Global Cyanate Ester Resins Market Size, Share, and COVID-19 Impact Analysis, By Resin Type (Bisphenol A Cyanates, Bisphenol E Cyanates, Novolac Cyanates), By Application (Composites, Adhesives, Coatings), By End Use (Electrical & Electronics, Transportation, Aerospace & Defense), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Cyanate Ester Resins Market Insights Forecasts to 2035

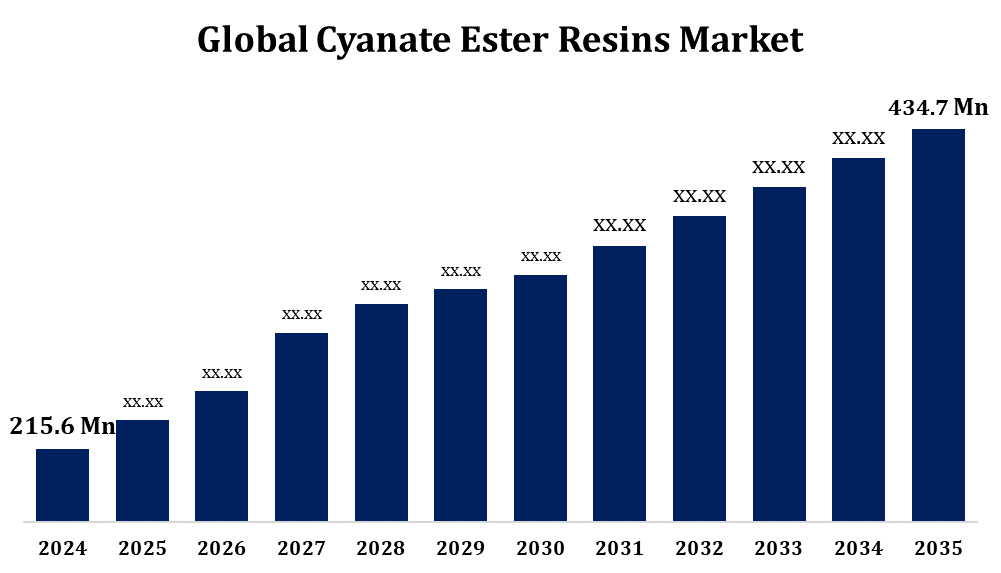

- The Cyanate Ester Resins Market was valued at USD 215.6 Million in 2024.

- The Market Size is Growing at a CAGR of 7.26% from 2025 to 2035.

- The Worldwide Global Cyanate Ester Resins Market Size is Expected to Reach USD 434.7 Million by 2035.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cyanate Ester Resins Market Size is Expected to Reach USD 434.7 Million by 2035, at a CAGR of 7.26% during the forecast period 2025 to 2035.

The Cyanate Ester Resins market is experiencing steady growth, driven by increasing demand across high-performance industries such as aerospace, defense, automotive, and electronics. These resins offer exceptional thermal stability, low dielectric constant, and superior mechanical properties, making them ideal for advanced composites and electronic components. In aerospace and defense, cyanate ester resins are favoured for their ability to withstand extreme conditions, while in the automotive sector, they support lightweighting efforts and enhanced performance. The expanding use of high-frequency communication devices and 5G infrastructure is further boosting adoption in the electronics segment. Moreover, ongoing R&D activities and advancements in resin formulations are enhancing processability and broadening application scope. However, high production costs may pose a challenge to widespread commercialization, especially in cost-sensitive markets.

Cyanate Ester Resins Market Value Chain Analysis

The value chain of the Cyanate Ester Resins market comprises several interconnected stages, starting with raw material suppliers providing phenols, cyanogen halides, and catalysts. These are processed by resin manufacturers who synthesize cyanate ester resins with desired thermal and mechanical properties. The resins are then supplied to formulators and compounders who modify them for specific applications, such as prepregs or molded components. These intermediate products are delivered to end-use industries including aerospace, automotive, electronics, and defense, where they are integrated into composite structures or electronic devices. Distributors and logistics providers play a crucial role in ensuring timely supply across global markets. Finally, end-of-life disposal and recycling are gaining attention, driven by environmental concerns and sustainability initiatives within the advanced materials industry.

Cyanate Ester Resins Market Opportunity Analysis

The cyanate ester resins market offers significant growth opportunities, driven by the increasing demand for high-performance materials across aerospace, defense, automotive, and electronics industries. These resins are prized for their superior thermal stability, low dielectric constant, and excellent mechanical strength, making them ideal for lightweight composite applications and advanced electronic components. The rapid expansion of the aerospace and space sectors, along with the deployment of 5G networks and high-frequency devices, is boosting the adoption of cyanate ester-based materials. Emerging markets, particularly in Asia-Pacific, are witnessing increased investments in aerospace manufacturing and electronics, creating further growth avenues. Moreover, ongoing innovations in resin formulation and processing technologies are enhancing cost-efficiency and product performance, while rising emphasis on sustainability is encouraging the development of recyclable and eco-friendly resin systems.

Global Cyanate Ester Resins Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 215.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.26% |

| 2035 Value Projection: | USD 434.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Application, By Resin Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Huntsman International LLC, Arxada Ltd., Toray Advanced Composites, Hexcel Corporation, MITSUBISHI GAS CHEMICAL COMPANY, INC., Henkel AG & Company, Novoset; LLC, Solvay, Syensqo, TenCate Advanced Composites And Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Cyanate Ester Resins Market Dynamics

Increasing Demand for Lightweight Materials to Propel the Market Growth

The growing emphasis on lightweight materials across key industries is a major factor propelling the growth of the cyanate ester resins market. In sectors such as aerospace, automotive, and defense, reducing weight without compromising strength or performance is essential for improving fuel efficiency, operational range, and overall sustainability. Cyanate ester resins offer exceptional strength-to-weight ratios, thermal stability, and dimensional integrity, making them an ideal choice for high-performance composite structures. Their compatibility with carbon and glass fibers enables the production of lightweight components used in aircraft fuselages, satellite parts, and advanced vehicle structures. Additionally, the shift toward electric vehicles and fuel-efficient aircraft is intensifying the demand for advanced materials. This trend, combined with increasing R&D investments, is expected to significantly boost the adoption of cyanate ester resins globally.

Restraints & Challenges

One of the primary concerns is the high production and processing cost, which makes these resins significantly more expensive than conventional alternatives such as epoxies. This restricts their use largely to high-performance and specialized applications. Additionally, the market is impacted by supply chain constraints, as it depends on limited sources for critical raw materials. Technical challenges also exist, including narrow curing windows, brittleness, and the need for specialized equipment and skilled labor to handle complex processing requirements. Furthermore, long qualification cycles in highly regulated sectors like aerospace slow down the commercialisation of new products. The market also faces competition from other high-performance polymers, which offer comparable benefits at lower costs or with easier processing.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Cyanate Ester Resins Market from 2025 to 2035. North America plays a pivotal role in the cyanate ester resins market, supported by its strong presence in aerospace, defense, and electronics industries. The region is home to major aircraft and defense system manufacturers who extensively use cyanate ester resins for high-performance composite applications due to their excellent thermal stability, mechanical strength, and lightweight characteristics. The growing demand for advanced materials in aircraft structures, satellite systems, and missile components is a key driver. Additionally, the region’s well-developed electronics industry is contributing to increased usage of these resins in high-frequency printed circuit boards and semiconductor packaging. Robust R&D infrastructure, government support for defense innovation, and strategic investments in space exploration further enhance market potential.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. China, Japan, South Korea, and India are witnessing increased adoption of high-performance materials for use in aircraft, satellites, and defense systems, where lightweight and thermally stable composites are essential. The region's rapidly growing electronics sector further fuels demand, particularly for applications such as high-frequency printed circuit boards and semiconductor components. Industrialization, infrastructure development, and rising automotive production are also contributing to market expansion. Additionally, government support for advanced materials research and strong investment in manufacturing technologies are enhancing regional capabilities.

Segmentation Analysis

Insights by Resin Type

The Bisphenol E cyanates segment accounted for the largest market share over the forecast period 2025 to 2035. These resins offer lower viscosity, enhanced thermal stability, and reduced moisture absorption compared to Bisphenol A-based variants, making them easier to process and more reliable in demanding applications. Their excellent electrical insulation properties and lower toxicity also align with increasing environmental and safety standards. As a result, they are gaining widespread adoption in sectors such as aerospace, automotive, and high-frequency electronics. The segment is particularly gaining momentum in regions like Asia-Pacific, North America, and Europe, where there is strong investment in advanced manufacturing and high-performance materials. With rising demand for lightweight, eco-friendly, and high-strength composites, Bisphenol E cyanates are poised for continued expansion.

Insights by Application

The Composites segment accounted for the largest market share over the forecast period 2025 to 2035. Cyanate ester resins are widely used as matrix materials in high-performance composites due to their excellent thermal stability, mechanical strength, and resistance to moisture and chemicals. These properties make them ideal for applications such as aircraft components, radomes, satellite structures, and lightweight automotive parts. In the electronics sector, they are valued for their low dielectric constant and dimensional stability, supporting use in high-frequency circuit boards and semiconductor packaging. The push for lightweight and durable materials in fuel-efficient vehicles and advanced aerospace systems is further accelerating adoption. As industries increasingly focus on performance, reliability, and efficiency, the composites segment is expected to maintain strong momentum in the cyanate ester resins market.

Insights by End Use

The Aerospace & defense segment accounted for the largest market share over the forecast period 2025 to 2035. With outstanding thermal tolerance, excellent fatigue resistance, and favourable strength-to-weight characteristics, these resins are widely used in structural aerospace components, missile casings, radomes, and satellite parts. They also meet strict fire, smoke, and toxicity (FST) standards, which are essential for aviation safety. Military programs increasingly demand lightweight, high-reliability materials, further propelling adoption. Growth is particularly strong amid modernisation initiatives, space exploration, and next-generation defense projects worldwide. Additionally, extensive R&D investments and rigorous qualification processes in the aerospace and defense sectors reinforce confidence in cyanate ester resins. As global geopolitical and technological trends continue to drive defense capabilities, this segment is set to maintain robust expansion.

Recent Market Developments

- In January 2023, NEXX Technologies introduced a vertically integrated cyanate ester prepreg system, positioned as a cost-effective and innovative solution in the composites industry.

Competitive Landscape

Major players in the market

- Huntsman International LLC

- Arxada Ltd.

- Toray Advanced Composites

- Hexcel Corporation

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Henkel AG & Company

- Novoset; LLC

- Solvay

- Syensqo

- TenCate Advanced Composites

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Cyanate Ester Resins Market, Resin Type Analysis

- Bisphenol A Cyanates

- Bisphenol E Cyanates

- Novolac Cyanates

Cyanate Ester Resins Market, Application Analysis

- Composites

- Adhesives

- Coatings

Cyanate Ester Resins Market, End Use Analysis

- Electrical & Electronics

- Transportation

- Aerospace & Defense

Cyanate Ester Resins Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Cyanate Ester Resins Market?The global Cyanate Ester Resins Market is expected to grow from USD 215.6 million in 2024 to USD 434.7 million by 2035, at a CAGR of 7.26% during the forecast period 2025-2035.

-

2. Who are the key market players of the Cyanate Ester Resins Market?Some of the key market players of the market are Huntsman International LLC, Arxada Ltd., Toray Advanced Composites, Hexcel Corporation, MITSUBISHI GAS CHEMICAL COMPANY, INC., Henkel AG & Company, Novoset, LLC, Solvay, Syensqo, and TenCate Advanced Composites.

-

3. Which segment holds the largest market share?The composites segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?