Global Data Business in Oil and Gas Market Size, Share, and COVID-19 Impact Analysis, By Component (Big Data, Data Management, and Direct Data Monetization), By Application (Upstream, Midstream, and Downstream), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Data Business in Oil & Gas Market Insights Forecasts to 2035

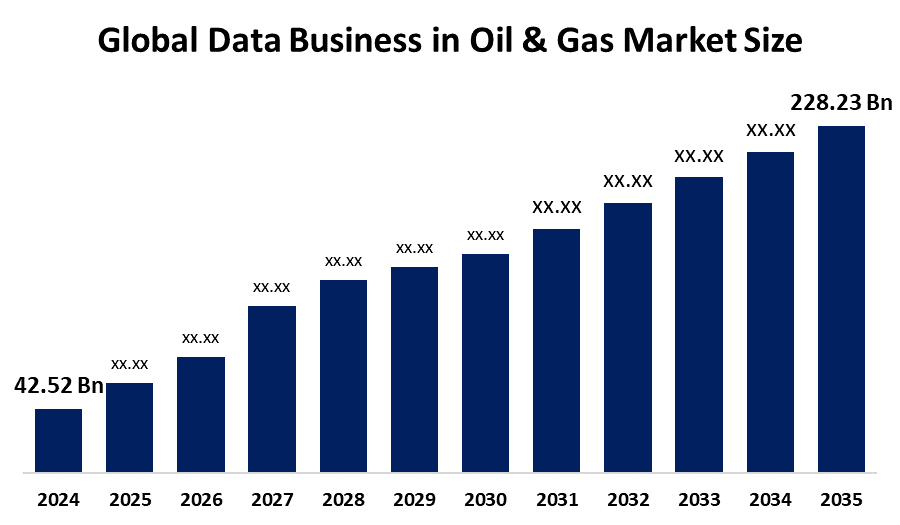

- The Global Data Business in Oil & Gas Market Size Was Estimated at USD 42.52 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.5% from 2025 to 2035

- The Worldwide Data Business in Oil & Gas Market Size is Expected to Reach USD 228.23 Billion by 2035

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Data Business in Oil & Gas Market Size was worth around USD 42.52 Billion in 2024, growing to USD 49.62 Billion in 2025, and is predicted to grow to around USD 228.23 Billion by 2035 with a compound annual growth rate (CAGR) of 16.5% from 2025 to 2035. The data business in the oil and gas data market is growing as firms look for improved operational effectiveness and make the most of digital technologies such as AI and big data analytics. The technologies improve risk management, predictive maintenance, and decision-making, ensuring optimized costs and enhanced performance in upstream, midstream, and downstream operations in the face of increasing data volumes.

Global Data Business in Oil & Gas Market Forecast and Revenue Outlook

- 2024 Market Size: USD 42.52 Billion

- 2025 Market Size: USD 49.62 Billion

- 2035 Projected Market Size: USD 228.23 Billion

- CAGR (2025-2035): 16.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The data business in the oil and gas market refers to the gathering, administration, analysis, and use of vast amounts of data created during exploration, production, refining, and distribution activities. The data is utilized in order to improve resolution, optimize processes, minimize cost, and increase safety and effectiveness along the value chain. Uses involve real-time surveillance, predictive maintenance, reservoir simulation, and drilling optimization. Complexified. The key drivers are the increasing demand for operational efficiency, the increasing complexity of oilfield operations, and the widening application of higher order digital technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics.

Opportunities are expanding as oil and gas organizations are spending on digital transformation to stay competitive, especially in remote operations and sustainability initiatives. The major players in this space are Schlumberger, Halliburton, Baker Hughes, IBM, Microsoft, and Amazon Web Services, which provide data solutions that are compatible with upstream, midstream, and downstream operations. Government initiatives towards the promotion of digital innovation, reduction of carbon footprints, and the preservation of energy security are also adding to the development of the market. For instance, digital infrastructure spending and smart energy initiatives are driving the uptake of data-intensive solutions throughout the industry.

Key Market Insights

- North America is expected to account for the largest share in the data business in oil & gas market during the forecast period.

- In terms of component, the big data segment is projected to lead the data business in oil & gas market throughout the forecast period

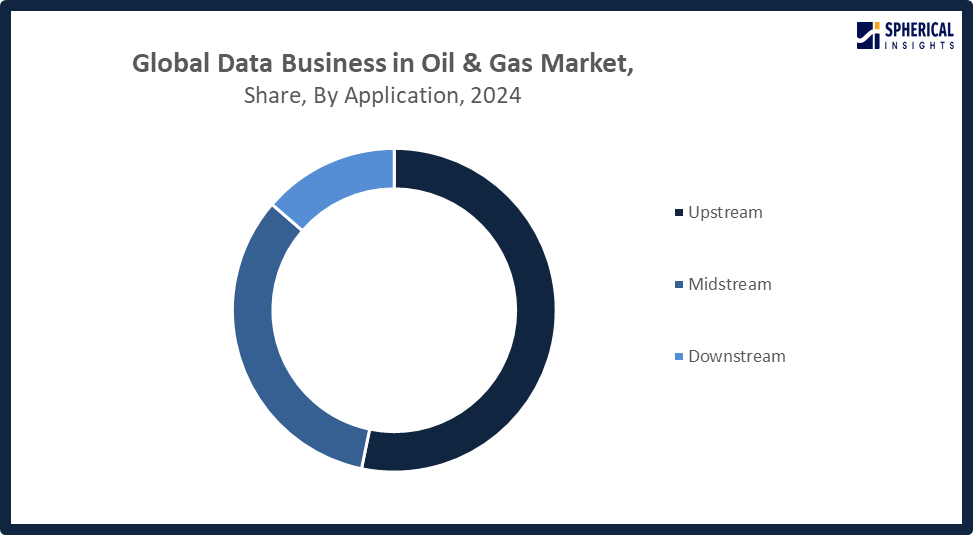

- In terms of application, the upstream segment captured the largest portion of the market

Data Business in Oil & Gas Market Trends

- Big data analytics is driving smarter exploration and production decisions in the oil & gas industry.

- Digital twins are gaining traction for simulation and operational planning.

- IoT devices are expanding real-time monitoring capabilities in remote and offshore locations.

- AI and machine learning are being increasingly used for predictive maintenance and anomaly detection.

- Cloud platforms are enabling scalable, secure data storage and faster processing.

Report Coverage

This research report categorizes the data business in oil & gas market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the data business in oil & gas market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the data business in the oil & gas market.

Global Data Business in Oil and Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 42.52 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.5% |

| 2035 Value Projection: | USD 228.23 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 219 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Component, By Application and By Region |

| Companies covered:: | IBM Corporation, SAP SE, Accenture, Oracle Corporation, Microsoft Corporation, Cloudera, Inc., Hitachi, Hortonworks, Inc., Baker Hughes Company, Cisco Systems, Schlumberger, Palantir Technologies Inc., Tableau Software LLC, Hewlett Packard Enterprise, and Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The oil & gas data business is fueled by main drivers including increasing demand for efficiency, digital transformation, big data adoption, AI integration, and live monitoring. Increasing demand for efficiency compels companies to streamline resources and reduce costs. Digital transformation supports automation and intelligent workflows. Big data adoption assists in processing huge amounts of geological and operational data. AI integration enhances predictions and resolution. Real-time monitoring improves safety, performance, and equipment reliability through the capability to respond instantly to changes in operation and problems.

Restraining Factor

Major limiting factors for the worldwide oil and gas data business are high costs of implementation, data security threats, a shortage of skilled human resources, and resistance to computer adoption. High costs of implementation deter investment in sophisticated data systems. Data security threats, shortage of skilled human resources, and resistance to computer adoption also limit development, since conventional practices still dominate the oil and gas industry.

Market Segmentation

The global data business in oil & gas market is divided into component and application.

Global Data Business in Oil & Gas Market, By Component:

What factors are driving the anticipated growth of the big data segment during the forecast period?

The growth in the big data segment is expected to be boosted by rising volumes of data from production and exploration, rising use of AI and machine learning, and the demand for real-time analysis. Business firms are using big data to improve operational effectiveness, cut costs, and enable predictive maintenance across oil and gas activities.

The data management segment in the data business in oil & gas market is expected to grow at the fastest CAGR over the forecast period. The growth of the data management segment is fueled by the rise in data complexity, the necessity for convenient storage and access, compliance with regulations, and the growing deployment of cloud and digital technology in oil and gas activities.

Global Data Business in Oil & Gas Market, By Application:

Why did the upstream segment account for the largest share of the data business in oil & gas market in 2024?

The upstream segment is leading due to vast data generation through exploration, drilling, and production operations. Its imperative requirement of advanced analytics, real-time monitoring, and predictive technologies for business optimization and cost cutting led to major investment in data solutions by this segment.

Get more details on this report -

The midstream segment in the data business in oil & gas market is expected to grow at the fastest CAGR over the forecast period. The fastest growth in the midstream segment is fueled by rising demand for monitoring of pipelines, real-time analytics of data, asset management, and the use of IoT technologies to promote safety, efficiency, and compliance with regulations in transportation operations.

Regional Segment Analysis of the Global Data Business in Oil & Gas Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Data Business in Oil & Gas Market Trends

Why is North America expected to dominate the global data business in oil & gas market during the forecast period?

North America leads the data business in the oil & gas sector due to its sophisticated technology infrastructure, early digital solution adoption, and robust base of leading oil and gas firms. The region appreciates high investment in big data analytics, AI, and IoT, which improve operational efficiency and safety. Supportive government policies, as well as growing focus on data-driven resolution, further spur market growth in North America.

What factors influence the U.S. oil & gas data market trends?

U.S. oil & gas data market trends are shaped by technological innovation, regulatory policy, digitalization uptake, operational efficiency demands, and spending on AI, big data analytics, and IoT solutions.

Asia Pacific Data Business in Oil & Gas Market Trends

What factors are driving the rapid growth of the data business in oil & gas market in the Asia Pacific?

The emerging data business growth in the Asia Pacific oil & gas market is fueled by some major drivers. Rise in exploration and production in nations such as China and India creates enormous volumes of data, and the need for sophisticated data analytics is driven by it. The region's increased uptake of digital technologies such as AI, IoT, and cloud computing improves the efficiency and safety of operations. Government policies driving digital transformation, infrastructure investments, and an increasing emphasis on sustainability and predictive maintenance further drive the market's rapid growth.

What are the growth drivers in India’s oil & gas data business?

India's oil & gas data growth is spurred by growing exploration activities, growing digitalization, government initiatives for technology integration, rising investments in AI and big data analytics, and the requirement for better operational efficiency and predictive maintenance.

What are the key trends in China’s oil & gas data business?

Major trends in China's oil & gas data industry are escalating digitalization, expanded application of AI and big data analytics, rising exploration activities, IoT technology adoption, and government assistance for modernization of the industry.

Why is the data business in Japan’s oil & gas market evolving?

Japan's oil & gas data industry is changing on account of expanding digital adoption, government assistance for energy innovation, the necessity for operational effectiveness, and technologies related to AI and IoT evolving in the industry.

Europe Data Business in Oil & Gas Market Trends

Major growth drivers for Europe's oil & gas data business are the growing uptake of digital technologies such as AI, big data analytics, and IoT to improve operational efficiency and safety. Stringent regulatory and environmental compliance compel companies to optimize processes. On top of that, investment in renewable energy integration and sustainability further fuels the demand for sophisticated data solutions in the region.

What are the key growth drivers in Europe’s oil & gas data business?

What are the key trends in the U.K.’s oil & gas data business?

Some of the key trends in the U.K.'s oil & gas data industry are growing digitalization, uptake of AI and analytics, focus on sustainability, compliance with regulations, and investments in data-centric solutions for operational effectiveness and safety enhancements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global data business in oil & gas market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Data Business in Oil & Gas Market Include

- IBM Corporation

- SAP SE

- Accenture

- Oracle Corporation

- Microsoft Corporation

- Cloudera, Inc.

- Hitachi

- Hortonworks, Inc.

- Baker Hughes Company

- Cisco Systems

- Schlumberger

- Palantir Technologies Inc.

- Tableau Software LLC

- Hewlett Packard Enterprise

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In September 2025, at SPLUNK.CONF, Cisco introduced Splunk Federated Search for Snowflake, enabling seamless querying across Splunk and Snowflake. This integration supports an open data ecosystem and accelerates insights by combining operational and business data.

- In May 2025, Baker Hughes announced the launch of Flame Tracker Increased Low Gain (ILG), an advanced flame detection technology designed to improve flame sensing capabilities on gas turbines.

- In April 2025, S&P Global launched AI agent capabilities integrated with Microsoft 365 Copilot, leveraging its Commodity Insights AI Ready Data to deliver advanced insights for the commodities, energy, and energy transition markets.

- In March 2025, Accenture expanded its AI Refinery platform by launching an AI agent builder, empowering business users to rapidly create and customize agents. It also introduced pre-configured industry solutions to scale AI agent networks enterprise wide.

- In October 2024, Oracle launched Oracle Analytics Intelligence for Life Sciences, an AI-powered platform that unifies data, accelerates insights, and integrates findings into existing Oracle Health and Life Sciences applications.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the data business in oil & gas market based on the following segments:

Global Data Business in Oil & Gas Market, By Component

- Big Data

- Data Management

- Direct Data Monetization

Global Data Business in Oil & Gas Market, By Application

- Upstream

- Midstream

- Downstream

Global Data Business in Oil & Gas Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the data business in oil & gas market over the forecast period?The global data business in oil & gas market is projected to expand at a CAGR of 16.5% during the forecast period.

-

2. What is the market size of the data business in oil & gas market?The global data business in oil & gas market size is expected to grow from USD 42.52 billion in 2024 to USD 228.23 billion by 2035, at a CAGR 16.5% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the data business in oil & gas market?North America is anticipated to hold the largest share of the data business in oil & gas market over the predicted timeframe.

-

4. What are the market trends in the data business in oil & gas market?Market trends include AI integration, cloud adoption, IoT-driven data collection, advanced analytics, digital twins, and increased focus on sustainability.

-

5. Who are the top 10 companies operating in the global data business in oil & gas market?The major players operating in the data business in oil & gas market are IBM Corporation, SAP SE, Accenture, Oracle Corporation, Microsoft Corporation, Cloudera, Inc., Hitachi, Hortonworks, Inc., Baker Hughes Company, Cisco Systems, and Others.

-

6. What factors are driving the growth of the data business in oil & gas market?Growth in oil & gas data business is driven by digital transformation, AI adoption, real-time analytics, IoT integration, enhanced exploration efficiency, predictive maintenance, regulatory compliance, and the need for optimized production and cost reduction.

-

7. What are the main challenges restricting wider adoption of the data business in oil & gas market?Challenges include data security concerns, high implementation costs, legacy system integration, skill shortages, data quality issues, and regulatory complexities.

Need help to buy this report?