Global Corrosion Testing Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Laboratory Testing and Field Testing), By Service (Material Testing, Coating Testing, Corrosion Monitoring, Failure Analysis, and Others), By End-User (Oil & Gas, Automotive, Aerospace, Construction, Marine, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Construction & ManufacturingGlobal Corrosion Testing Services Market Insights Forecasts to 2035

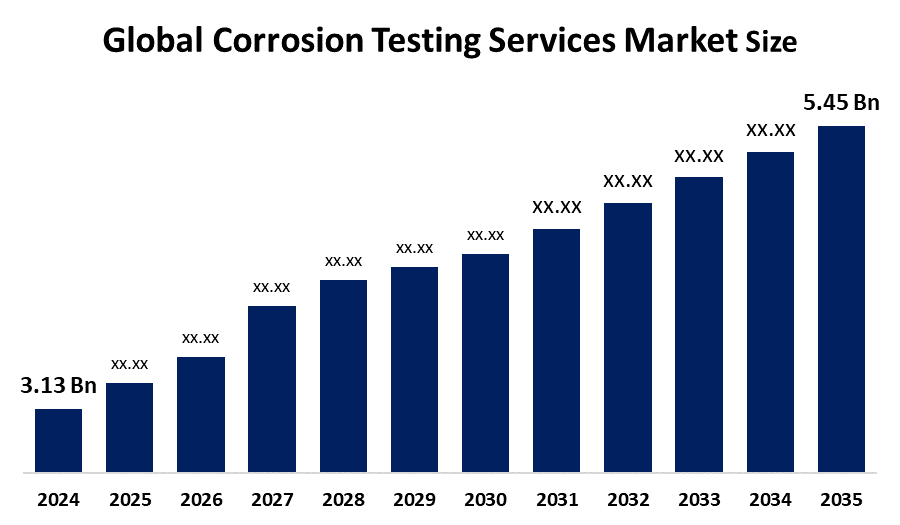

- The Global Corrosion Testing Services Market Size Was Estimated at USD 3.13 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.17% from 2025 to 2035

- The Worldwide Corrosion Testing Services Market Size is Expected to Reach USD 5.45 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

Market Overview

The Global Corrosion Testing Services Market Size refers to the industry that deals with studying material durability, degradation behaviour, and long-term performance in corrosive environments. It is also used to detect potential failure points within industries, optimise the selection of materials, and prolong the life expectancy of critical assets. Corrosion testing has broad applications across oil and gas, marine, aerospace, automotive, construction, power generation, chemical processing, and manufacturing industries due to the fact that degradation of metals and materials can have substantial consequences on safety, efficiency, and operating costs. The primary factors fostering growth in the market include increasing industrial activity, an ageing infrastructure, and greater regulatory requirements concerning the integrity and environmental safety of assets. Today, companies increasingly rely on corrosion testing as a method to reduce equipment failures, downtime, and meet safety standards. Innovation in this market is being driven by improving technologies for electrochemical testing, non-destructive evaluation techniques, digital corrosion monitoring, and predictive analytics supported through IoT and AI technologies. These advancements make it possible to provide improved real-time accuracy in the assessment of corrosion risk and plan smarter maintenance.

Opportunities continue to expand due to the gradual shift toward smart infrastructure, the installation of renewable energy, and the development of new materials that require specialised corrosion assessment. Emerging markets present high growth prospects across Asia-Pacific and the Middle East, dominated by large-scale industrial and construction projects. Other key players in the market are SGS SA, Intertek Group, Bureau Veritas, Element Materials Technology, MISTRAS Group, TUV SUD, and Applus, offering an extensive portfolio of testing, inspection, and certification services aimed at material reliability and operational safety. In July 2025, the Confederation of Indian Industry's Corrosion Management Division urged the Government of India to implement a National Policy on Corrosion Control and Management to protect against infrastructure degradation and economic loss. The appeal for this was made at CII CORTEM 2025 in New Delhi, stating that corrosion results in losses amounting to RS13.2 lakh crore annually, approximately 4% of India's GDP, underscoring the urgent need for national intervention.

Report Coverage

This research report categorizes the corrosion testing services market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the corrosion testing services market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the corrosion testing services market.

Driving Factors

The growth of the corrosion testing services market size is driven by factors such as increasing industrialization, growing infrastructure projects, and greater demand for asset integrity in the oil and gas, marine, energy, and automotive industries. With ageing pipelines and equipment, there is an escalated demand for higher-end corrosion monitoring and failure analysis to minimize operational risks and reduce costly downtime. Stringent government regulations and safety standards press industries toward more comprehensive testing solutions. Moreover, increased awareness about material degradation in harsh environments and consideration for the shift toward predictive maintenance technologies lead companies to invest in credible corrosion testing services to prolong the lifespan of assets while enhancing performance.

Restraining Factors

High initial implementation costs and a lack of proficient personnel to manage advanced monitoring systems are the key factors restraining growth in the global corrosion testing services market. Besides this, insufficient regulatory mandates in certain regions and limited awareness among small and medium enterprises about the long-term benefits of corrosion testing services challenge the market's growth. Technical complexities in integrating new monitoring technologies with existing legacy systems also restrain the adoption.

Market Segmentation

The corrosion testing services market share is classified into type, service, and end-user.

- The laboratory testing segment dominated the market in 2024, approximately 72% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the corrosion testing services market is divided into laboratory testing and field testing. Among these, the laboratory testing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The dominance of the laboratory testing segment in the corrosion testing services market can be attributed to the fact that it provides conditions that are precise, controlled, and reproducible in assessing material durability as well as corrosion resistance. Its vast application in R&D, new coatings, and alloy development, together with accelerated testing methods, allows the correct forecast of long-term performance. In addition, higher demands for material quality and strict industry standards enhance segment growth significantly.

- The material testing segment accounted for the largest share in 2024, approximately 65% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the service, the corrosion testing services market is divided into material testing, coating testing, corrosion monitoring, failure analysis, and others. Among these, the material testing segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Material testing forms a segment within the corrosion testing services market that is growing owing to its critical role in testing the mechanical properties, chemical composition, and corrosion resistance of metals and alloys. Its importance across industries such as oil & gas, automotive, aerospace, and construction, added to the need to prevent material failures and ensure asset longevity, has driven substantial growth and widespread adoption of material testing services.

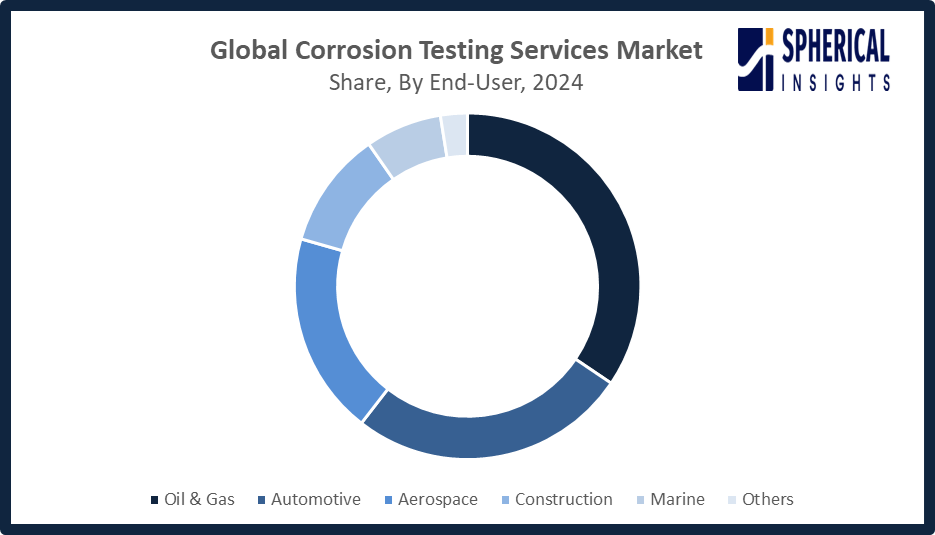

- The oil & gas segment accounted for the highest market revenue in 2024, approximately 34% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the corrosion testing services market is divided into oil & gas, automotive, aerospace, construction, marine, and others. Among these, the oil & gas segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Growth in the oil & gas segment is due to the high vulnerability of the industry to corrosion in pipelines, storage tanks, and offshore platforms. Stringent safety regulations, combined with an ageing infrastructure and the enormous economic and environmental consequences of equipment failure, ensure that corrosion testing, monitoring, and preventive maintenance see widespread investment in the industry, leading to market growth.

Get more details on this report -

Regional Segment Analysis of the Corrosion Testing Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the corrosion testing services market over the predicted timeframe.

North America is anticipated to hold the largest share of the corrosion testing services market over the predicted timeframe. North America continues to dominate the corrosion testing services market, with an approximate 36% market share, due to the presence of established industrial and manufacturing sectors, strict government regulations, and a growing focus on asset integrity and safety. The United States will account for the majority share in this region due to its widespread oil & gas infrastructure, the aerospace sector, and the chemical industry, which need advanced corrosion testing to avoid failures and environmental hazards. Canada also shows good momentum with energy and construction projects on the rise. High adoption of laboratory and field-testing technologies, coupled with investments in predictive maintenance and R&D, further supports the region's market dominance.

Get more details on this report -

The Association for Materials Protection and Performance (AMPP) published Guide 21569-2024 to help pipeline operators meet new PHMSA regulatory requirements for onshore gas transmission. Developed by Standards Committee SC 15, the guide provides detailed corrosion control methodologies aligned with the updated Federal Pipeline Safety Regulations under Part 2 of the PHMSA Gas Mega Rule, enhancing pipeline safety and integrity.

Asia Pacific is expected to grow at a rapid CAGR in the corrosion testing services market during the forecast period. The market for corrosion testing services is rapidly growing in the Asia Pacific region, with an approximate 25% market share, due to rapid industrialization, expansion of infrastructure projects, and rising investments in oil & gas, marine, and construction sectors. China and India are the major contributors, driven by large-scale energy, transportation, and urban development projects that require widespread corrosion monitoring and testing. Growing awareness of material degradation, adoption of the latest testing technologies, and government initiatives toward the safety and durability of critical assets further accelerate the market growth in this region.

Europe is witnessing steady growth in the corrosion testing services market due to stringent environmental and safety regulations, ageing industrial infrastructure, and high adoption of advanced materials in sectors such as oil & gas, aerospace, and automotive. Major contributors in this region include Germany and the United Kingdom, where demand is driven by Germany's strong manufacturing and automotive industries, along with the UK's initiative to maintain its energy and infrastructure sectors. Development of R&D and predictive corrosion monitoring further supports market growth in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the corrosion testing services market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SGS SA

- IMR Test Labs

- CorrTech

- Sigmatest

- Element Materials Technology

- Stolk Labs

- Paragon Laboratories

- A.J. Rose Manufacturing

- Emerson Electric Co.

- Honeywell International Inc.

- Baker Hughes

- Pepperl+Fuchs

- Intertek Group plc.

- Applied Technical Services

- Corrpro Companies, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Baker Hughes announced a joint technology program with Petrobras to address carbon dioxide-induced stress corrosion cracking in flexible pipes. The pre-commercial agreement covers development, testing, and a purchase option for next-generation pipes with a 30-year service life, conducted at Baker Hughes’ Rio de Janeiro innovation and manufacturing facilities.

- In October 2024, Baker Hughes launched XMO2pro, an advanced oxygen analyzer that enhances stability, accuracy, and reliability. Leveraging 60 years of expertise, it helps industrial and energy sectors, including oil & gas, biogas, pharmaceutical, and steel, improve safety, prevent corrosion, and optimize efficiency in processes involving oxygen monitoring.

- In September 2023, Intertek announced the revival of the CAPCIS brand, honoring the specialist team’s 50-year legacy since 1973 at UMIST. The move leverages Intertek’s global reputation in corrosion and materials assurance, reinforcing its leadership in total quality assurance services worldwide.

- In July 2022, Element Materials Technology expanded its Wednesbury, UK lab with the Suga CCT-2LCE cyclic test chamber. This enhances accelerated corrosion testing, meeting new standards like VDA 233-102, and allows simultaneous evaluations by combining salt spray and environmental testing in a single setup.

- In March 2021, Emerson launched a corrosion and erosion monitoring portfolio, integrating the Rosemount 4390 wireless transmitters with Plantweb Insight. The solution converts offline probes to online monitoring tools, combining Permasense sensors to assess corrosion and erosion risks and their impact on plant asset health.

- In August 2019, Element Materials Technology expanded its oil and gas testing capabilities at its Amsterdam laboratory by introducing corrosion inhibitor testing, enhancing its services for the energy sector and strengthening its position in advanced materials and corrosion assessment.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the corrosion testing services market based on the below-mentioned segments:

Global Corrosion Testing Services Market, By Type

- Laboratory Testing

- Field Testing

Global Corrosion Testing Services Market, By Service

- Material Testing

- Coating Testing

- Corrosion Monitoring

- Failure Analysis

- Others

Global Corrosion Testing Services Market, By End-User

- Oil & Gas

- Automotive

- Aerospace

- Construction

- Marine

- Others

Global Corrosion Testing Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the corrosion testing services market over the forecast period?The global corrosion testing services market is projected to expand at a CAGR of 5.17% during the forecast period.

-

2. What is the corrosion testing services market?The corrosion testing services market is a sector that provides specialized services to evaluate the resistance of materials and products to corrosion.

-

The corrosion testing services market is a sector that provides specialized services to evaluate the resistance of materials and products to corrosion.The global corrosion testing services market size is expected to grow from USD 3.13 billion in 2024 to USD 5.45 billion by 2035, at a CAGR of 5.17% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the corrosion testing services market?North America is anticipated to hold the largest share of the corrosion testing services market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global corrosion testing services market?SGS SA, IMR Test Labs, CorrTech, Sigmatest, Element Materials Technology, Stolk Labs, Paragon Laboratories, A.J. Rose Manufacturing, Emerson Electric Co., Honeywell International Inc., and Others.

-

6. What factors are driving the growth of the corrosion testing services market?The growth of the corrosion testing services market is driven by several key factors, including the need to manage ageing infrastructure, increasingly stringent safety and environmental regulations, and technological advancements in monitoring and testing.

-

7. What are the market trends in the corrosion testing services market?Market trends in corrosion testing services include a shift toward real-time and predictive monitoring, driven by the need to protect assets and reduce costs, especially in the oil and gas sector. There is also a growing demand for more sophisticated, non-intrusive methods and the integration of AI and IoT technologies.

-

8. What are the main challenges restricting wider adoption of the corrosion testing services market?The main challenges restricting the wider adoption of the corrosion testing services market are high initial costs, a shortage of skilled professionals, and technical limitations in certain environments.

Need help to buy this report?