Global Cyclohexane Market Size, Share, and COVID-19 Impact Analysis, By Application (Adipic acid, Caprolactam, and Others), By End User (Nylon 6, Nylon 66, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Cyclohexane Market Insights Forecasts to 2035

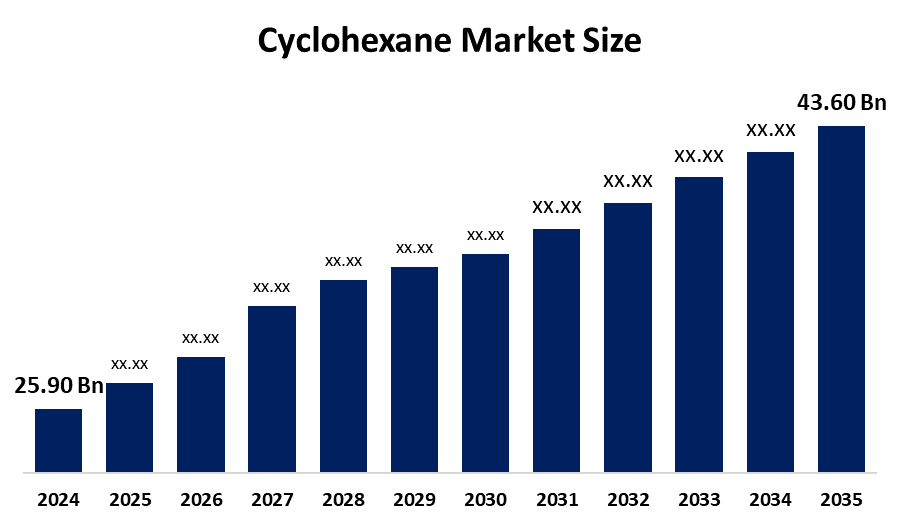

- The Global Cyclohexane Market Size Was Estimated at USD 25.90 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.85% from 2025 to 2035

- The Worldwide Cyclohexane Market Size is Expected to Reach USD 43.60 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global cyclohexane market size was worth around USD 25.90 billion in 2024, growing to USD 31.72 billion in 2025, and is predicted to grow to around USD 43.60 billion by 2035 with a compound annual growth rate (CAGR) of 4.85% from 2025 to 2035. The growing demand for nylon-based products, improvements in sustainable production techniques, growth in emerging economies, and expanding applications in the construction and automotive industries present opportunities for the cyclohexane market. These variables also encourage innovation, capacity expansion, and strategic investments throughout the global petrochemical industry.

Global Cyclohexane Market Forecast and Revenue Size

- 2024 Market Size: USD 25.90 Billion

- 2025 Market Size: USD 31.72 Billion

- 2035 Projected Market Size: USD 43.60 Billion

- CAGR (2025-2035): 4.85%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Key Market Insights

- Asia Pacific is expected to account for the largest share in the cyclohexane market during the forecast period.

- In terms of application, the caprolactam segment is projected to lead the cyclohexane market throughout the forecast period

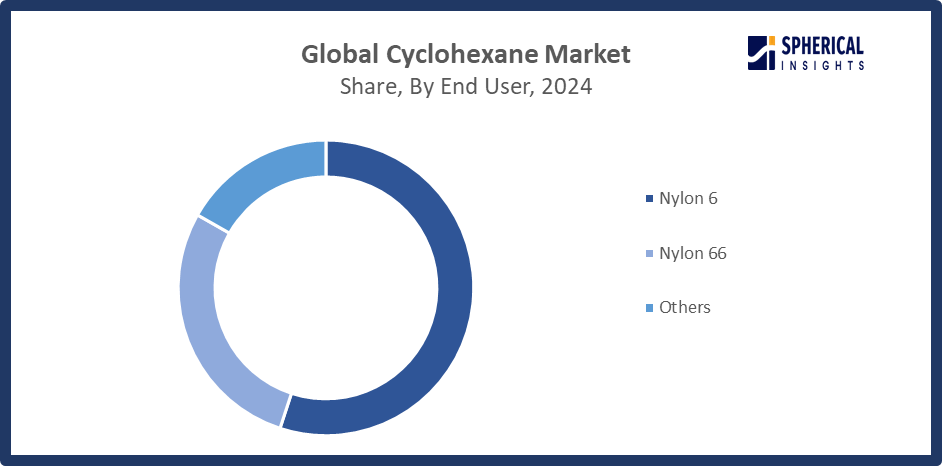

- In terms of end user, the nylon 6 segment captured the largest portion of the market

Cyclohexane Market Trends

- The strategic alliances and mergers amongst important market participants.

- The growing focus on bio-based and sustainable cyclohexane synthesis.

- The growth of end-use sectors such as construction, textiles, and automobiles.

- The increasing demand for nylon intermediates like caprolactam and adipic acid.

- The growing expenditures in emerging economies for petrochemical infrastructure.

Report Coverage

This research report categorizes the cyclohexane market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the cyclohexane market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the cyclohexane market.

Global Cyclohexane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 25.90 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.85% |

| 2035 Value Projection: | USD 25.90 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Application, By End User and By Region |

| Companies covered:: | BASF, CEPSA, Clariant, Idemitsu Kosan Co., Ltd, The Dow Chemical Company, CITGO Petroleum Corporation, Reliance Industries Limited, BP Refining & Petrochemicals GmbH, Chevron Phillips Chemical Company, China Petroleum & Chemical Corporation, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving factors:

The growing need for nylon and other chemical intermediates is propelling the worldwide cyclohexane market, indicating a promising future for the industry. Rising demand for nylon manufacture, industrial expansion in developing nations, improvements in petrochemical processes, and the growing use of sustainable materials in the textile and automotive sectors are the main factors driving the cyclohexane market. Over the next ten years, the global cyclohexane market is expected to rise significantly. Rising industrial uses, technological developments, and regulatory backing are some of the factors driving this growth, and they will all probably influence the cyclohexane market's future.

Restraining Factors:

High manufacturing costs, strict environmental laws, fluctuating crude oil prices, and the availability of sustainable or bio-based material alternatives that lessen reliance on petrochemicals are the main factors restricting the cyclohexane market.

Market Segmentation

The global cyclohexane market is divided into application and end user.

Global Cyclohexane Market, By Application:

How has the demand from the textile and automotive sectors affected caprolactam’s market position?

The caprolactam segment led the cyclohexane market, generating the largest revenue share. Caprolactam is credited with playing a crucial part in the production of nylon 6, which is used extensively in consumer goods, engineering plastics, and textiles. Caprolactam's market position was further strengthened by the strong demand from the textile and automotive industries. The segment's expansion has also been fueled by the rising need for high-performance, lightweight, and long-lasting materials, especially in the clothing and automotive sectors.

Get more details on this report -

The adipic acid segment in the cyclohexane market is expected to grow at the fastest CAGR over the forecast period. The growing use of adipic acid in the manufacturing of nylon 66 and polyurethane products is what drives its use. Adipic acid's growth is being driven by the automotive and construction sectors' increasing need for strong, lightweight materials as well as a move toward sustainable polyamides.

Global Cyclohexane Market, By End User:

Which sectors contribute most to the demand for Nylon 6?

The nylon 6 segment held the largest market share in the cyclohexane market. Nylon 6's widespread use in a variety of industries, including consumer goods, automotive, and textiles, is what largely propels the Nylon 6 market. Caprolactam, which is manufactured from cyclohexane, is the main polymer used to create nylon 6. Nylon 6 fibers' strong demand in goods including clothing, carpets, and industrial components helped it become the industry leader.

The nylon 66 segment in the cyclohexane market is expected to grow at the fastest CAGR over the forecast period. Nylon 66, which is made from adipic acid and hexamethylenediamine, is perfect for items like industrial machinery, electrical connectors, and engine parts because of its exceptional mechanical strength and thermal stability.

Regional Segment Analysis of the Global Cyclohexane Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Cyclohexane Market Trends

Which government actions are encouraging growth in the Asia Pacific market?

The Asia Pacific region is propelled by growing manufacturing capacity, quick industrialization, and encouraging government policies. The market's expansion is also aided by the region's growing need for petrochemicals. The demand for cyclohexane in the region was fueled by the region's expanding population and rising living standards. China and India are two emerging economies in the region that are developing and going through major economic transformations. India’s INR 1,500 crore PLI scheme for specialty chemicals and the ASEAN Smart Cities Mission are boosting regional manufacturing resilience and infrastructure efficiency across India, Indonesia, and Vietnam’s chemical sectors. The cyclohexane market in this area is expanding due to the rising demand for nylon, adipic acid, and caprolactam, which is being driven by the expanding automotive and construction sectors.

China Cyclohexane Market Trends

What makes the cyclohexane market crucial in China’s chemical industry?

The market for cyclohexane is a crucial sector of China's vast chemical industry, mainly due to its widespread use in the production of nylon intermediates like caprolactam and adipic acid. These substances are necessary for the production of nylon-6 and nylon-66, which are used in textiles, automobile parts, and industrial machinery, among other applications. Toray and Honda have started chemical recycling pilot projects for polyamides, demonstrating their dedication to sustainability and possibly revolutionizing the cyclohexane supply chain with creative environmentally friendly methods.

Japan Cyclohexane Market Trends

Which factors contribute to the significance of the cyclohexane market in Japan?

The need for nylon intermediates, such as adipic acid and caprolactam, which are necessary for industrial, textile, and automotive applications, is what is driving this rise. Through programs like the Hydrogen Society Promotion Act, which encourages the use of hydrogen technology, such as methylcyclohexane as a hydrogen carrier, the Japanese government supports this industry.

North America Cyclohexane Market Trends

Get more details on this report -

What are the primary products driving demand for cyclohexane in North America?

The cyclohexane market in North America is expanding as a result of the rising demand for nylon and adipic acid, which are utilized in a variety of industries like consumer products, construction, and automobiles. Furthermore, North American cyclohexane output has increased as a result of the US's shale gas development. The U.S. government launched the Executive Order on Unleashing American Energy in January 2025, prioritizing domestic petrochemical growth with $500 million for infrastructure and incentives for natural gas-derived feedstocks. The region's requirement for nylon intermediates, such as adipic acid and caprolactam, which are necessary for making nylon-6 and nylon-66, is being driven by rising demand from the automotive, textile, and construction sectors.

U.S Cyclohexane Market Trends

What factors are expected to propel the U.S. cyclohexane market expansion?

The growing demand in the automotive, textile, and industrial sectors is expected to propel the U.S. cyclohexane market's significant expansion. Cyclohexane is a vital raw ingredient used in the production of nylon intermediates, which are necessary for the production of nylon-6 and nylon-66 and include adipic acid and caprolactam. The government's efforts, such as the 2025 Executive Order on Unleashing American Energy, which streamlined approval procedures and provided $500 million for infrastructure improvements, have supported domestic petrochemical manufacturing.

Canada Cyclohexane Market Trends

Which nylon intermediates are produced from cyclohexane in Canada?

In Canada, cyclohexane is mostly used to make nylon intermediates such as adipic acid and caprolactam, which are necessary for the production of nylon-6 and nylon-66, which are utilized in industrial, automotive, and textile applications. The market's expansion is further supported by the nation's strong industrial infrastructure, advantageous trade regulations, and encouraging government incentives. Furthermore, Canada is more competitive in the cyclohexane market due to its strategic location in the global supply chain and dedication to environmentally friendly chemical production methods.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global cyclohexane market, along with a comparative evaluation primarily based on their Application of offerings, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Application development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Cyclohexane Market Include

- BASF

- CEPSA

- Clariant

- Idemitsu Kosan Co., Ltd

- The Dow Chemical Company

- CITGO Petroleum Corporation

- Reliance Industries Limited

- BP Refining & Petrochemicals GmbH

- Chevron Phillips Chemical Company

- China Petroleum & Chemical Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2021, Cepsa Química has launched a new line of sustainable products featuring recyclable and renewable raw materials, showcasing its commitment to innovation and advancing environmentally responsible chemical manufacturing.

- In May 2021, Chevron Phillips Chemical has launched plans to expand its alpha olefins industry by building a second world-scale 1-hexene plant in Old Ocean, Texas, with 266 KTA capacity, creating approximately 650 jobs, and commencing operations in 2023.

- In May 2021, Cepsa launched operations in San Roque, Spain, marking the first European chemical factory to use safer, sustainable Detal technology. This innovation replaces hydrofluoric acid, enhancing efficiency and reducing emissions in Linear Alkylbenzene production.

- In January 2020, Uniphos Envirotronic Inc. launched two new gas detector tubes: the KwikDraw Cyclohexane-40 and Uniphos H2S+SO2. These innovations enhance monitoring of cyclohexane, a crucial component in producing caprolactam and adipic acid for nylon manufacturing.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cyclohexane market based on the following segments:

Global Cyclohexane Market, By Application

- Adipic acid

- Caprolactam

- Others

Global Cyclohexane Market, By End User

- Nylon 6

- Nylon 66

- Others

Global Cyclohexane Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cyclohexane market over the forecast period?The global cyclohexane market is projected to expand at a CAGR of 4.85% during the forecast period.

-

2. What is the market size of the cyclohexane market?The global cyclohexane market size is expected to grow from USD 25.90 billion in 2024 to USD 43.60 billion by 2035, at a CAGR 4.85% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the cyclohexane market?Asia Pacific is anticipated to hold the largest share of the cyclohexane market over the predicted timeframe.

-

4. Who are the top companies operating in the global cyclohexane market?BASF, CEPSA, Clariant, Idemitsu Kosan Co., Ltd, The Dow Chemical Company, CITGO Petroleum Corporation, Reliance Industries Limited, BP Refining & Petrochemicals GmbH, Chevron Phillips Chemical Company, China Petroleum & Chemical Corporation, and Others.

-

5. What factors are driving the growth of the cyclohexane market?Rising demand for nylon intermediates, growing end-use industries, technological developments, and supporting government policies encouraging sustainable chemical production are some of the primary factors propelling the growth of the cyclohexane market.

-

6. What are market trends in the cyclohexane market?The market trends for cyclohexane at the moment include rising bio-based production, expanding use in automotive textiles, green technology acceptance, and developing manufacturing capacities in emerging nations.

-

7. What are the main challenges restricting wider adoption of the cyclohexane market?Feedstock price volatility, environmental requirements, maintenance of manufacturing facilities, and competition from alternative materials and techniques are the key challenges preventing the growth of the cyclohexane market.

Need help to buy this report?