Global Copper Market Size, Share, and COVID-19 Impact Analysis, By Type (Primary, Secondary), By Application (Construction, Power Generation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Copper Market Insights Forecasts to 2033

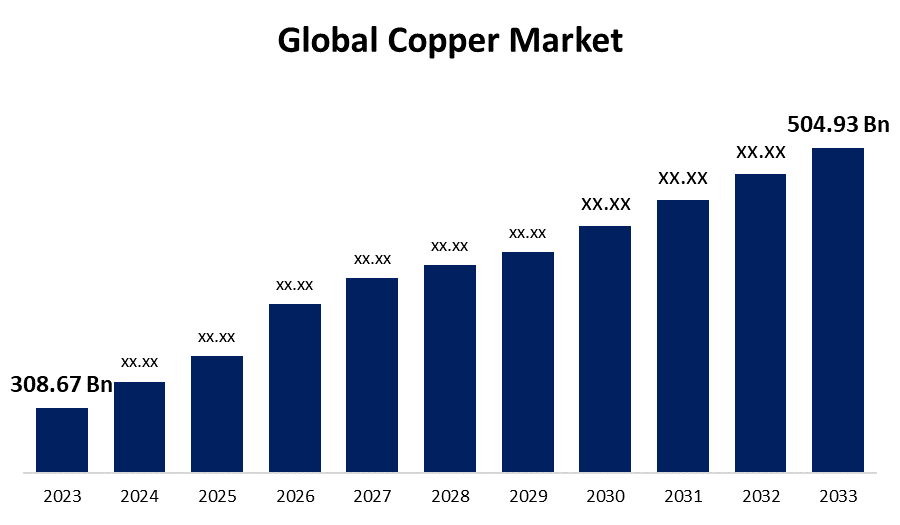

- The Global Copper Market Size was valued at USD 308.67 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.04% from 2023 to 2033.

- The Worldwide Copper Market Size is expected to reach USD 504.93 Billion by 2033.

- The Middle East & Africa is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Copper Market Size is expected to reach USD 504.93 Billion by 2033, at a CAGR of 5.04% during the forecast period 2023 to 2033.

Copper is a common alloying metal. When compared to other metals, it has superior electrical conductivity, mechanical strength, and endurance, which makes it the material of choice for industrial products. It is a ductile, malleable metal with good thermal and electrical conductivity. A newly uncovered pure copper surface has an orange-pink hue. Copper is used about four times more in electric vehicles than in hybrid or IC engine automobiles. According to estimates, there is a good probability that market participants will grow and that the copper market will expand significantly over the course of the forecast period. In an effort to preserve their economic competitiveness while simultaneously bolstering the reserve base, copper mining companies are also engaging in exploration efforts. In addition, producers of copper still give sustainability a lot of attention, making investments in environmental, social, and governance (ESG) goals and meeting strict regulatory obligations. By 2030, the British government plans to stop selling new gasoline and diesel cars. Several other nations are now joining the shift toward the use of electric cars (EVs). Germany has unveiled a 130-billion-euro recovery plan that includes significant subsidies for owners of battery-powered cars but excludes finance for combustion engine vehicles. China and Israel have declared that they intend to phase out fossil fuel-powered automobiles by 2030.

Report Coverage

This research report categorizes the market for the global copper market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global copper market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global copper market.

Global Copper Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 308.67 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.04% |

| 2033 Value Projection: | USD 504.93 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | First Quantum Minerals Ltd., Grupo México, Jiangxi Copper Co. Ltd., JX Nippon Mining & Metals Corporation, KGHM, KME GERMANY GMBH, Anglo American, Antofagasta Plc, BHP, Codelco, Mitsubishi Materials Corporation, Mitsui Mining & Smelting Co. Ltd., Norilsk Nickel, OM Group Inc., Rio Tinto, Sumitomo Metal Mining Co., Ltd., Teck Resources Limited, UMMC Holding Corp., Vale, Glencore, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Rising economies like China and India continue to fuel the demand for copper through rapid industrialization, urbanization, and infrastructure expansion. These nations are significant users of copper for the manufacturing, electrical, and construction industries.

Expanding the Electric Car (EV) Market: The trend toward electric cars is driving up copper prices. Compared to conventional internal combustion engine vehicles, electric vehicles (EVs) require a substantially larger quantity of copper, mainly for their electrical systems and infrastructure for charging.

Restraining Factors

Production is hampered by labour strikes and instability in copper-producing countries, leading to shortages and price increases. A decrease in mine output affects the world's supply, tightening the market. Industries that depend on copper are impacted by the shortfall, which raises prices even as demand stays constant. Uncertainty for investors could cause market volatility and negative economic effects in the impacted areas.

Market Segmentation

By Type Insights

The primary segment dominates the market with the largest revenue share over the forecast period.

On the basis of type, the global copper market is segmented into primary, and secondary. Among these, the primary segment is dominating the market with the largest revenue share over the forecast period. It refers to copper that comes from original sources, mostly from the mining and subsequent processing of copper ores. The majority of copper produced worldwide is obtained through primary production techniques. In order to make pure copper cathodes or other refined copper products, primary copper production entails removing copper ores from mines, crushing and grinding them to create copper concentrates, and then smelting and refining these concentrates.

By Application Insights

The construction segment is witnessing significant CAGR growth over the forecast period.

On the basis of application, the global copper market is segmented into construction, and power generation. Among these, the construction segment is witnessing significant growth over the forecast period. Construction is one of the major global users of copper because of the numerous applications that it finds use in. Copper is frequently used in construction for roofing materials, plumbing and heating systems, and electrical wiring systems. It is the recommended option for electrical wiring in residential, commercial, and industrial structures due to its superior electrical conductivity and resistance to corrosion. Plumbing systems make considerable use of copper pipes and fittings because of their strength and antibacterial qualities.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with the largest market share over the forecast period. The initiatives of countries like China, India, and Japan are largely responsible for the expansion of the copper market in the region. Because of its booming electric vehicle sectors, China is the world's largest user of copper. The rise of end-use industries like electronics and automobiles, along with rising per capita income, have helped these nations' copper markets flourish. Despite the pandemic-related global decline in car sales, which saw a 16.2% decline in global car sales in 2022, electric car registrations increased by 41.3%, according to the International Energy Agency (IEA). After a decade of phenomenal growth, there were 10 million electric cars on the road worldwide by the end of 2022. The expanding population in this area has also contributed to the market's rise, as has the increased demand for high-quality products.

The Middle East and Africa are expected to grow the fastest during the forecast period. Middle Eastern nations such as Saudi Arabia, Iran, and Oman are making significant investments in building projects, industrial activity, and infrastructure development. Copper is in high demand due to these measures, particularly in plumbing and electrical wiring applications. Conversely, there is a spike in copper production and exploration activity occurring in Africa. With large reserves of copper, nations like South Africa, Zambia, and the Democratic Republic of the Congo are growing their mining industries. Furthermore, there is a surge in investments in renewable energy projects, such as wind and solar farms, in the Middle East and Africa. Due to the substantial copper wire and component requirements of these projects, the market is increasing in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global copper market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players

- First Quantum Minerals Ltd.

- Grupo México

- Jiangxi Copper Co. Ltd.

- JX Nippon Mining & Metals Corporation

- KGHM

- KME GERMANY GMBH

- Anglo American

- Antofagasta Plc

- BHP

- Codelco

- Mitsubishi Materials Corporation

- Mitsui Mining & Smelting Co. Ltd.

- Norilsk Nickel

- OM Group Inc.

- Rio Tinto

- Sumitomo Metal Mining Co., Ltd.

- Teck Resources Limited

- UMMC Holding Corp.

- Vale

- Glencore

- Others

Key Market Developments

- In November 2022, in its Azrar Project in Morocco, the London-based mining company Alterian revealed a noteworthy discovery of high-grade copper and silver. This finding highlights the possibility of more supply entering the copper market, providing encouraging opportunities for the expansion and stability of the sector.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Copper Market based on the below-mentioned segments:

Copper Market, Type Analysis

- Primary

- Secondary

Copper Market, Application Analysis

- Construction

- Power Generation

Copper Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Global Copper Market?The Global Copper Market is expected to grow from USD 308.67 billion in 2023 to USD 504.93 Billion by 2033, at a CAGR of 5.04% during the forecast period 2023-2033.

-

2. Which region is dominating the global Copper market?Asia Pacific is dominating the market with the largest market share over the forecast period.

-

3. Which are the key companies in the market?First Quantum Minerals Ltd., Grupo México, Jiangxi Copper Co. Ltd., JX Nippon Mining & Metals Corporation, KGHM, KME GERMANY GMBH, Anglo American, Antofagasta Plc, BHP, Codelco, Mitsubishi Materials Corporation, Mitsui Mining & Smelting Co. Ltd., Norilsk Nickel, OM Group Inc., Rio Tinto, Sumitomo Metal Mining Co., Ltd., Teck Resources Limited, UMMC Holding Corp., Vale, Glencore, and Others.

Need help to buy this report?