Global Copper Rods Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Round, Square, Hexagonal, and Others), By Application (Electrical, Construction, Transportation, Industrial Machinery, and Others), By Distribution Channel (Direct Sales, Distributors, Online Sales, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Construction & ManufacturingGlobal Copper Rods Market Insights Forecasts to 2035

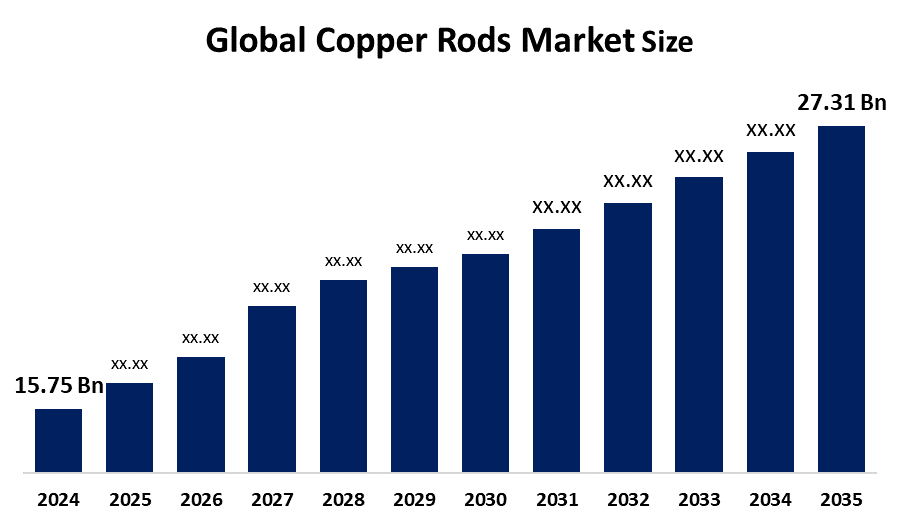

- The Global Copper Rods Market Size Was Estimated at USD 15.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.13% from 2025 to 2035

- The Worldwide Copper Rods Market Size is Expected to Reach USD 27.31 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Copper Rods Market Size was worth around USD 15.75 Billion in 2024 and is predicted to grow to around USD 27.31 billion by 2035 with a compound annual growth rate (CAGR) of 5.13% from 2025 to 2035. The market for copper rods is expanding due to increased demand in electricity infrastructure, renewable energy installations, and electric vehicles. Urbanization, industrialization, and government expenditure on power transmission also fuel expansion, as well as the higher conductivity and recyclability of copper.

Market Overview

The Global Copper Rods Market Size refers to the business centred on the manufacture and sale of copper rods, which are semi-finished products usually applied in electric uses as a result of the excellent electrical and thermal conductivity of copper. The rods are manufactured using techniques such as continuous casting and rolling, and they provide the main raw material for the production of wire and cable, transmission of power, motors, transformers, and other electrical devices. The increasing need for efficient electrical systems and the worldwide moves towards renewable sources of energy are key drivers for the copper rods market. Urbanization and infrastructure development, especially in developing economies, as well as growing adoption of electric vehicles and increased usage of smart grid technology, are other significant drivers for the growth of the market.

Process technologies, such as oxygen-free copper and high-conductivity rods, have improved performance and increased application ranges through technological development. Global interest in sustainability also enhances opportunities, as copper is easily recyclable with no loss of properties, being in line with circular economy principles. Major industry players such as Aurubis AG, Mitsubishi Materials Corporation, Sumitomo Electric, and Jiangxi Copper Company invest in capacity enhancement and development to stay competitive. The Ministry of Finance, through Notification No. 06/2025-Customs (CVD) dated 3rd July 2025, has imposed a five-year countervailing duty on imports of Continuous Cast Copper Wire Rods from Malaysia, Thailand, Vietnam, and Indonesia. The decision follows DGTR's final findings confirming ongoing subsidization and a substantial threat of injury to domestic producers.

Report Coverage

This research report categorizes the copper rods market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the copper rods market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the copper rods market.

Global Copper Rods Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15.75 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.13% |

| 2035 Value Projection: | USD 27.31 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Aurubis AG, Glencore, Nexans, Jiangxi Copper Corporation, KME Group, Hindalco Industries Limited, Southwire Company, BHP Group, Freeport McMoRan, Rio Tinto, Mitsubishi Materials Corporation, Sumitomo Metal Mining Co., Ltd., and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Market Size for Copper Rods is driven by the growing demand for electricity and development in electrical infrastructure across the globe. Copper rods, characterized by high conductivity, play a critical role in power transmission, distribution, and electronic use. The accelerated development of renewable energy installations such as solar and wind, as well as the widespread use of electric vehicles, contributes to enhanced market demand. In addition, urbanization, infrastructure growth, and industrialization in the developing world support higher consumption. Initiatives by governments favoring green energy and smart grid technologies also contribute significantly. Copper's recyclability and eco-friendliness give it an edge as a favored material, which supplements its long-term market expansion.

Restraining Factors

The Copper Rods Market Size industry is under pressure from volatile raw material prices, mainly influenced by worldwide supply-demand imbalances. Production costs and mining-related environmental issues are also significant growth obstacles. Additionally, the accessibility of competitive conductive substitutes, such as aluminum, remains an obstacle to copper rod producers.

Market Segmentation

The copper rods market share is classified into product type, application, and distribution channel.

- The round segment dominated the market in 2024, approximately 48% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the copper rods market is divided into round, square, hexagonal, and others. Among these, the round segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This segment market is dominated due to its extensive applications in various industries, notably in the electrical and electronics sectors. Due to their high conductivity and easy installation, they are well-suited for wiring, transmission of power, and distribution systems. Their round shape guarantees a smooth flow of current, which facilitates a stable power supply. The growing need for energy-efficient electrical systems also boosts the use of round copper rods globally.

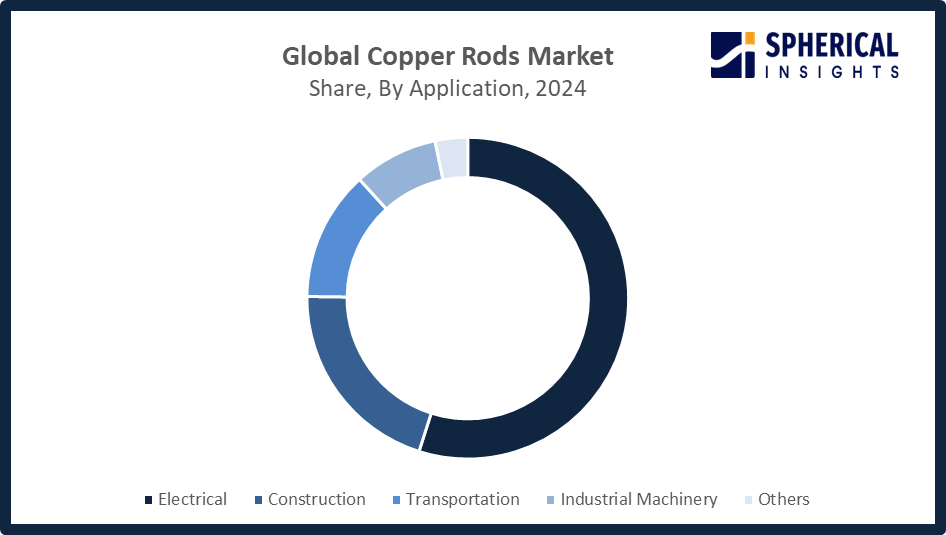

- The electrical segment accounted for the largest share in 2024, approximately 55% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the copper rods market is divided into electrical, construction, transportation, industrial machinery, and others. Among these, the electrical segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Copper rods play a vital role in the electrical industry to produce wires, cables, and components because of their high conductivity. Increasing adoption of renewable energy and smart grids promotes their demand. With more adoption of clean energy, the role of copper in effective power generation and transmission assumes importance due to electrification initiatives worldwide and electrical infrastructure upgrading.

Get more details on this report -

- The direct sales segment accounted for the highest market revenue in 2024, approximately 43% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the copper rods market is divided into direct sales, distributors, online sales, and others. Among these, the direct sales segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Direct sales prevail in the market as manufacturers want to sell directly to large industrial customers and end-users. This channel guarantees good customer relationships, product quality, and timely delivery. It's particularly prevalent in countries with established industries, facilitating high-volume orders and customizations to serve the particular needs of large companies.

Regional Segment Analysis of the Copper Rods Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the copper rods market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the copper rods market over the predicted timeframe. The Asia Pacific is expected to have approximately a market share of 45% in the market for copper rods during the forecast period, based on swift industrialization, urbanization, and large investments in infrastructure development. China and India are the key drivers among these countries based on their growing electrical and construction industries. The increasing focus of the region on renewable energy projects, adoption of electric vehicles, and smart grid technologies also increases demand. Moreover, government support for local production and upgradation of power transmission infrastructure leads to continued market expansion, which propels the Asia Pacific region as the primary driving force in the global copper rods market.

Get more details on this report -

On 2 October 2025, the Indian Primary Copper Producers Association (IPCPA) expressed concerns over increasing copper rod imports from the UAE under the India-UAE CEPA, warning that this rise threatens domestic copper refining investments and could negatively impact the growth and sustainability of the local copper industry.

North America is expected to grow at a rapid CAGR in the copper rods market during the forecast period. North America is a rapidly growing region in the copper rods market, with an approximate market share of 25%, spurred by increased demand for renewable energy solutions and high concern for energy efficiency. The United States and Canada are undertaking a lot of investment in upgrading electrical grids and developing renewable energy capacity, which increases demand for copper rods. The focus of the region on electric cars and smart technologies also increases market support, since these industries are dependent on copper products. North America also has an established industrial base and technological innovations, setting a strong platform that ensures constant demand in different applications.

Europe is a significant market for copper rods, driven by sustainability and green initiatives. The EU’s focus on reducing carbon emissions and promoting renewable energy boosts demand, especially in the energy and transportation sectors. The region’s strong automotive industry, shifting towards electric vehicles, offers growth opportunities. Continued investments in infrastructure and smart city projects are expected to further increase copper rod demand, strengthening Europe’s share in the global market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the copper rods market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aurubis AG

- Glencore

- Nexans

- Jiangxi Copper Corporation

- KME Group

- Hindalco Industries Limited

- Southwire Company

- BHP Group

- Freeport McMoRan

- Rio Tinto

- Mitsubishi Materials Corporation

- Sumitomo Metal Mining Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Aurubis AG modernized its shaft furnace at the Avellino site, enhancing copper wire rod production efficiency and sustainability. With a €5 million investment, capacity increased by nearly 20%. Copper wire is vital for digital infrastructure, electrification, and e-mobility, boosting Aurubis Group’s operating profitability.

- In May 2025, Glencore Plc purchased Russian copper on the London Metal Exchange to deliver to China, highlighting supply pressure in the world’s largest copper market. Recent withdrawals of about 15,000 tons from Rotterdam warehouses, led by Glencore, have reduced LME inventories to their lowest level in a year.

- In April 2025, Sumitomo Metal Mining announced plans to produce 433,000 mt of refined copper in fiscal year 2025/26, down 2.6% from the previous year. The decline is due to scheduled maintenance at its Toyo Smelter in October and its nickel plant in May and December.

- In October 2024, Nexans partnered with Continuus Properzi to build an innovative copper production and recycling plant in Lens, France, by 2026. This project addresses rising global copper demand and promotes recycling as a key solution to potential shortages critical for electrification.

- In October 2024, Hindalco Industries Ltd., part of the Aditya Birla Group, reaffirmed its leadership in copper and aluminum production. As India’s largest copper producer, its advanced smelter, among Asia’s largest, produces copper cathodes and rods, driving sustainable growth for both domestic and global markets.

- In September 2024, Prime Minister Modi launched India’s first Namo Bharat Rapid Rail in Gujarat, marking a key milestone for Hindalco Industries. As a major copper and aluminum producer, Hindalco supplies essential metals for the rail’s electric lines, motors, and internal wiring, supporting sustainable, modern transportation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the copper rods market based on the below-mentioned segments:

Global Copper Rods Market, By Product Type

- Round

- Square

- Hexagonal

- Others

Global Copper Rods Market, By Application

- Electrical

- Construction

- Transportation

- Industrial Machinery

- Others

Global Copper Rods Market, By Distribution Channel

- Direct Sales

- Distributors

- Online Sales

- Others

Global Copper Rods Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the copper rods market over the forecast period?The global copper rods market is projected to expand at a CAGR of 5.13% during the forecast period.

-

2. What is the market size of the copper rods market?The global copper rods market size is expected to grow from USD 15.75 billion in 2024 to USD 27.31 billion by 2035, at a CAGR of 5.13% during the forecast period 2025-2035.

-

3.What is the copper rods market?The copper rods market is the global ecosystem of manufacturers, suppliers, and users of copper rods, which are essential intermediates for producing electrical wiring, cables, and other components.

-

4.Which region holds the largest share of the copper rods market?Asia Pacific is anticipated to hold the largest share of the copper rods market over the predicted timeframe.

-

5.Who are the top 10 companies operating in the global copper rods market?The major players operating in the copper rods market are Aurubis AG, Glencore, Nexans, Jiangxi Copper Corporation, KME Group, Hindalco Industries Limited, Southwire Company, BHP Group, Freeport McMoRan, Rio Tinto, Mitsubishi Materials Corporation, Sumitomo Metal Mining Co., Ltd., and Others.

-

6.What factors are driving the growth of the copper rods market?The growth of the copper rods market is being driven by the global energy transition, which is increasing demand from the electric vehicle (EV) and renewable energy sectors. Rapid urbanization and industrialization, especially in the Asia Pacific, are also fuelling growth in the electrical, electronics, and construction industries.

-

7.What are the market trends in the copper rods market?Current trends in the copper rods market show steady growth driven by increasing demand from renewable energy, electric vehicles (EVs), construction, and electronics sectors.

-

8.What are the main challenges restricting wider adoption of the copper rods market?The wider adoption of the copper rods market is mainly restricted by raw material price volatility, supply chain vulnerabilities, intense competition from alternative materials, and high operational costs.

Need help to buy this report?