Global Corneal Transplant Market Size, Share, and COVID-19 Impact Analysis, By Procedure Type (Penetrating Keratoplasty, Endothelial Keratoplasty, Descemet Stripping Automated Endothelial Keratoplasty (DSAEK), Corneal Graft, Corneal Limbal Stem Cell Transplant and Others), By Indication (Fungal Corneal Ulcer, Bullous Keratopathy, Keratoconus, Keratitis and Others), By End-user (Hospitals, Eye Clinics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Corneal Transplant Market Insights Forecasts to 2035

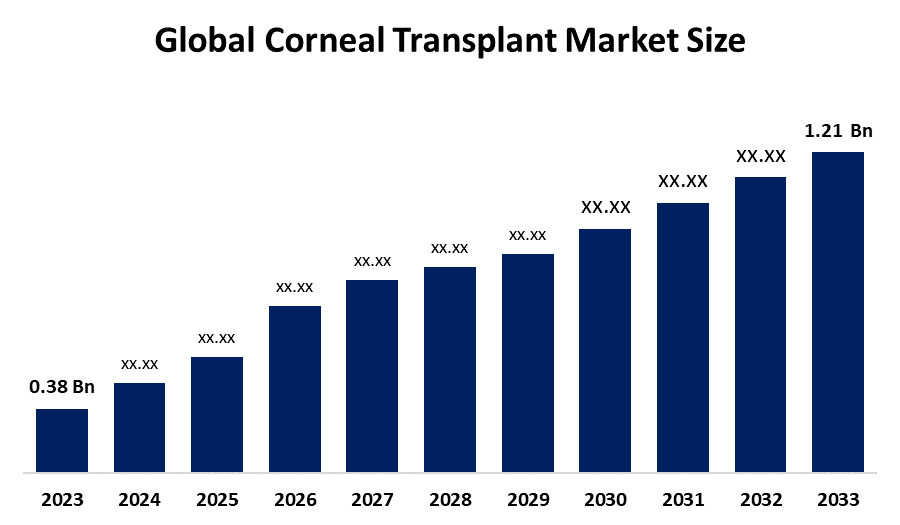

- The Global Corneal Transplant Market Size Was Estimated at USD 0.38 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.1% from 2025 to 2035

- The Worldwide Corneal Transplant Market Size is Expected to Reach USD 1.21 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global corneal transplant market size was worth around USD 0.38 billion in 2024 and is predicted to grow to around USD 1.21 billion by 2035 with a compound annual growth rate (CAGR) of 11.1% from 2025 to 2035. The corneal transplant market is growing, driven by an increasing incidence of corneal diseases, a rise in the geriatric population, and a continuous shortage of human donor corneas, thereby increasing demand for artificial implants and new surgical techniques.

Market Overview

The Worldwide Corneal Transplant Market Size refers to a procedure that substitutes a diseased or impaired cornea with a healthy donor graft or an artificial substitute to recover vision, alleviate discomfort and enhance appearance. Applications include the treatment of conditions related to keratoconus, Fuchs' dystrophy, corneal ulcers, and oedema. Driving factors for the market include an increase in global corneal disorders, an ageing population with vulnerability to eye diseases, and key developments made in surgical techniques such as EK, along with the development of artificial corneas.

The Union Health Ministry announced its decision to set up a national eye-bank registry in June 2024 so that more people can have access to corneal transplants and reduce delays. Resource gaps result in half of the patients being left untreated. The registry will send alerts on the availability of corneas to doctors and patients. Corneal diseases cause blindness among 37.5% Indians below 49 years, reports the RAAB survey. The ongoing shortage of human donor corneas has catalyzed innovation in bioengineered and synthetic implants, thus expanding eye care infrastructure in emerging markets of the Asia Pacific and Latin America. Key companies operating within the corneal transplant market are CorneaGen, Alcon, Carl Zeiss, AJL Ophthalmic, DIOPTEX, and KeraMed, and are focusing on R&D and collaborations.

Report Coverage

This research report categorizes the corneal transplant market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the corneal transplant market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the corneal transplant market.

Global Corneal Transplant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.38 Billion |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 11.1% |

| 024 – 2035 Value Projection: | USD 1.21 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Procedure Type, By Indication |

| Companies covered:: | Alcon Inc., KeraMed, Inc., CorneaGen Inc., Presbia PLC, Carl Zeiss, DIOPTEX, CorNeat Vision Ltd., Medtronic, Auro Laboratories Ltd., CryoLife, Inc., AJL Ophthalmic S.A., Kohler GmbH, Florida Lions Eye Bank, LinkoCare Life Sciences AB, And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing frequency of corneal conditions, such as keratoconus, infections and degeneration related to ageing, drives the expansion of the worldwide corneal transplant market. Enhanced awareness of treatment options, along with advancements in methods, enlarges the number of patients. Enhanced surgical results through cutting-edge methods like DMEK, DSAEK and femtosecond laser-assisted procedures promote acceptance. This aspect, along with access to donor tissues due to the growth of eye bank networks, supports the market. Moreover, advanced technologies, like bioengineered corneas and synthetic corneal implants, also offer possibilities. Rising healthcare spending, aided by government policies and greater availability of specialized eye care in emerging markets, further propels the expansion.

In December 2024, UT Southwestern partnered with Carnegie Mellon to participate in the THEA program at ARPA-H, aiming to perform entire eye transplants. Their research focuses on methods and nerve regrowth to enhance transplant success and recover vision in blind individuals.

Restraining Factors

The major factors hindering the expansion of the transplant market are the high price of the surgery and the implant, along with the limited availability of human donor corneas. Additional significant obstacles involve surgical complications such as graft rejection and infections, the necessity for highly trained surgeons to operate, and the variability in regulatory processes.

Market Segmentation

The corneal transplant market share is classified into procedure type, indication, and end-user.

- The penetrating keratoplasty segment dominated the market in 2024, approximately 40% and is projected to grow at a substantial CAGR during the forecast period.

Based on the procedure type, the corneal transplant market is divided into penetrating keratoplasty, endothelial keratoplasty, descemet stripping automated endothelial keratoplasty (DSAEK), corneal graft, corneal limbal stem cell transplant and others. Among these, the penetrating keratoplasty segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is expected to grow due to the versatility of penetrating keratoplasty in treating a wide variety of corneal disorders, including full-thickness corneal damage, scarring, and keratoconus. Well-established clinical success, wider availability of surgical expertise, and the ability of the intervention to restore vision effectively in severe cases make it a preferred choice, hence leading to high adoption and significant market expansion.

- The keratoconus segment accounted for the largest share in 2024, approximately 30% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the indication, the corneal transplant market is divided into fungal corneal ulcer, bullous keratopathy, keratoconus, keratitis and others. Among these, the keratoconus segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Within the growth of the corneal transplant market, the segment of keratoconus is growing, owing to its rising prevalence and increasing awareness regarding treatments for vision restoration, besides early diagnosis facilitated through advanced imaging technologies. Corneal transplantation is increasingly recognized and performed, particularly on younger individuals with diagnoses related to keratoconus, together with supportive healthcare policies and initiatives.

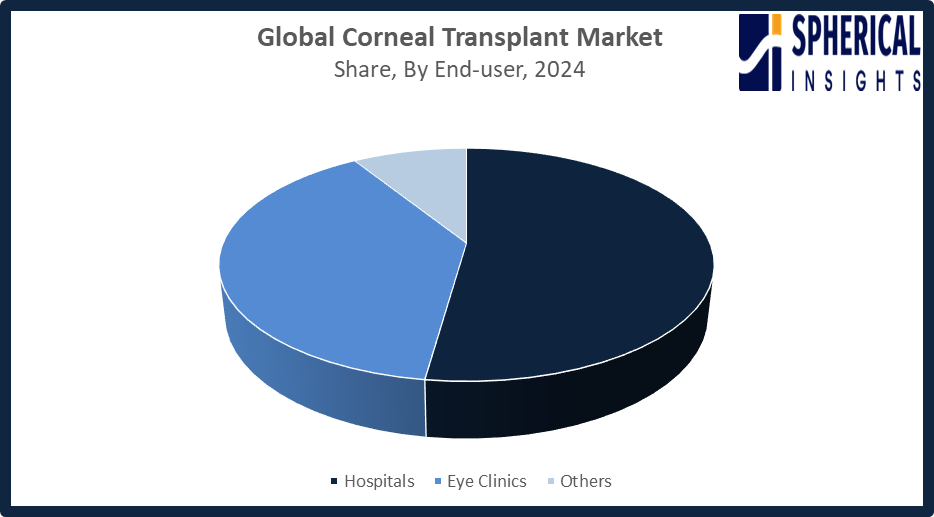

- The hospitals segment accounted for the highest market revenue in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user, the corneal transplant market is divided into hospitals, eye clinics, and others. Among these, the hospitals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment of hospitals is one of the major factors driving growth in the corneal transplant market, driven by advanced surgical facilities, the availability of specialized ophthalmic surgeons, and comprehensive post-operative care. Hospitals receive higher volumes of complex procedures and also provide access to advanced technologies, which, in turn, have made hospitals a better and more preferred end-user setting for performing corneal transplants, thereby driving significant market expansion.

Get more details on this report -

Regional Segment Analysis of the Corneal Transplant Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the corneal transplant market over the predicted timeframe.

North America is anticipated to hold the largest share of the corneal transplant market over the predicted timeframe. The North American region is expected to hold 44% of the market share in the corneal transplant market due to high awareness about corneal diseases and the adoption of newer surgical techniques such as DSAEK and DMEK, made possible by developed healthcare systems. Its major share lies in the United States, due to its unique eye banking system, government support, and general research in the field of regenerative ocular medicine. This is followed by Canada, with easy availability of and access to specialized eye care and transplant services. Higher expenditures on health, along with reimbursement policies and a focus on timely diagnosis and treatment, are driving market growth across the region. In December 2024, ARPA-H of the U.S. Department of Health and Human Services committed as much as USD125 million under its THEA program to develop the world's first complete eye transplant. More than 40 experts from the teams at USC and NYU Langone will study transplant feasibility and improve partial-eye transplantation to bring vision to blind patients.

Asia Pacific is expected to grow at a rapid CAGR in the corneal transplant market during the forecast period. The main driving factors for the growth of the transplant market in the Asia Pacific region, with around 17% of the market, are due to an increasing prevalence of corneal diseases, growing awareness about treatment options, and better healthcare services. Major countries contributing to this would include India, China, and Japan due to the availability of more specialized eye care centers and eye banks. Government support and better access to advanced procedures, along with a big pool of patients with unmet needs, will help drive the growth of the market and make it the fastest-growing region. In November 2024, the Centre asked states to make it mandatory for all eye banks and hospitals that perform tissue or cornea transplants to report all such procedures to NOTTO’s national registry. The facilities have to report data related to waiting patients, donations, transplants performed, and tissues stored or used, in an effort to bring in transparency and streamline transplant management.

The European region experiences stable growth in the corneal transplant market due to better healthcare, increased awareness related to corneal diseases, and well-established eye-bank networks within the region. The major countries contributing toward business growth in this respect include Germany, the U.K., and France, with various specialty ophthalmic centers considering complex procedures with the use of advanced techniques, such as DMEK and DSAEK. Supportive government policies, strong R&D activities, and increased adoption of minimally invasive surgical procedures further enhance patient outcomes and regional market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the corneal transplant market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alcon Inc.

- KeraMed, Inc.

- CorneaGen Inc.

- Presbia PLC

- Carl Zeiss

- DIOPTEX

- CorNeat Vision Ltd.

- Medtronic

- Auro Laboratories Ltd.

- CryoLife, Inc.

- AJL Ophthalmic S.A.

- Kohler GmbH

- Florida Lions Eye Bank

- LinkoCare Life Sciences AB

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Alcon announced it acquired a majority stake in Aurion Biotech, a clinical-stage company developing advanced cell therapies for eye diseases. Aurion will operate independently, with Alcon support, advancing its allogeneic cell therapy AURN001 into Phase 3 trials for corneal oedema secondary to endothelial disease in H2 2025.

- In September 2024, Aurion Biotech launched Vyznova (neltependocel, formerly AURN001) in Japan for bullous keratopathy, offering an alternative to donor corneal transplants. As the world’s first allogeneic cell therapy for corneal endothelial disease, Vyznova has reimbursement approval and is being used at Kyoto Prefecture University of Medicine.

- In June 2024, CorneaGen launched Corneal Tissue Addition for Keratoplasty (CTAK) in the U.S., a cryopreserved stromal lenticule that enhances donor corneas, improves graft survival in complex keratoconus cases, reduces rejection risks, and boosts overall patient outcomes.

- In July 2022, Carl Zeiss Meditec and Precise Bio partnered to develop and commercialize fabricated corneal tissue for endothelial keratoplasty and natural lenticule transplants, targeting keratoconus treatment and vision correction in patients requiring advanced corneal procedures.

- In January 2020, Israel-based CorNeat Vision began developing an affordable, easily implantable artificial cornea aimed at replacing donor corneas and addressing the global shortage of transplantable corneal tissue.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the corneal transplant market based on the below-mentioned segments:

Global Corneal Transplant Market, By Procedure Type

- Penetrating Keratoplasty

- Endothelial Keratoplasty

- Descemet Stripping Automated Endothelial Keratoplasty (DSAEK)

- Corneal Graft

- Corneal Limbal Stem Cell Transplant

- Others

Global Corneal Transplant Market, By Indication

- Fungal Corneal Ulcer

- Bullous Keratopathy

- Keratoconus

- Keratitis

- Others

Global Corneal Transplant Market, By End-user

- Hospitals

- Eye Clinics

- Others

Global Corneal Transplant Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the corneal transplant market over the forecast period?The global corneal transplant market is projected to expand at a CAGR of 11.1% during the forecast period.

-

2. What is the corneal transplant market?The corneal transplant market is the global industry for the surgical replacement of a damaged or diseased cornea with donated human tissue or a synthetic artificial cornea.

-

3. What is the market size of the corneal transplant market?The global corneal transplant market size is expected to grow from USD 0.38 billion in 2024 to USD 1.21 billion by 2035, at a CAGR of 11.1% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the corneal transplant market?North America is anticipated to hold the largest share of the corneal transplant market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global corneal transplant market?Alcon Inc., KeraMed, Inc., CorneaGen Inc., Presbia PLC, Carl Zeiss, DIOPTEX, CorNeat Vision Ltd., Medtronic, Auro Laboratories Ltd., CryoLife, Inc., and Others.

-

6. What factors are driving the growth of the corneal transplant market?The growth of the corneal transplant market is primarily driven by the increasing prevalence of corneal diseases, a shortage of human organ donors, which spurs the development of artificial alternatives, and advancements in surgical techniques.

-

7. What are the market trends in the corneal transplant market?Market trends in the corneal transplant market include the rise of artificial corneas and new techniques like cultured endothelial cell (CEC) injections due to donor shortages.

-

8. What are the main challenges restricting wider adoption of the corneal transplant market?The main challenges restricting the wider adoption of the corneal transplant market include a severe shortage of donor corneas, high costs associated with procedures, and a lack of specialized healthcare infrastructure and trained professionals in many regions.

Need help to buy this report?