Global Corrugated Pipe Market Size, Share, and COVID-19 Impact Analysis, By Type (Single Wall Corrugated and Double Wall Corrugated), By Application (Water Management, Construction, Electrical & Telecommunications, Agricultural Fields, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Corrugated Pipe Market Insights Forecasts to 2035

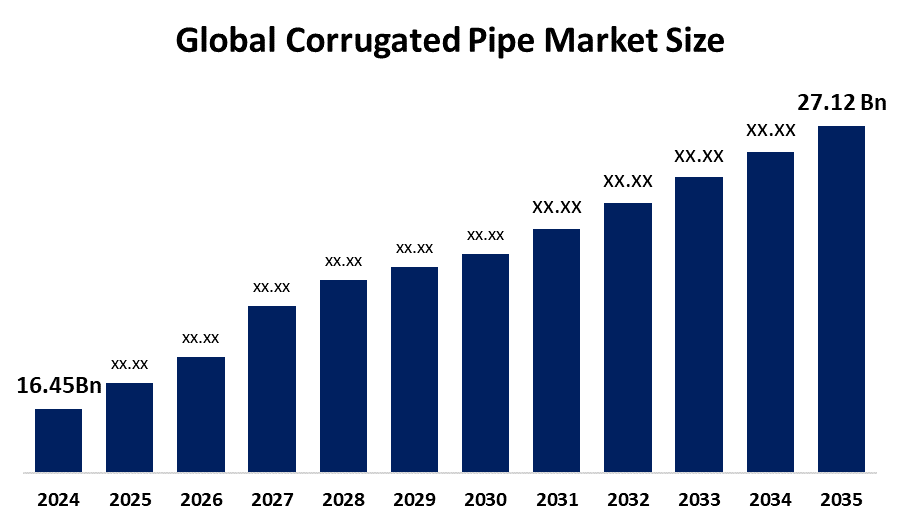

- The Global Corrugated Pipe Market Size Was Estimated at USD 16.45 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.65 % from 2025 to 2035

- The Worldwide Corrugated Pipe Market Size is Expected to Reach USD 27.12 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global corrugated pipe market size was worth around USD 16.45 billion in 2024 and is predicted to grow to around USD 27.12 billion by 2035 with a compound annual growth rate (CAGR) of 4.65% from 2025 to 2035. Growing infrastructure development, increasing demand for effective drainage systems, greater agricultural use, urbanization, and the adoption of sustainable, lightweight, and affordable piping solutions all present growth opportunities for the corrugated pipe market.

Market Overview

The Corrugated Pipe Market involves the entire world that produces, distributes, and applies specific piping systems with parallel ridges and grooves on their outer surfaces, which results in their being strong, flexible, and resistant to pressures from outside the pipe while at the same time being lightweight. Most of the time, these pipes are made from high-density polyethylene (HDPE), polyvinyl chloride (PVC), polypropylene (PP), or metals such as steel and aluminum, and are used in stormwater drainage, sewage systems, irrigation, culvert construction, and underground cable protection, etc. For Instance, in October 2025, Fratco launched a 42,000 sq ft production facility in Alabama, while Lane Enterprises initiated the strategic integration of Pacific Corrugated Pipe, thereby strengthening its leadership in comprehensive metal and plastic drainage solutions. The market for corrugated pipe is driven by rising investments in urban drainage systems, infrastructure expansion, and agricultural modernization in both developed and emerging nations. The increased demand was also fueled by environmental benefits, including recyclability and a smaller carbon footprint than conventional concrete or metal pipes.

Report Coverage

This research report categorizes the corrugated pipe market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the corrugated pipe market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the corrugated pipe market.

Global Corrugated Pipe Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 16.45 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.65% |

| 2035 Value Projection: | USD 27.12 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type |

| Companies covered:: | ASTRAL PIPES, Bina Plastic Industries Sdn. Bhd., Contech Engineered Solutions LLC, Crown Pipes, Dutron, FRÄNKISCHE Industrial Pipes GmbH & Co. KG, JM Eagle Inc., Jain Irrigation Systems Ltd., Pars Ethylene Kish Co., Thai-Asia P.E. Pipe Co., Ltd., and other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rapid urbanization, more infrastructure and drainage development, and growing investments in water management and agricultural irrigation systems are the main factors propelling the corrugated pipe market. Corrugated pipes, especially those composed of HDPE and PVC, are a crucial aspect of contemporary infrastructure projects since they work better, are lighter, and are easier to install than conventional concrete or metal pipes. The need for affordable and environmentally friendly piping materials has increased due to the expanding building industry in emerging countries. The market for corrugated pipes is undergoing a significant change at the moment due to a number of variables that affect its growth trajectory.

Restraining Factors

Variations in raw material prices, high initial installation costs, strict environmental restrictions, low awareness in developing regions, and competition from alternative pipeline materials with established market acceptability are some of the difficulties facing the corrugated pipe market.

Market Segmentation

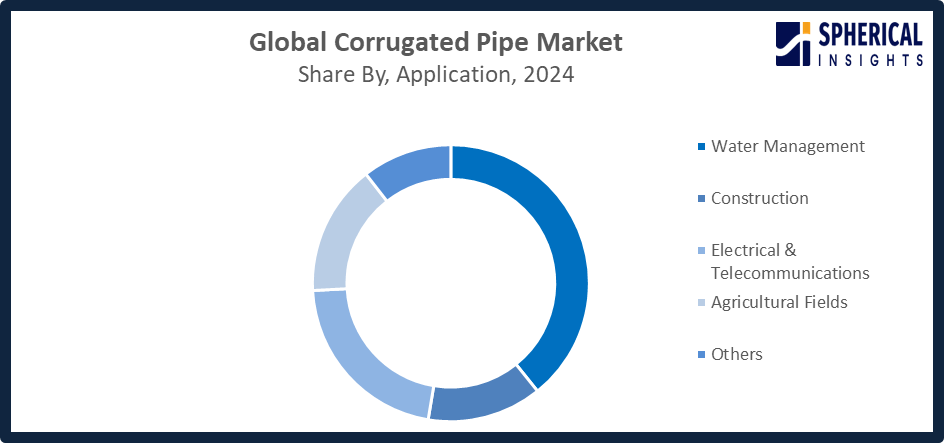

The corrugated pipe market share is classified into type and application.

- The double wall corrugated segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the corrugated pipe market is divided into single wall corrugated and double wall corrugated. Among these, the double wall corrugated segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Hydraulic performance and durability under high traffic or soil pressure are boosted by the increasing usage of HDPE and PP double-wall corrugated. Global segment expansion is also being fueled by infrastructure modernization initiatives, stringent stormwater laws, and the transition to sustainable sewage systems.

- The water management segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the corrugated pipe market is divided into water management, construction, electrical & telecommunications, agricultural fields, and others. Among these, the water management segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Growing global worries about water scarcity, urban flooding, and poor drainage infrastructure are driving the water management segment's expansion. Their lightweight characteristics shorten installation times, and their adaptability and leak-proof construction guarantee effective flow management.

Get more details on this report -

Regional Segment Analysis of the Corrugated Pipe Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the corrugated pipe market over the predicted timeframe.

North America is anticipated to hold the largest share of the corrugated pipe market over the predicted timeframe. The market is expanding due to significant expenditures in smart infrastructure projects, highway restoration, and stormwater management. Market potential is increased by favorable government legislation, urban development programs, and rising understanding of sustainable irrigation and drainage techniques. The need for corrugated pipes made of plastic and metal has increased due to the U.S. Environmental Protection Agency's (EPA) laws that support sustainable drainage systems. Due to their longevity and adherence to environmental regulations, HDPE and double-wall corrugated versions are extensively used. In 2025, SIBUR introduced PP1003 EX polypropylene pipes, which provide corrosion resistance, hydraulic efficiency, and lightweight, environmentally friendly solutions for North American infrastructure, while Advanced Drainage Systems introduced AI-enhanced stormwater products.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the corrugated pipe market during the forecast period. The growth of the drainage and construction projects in the major developing areas of China, India, and Southeast Asia is where the use of economical corrugated plastic pipes is widespread. Governments have made heavy investments in the case of China’s “New Infrastructure Plan” and India’s rural revitalization, along with other measures, to create flood-resistant drainage systems in Southeast Asia, thus adding infrastructure development and water management improvement. In September 2025, Astral Pipes launched eco-friendly drainage products in India, aiming for a 20% market growth, aligning with regulatory initiatives promoting sustainable materials and environmentally responsible infrastructure solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the corrugated pipe market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ASTRAL PIPES

- Bina Plastic Industries Sdn. Bhd.

- Contech Engineered Solutions LLC

- Crown Pipes

- Dutron

- FRÄNKISCHE Industrial Pipes GmbH & Co. KG

- JM Eagle Inc.

- Jain Irrigation Systems Ltd.

- Pars Ethylene Kish Co.

- Thai-Asia P.E. Pipe Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Sintex by Welspun launched India’s first anti-microbial CPVC corrugated pipes in Chandigarh, expanding its water distribution portfolio with a full range of durable, efficient pipes designed for hot, cold, greywater, and drainage applications.

- In May 2025, SIBUR launched a new polypropylene grade, PPI003 EX, enhancing strength for corrugated pipes, offering lightweight, flexible, and durable solutions for efficient sewer and drainage system installations.

- In November 2023, ADS announced the establishment of a new state-of-the-art corrugated thermoplastic pipe manufacturing plant in Lake Wales, Florida (100-acre site; complements Sebring & Winter Garden), representing a significant capacity expansion in the U.S. Southeast.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the corrugated pipe market based on the below-mentioned segments

Global Corrugated Pipe Market, By Type

- Single Wall Corrugated

- Double Wall Corrugated

Global Corrugated Pipe Market, By Application

- Water Management

- Construction

- Electrical & Telecommunications

- Agricultural Fields

- Others

Global Corrugated Pipe Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the corrugated pipe market over the forecast period?The global corrugated pipe market is projected to expand at a CAGR of 4.65% during the forecast period

-

2. What is the market size of the corrugated pipe market?The global corrugated pipe market size is expected to grow from USD 16.45 billion in 2024 to USD 27.12 billion by 2035, at a CAGR of 4.65 % during the forecast period 2025-2035

-

3. Which region holds the largest share of the corrugated pipe market?North America is anticipated to hold the largest share of the corrugated pipe market over the predicted timeframe

-

4. Who are the top 10 companies operating in the global corrugated pipe market?ASTRAL PIPES, Bina Plastic Industries Sdn. Bhd., Contech Engineered Solutions LLC, Crown Pipes, Dutron, FRÄNKISCHE Industrial Pipes GmbH & Co. KG, JM Eagle Inc., Jain Irrigation Systems Ltd., Pars Ethylene Kish Co., Thai-Asia P.E. Pipe Co., Ltd., and Others

-

5. What factors are driving the growth of the corrugated pipe market?Urbanization, infrastructure development, agricultural irrigation needs, government efforts, technical breakthroughs, and the growing demand for long-lasting, lightweight, and reasonably priced piping solutions are the main factors driving the corrugated pipe market.

-

6. What are the market trends in the corrugated pipe market?The key market trends include the adoption of sustainable materials, AI-enhanced drainage solutions, the integration of smart water management systems, expansion in developing regions, and increased preference for corrosion-resistant and eco-friendly corrugated pipes.

-

7. What are the main challenges restricting the wider adoption of the corrugated pipe market?Variations in raw material pricing, high initial installation costs, tight environmental restrictions, low awareness in developing markets, and competition from alternative piping materials with established usage all restrict market expansion.

Need help to buy this report?