Global Corn Glucose Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid Glucose and Solid Glucose), By Application (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, and Industrial Applications) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Corn Glucose Market Insights Forecasts to 2035

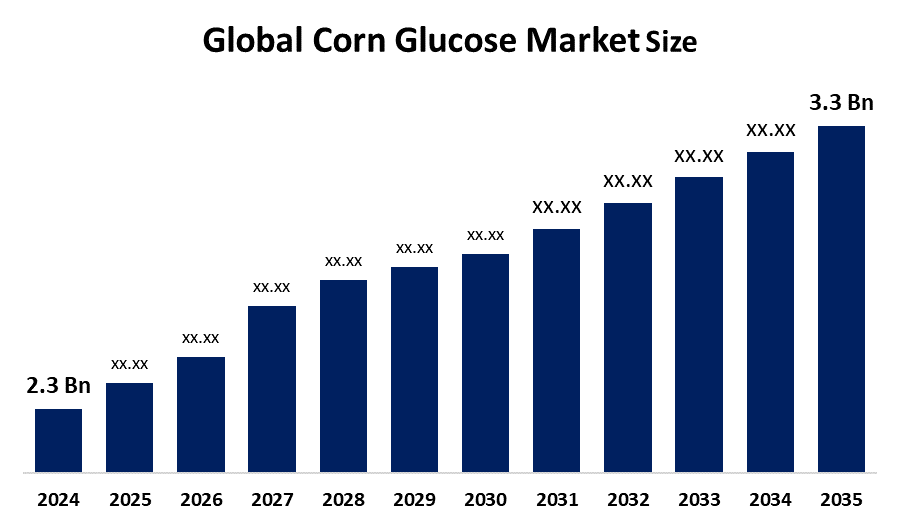

- The Global Corn Glucose Market Size Was Estimated at USD 2.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.34% from 2025 to 2035

- The Worldwide Corn Glucose Market Size is Expected to Reach USD 3.3 Billion by 2035

- Asia-Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Corn Glucose Market Size was worth around USD 2.3 Billion in 2024 and is predicted to Grow to around USD 3.3 Billion by 2035 with a compound annual growth rate (CAGR) of 3.34% from 2025 to 2035. The market is being propelled by factors such as the surging demand for frozen foods, the widespread occurrence of various medical ailments, and the expanding application of the product in the production of cosmetic goods.

Market Overview

The Global Corn Glucose Market Size encompasses the whole industry of making and selling glucose obtained from cornstarch, which is mostly known as dextrose and has numerous applications as a sweetener, stabilizer, and energy source. Due to its excellent solubility, fast energy release, and adaptability in a variety of products such as baked goods, confections, beverages, and processed foods, corn glucose is widely used in the food and beverages, pharmaceuticals, and industrial sectors. The market is expanding because of the increasing demand for convenience and ready-to-eat foods, growing sales of energy and sports supplements, widening applications in the pharmaceutical sector, and a booming beverage market. Furthermore, the global adoption of advanced enzymatic and biotechnology production processes is continually improving the efficiency of production and quality of end products.

Report Coverage

This research report categorizes the corn glucose market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the corn glucose market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the corn glucose market.

Global Corn Glucose Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.3 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.34% |

| 2035 Value Projection: | USD 3.3 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Cargill, Incorporated, Archer Daniels Midland Company (ADM), Tate & Lyle PLC, Ingredion Incorporated, Roquette Frères, Global Sweeteners Holdings Ltd., Tereos Group, AGRANA Beteiligungs-AG, Foodchem International Corporation, Gulshan Polyols Ltd., and Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Processed and packaged foods have large emerging economies as their new consumer market, and one of the main reasons for the corn glucose market's growth is the consumer's choice of the easy access to the variety of ready-made meals, snacks, and drinks. Corn glucose is used as a sweetener, humectant, and preservative in packaged foods due to its cost-effectiveness. It gives texture, and taste, prolongs shelf life and thus it is important for packaged foods. With the growing of the middle-class and the increasing of young people in the world now make it possible to see the usage of corn glucose in sweets, bakery and dairy product consumption to rise.

Restraining Factors

One major limitation of the corn glucose market size is the reliance on corn as a primary raw material which makes the industry vulnerable to price fluctuations and disruptions in the supply chain. The industry can gain or lose access to its raw materials due to the demand changes from animal feed, biofuels, and other industrial uses. Weather-related factors impacting the corn crop can be worsened by diseases, political tensions resulting in export bans or trade restrictions, and other such reasons.

Market Segmentation

The corn glucose market share is classified into type and application.

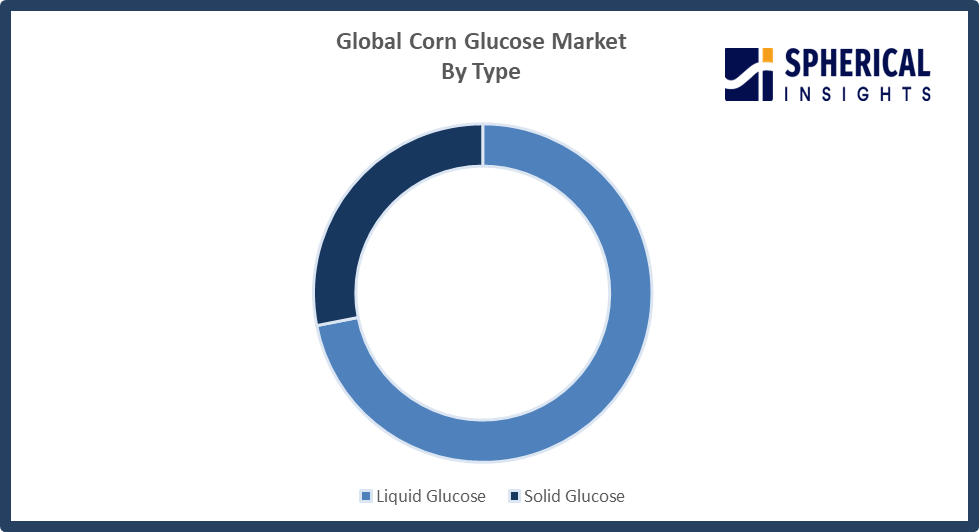

- The liquid glucose segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the corn glucose market is divided into liquid glucose and solid glucose. Among these, the liquid glucose segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment is increasing in size because of high solubility, ease of blending, and versatility in food and beverage applications. Besides, the rising demand for processed foods, confectionery, and energy drinks, along with its use as a stabilizer and sweetener in industrial and pharmaceutical products, drive market growth.

Get more details on this report -

- The industrial applications segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the corn glucose market size is divided into food & beverages, pharmaceuticals, cosmetics & personal care, industrial applications. Among these, the industrial applications segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment is witnessing an upward trend which can be attributed to the increasing consumption of corn glucose in the bioethanol industry, fermentation, and chemical process. Corn glucose being an economical and multipurpose raw material is also one of the major factors propelling the global market and is supported by the increasing industrialization and the growing pharmaceutical manufacturing.

Regional Segment Analysis of the Corn Glucose Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the corn glucose market over the predicted timeframe.

North America is anticipated to hold the largest share of the corn glucose market size over the predicted timeframe. The large-scale use of convenience and processed foods, the presence of powerful food and beverage industries, the availability of modern manufacturing facilities, the strength of the pharmaceutical and industrial sectors, the rising requirement of sweeteners and stabilizers, and the never-ending influx of funds into research and technology have all contributed to this situation.

Get more details on this report -

Asia-Pacific is expected to grow at a rapid CAGR in the corn glucose market during the forecast period. The market is going through a fast-growing phase because of various factors like the increase in population, more money in people's pockets, the need for more processed and convenience foods, the growth of beverage and confectionery industries, the use of pharmaceuticals and chemicals, and the industrial usage of the products. Good agricultural output and better factory facilities in places like China and India are also helping the market to grow.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the corn glucose market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Tate & Lyle PLC

- Ingredion Incorporated

- Roquette Freres

- Global Sweeteners Holdings Ltd.

- Tereos Group

- AGRANA Beteiligungs AG

- Foodchem International Corporation

- Gulshan Polyols Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value Added Resellers (VARs)

Recent Development

• In July 2025, Coca-Cola announced plans to offer U.S. sodas sweetened with cane sugar instead of high-fructose corn syrup, sparking debate over health and consumer preferences. Nutrition experts noted that both sweeteners have similar health effects when consumed in excess.

Market Segmentation

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the corn glucose market based on the following categories:

Global Corn Glucose Market, By Type

• Liquid Glucose

• Solid Glucose

Global Corn Glucose Market, By Application

• Food & Beverages

• Pharmaceuticals

• Cosmetics & Personal Care

• Industrial Applications

Global Corn Glucose Market, By Regional Analysis

North America

• U.S.

• Canada

• Mexico

Europe

• Germany

• UK

• France

• Italy

• Spain

• Russia

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• South Korea

• Australia

• Rest of Asia Pacific

South America

• Brazil

• Argentina

• Rest of South America

Middle East & Africa

• UAE

• Saudi Arabia

• Qatar

• South Africa

• Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the corn glucose market over the forecast period?The global situation awareness system (SAS) market is projected to expand at a CAGR of 3.34% during the forecast period.

-

2. What is the market size of the corn glucose market?the global corn glucose market Size is expected to grow from USD 2.3 billion in 2024 to USD 3.3 billion by 2035, at a CAGR of 3.34% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the corn glucose market?North America is anticipated to hold the largest share of the corn glucose market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global corn glucose market?Cargill, Incorporated, Archer Daniels Midland Company (ADM), Tate & Lyle PLC, Ingredion Incorporated, Roquette Frères, Global Sweeteners Holdings Ltd., Tereos Group, AGRANA Beteiligungs-AG, Foodchem International Corporation, Gulshan Polyols Ltd., and Others.

-

5. What are the market trends in the corn glucose market?Growing demand for processed foods and beverages, growing use of liquid glucose, expanding pharmaceutical and industrial applications, technological advancements in production, and an increasing emphasis on high-quality and sustainable corn-derived sweeteners are some of the major market trends.

Need help to buy this report?