Global Courier, Express, and Parcel Market Size, Share, and COVID-19 Impact Analysis, Russia-Ukraine War Impact, Tariff Analysis, By Service (Standard Delivery, Express Delivery, Same-Day Delivery, and Last-Mile Delivery), By End Use (E-commerce, Healthcare, Manufacturing, Wholesale & Retail, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyCourier, Express, and Parcel Market Summary, Size & Emerging Trends

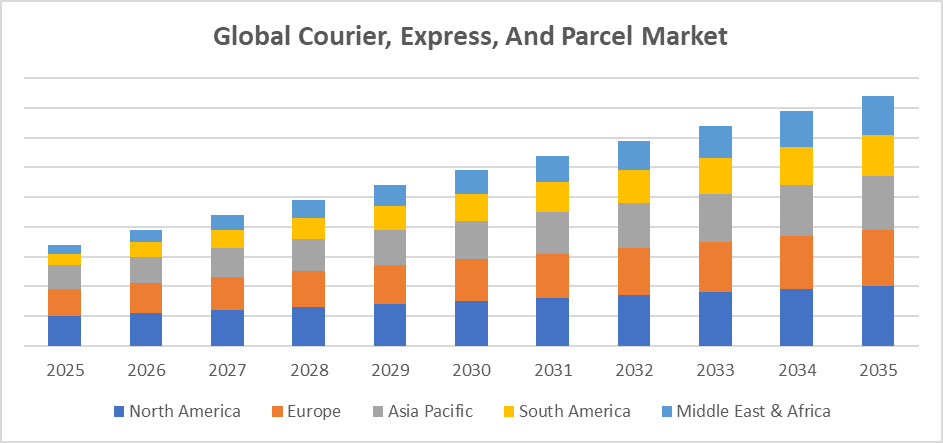

According to Spherical Insights, the Global Courier, Express, and Parcel Market Size is expected to grow from USD 485.50 billion in 2024 to USD 1086.20 billion by 2035, at a CAGR of 7.6 % during the forecast period 2025-2035. The increase of e-commerce, technical developments, improvements in last-mile delivery, expansion of cross-border trade, and rising need for quick, dependable, and frictionless logistics solutions all create opportunities for the courier, express, and parcel market.

Key Market Size Insights

Get more details on this report -

- North America is expected to account for the largest share in the courier, express, and parcel market during the forecast period.

- In terms of service, the standard delivery segment is projected to lead the courier, express, and parcel market in terms of equipment throughout the forecast period

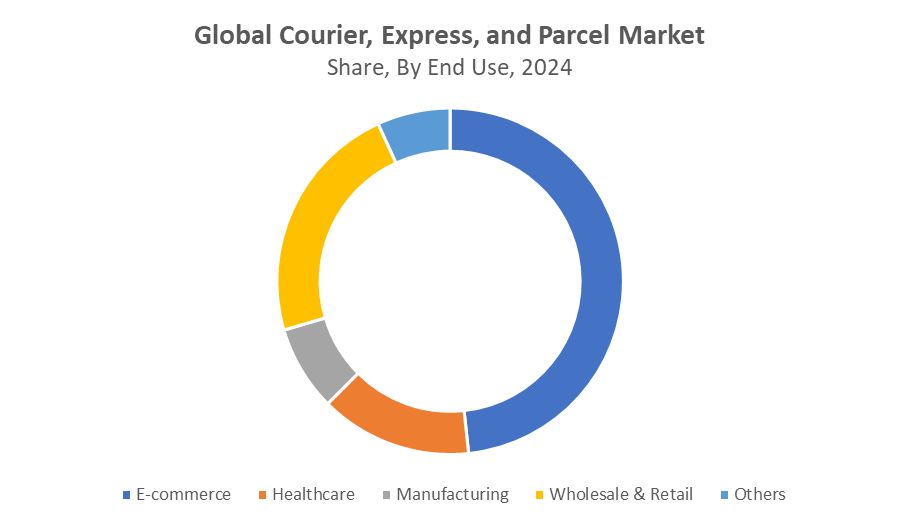

- In terms of end use, the e-commerce segment captured the largest portion of the market

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 485.50 Billion

- 2035 Projected Market Size: USD 1086.20 Billion

- CAGR (2025-2035): 7.6 %

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Courier, Express, and Parcel Market

The courier, express, and parcel (CEP) market refers to the segment of the logistics and transportation industry that specializes in the delivery of documents, packages, and parcels through various modes, including air, road, and rail. The courier, express, and parcel market is characterized by time-sensitive shipments, door-to-door delivery services, and the use of tracking technologies to ensure reliability and efficiency. It focuses on three primary categories: courier services, which typically handle smaller-scale, local deliveries express services, which focus on rapid, often overnight, deliveries with guaranteed timeframes; and parcel services, which deal with bulk and standard-sized shipments. For instance, in May 2025, Evri and DHL eCommerce announced a strategic merger of DHL eCommerce UK with Evri, creating a major parcel delivery entity in the UK. The merged business will handle over 1 billion parcels annually, with DHL Group acquiring a significant minority stake, enhancing service offerings and cost-efficient delivery solutions. The courier, express, and parcel market is propelled by several key factors. The shift towards online shopping has led to a substantial increase in parcel volumes, with consumers expecting faster and more reliable delivery options.

Courier, Express, and Parcel Market Trends

- E-commerce Expansion: Demand for quicker deliveries and higher parcel quantities are being driven by the rapid expansion of online shopping.

- Technological Advancements: The user experience and operational efficiency improve by integrating AI, automation, robotics, and real-time tracking.

- Sustainability Focus: Adoption of environmentally friendly delivery methods to lessen the impact on the environment, such as carbon-neutral logistics and electric vehicles.

- Innovative Last-Mile Solutions: Drones, driverless cars, and smart lockers are being used to increase the convenience and speed of last-mile deliveries.

Courier, Express, and Parcel Market Dynamics

Global Courier, Express, and Parcel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 485.50 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.6 % |

| 2035 Value Projection: | USD 1086.20 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 258 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Service, By End Use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | FedEx, Aramex, TNT Express, Amazon Logistics, Blue Dart Express Ltd., Qantas Airways Limited, Deutsche Post DHL Group, Royal Mail Group Limited, Yamato Transport Co., Ltd., SF Express (Group) Co. Ltd., One World Express Inc. Ltd., United Parcel Service Inc. (UPS), and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors: E-commerce, globalization, on-demand delivery, urbanization, sustainability, and digital transformation drive growth.

The courier, express, and parcel market is being driven by a number of significant factors, including the growing e-commerce industry, globalization of trade, the growing demand for on-demand delivery, rapid urbanization, sustainability objectives, and digital transformation. A number of important themes are driving the courier, express, and parcel market's present dramatic change. The exponential growth of e-commerce is the most notable of them, as it has led to a significant rise in parcel quantities. The courier, express, and parcel (CEP) companies have made significant investments in last-mile delivery improvements, infrastructure expansion, and the incorporation of cutting-edge technologies like automation, robotics, and artificial intelligence to satisfy customers' increased demands for reliable and timely deliveries.

Restrain Factors: High costs, complex regulations, weak infrastructure, labor shortages, and delivery issues.

The market for courier, express, and parcel market is restricted by a number of problems, such as high operating costs, complicated regulations, inadequate infrastructure in developing nations, and environmental concerns. Intense rivalry, workforce shortages, and difficulties with last-mile deliveries might also impede service effectiveness and profitability, which could affect the market's overall expansion.

Opportunity: E-commerce growth, fast delivery demand, and tech innovation are creating new opportunities in the courier, express, and parcel market

Increased consumer demand for dependable, quick delivery services and the quick growth of e-commerce present substantial opportunities for the courier, express, and parcel market. Opportunities are created for the major participants in the industry by technical developments in delivery services, the rise of last-mile deliveries, and logistics automation. The need for CEP services has increased due to the rise of global e-commerce platforms, offering lucrative prospects for market expansion. Cross-border commerce expansion creates new opportunities for foreign markets, and last-mile delivery innovations like drones and electric cars encourage cost-effectiveness and sustainability.

Challenges: Insufficient infrastructure, complicated rules, and high costs impact the expansion of the courier, express, and parcel market.

High operating and fuel costs, complicated regional regulatory compliance, and inadequate infrastructure in emerging economies are some of the major challenges facing the Courier, Express, and Parcel market. Additionally, because of traffic jams and address errors, last-mile delivery is still an important challenge. The effectiveness of services is further strained by labor shortages and growing salary demands. Concerns about the environment also force suppliers to implement expensive sustainable practices, which affects profitability as they work to satisfy customers' increasing demands for dependable, quicker delivery.

Global Courier, Express, and Parcel Market Ecosystem Analysis

The global courier, express, and parcel (CEP) market ecosystem is made up of a complex web of players, including service providers, logistics companies, technology vendors, and end consumers. The regulatory organizations that oversee commerce and transportation norms also contribute to the ecosystem. Demand is largely driven by retailers and e-commerce platforms, while infrastructure suppliers provide smooth logistics processes. The ecosystem is being shaped more and more by cooperative alliances and investments in sustainable practices, which allow for flexibility in response to changing global consumer demands and market dynamics.

Global Courier, Express, and Parcel Market, By Service

The standard delivery segment led the courier, express, and parcel market, generating the largest revenue share. This category includes deliveries that may be made within a normal timescale, often between three and seven days, and do not require accelerated services. Standard delivery is the favored option for routine and large-scale shipments due to its affordability, which fuels its strong demand. The demand for standard delivery services is further increased by the growth of e-commerce, especially for non-perishable and less urgent items.

The same-day delivery segment in the Courier, Express, and Parcel market is expected to grow at the fastest CAGR over the forecast period. Technological developments in real-time tracking, route optimization, and the utilization of localized warehouses all contribute to the increase of same-day delivery. Same-day delivery has become popular as companies adjusted to shifting customer preferences, highlighting the demand for prompt and dependable delivery services.

Global Courier, Express, and Parcel Market, By End Use

The e-commerce segment held the largest market share in the courier, express, and parcel market. The development trajectory of e-commerce is showing no signs of slowing down, and ongoing advancements in delivery services, such as drones and driverless cars, are anticipated to further revolutionize the business. E-commerce is a key factor driving the CEP market, and its rise has been further attributed to the widespread use of mobile devices and better internet connectivity.

Get more details on this report -

The wholesale and retail segment in the courier, express, and parcel market is projected to register the fastest CAGR, Reliable and quick CEP services are necessary since retailers are under pressure to maintain low inventory levels and guarantee prompt stock replenishment to satisfy customer demand. In order to handle high product volumes and enable prompt delivery to retailers and final customers, wholesale distributors also mainly depend on CEP services.

North America is expected to account for the largest share of the courier, express, and parcel market during the forecast period.

Get more details on this report -

The growth of the e-commerce industry, improvements in logistics technology, and rising customer demands for quicker delivery times are the main drivers of North America. Furthermore, North America focus on sustainability is propelling the use of green logistics techniques and electric delivery trucks, which are becoming more and more crucial to satisfy customer demand for eco-friendly services and legal regulations.

The United States is experiencing steady growth in the courier, express, and parcel market.

The main drivers of this growth are the United States and Canada, with the U.S. market being especially robust due to its sizable customer base and the dominance of e-commerce behemoths like Amazon and Walmart. The need for international CEP services is also being increased by the expanding trend of cross-border e-commerce between the United States and Canada.

Asia Pacific is expected to grow at the fastest CAGR in the courier, express, and parcel market during the forecast period.

The need for CEP services has increased due to the region's sizable and expanding middle class, high internet and smartphone penetration, and the rise in online shopping. The volume of foreign packages has expanded dramatically due to the growth of cross-border e-commerce, further solidifying the region's position.

China is the largest market for Courier, Express, and Parcel (CEP)

Due to its extensive e-commerce sector, strong logistics infrastructure, technological advancements, and high customer demand for quick and effective delivery services in both domestic and foreign markets.

WORLDWIDE TOP KEY PLAYERS IN THE COURIER, EXPRESS, AND PARCEL MARKET INCLUDE

- FedEx

- Aramex

- TNT Express

- Amazon Logistics

- Blue Dart Express Ltd.

- Qantas Airways Limited

- Deutsche Post DHL Group

- Royal Mail Group Limited

- Yamato Transport Co., Ltd.

- SF Express (Group) Co. Ltd.

- One World Express Inc. Ltd.

- United Parcel Service Inc. (UPS)

- Others

Product Launches in Plant Phenotyping Equipment

- In February 2024, the UAE's courier, express, and package (CEP) market is being transformed by EMX, a new business of Emirates Post Group, which has been relaunched as 7X. EMX prioritizes speed, dependability, and customer-focused services to provide unmatched logistics solutions by utilizing cutting-edge technologies.

- In May 2023, the High-Performance Conveyor Platform (HPP), created especially for the picky courier, express, and package markets, was launched by Interroll. High throughput and customizable sorting are made possible by this platform's clever diverter module. In addition to optimizing system uptime and return on investment, the HPP's sturdy design and cutting-edge Multi Belt Switch guarantee the effective and delicate handling of a variety of package kinds.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the courier, express, and parcel market based on the below-mentioned segments:

Global Courier, Express, and Parcel Market, By Service

- Standard Delivery

- Express Delivery

- Same-Day Delivery

- Last-Mile Delivery

Global Courier, Express, and Parcel Market, By End Use

- E-commerce

- Healthcare

- Manufacturing

- Wholesale & Retail

- Others

Global Courier, Express, and Parcel Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the courier, express, and parcel market over the forecast period?The global courier, express, and parcel market is projected to expand at a CAGR of 7.6% during the forecast period.

-

2.What is the market size of the courier, express, and parcel market?The global courier, express, and parcel market size is expected to grow from USD 485.50 billion in 2024 to USD 1086.20 billion by 2035, at a CAGR of 7.6% during the forecast period 2025-2035.

-

3.Which region holds the largest share of the courier, express, and parcel market?North America is anticipated to hold the largest share of the courier, express, and parcel market over the predicted timeframe.

-

4.Who are the top 10 companies operating in the global courier, express, and parcel market?Key players include FedEx, Aramex, TNT Express, Amazon Logistics, Blue Dart Express Ltd., Qantas Airways Limited, Deutsche Post DHL Group, Royal Mail Group Limited, Yamato Transport Co., Ltd., SF Express (Group) Co. Ltd., One World Express Inc. Ltd., United Parcel Service Inc. (UPS), and Others.

-

5.What factors are driving the growth of the courier, express, and parcel market?The growth of the courier, express, and parcel market is driven by expanding e-commerce, rising consumer demand for fast deliveries, technological advancements, urbanization, global trade expansion, and evolving last-mile solutions.

-

6.What are the main challenges restricting wider adoption of the courier, express, and parcel market?The courier, express, and parcel market faces challenges such as high operational costs, regulatory complexities, inadequate infrastructure, last-mile delivery inefficiencies, labor shortages, and environmental concerns, which restrict broader adoption and growth.

-

7.What regional trends are expected to influence the market during the forecast period?North America’s tech-driven logistics innovations and infrastructure development in emerging economies collectively shape market strategies during the forecast period. Asia Pacific is expected to the fastest e-commerce growth, and urbanization and digital adoption are key trends influencing courier, express, and parcel market expansion.

Need help to buy this report?