Global Dairy Enzyme Market Size, Share, and COVID-19 Impact Analysis, By Type (Lactase, Chymosin, Microbial Rennet, Lipase, and Others), By Source (Plant, and Animal & Microorganism), By Application (Milk, Cheese, Ice Cream & Desserts, Yogurt, Whey, Infant Formula, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Dairy Enzyme Market Insights Forecasts to 2035

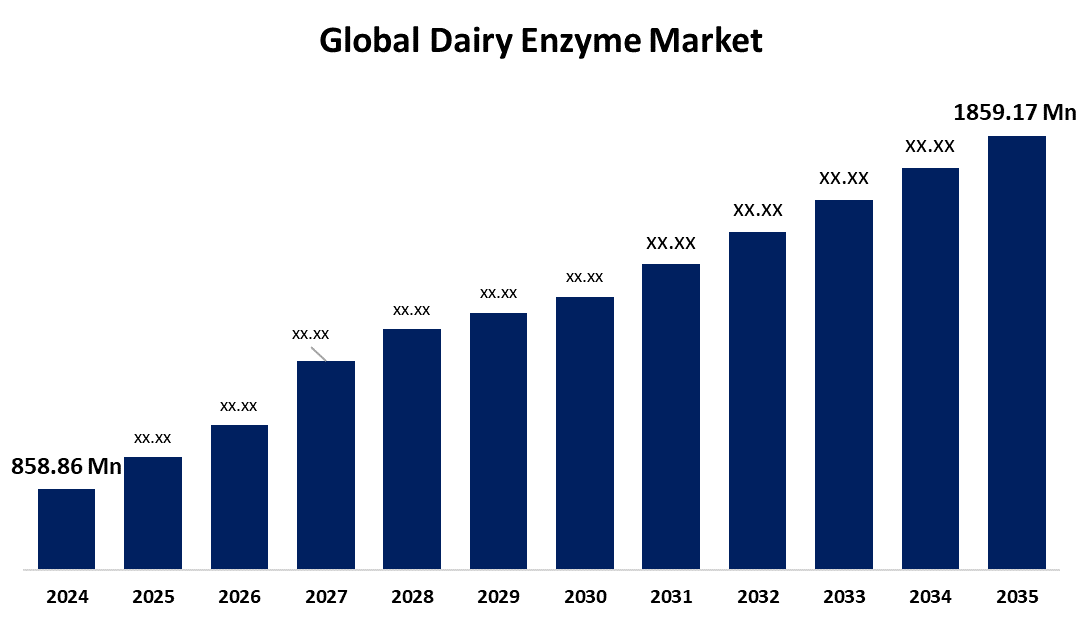

- The Global Dairy Enzyme Market Size Was Estimated at USD 858.86 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.27% from 2025 to 2035

- The Worldwide Dairy Enzyme Market Size is Expected to Reach USD 1859.17 Million by 2035

- Asia Pacific is Expected to Grow the Fastest During the Forecast Period.

Get more details on this report -

The Global Dairy Enzyme Market Size was Worth around USD 858.86 Million in 2024 and is Predicted to Grow to around USD 1859.17 Million by 2035 with a Compound Annual Growth Rate (CAGR) of 7.27% from 2025 to 2035. The rising digestive health awareness, growing demand for lactose-free and processed dairy, and enzyme innovation are key drivers of market growth. Together, these factors are expected to sustain strong momentum in the dairy enzymes market during the forecast period.

Market Overview

The dairy enzyme market refers to the international economy that focuses on the development, manufacturing, marketing, and usage of enzymes for dairy processing. In the production of dairy products, including cheese, yogurt, kefir, and milk-based beverages, these enzymes function as biological catalysts to accelerate or facilitate chemical reactions.

The market for dairy enzymes worldwide is expanding steadily due to consumer demand for clean-label, lactose-free, and functional dairy products. Enzymes promote digestive health while improving the taste, texture, and nutritional value of contemporary dairy products. They are being used in more and more common items, including cheese, yogurt, and milk-based drinks. Innovation in the sector is also being driven by technological developments, especially in the extraction of microbial enzymes. Small manufacturers had brief hurdles due to the COVID-19 outbreak, but the sector as a whole still has a lot of promise. Long-term demand for dairy enzyme solutions would be maintained by consumers' continued emphasis on health and well-being.

Report Coverage

This research report categorizes the dairy enzyme market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the dairy enzyme market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the dairy enzyme market.

Global Dairy Enzyme Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 858.86 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.27% |

| 2035 Value Projection: | USD 1859.17 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Source, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Chr. Hansen A/S, Fonterra Co-operative Group Limited, Kerry Group., DUMOCO, Novozymes, Roquette Frères, Genencor International, Inc., SternEnzym GmbH & Co. KG, Wilbur-Ellis Holdings, Inc., Dow, Fytozimus Biotech, ENMEX, Danisco A/S, Biocatalysts, FrieslandCampina and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for fermented and lactose-free dairy products is being driven by the increased emphasis on digestive health and the growing prevalence of gastrointestinal disorders. One of the main development drivers in developing countries is the rise in the consumption of processed dairy products, cheese, and yogurt. The trend toward vegan and ready-to-use enzyme solutions encourages market growth even more. Enzyme efficiency is being increased by manufacturers through innovation, allowing for quicker and more economical production. Market momentum is also fueled by public knowledge of the health benefits of dairy products and the benefits of using enzymes for the environment. All of these elements are anticipated to support the dairy enzymes market's robust growth throughout the course of the projected year.

Restraining Factors

The market growth is hindered by the significant manufacturing costs as a result of intricate biotechnology procedures. Operational pressure is increased by regulatory compliance with international food safety requirements. Additionally, customer preferences are changing as plant-based dairy substitutes gain popularity. Traditional dairy enzymes may become less in demand as a result of this shift, especially in the manufacturing of cheese and yogurt.

Market Segmentation

The dairy enzyme market share is classified into type, source, and application.

- The microbial segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the dairy enzyme market is classified into lactase, chymosin, microbial rennet, lipase, and others. Among these, the microbial segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the rise in vegan and flexitarian communities. A coagulating substance called microbial rennet is derived from living things such as mold, fungus, or yeast. Microbial rennet is produced in a laboratory under carefully monitored circumstances to ensure that each ounce of rennet has the proper amount of mold, fungi, or yeast.

- The animal and microorganism segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the source, the dairy enzyme market is categorized into plant and animal & microorganism. Among these, the animal and microorganism segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to their efficiency and adaptability. Microbial enzymes are employed extensively in the food sectors, including dairy, brewing, baking, and processed foods. Animal microbiomes support the generation of natural enzymes and are essential to ecosystem balance and health. The favored option in industrial applications is microbial enzymes due to their affordability, uniformity, and wide nutritional acceptance. Their market domination is further fueled by their adherence to clean-label and non-GMO movements.

- The cheese segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the application, the dairy enzyme market is categorized into milk, cheese, ice cream & desserts, yogurt, whey, infant formula, and others. Among these, the cheese segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the significant role enzymes play in cheese production, especially in coagulation and flavor development, and the enormous global consumption of cheese. Within the dairy enzyme industry, this segment is the most enzyme-intensive and commercially significant since enzymes, including chymosin, microbial rennet, and lipase, are necessary for both traditional and industrial cheese-making.

Regional Segment Analysis of the Dairy Enzyme Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the dairy enzyme market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the dairy enzyme market over the predicted timeframe. The regional growth can be attributed to the established dairy processing sector in the area, and growing customer demand for novel dairy products is also a factor in this. Manufacturers in the US and Canada have started using enzymatic solutions as a result of this consumer demand, as well as the general growing interest in lactose-free and functional dairy products. The increasing popularity of clean-label products and effective production methods in the region is driving the dairy enzyme market in the region.

Asia Pacific is expected to grow at a rapid CAGR in the dairy enzyme market during the forecast period. The region's growth is being driven by its growing economic significance. The two biggest contributors to the region's strong demand for dairy enzymes are China and India. The market for dairy enzymes has expanded due to the region's improved industrialized growth over the years and advancements in the food and beverage sector. Future growth is anticipated to be fueled by the region's economic expansion as well as the rising demand for wholesome dairy products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the dairy enzyme market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chr. Hansen A/S

- Fonterra Co-operative Group Limited

- Kerry Group.

- DUMOCO

- Novozymes

- Roquette Frères

- Genencor International, Inc.

- SternEnzym GmbH & Co. KG

- Wilbur-Ellis Holdings, Inc.

- Dow

- Fytozimus Biotech

- ENMEX

- Danisco A/S

- Biocatalysts

- FrieslandCampina

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dairy enzyme market based on the below-mentioned segments:

Global Dairy Enzyme Market, By Type

- Lactase

- Chymosin

- Microbial Rennet

- Lipase

- Others

Global Dairy Enzyme Market, By Source

- Plant

- Animal & Microorganism

Global Dairy Enzyme Market, By Application

- Milk

- Cheese

- Ice Cream & Desserts

- Yogurt

- Whey

- Infant Formula

- Others

Global Dairy Enzyme Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the dairy enzyme market over the forecast period?The global dairy enzyme market is projected to expand at a CAGR of 7.27% during the forecast period.

-

2. What is the market size of the dairy enzyme market?The global dairy enzyme market size is expected to grow from USD 858.86 Million in 2024 to USD 1859.17 Million by 2035, at a CAGR of 7.27% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the dairy enzyme market?North America is anticipated to hold the largest share of the dairy enzyme market over the predicted timeframe.

Need help to buy this report?