Global Crawler Drilling Machine Market Size, Share, and COVID-19 Impact Analysis, By Type (Hydraulic Crawler Drills and Pneumatic Crawler Drills), By Application (Oil & Gas, Hydro Power, Civil Construction, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Machinery & EquipmentGlobal Crawler Drilling Machine Market Insights Forecasts to 2035

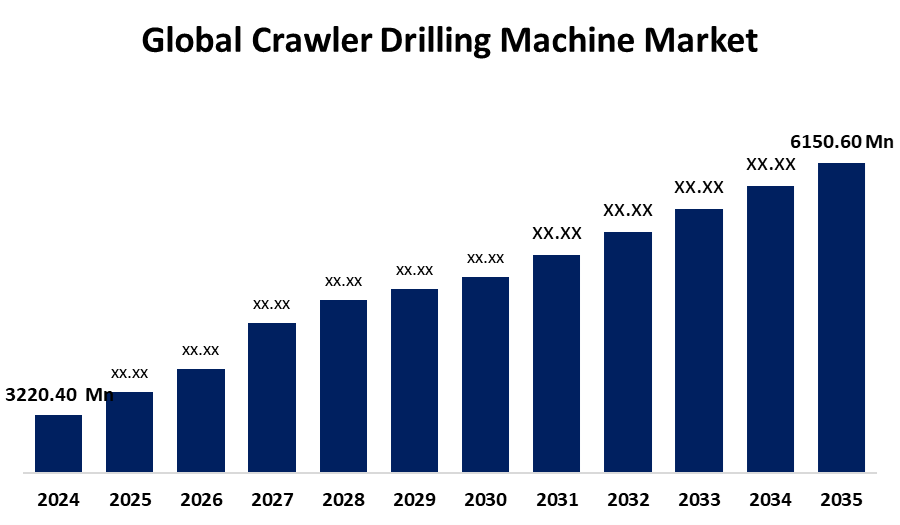

- The Global Crawler Drilling Machine Market Size Was Estimated at USD 3220.40 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.06 % from 2025 to 2035

- The Worldwide Crawler Drilling Machine Market Size is Expected to Reach USD 6150.60 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Crawler Drilling Machine market size was worth around USD 3220.40 million in 2024 and is predicted to grow to around USD 6150.60 million by 2035 with a compound annual growth rate (CAGR) of 6.06 % from 2025 to 2035. The crawler drilling machine market has growth opportunities driven by expanding infrastructure development, increased mining and construction activities, technical developments, and the growing need for efficient, adaptable, and durable drilling solutions across varied geographies.

Market Overview

The crawler drilling machine market refers to the global industry focusing on the manufacturing, distribution, and application of drilling equipment placed on crawler tracks. These devices are made to carry out drilling operations in difficult environments, such as tunneling zones, mining areas, construction sites, and geotechnical projects. For applications in mining, oil and gas exploration, hydroelectric tunnels, civil engineering, and geotechnical studies, these machines, powered by continuous crawler tracks, ensure stability and mobility when wheeled options falter. Ontario's recognition of Magna Mining's McCreedy West project, launched amid increased policy backing, signifies expansion as Canada predicts 5,709 wells in 2026, driving mechanized, electric, and AI-enhanced drilling innovation forward. The crawler drilling machine market is seeing development prospects due to government initiatives related to the machine tools sector and rapid advancements in manufacturing machinery. The crawler drilling machine market is driven by a combination of strategic, economic, and technological factors that collectively promote its global expansion. Growing investments in mining activities, particularly for minerals, metals, and renewable energy sources, further drive the crawler drilling machine market.

Report Coverage

This research report categorizes the crawler drilling machine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the crawler drilling machine market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the crawler drilling machine market.

Global Crawler Drilling Machine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 3220.40 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.06% |

| 2035 Value Projection: | 6150.60 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Acker Drill Company, Atlas Copco, Beretta Alfredo, Caterpillar, Furukawa Rock Drill, IHC Fundex Equipment, Jupiter Rock Drills, Sandvik AB, SANY, Soilmec S.p.A., Vermeer Manufacturing, Xuzhou Construction Machinery, and other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The crawler drilling machine market is driven by rising worldwide needs for mineral extraction, infrastructure growth, and energy transition, further improved by purposeful government actions. The rapid growth of infrastructure projects, which include transportation systems, urban development, and large-scale civil engineering, is a major reason for the demand for advanced and reliable drilling technologies. Electric and hybrid drilling machines have been increasingly adopted due to stricter emissions regulations and sustainability targets, thereby providing the market with cheaper and more environmentally-friendly alternatives and thus, furthering the crawler drilling machine market's expansion.

Restraining Factors

High upfront costs, complicated maintenance needs, volatile raw material prices, stringent environmental restrictions, and a lack of qualified operators all hinder the crawler drilling machine market and restrict expansion in the mining and construction industries.

Market Segmentation

The crawler drilling machine market share is classified into type and application.

- The hydraulic crawler drills segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the crawler drilling machine market is divided into hydraulic crawler drills and pneumatic crawler drills. Among these, the hydraulic crawler drills segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hydraulic crawler drills segment is driven by its high efficiency, precision, and adaptability in different and tough terrains. Large-scale construction, mining, and geotechnical operations benefit greatly from this equipment' improved power, stability, and operational control. Furthermore, it is anticipated that continuous technical developments, such as automation and energy-efficient systems, would increase their need.

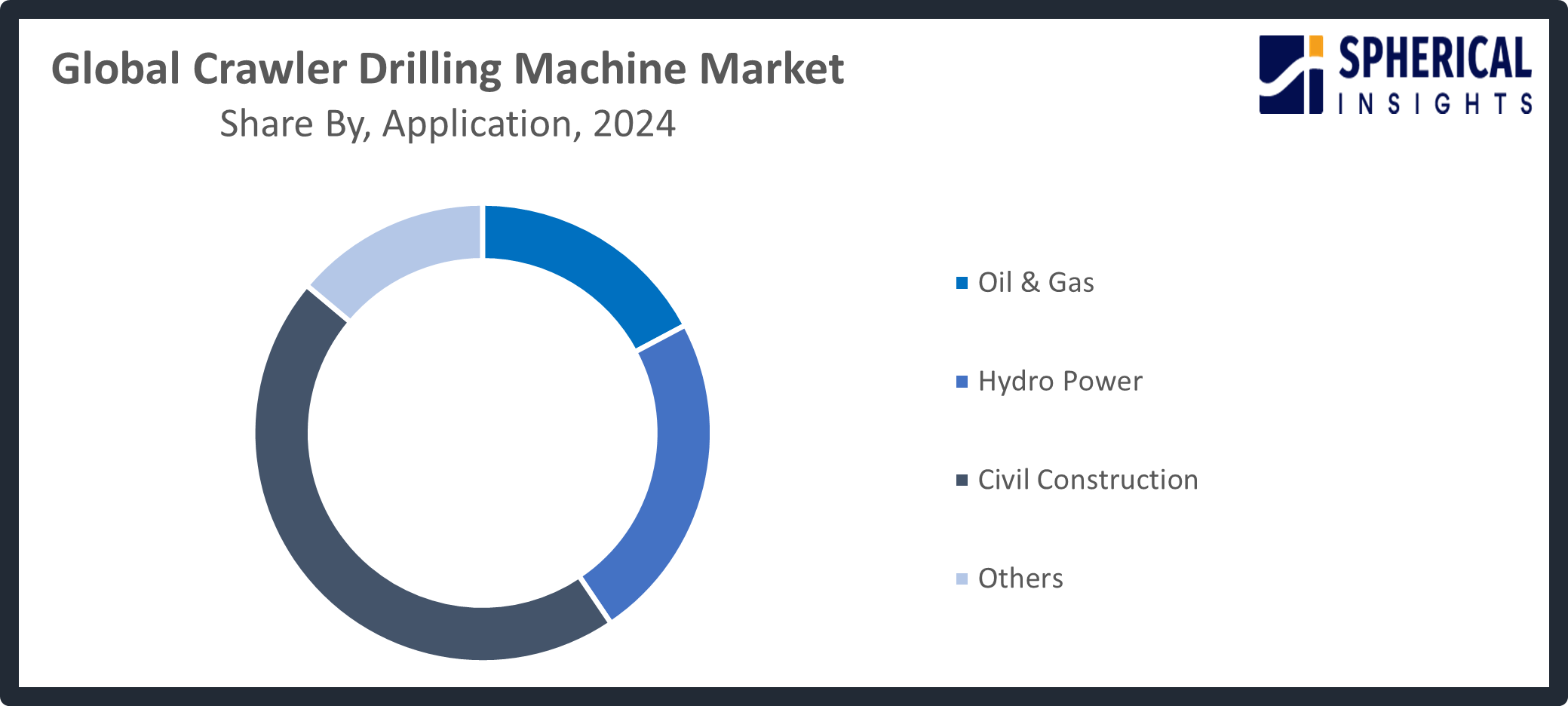

- The civil construction segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the crawler drilling machine market is divided into oil & gas, hydro power, civil construction, and others. Among these, the civil construction segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The civil construction segment accounted for the biggest market revenue, driven by considerable infrastructure development, including roads, bridges, tunnels, and urban projects across emerging and developed economies. The need for effective, high-performance drilling equipment that can function in a variety of difficult environments has strengthened this market's supremacy.

Get more details on this report -

Regional Segment Analysis of the Crawler Drilling Machine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the crawler drilling machine market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the crawler drilling machine market over the predicted timeframe. Asia Pacific is driven by massive infrastructure development and increasing urbanization across key economies such as China, India, and Southeast Asian states. The region's expanding economies have also stimulated infrastructure and building initiatives, which are anticipated to generate enormous demand for drilling equipment. 15 new exploration licenses and a USD 1.2 million budget for geotechnical drilling methods were prompted by the announcement of strategic reserves for 12 important metals in India's National Mineral Security Strategy (2025). The Quad Critical Minerals Initiative, which unites the US, Australia, India, and Japan, was introduced in July 2025 to diversify supply chains and improve drilling capacities for the extraction of lithium and rare earth elements.

North America is expected to grow at a rapid CAGR in the crawler drilling machine market during the forecast period. North America experiences the benefits of its mining, oil, and gas exploration investments and large-scale infrastructure rehabilitation. The latter is decidedly the most intensified support by technological advancements, and manufacturers in both the U.S. and Canada are getting more and more integrated into trends such as automation, electrification, and digital monitoring for better operational performance and environmental compliance. In November of 2025, the U.S. Department of Energy initiated a USD 355 million program aimed at increasing domestic production of critical minerals, which nicely supplemented the August announcement of almost USD 1 million for upscaling of mining technologies that include AI-amplified crawler systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the crawler drilling machine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Acker Drill Company

- Atlas Copco

- Beretta Alfredo

- Caterpillar

- Furukawa Rock Drill

- IHC Fundex Equipment

- Jupiter Rock Drills

- Sandvik AB

- SANY

- Soilmec S.p.A.

- Vermeer Manufacturing

- Xuzhou Construction Machinery

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2021, Sany India launched its first ‘Made in India’ piling rig, SR235, manufactured in Pune. The state-of-the-art machine, featuring best-in-class technology, strengthens the government’s ‘Make in India’ initiative and supports the domestic construction equipment industry

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the crawler drilling machine market based on the below-mentioned segments:

Global Crawler Drilling Machine Market, By Type

- Hydraulic Crawler Drills

- Pneumatic Crawler Drills

Global Crawler Drilling Machine Market, By Application

- Oil & Gas

- Hydro Power

- Civil Construction

- Others

Global Crawler Drilling Machine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the crawler drilling machine market over the forecast period?The global crawler drilling machine market is projected to expand at a CAGR of 6.06% during the forecast period.

-

2. What is the market size of the crawler drilling machine market?The global crawler drilling machine market size is expected to grow from USD 3220.40 million in 2024 to USD 6150.60 million by 2035, at a CAGR of 6.06 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the crawler drilling machine market?Asia Pacific is anticipated to hold the largest share of the Crawler Drilling Machine market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global crawler drilling machine market?Acker Drill Company, Atlas Copco, Beretta Alfredo, Caterpillar, Furukawa Rock Drill, IHC Fundex Equipment, Jupiter Rock Drills, Sandvik AB, SANY, Soilmec S.p.A., Vermeer Manufacturing, Xuzhou Construction Machinery, and Others.

-

5. What factors are driving the growth of the crawler drilling machine market?Rapid expansion in infrastructure and construction projects such as roads, tunnels, bridges, and urban development, along with rising mining and mineral exploration activities globally, are driving demand for crawler drilling machines.

-

6. What are the market trends in the Crawler Drilling Machine market?The increasing adoption of automation, smart‑control, remote‑monitoring and IoT‑enabled drilling rigs, along with a shift toward fuel‑efficient, low‑emission or hybrid/electric crawler drills, especially in regions with stringent environmental norms.

-

7. What are the main challenges restricting the wider adoption of the crawler drilling machine market?High initial capital cost plus significant maintenance and operating expenses, coupled with scarcity of skilled operators and stricter environmental and regulatory requirements, limit adoption, especially among small and medium‑sized contractors.

Need help to buy this report?