Global Dairy Starter Culture Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Mesophilic Type, Thermophilic Type, Probiotics, and Others), By Distribution Channels (Direct Sales and Distributor), By Application (Dairy & Dairy-Based Products and Meat & Seafood), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Dairy Starter Culture Market Insights Forecasts to 2035

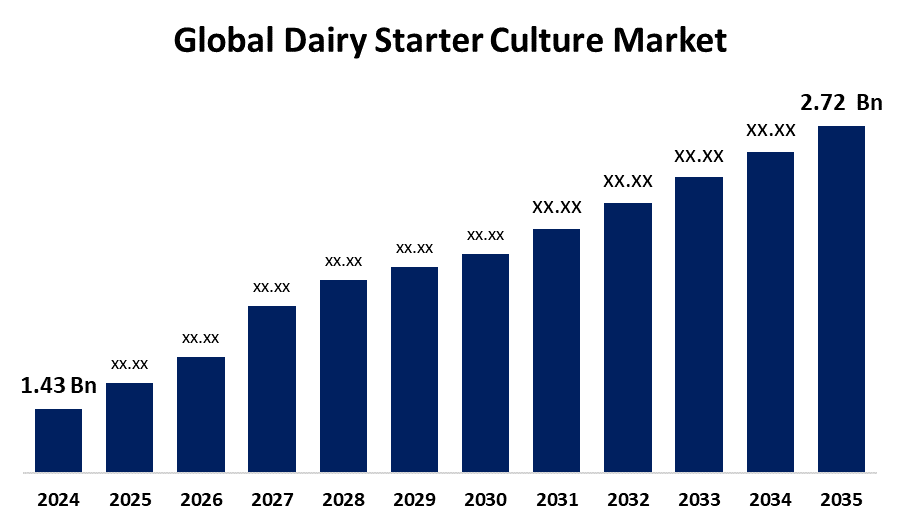

- The Global Dairy Starter Culture Market Size Was Estimated at USD 1.43 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.02% from 2025 to 2035

- The Worldwide Dairy Starter Culture Market Size is Expected to Reach USD 2.72 Billion by 2035

- Asia Pacific is Expected to Grow the Fastest during the Forecast Period.

Get more details on this report -

The Global Dairy Starter Culture Market Size was worth around USD 1.43 Billion in 2024 and is Predicted to Grow to around USD 2.72 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 6.02% from 2025 to 2035. The rising consumer demand for safe, healthy, and natural products. Their expanding applications across industries further drive market growth and relevance.

Market Overview

The dairy starter culture market refers to the microbes that are intentionally supplied to milk to start and finish the appropriate fermentation process under carefully monitored circumstances. Cheese, kefir, and yoghurt are examples of fermented milk products made with it. The market for dairy starter cultures is expanding globally due to the dairy processing industry's explosive growth and rising demand for fermented dairy products.

The growing demand for probiotic and functional dairy products is propelling the worldwide dairy starter culture market's notable expansion. Products that promote digestion and general wellness are becoming more and more popular among health-conscious consumers. This need is further fueled by the drive toward natural, clean-label, and organic ingredients. Manufacturers are therefore making significant investments in R&D in order to develop and satisfy changing consumer demands. A significant growth opportunity is presented by the trend toward healthful, low-fat, and low-sugar products. In the end, the market is expected to grow as manufacturers follow the worldwide wellness and health trend

Report Coverage

This research report categorizes the dairy starter culture market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dairy starter culture market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dairy starter culture market.

Global Dairy Starter Culture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.43 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.02% |

| 2035 Value Projection: | USD 2.72 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Distribution Channels, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | CHR. Hansen Holdings A/S, Balletic Inc., Lallemand Inc., AVANTMEATS.COM, Novus International, ADM, DSM, BASF SE, Alltech Inc., Cargill, Incorporated, Upside Foods, Charoen Popkhand Foods and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is driven by the growing consumer demand for dairy products that are safe, excellent, and beneficial to health. Consumer interest in starter cultures is being fueled by their associated health benefits, which include immunological and digestive support. Their uses in the food and beverage, pharmaceutical, and medical sectors are growing. Market expansion is also supported by growing consumer demand for natural and organic products. All things considered, dairy starter cultures are becoming crucial to satisfying changing business and customer demands.

Restraining Factors

The market growth is hindered by the low-quality inputs, and contaminants could impede development. Nonetheless, there are a lot of chances due to ongoing breakthroughs, regulatory insights, and strategic advancements. Making well-informed decisions is supported by thorough market analysis. Businesses may navigate and profit from new trends by working with specialized research firms.

Market Segmentation

The dairy starter culture market share is classified into product type, distribution channels, and application.

- The thermophilic type segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the product type, the dairy starter culture market is categorized into mesophilic type, thermophilic type, probiotics, and others. Among these, the thermophilic type segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the extensive application in the manufacturing of well-known fermented dairy products, such as yogurt and some cheeses, which call for higher fermentation temperatures. Dairy producers all around the world favor thermophilic cultures because of their effectiveness, quicker fermentation, and capacity to provide consistent flavor and texture.

- The direct sales segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channels, the dairy starter culture market is categorized into direct sales and distributor. Among these, the direct sales segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the preference of large dairy product producers to sell their starter cultures directly to consumers to maintain quality control, create unique formulas, and guarantee a steady supply. Additionally, direct sales facilitate stronger business ties, improved communication, and technical support, all of which are essential in the industrial use of dairy starter cultures.

- The dairy and dairy-based products segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the dairy starter culture market is categorized into dairy & dairy-based products and meat & seafood. Among these, the dairy and dairy-based product segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the widespread use of starter cultures in foods that depend on microbial fermentation for flavor, texture, and health advantages, such as sour cream, yogurt, cheese, kefir, and butter. The market's dominance over other uses, such as meat and seafood, is further reinforced by the growing demand for probiotic and functional dairy products.

Regional Segment Analysis of the Dairy Starter Culture Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the dairy starter culture market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the dairy starter culture market over the predicted timeframe. The regional growth can be attributed to the growing customer desire for natural products and health consciousness. The advanced dairy processing industries and increased demand for yogurt & cheese products are significantly contributing to propel the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the dairy starter culture market during the forecast period. The expansion of the food and beverage industry is driving the growth of the Asia Pacific dairy starter culture market. Throughout the projection period, the dairy starter culture market would be driven by rising demand from emerging economies like China, India, and Indonesia, among others. In terms of volume, Asia-Pacific is anticipated to continue to be the most significant area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dairy starter culture market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CHR. Hansen Holdings A/S

- Balletic Inc.

- Lallemand Inc.

- AVANTMEATS.COM

- Novus International

- ADM

- DSM

- BASF SE

- Alltech Inc.

- Cargill, Incorporated

- Upside Foods

- Charoen Popkhand Foods

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2021, DSM announced the release of a new yogurt culture, Delvo Fresh YS-042. The culture, which is an extension of DSM's Delvo Fresh culture portfolio, allows manufacturers to create stirred yogurt that remains exceptionally mild, creamy, and thick throughout its shelf life without the use of texturizers or additional proteins.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dairy starter culture market based on the below-mentioned segments:

Global Dairy Starter Culture Market, By Product Type

- Mesophilic Type

- Thermophilic Type

- Probiotics

- Others

Global Dairy Starter Culture Market, By Distribution Channels

- Direct Sales

- Distributor

Global Dairy Starter Culture Market, By Application

- Dairy & Dairy-Based Products

- Meat & Seafood

Global Dairy Starter Culture Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the dairy starter culture market over the forecast period?The global dairy starter culture market is projected to expand at a CAGR of 6.02% during the forecast period.

-

2. What is the market size of the dairy starter culture market?The global dairy starter culture market size is expected to grow from USD 1.43 Billion in 2024 to USD 2.72 Billion by 2035, at a CAGR of 6.02% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the dairy starter culture market?North America is anticipated to hold the largest share of the dairy starter culture market over the predicted timeframe.

Need help to buy this report?