustainability make the data-center sector incredibly promising. Particularly in tier 2 cities, the growth of AI, 5G, and IoT is driving demand for edge and hyperscale data centers, opening up opportunities for investment in managed services, green energy, and infrastructure. India is positioned to become a major hub for digital infrastructure in the Asia-Pacific area, with capacity expected to quadruple by 2026 and increased demand worldwide.

Report Coverage

This research report categorizes the data center market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the data center market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the data center market.

Global Data Center Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 319.53 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.80% |

| 2035 Value Projection: | USD 987.68 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Component, By Data Center Type, By Tier Level, By Data Center Size, By Industry, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Comarch SA (Poland), Alibaba Cloud, Tencent Cloud, Amazon Web Services, Inc., Oracle, AT&T Intellectual Property, NTT Communications Corporation, Lumen Technologies (CenturyLink), Microsoft, China Telecom Americas, Inc., IBM Corporation, CoreSite, Google Cloud, CyrusOne, Equinix, Inc., Others and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Strong data infrastructure is becoming more and more necessary as a result of the digital transformation boom. One of the main forces behind this expansion is the use of cloud computing in private, public, and hybrid forms. Data center investments are increasing to provide scalable and effective digital operations. The proliferation of edge data centers is being driven by the implementation of 5G and the demand for reduced latency. For real-time applications like autonomous technology and smart cities, edge facilities are essential. The ecosystem of data centers in India is well-positioned for long-term expansion, innovation, and worldwide significance.

Restraining Factors

A substantial upfront investment is needed for the data center's infrastructure, which includes network equipment, IT gear, real estate, and power and cooling systems. For startups or SMEs with little funding, this first large investment may be a deterrent. Additionally, this institution has substantial operating expenditures for staffing, maintenance, security, cooling, and power. Since rising operating costs can put a strain on the budget and lower data center operations' profitability, these expenses can add up for big businesses.

Market Segmentation

The data center market share is classified into component, data center type, tier level, data center size, and industry.

- The hardware segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the component, the data center market is divided into hardware, data center infrastructure management software, and services. Among these, the hardware segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by it offers the framework for creating dependable, high-performing infrastructure to meet the demands of contemporary computing, from established enterprise applications to cutting-edge technologies like big data analytics and artificial intelligence. Additionally, this gear can be scaled up or down to accommodate fluctuating demands, enabling businesses to increase their processing capacity as needed without experiencing prolonged downtime.

- The colocation segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the data center type, the data center market is divided into colocation, hyperscale, edge, and others. Among these, the colocation segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to tenants being able to rapidly and effectively grow their IT infrastructure in response to shifting business needs through the various scalability options that colocation facilities offer. Building and sustaining a private data storage facility requires less upfront capital investment when infrastructure resources are shared with other tenants. Furthermore, colocation providers can provide affordable security and connectivity solutions due to economies of scale, which lowers operating costs for tenants.

- The tier 3 segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the tier level, the data center market is divided into tier 1 and tier 2, tier 3, and tier 4. Among these, the tier 3 segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to redundant network connectivity across several carriers and ISPs, which guarantees a variety of robust communication channels. This reduces the possibility of network disruptions and guarantees dependable connectivity for services and applications that are essential to the mission.

- The large segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the data center size, the data center market is divided into small, medium, and large. Among these, the large segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to tenants who can create high-speed, low-latency connections to their preferred carriers and cloud platforms through their access to a variety of network service providers, cloud providers, and internet exchanges. This facilitates hybrid cloud and multi-cloud deployments, expands connectivity options, and boosts network performance.

- The IT and telecom segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the industry, the data center market is divided into BFSI, IT & telecom, healthcare, government, manufacturing, retail & e-commerce, and others. Among these, the IT and telecom segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by initiatives for digital transformation that are being undertaken by telecom and IT firms to update their services, apps, and infrastructure. By offering the processing power, storage space, and networking capabilities required to implement new technologies and provide cutting-edge digital services, data centers contribute significantly to these efforts.

Regional Segment Analysis of the Data Center Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the data center market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the data center market over the predicted timeframe. The region's demand for data centers has increased due to the quick uptake of cloud services, artificial intelligence, and big data applications. Businesses are using generative AI and other cutting-edge technologies more and more, which calls for stronger infrastructure and improved data processing capabilities. Market expansion is fueled by significant investments from major players like Cisco, IBM, Schneider Electric, and others.

Asia Pacific is expected to grow at a rapid CAGR in the data center market during the forecast period. Higher growth in the area increased demand for data center capacity worldwide, and this trend is predicted to continue, with total supply going from 11.1 GW in 2023 to 26.7 GW by 2028. Furthermore, Indonesia has emerged as a crucial market due to its expanding population and rising digital demands. Hyperscale data centers are being developed with significant expenditures, especially in Jakarta and Eastern Java.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the data center market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Comarch SA (Poland)

- Alibaba Cloud

- Tencent Cloud

- Amazon Web Services, Inc.

- Oracle

- AT&T Intellectual Property

- NTT Communications Corporation

- Lumen Technologies (CenturyLink)

- Microsoft

- China Telecom Americas, Inc.

- IBM Corporation

- CoreSite

- Google Cloud

- CyrusOne

- Equinix, Inc.

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Alibaba Cloud, Alibaba Group's digital technology subsidiary, constructed its second data center in Thailand to accommodate rising demand for cloud computing services, notably generative AI applications. The new facility strengthens local capabilities and complements the Thai government's initiatives to foster digital innovation and sustainable technologies. The data center strives to handle industry-specific difficulties by providing a variety of services such as elastic computing, storage, databases, security, networking, data analytics, and artificial intelligence.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the data center market based on the below-mentioned segments:

Global Data Center Market, By Component

- Hardware

- Data Center Infrastructure Management Software

- Services

Global Data Center Market, By Data Center Type

- Colocation

- Hyperscale

- Edge

- Others

Global Data Center Market, By Tier Level

- Tier 1 and Tier 2

- Tier 3

- Tier 4

Global Data Center Market, By Data Center Size

- Small

- Medium

- Large

Global Data Center Market, By Industry

- BFSI

- IT & Telecom

- Healthcare

- Government

- Manufacturing

- Retail & E-commerce

- Others

Global Data Center Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the data center market over the forecast period?The global data center market is projected to expand at a CAGR of 10.80% during the forecast period.

-

2. What is the market size of the data center market?The global Data Center market size is expected to grow from USD 319.53 Billion in 2024 to USD 987.68 Billion by 2035, at a CAGR of 10.80% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the data center market?North America is anticipated to hold the largest share of the data center market over the predicted timeframe.

Need help to buy this report?