Global Copper Products Market Size, Share, and COVID-19 Impact Analysis, By Product (Bars, Wires, Rods, Tubes & Pipes, Strips, Foils, Alloy Products, Profiles, Tapes, and Others), By Application (Conductive Use, Structural Use, Earthing, Shielding, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Copper Products Market Insights Forecasts to 2035

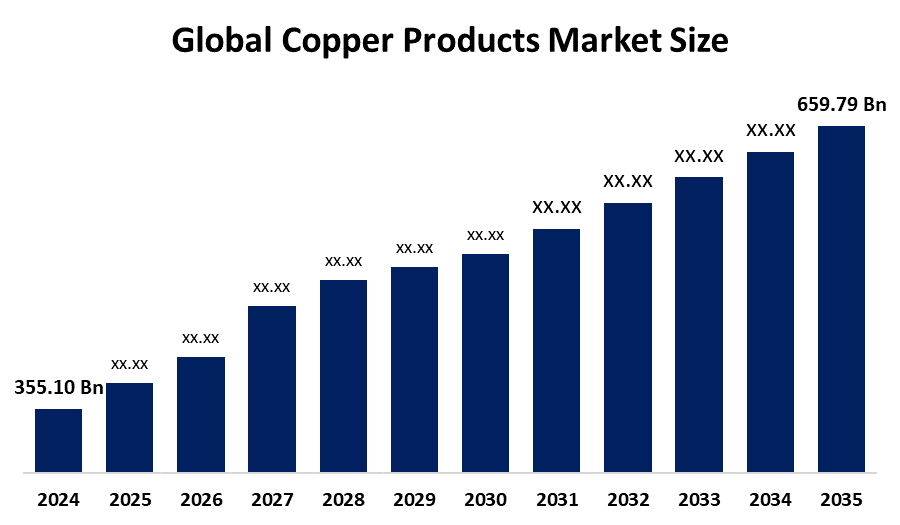

- The Global Copper Products Market Size Was Estimated at USD 355.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.79% from 2025 to 2035

- The Worldwide Copper Products Market Size is Expected to Reach USD 659.79 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Copper Products Market Size was worth around USD 355.10 Billion in 2024 and is predicted to grow to around USD 659.79 Billion by 2035 with a compound annual growth rate (CAGR) of 5.79% from 2025 and 2035. The market for copper products has a number of opportunities to grow due to the need for copper, which is necessary for infrastructure and electrical wiring, and has grown as a result of the world's shift to renewable energy sources like solar and wind.

Market Overview

The copper products refer to a broad category of goods made from copper metal or its alloys, taking advantage of its special qualities like superior electrical and thermal conductivity, resistance to corrosion, and malleability. The use of copper in electronics, construction, renewable energy, and electrification is propelling the market for copper products. The need for copper rods, strips, and foils is driven by the growing need for 5G networks, electric vehicles, and power infrastructure. The 100% recyclable nature of copper is a major motivator since it lowers production costs, guarantees the stability of raw materials, and supports the objectives of the circular economy and global sustainability. Demand is further strengthened by growing urbanization, improvements to infrastructure, and the move to sustainable energy. Furthermore, copper's exceptional electrical and thermal conductivity renders it indispensable in vital applications, guaranteeing consistent long term growth in spite of fluctuations in mining and raw material supplies.

In Chukotka, Russias easternmost region, the national development bank, VEB, is investing more than USD 13.4 billion to develop the Baimskaya copper mine. This project would increase Russias copper output by 25%, which would improve the country's position in the global market and support its strategic focus on Arctic development.

Report Coverage

This research report categorizes the copper products market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the copper products market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the copper products market.

Global Copper Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 355.10 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.79% |

| 2035 Value Projection: | USD 659.79 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 169 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Application and By Region |

| Companies covered:: | BHP Group, Glencore, Freeport McMoRan, Southern Copper Corporation, Antofagasta PLC, Rio Tinto, Anglo American, Teck Resources, Codelco, Jiangxi Copper Corporation, Aurubis AG, KME Group, Hindalco Industries, Vedanta Limited, Xingye Alloy Materials Group, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The copper products market is driven by technological breakthroughs in their formulation and production methods. These developments have enhanced the conductivity, durability, and performance of copper alloys, making them indispensable in high performance sectors. For instance, because of their exceptional resistance to corrosion in challenging conditions, copper nickel alloys have become more and more popular in the offshore and marine sectors. They are widely utilized in shipbuilding, seawater pipelines, and desalination facilities. Innovations in additive manufacturing, including 3D printing, have made it possible to precisely and intricately create copper alloy components with exceptional mechanical qualities. The automobile, electronics, and aerospace industries are all affected by this increase in applicability.

Restraining Factors

The copper products market is restricted by factors like economic conditions, geopolitical events, investor attitude, and supply and demand dynamics, all have an impact on copper prices. The price of copper wire and its demand across many industries can be greatly impacted by these price swings. For example, copper is widely used in the construction sector for power transmission systems, infrastructure projects, and electrical wiring in buildings.

Market Segmentation

The copper products market share is classified into product and application.

- The wires segment dominated the market in 2024, accounting for approximately 61.7% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the copper products market is divided into bars, wires, rods, tubes & pipes, strips, foils, alloy products, profiles, tapes, and others. Among these, the wires segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven because it is essential to power transmission, distribution, and networking across numerous industries. In residential, commercial, and industrial applications, copper is the material of choice for wires due to its exceptional electrical conductivity, high thermal resistance, and durability. A major factor driving the need for copper wires is the quick development of electrical infrastructure, grid upgrading, and the growing use of renewable energy projects.

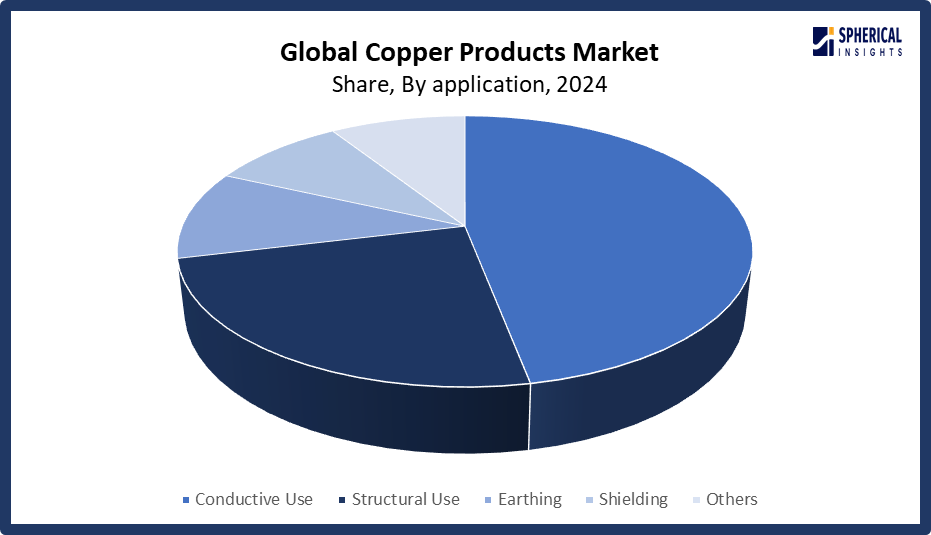

The conductive use segment accounted for the largest share in 2024, accounting for approximately 47% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the copper products market is divided into conductive use, structural Use, earthing, shielding, and others. Among these, the conductive use segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the foundation of electrical transmission and distribution, copper is widely utilized in wiring, transformers, busbars, cables, and switchgear. Modernizing the grid, integrating renewable energy sources, and increasing demand for dependable power infrastructure have all greatly increased the use of copper in conductive applications. Copper is also becoming more and more necessary for wiring harnesses, motors, and connectors as electric cars, charging stations, and battery systems proliferate.

Get more details on this report -

Regional Segment Analysis of the Copper Products Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 55% of the copper products market over the predicted timeframe.

North America is anticipated to hold the largest share, representing nearly 55% of the copper products market over the predicted timeframe. In the North American market, the market is rising due to the strong demand from important markets including South Korea, Japan, China, and India. China alone accounts for nearly half of the world's demand for refined copper, due to its vast manufacturing base and booming construction industry. Significant copper use in transportation, electrical networks, and infrastructure development is being fueled by the region's fast urbanization and industrialization. Additionally, as solar and wind projects in China and India require significant amounts of copper for grid connectivity and power generation, the growth in renewable energy installations has further increased the demand for copper.

The United States dominates the market for copper products due to the significant demand for copper across a variety of industries, such as electronics, automotive, and construction. The U.S. government has also enacted policies, like levying tariffs on imported copper products, to boost domestic manufacturing and reduce reliance on foreign suppliers.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 49% in the copper products market during the forecast period. The Asia Pacific area has a thriving market for copper products due to the fast urbanization and industrialization of nations like China and India. The demand for copper has increased due to the region's growth in renewable energy projects, especially solar and wind, as well as the rise in the use of electric vehicles. Large scale infrastructure projects like India's Smart Cities Mission and China's Belt and Road Initiative are also driving up demand for copper in smart grid systems, electricity distribution, and construction.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the copper products market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BHP Group

- Glencore

- Freeport McMoRan

- Southern Copper Corporation

- Antofagasta PLC

- Rio Tinto

- Anglo American

- Teck Resources

- Codelco

- Jiangxi Copper Corporation

- Aurubis AG

- KME Group

- Hindalco Industries

- Vedanta Limited

- Xingye Alloy Materials Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Schneider Electric partnered with Glencore to source responsibly obtained, recyclable copper for its European factories. This collaboration aims to advance decarbonization efforts and promote sustainable procurement practices.

- In September 2025, Anglo American and Teck Resources announced a merger to create a USD 50 billion copper-mining giant named Anglo Teck. The merger aims to enhance their global copper production capabilities.

- In January 2025, Kutch Copper Ltd, a subsidiary of Adani Group, joined the International Copper Association. The company is investing approximately USD 1.2 billion to establish a copper smelter in Gujarat, India, with an initial capacity of 0.5 million tons per annum.

- In December 2024, Mercuria, a Swiss commodities trader, established a metals trading unit in partnership with Zambia's Industrial Development Company. This joint venture aims to allow Zambia to directly participate in the minerals trading market, enhancing its position in the global minerals market.

- In October 2024, QC Copper and Gold Inc. acquired Cuprum Corp. a Canadian copper developer. The acquisition positions QC Copper as one of Canadas largest copper resource developers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the copper products market based on the below-mentioned segments:

Global Copper Products Market, By Product

- Bars

- Wires

- Rods

- Tubes & Pipes

- Strips

- Foils

- Alloy Products

- Profiles

- Tapes

- Others

Global Copper Products Market, By Application

- Conductive Use

- Structural Use

- Earthing

- Shielding

- Others

Global Copper Products Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the copper products market over the forecast period?The global copper products market is projected to expand at a CAGR of 5.79% during the forecast period

-

2. What is the market size of the copper products market?The global copper products market size is expected to grow from USD 355.10 Billion in 2024 to USD 659.79 Billion by 2035, at a CAGR of 5.79% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the copper products marketNorth America is anticipated to hold the largest share of the copper products market over the predicted timeframe

-

4. Who are the top 15 companies operating in the global copper products marketBHP Group, Glencore, Freeport McMoRan, Southern Copper Corporation, Antofagasta PLC, Rio Tinto, Anglo American, Teck Resources, Codelco, Jiangxi Copper Corporation, Aurubis AG, KME Group, Hindalco Industries, Vedanta Limited, Xingye Alloy Materials Group, and Others

-

5. What factors are driving the growth of the copper products market?The copper products market growth is driven by the global push for energy efficient technology, the growth of EV infrastructure, and the rising demand from renewable energy initiatives. Because of its remarkable electrical conductivity, copper is essential for motors, transformers, and wiring, especially as the world's power consumption keeps increasing

-

6. What are the market trends in the copper products market?The copper products market trends include electrification of transportation, expansion of renewable energy installations, recycling initiatives, technological innovations, and supply chain dynamics

-

7. What are the main challenges restricting wider adoption of the copper products market?The copper products market trends include supply chain interruptions and geopolitical tensions, which raise manufacturing costs and have an impact on profitability. Sustainability problems are made worse by environmental worries over mining operations and inadequate recycling facilities.

Need help to buy this report?