Global Copper Wire Market Size, Share, and COVID-19 Impact Analysis, By Type (Beryllium Copper Wire, Copper Alloy Wire, Copper Clad Aluminium Wire, Copper Clad Steel Wire, Copper Nickel & Nickel Plated Copper Wire, and Titanium Clad Copper Wire), By End Use (Construction, Motors, Transformers & Power Generation, Aerospace & Defence, Petrochemical and Nuclear, and Medical Industries), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Copper Wire Market Insights Forecasts to 2035

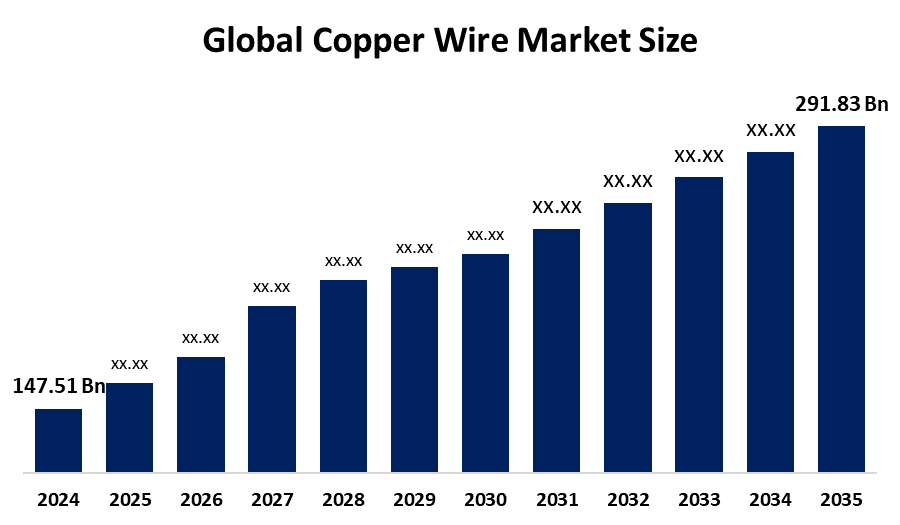

- The Global Copper Wire Market Size Was Estimated at USD 147.51 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.4% from 2025 to 2035

- The Worldwide Copper Wire Market Size is Expected to Reach USD 291.83 Billion by 2035

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Copper Wire Market Size was worth around USD 147.51 Billion in 2024 and is predicted to grow to around USD 291.83 Billion by 2035 with a compound annual growth rate (CAGR) of 6.4% from 2025 to 2035. The market for copper wire is expanding due to growing demand for electricity, urbanization, renewable energy initiatives, electric vehicles, and infrastructure growth. Chinese economic growth, technological innovations, 5G rollout, and increased construction in emerging economies also increase the use of copper wire worldwide.

Market Overview

The global copper wire market refers to the business of manufacturing, distributing, and utilizing copper-based electric conductors used in a range of industries. Copper wire, being highly conductive, flexible, and durable, is used in electrical power generation and transmission, telecommunications, electronics, automobile, and construction sectors. Its extensive application is prompted by the rising need for electricity, swift industrialization, urban growth, and the world's shift toward renewable energy sources. Advances in technology, including the construction of high-performance, heat-resistant, and environmentally friendly copper wires, have improved efficiency and longevity, encouraging wider use across industries.

Increased adoption of electric vehicles (EVs), deployment of expanded 5G networks, and rising investment in smart grid infrastructure are major drivers for market growth. Moreover, the upgrading of aged electrical infrastructure in mature areas and accelerated infrastructure creation in emerging markets also aid market expansion. Key market players such as Nexans S.A., Prysmian Group, Sumitomo Electric Industries, Ltd., Southwire Company, and LS Cable & System are emphasizing product innovation, strategic alliances, and capacity growth to enhance their global reach. The companies are also making investments in research and green production practices to keep pace with increasing environmental and regulatory demands. In FY25, India's imports of copper cathodes declined 34% year-on-year following a three-month supply halt triggered by a Quality Control Order (QCO). Downstream copper product imports, however, went up sharply with wire rising 17%, tubes and pipes by 30%, and plates, sheets, and strips advancing 49% to multi-year highs.

Report Coverage

This research report categorizes the copper wire market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the copper wire market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the copper wire market.

Global Copper Wire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 147.51 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.4% |

| 2035 Value Projection: | USD 291.83 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By End Use and By Region |

| Companies covered:: | Prysmian Group, Fujikura Ltd., Sumitomo Corporation, LS Cable & System, Encore Wire Corporation, Belden Inc, Nexans, Rea Magnet Wire, Cords Cable Industries Ltd., Southwire Company, Apar Industries Ltd., Polycab India Ltd., Furukawa Electric Co., Ltd., KEI Industries Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for copper wire is fueled by a number of important drivers, such as fast-growing urbanization, industrialization, and widening infrastructure projects globally. Increased power demand, accompanied by the trend toward alternative energy sources such as solar and wind, greatly increases copper wire application for power transmission. The expansion of electric vehicles (EVs) and the build-up of charging stations also contribute to market growth. The establishment of 5G networks, the rise in use of smart devices, and technology upgrades in electrical systems also enhance copper wire consumption. Positive government policies encouraging clean energy and the upgrading of old power infrastructure also aid in persistent market growth.

Restraining Factors

Fluctuating copper prices, fueled by supply-demand pressure and geopolitical tensions, impede the copper wire market. The high production and energy costs restrict profitability levels, while increased usage of aluminum as a lower-cost substitute impedes demand. Environmental issues, tight mining regulations, and recycling problems also limit market growth and expansion potential.

Market Segmentation

The copper wire market share is classified into type and end use.

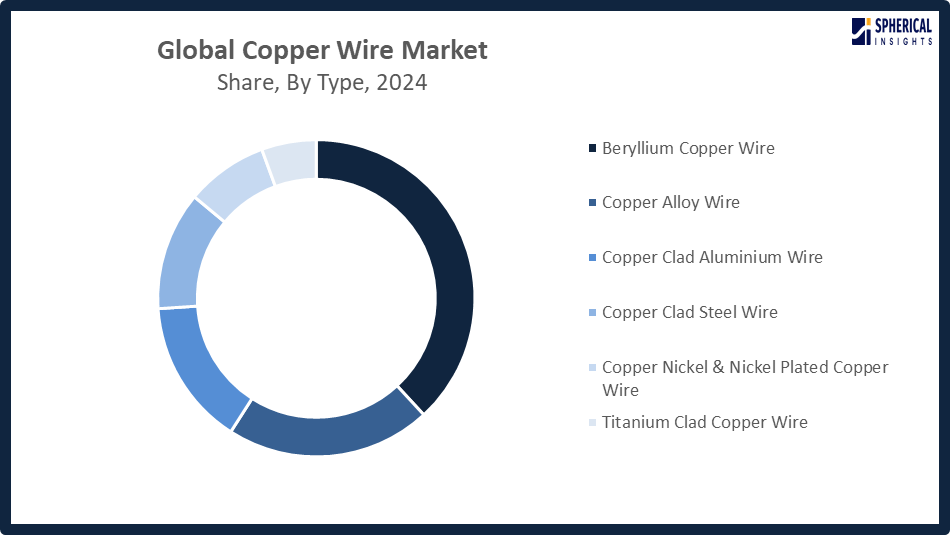

- The copper alloy wire segment dominated the market in 2024, approximately 38% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the copper wire market is divided into beryllium copper wire, copper alloy wire, copper clad aluminium wire, copper clad steel wire, copper nickel & nickel plated copper wire, and titanium clad copper wire. Among these, the copper alloy wire segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The copper alloy wire segment of the market, led by growth, is fueled by its excellent electrical conductivity, corrosion resistance, and mechanical strength, which make it perfect for electrical, automotive, aerospace, and industrial sectors. Increased global infrastructure development, new investments in renewable energy projects, and heightened demand for high-performance wiring solutions in electronics and machinery are set to further drive the use of copper alloy wires globally.

Get more details on this report -

- The construction segment accounted for the largest share in 2024, approximately 36% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the copper wire market is divided into construction, motors, transformers & power generation, aerospace & defence, petrochemical and nuclear, and medical industries. Among these, the construction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The construction segment captured the largest proportion of the copper wire market due to the expansion is fueled by booming urbanization, large-scale infrastructure development, and rising demand for household, commercial, and industrial electrification. Various government policies encouraging smart cities, energy-efficient structures, and upgraded power distribution networks, combined with growing investments in renewable energy and city infrastructure, are likely to continue driving the use of copper wires in the building industry across the world.

Regional Segment Analysis of the Copper Wire Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the copper wire market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the copper wire market over the predicted timeframe. The Asia Pacific is expected to dominate the copper wire market, with approximately 74% of the market share, with rapidly growing industrialization, urbanization, and massive infrastructure development on a large scale. Market growth is driven by strong demand from the construction, automotive, electronics, and renewable energy industries. China, being the regional leader as the largest market, is followed by extensive smart city developments, EV penetration, and manufacturing growth. India makes significant contributions with increasing electrification, residential projects, and industrial developments. Japan and South Korea also contribute to growth with developed electronics and automobile industries, making regional supremacy stronger.

On October 19, 2024, the Department for Promotion of Industry and Internal Trade (DPIIT) issued a Quality Control Order (QCO) requiring copper products such as wires and rods to adhere to Indian Standards and display the Bureau of Indian Standards (BIS) certification mark to maintain quality, safety, and reliability.

North America is expected to grow at a rapid CAGR in the copper wire market during the forecast period. North America is rapidly growing in the copper wire market over the forecast period, accounting for approximately market share 27%, led by rising investment in infrastructure upgrading, renewable energy developments, and smart grid installations. The United States holds a major market share in the region due to high government investment in electric vehicle uptake, power transmission line upgrades, and industrial electrification. Canada makes its contribution in the form of increasing demand from the construction and mining industries. Wiring technology improvements and increased use of energy-efficient electrical systems across residential, commercial, and industrial uses further bolster healthy market growth in the region.

Europe is experiencing consistent growth in the copper wire industry due to growing investments in renewable energy, electric vehicles, and industrial automation. Germany tops the region due to its robust automotive industry, sophisticated manufacturing, and government incentives for green energy infrastructure. Furthermore, expanding urbanization and modernization of power distribution networks in France, the UK, and Italy are driving demand for quality copper wiring solutions in construction, energy, and industrial uses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the copper wire market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Prysmian Group

- Fujikura Ltd.

- Sumitomo Corporation

- LS Cable & System

- Encore Wire Corporation

- Belden Inc

- Nexans

- Rea Magnet Wire

- Cords Cable Industries Ltd.

- Southwire Company

- Apar Industries Ltd.

- Polycab India Ltd.

- Furukawa Electric Co., Ltd.

- KEI Industries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Aurubis AG and Nexans announced separate investments to increase recycled-content copper production in Europe. Aurubis, based in Germany, invested $5.9 million in its Avellino, Italy, facility, modernizing a shaft furnace to boost copper wire rod production efficiency and sustainability, enhancing capacity by nearly 20%.

- In October 2024, Remee Wire & Cable introduced stranded copper ground wires under its Renewables line, designed for outdoor use in solar arrays and wind farms. The range includes bare and tinned copper conductors from 14 AWG to 4/0 AWG, with concentric lay strands made from multiple copper tempers.

- In September 2024, Prysmian will unveil its new partnership with Encore Wire Corporation, a leading copper and aluminum wire and cable manufacturer, at the NECA 2024 Convention & Trade Show in San Diego from September 28 to October 1, showcasing power generation and distribution solutions.

- In April 2024, Prysmian signed a long-term agreement with Aurubis, a leading copper recycler, to supply increasing volumes of copper wire rods annually, mainly to Prysmian’s European plants. Building on a 25-year partnership, the deal supports Prysmian’s operations and future growth, reflecting copper’s growing importance in energy transition and digitalization.

- In August 2024, Bedra Vietnam Alloy Material Co., Ltd. launched advanced copper alloy rods and wires for new energy vehicles and consumer electronics, engineered to be lead-free, beryllium-free, and environmentally friendly.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the copper wire market based on the below-mentioned segments:

Global Copper Wire Market, By Type

- Beryllium Copper Wire

- Copper Alloy Wire

- Copper Clad Aluminium Wire

- Copper Clad Steel Wire

- Copper Nickel & Nickel Plated Copper Wire

- Titanium Clad Copper Wire

Global Copper Wire Market, By End Use

- Construction

- Motors

- Transformers & Power Generation

- Aerospace & Defence

- Petrochemical and Nuclear

- Medical Industries

Global Copper Wire Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the copper wire market over the forecast period?The global copper wire market is projected to expand at a CAGR of 6.4% during the forecast period.

-

2. What is the market size of the copper wire market?The global copper wire market size is expected to grow from USD 147.51 billion in 2024 to USD 291.83 billion by 2035, at a CAGR of 6.4% during the forecast period 2025-2035.

-

3. What is the copper wire market?The copper wire market is the global industry for the production, distribution, and use of copper wire, driven by its use in power generation, electronics, construction, and telecommunications.

-

4. Which region holds the largest share of the copper wire market?Asia Pacific is anticipated to hold the largest share of the copper wire market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global copper wire market?Prysmian Group, Fujikura Ltd., Sumitomo Corporation, LS Cable & System, Encore Wire Corporation, Belden Inc., Nexans, Rea Magnet Wire, Cords Cable Industries Ltd., Southwire Company, Apar Industries Ltd., Polycab India Ltd., Furukawa Electric Co., Ltd., KEI Industries Ltd., and Others.

-

6. What factors are driving the growth of the copper wire market?The growth of the copper wire market is driven by expansion in the electronics, electrical, and communication sectors, fueled by global urbanization, infrastructure development, and the demand for advanced technologies like 5G and data centers.

-

7. What are the market trends in the copper wire market?The main trends in the copper wire market are the high demand from the renewable energy and electric vehicle (EV) sectors, increased focus on sustainability and recycling, and growth in the electrical and electronics industries.

-

8. What are the main challenges restricting wider adoption of the copper wire market?The wider adoption of the copper wire market is restricted by several key challenges, including price volatility, supply chain disruptions, environmental and regulatory pressures, and intense competition from alternative materials.

Need help to buy this report?