Global Dairy Food Market Size, Share, and COVID-19 Impact Analysis, By Source (Cattle, Sheep, Goat, and Camel), By Type (Lactose and Lactose-Free), By Product Type (Milk, Cheese, Butter, Dessert, Yogurt, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, and Online Retail), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Dairy Food Market Insights Forecasts to 2035

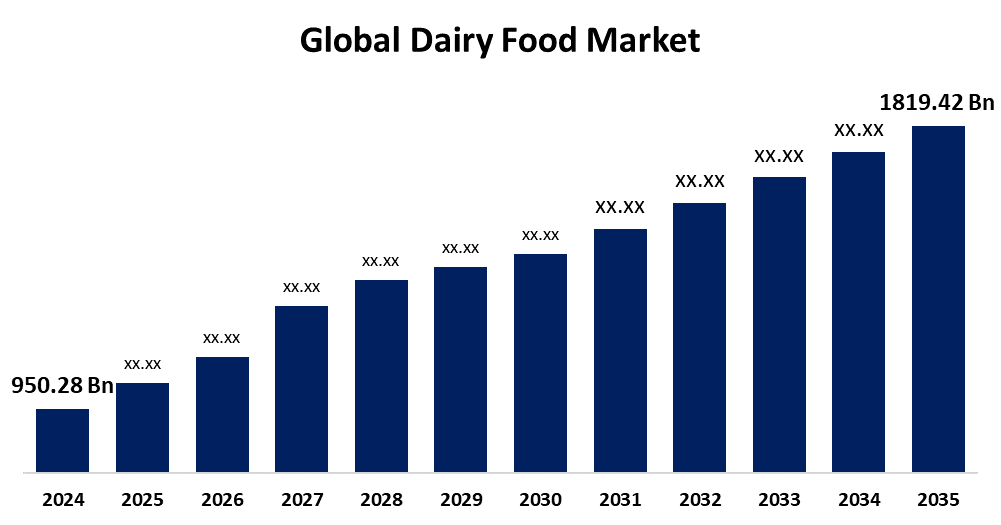

- The Global Dairy Food Market Size Was Estimated at USD 950.28 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.08% from 2025 to 2035

- The Worldwide Dairy Food Market Size is Expected to Reach USD 1819.42 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Dairy Food Market Size was worth around USD 950.28 Billion in 2024 and is Predicted to Ggrow to around USD 1819.42 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 6.08% from 2025 to 2035. The rising incomes, urbanization, and health awareness in both emerging and developed regions. Expanding food service demand and innovations in fortified, plant-based, and lactose-free products further support long-term market expansion.

Market Overview

The dairy food market refers to the worldwide industry that produces, processes, distributes, and sells food items manufactured from animal milk, mostly from sheep, goats, and cows. A vast array of goods is included in this sector, such as whey-based products, milk, cheese, yogurt, butter, cream, ice cream, and the product.

There is an increasing desire for wholesome, convenient products, urbanization, and health consciousness. The market potential is growing due to advancements in processing technology and the development of personalized and high-end dairy products. Due to changing dietary requirements and consumer attitudes, sustainability and lactose-free alternatives are becoming more popular. International trade disputes and COVID-19-related supply chain interruptions, however, continue to be problems. Global market expansion is hampered by regulatory disparities, such as those between the US and India. The dairy product sector is nonetheless well-positioned for long-term expansion in spite of these challenges.

Report Coverage

This research report categorizes the dairy food market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dairy food market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dairy food market.

Global Dairy Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 950.28 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.08% |

| 2035 Value Projection: | USD 1819.42 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Type By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Arla Foods amba, Amul, Mengniu Dairy, Dairy Farmers of America, Inc, Kwality Limited, Danone S.A., Nestle, Gujarat Cooperative Milk Marketing Federation Ltd., Royal FrieslandCampina, Meiji Holdings Co., Ltd., Saputo Inc., Inner Mongolia Yili Industrial Group Co., Ltd., Britannia Industries Limited, China Mengniu Dairy Company Limited, DMK Group and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market growth is driven by rising nations' populations and incomes, especially in Latin America and the Asia Pacific. Dairy consumption in these areas is being driven by a young population, growing urbanization, and rising disposable incomes. Because of their strong cultural affinity for dairy products and emphasis on nutrition, developed markets like North America and Europe also make a considerable contribution. The demand for processed dairy in food service applications is rising as a result of the expansion of restaurant and hotel chains around the world. The market appeal of nutrient-rich, fortified, and functional dairy products is also expanding due to growing health consciousness and consumer demand. The market is growing even more thanks to developments in plant-based and lactose-free alternatives. The dairy food market is positioned for long-term expansion worldwide due to these combined tendencies.

Restraining Factors

Price volatility for raw milk presents a significant obstacle that affects profitability and cost planning. Operational complexity and expenses are further increased by the high cold chain and storage needs for perishable dairy products. Market expansion is further constrained by inadequate infrastructure in emerging nations. All of these issues work together to limit the dairy food market's ability to grow internationally.

Market Segmentation

The dairy food market share is classified into source, type, product type, and distribution channel.

- The cattle segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the source, the dairy food market is classified into cattle, sheep, goat, and camel. Among these, the cattle segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to their perfect for dairy production because they are the most effective at turning feed protein into edible meals. Cattle milk, particularly cow's milk, is favored over other milk sources due to its many health advantages. It has less fat, is easier to digest, and has more vitamins and minerals. It appeals to consumers who are health-conscious because of its higher water content, which makes it less fatty. Cattle milk is widely accessible, which contributes to its rising demand worldwide.

- The lactose segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the type, the dairy food market is categorized into lactose and lactose-free. Among these, the lactose segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the energy-transmitting sugar lactose, which is made up of galactose and glucose, and is found in milk. Additionally, it supports immunological function, shapes the gut flora, and improves the absorption of vitamins and minerals, including manganese, calcium, and zinc, among other health benefits. In addition to being used in human meals, lactose is also widely employed in the food processing and pharmaceutical industries as a sweetener and in the manufacture of tablets.

- The milk segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the dairy food market is categorized into milk, cheese, butter, dessert, yogurt, and others. Among these, the milk segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The milk segment is further divided into powder and liquid. The segmental growth can be attributed to its high concentration of vital elements, particularly calcium. Milk continues to be the most popular dairy product. Because of its adaptability, it can be utilized in both savory and sweet recipes. Another common dairy product that is prized for its high protein, fat, and mineral content is cheese. Popular types like Swiss, Cheddar, and Mozzarella are mainstays in many different cuisines.

- The supermarkets/hypermarkets segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the dairy food market is categorized into supermarkets/hypermarkets, specialty stores, convenience stores, and online retail. Among these, the supermarkets/hypermarkets segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the highest profit since a variety of products are readily available and accessible. Supermarkets are typically massive establishments that sell convenience and necessary goods. The main benefit of going to a supermarket is that it allows customers to conveniently get all of their necessities in one place, saving them a great deal of time and effort.

Regional Segment Analysis of the Dairy Food Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the dairy food market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the dairy food market over the predicted timeframe. The region's growth is being driven by the rapid population increase, a big customer base, and westernized eating patterns. Dairy consumption is also increasing throughout the region due to the growing demand for foods high in protein. The demand for milk-based products is steadily increasing, according to reports, which reflects changing health trends. In the global dairy industry, Asia Pacific remains the market with the fastest rate of growth.

North America is expected to grow at a rapid CAGR in the dairy food market during the forecast period. The regional growth can be attributed to the growing consumer demand for high-end, organic, and health-conscious dairy products, as well as the growth of the food service and retail sectors. The region's customers are growing more conscious of food quality, origin, and environmental effects, which is driving up demand for dairy products that are nutrient-dense, clean-label, and sustainably derived. Furthermore, a greater variety of dairy products is now more easily accessible due to the growth of online grocery stores and improvements in cold-chain infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dairy food market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arla Foods amba

- Amul

- Mengniu Dairy

- Dairy Farmers of America, Inc

- Kwality Limited

- Danone S.A.

- Nestle

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Royal FrieslandCampina

- Meiji Holdings Co., Ltd.

- Saputo Inc.

- Inner Mongolia Yili Industrial Group Co., Ltd.

- Britannia Industries Limited

- China Mengniu Dairy Company Limited

- DMK Group

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, Arla Foods and DMK Group announced their desire to unite, creating Europe's strongest dairy cooperative. This historic unification would bring together the strengths of over 12,000 farmers, generating a combined pro forma revenue of €19 billion. The merger intends to foster global dairy innovation, ensure strong milk prices for cooperative members, and provide high-quality, nutritional dairy products around the world.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dairy food market based on the below-mentioned segments:

Global Dairy Food Market, By Source

- Cattle

- Sheep

- Goat

- Camel

Global Dairy Food Market, By Type

- Lactose

- Lactose-Free

Global Dairy Food Market, By Product Type

- Milk

- Cheese

- Butter

- Dessert

- Yogurt

- Others

Global Dairy Food Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

Global Dairy Food Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the dairy food market over the forecast period?The global dairy food market is projected to expand at a CAGR of 6.08% during the forecast period.

-

2. What is the market size of the dairy food market?The global dairy food market size is expected to grow from USD 950.28 Billion in 2024 to USD 1819.42 Billion by 2035, at a CAGR of 6.08% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the dairy food market?Asia Pacific is anticipated to hold the largest share of the dairy food market over the predicted timeframe.

Need help to buy this report?