Global Copper-Clad Aluminium Wire Market Size, Share, and COVID-19 Impact Analysis, By Product Type (CCA Wire for Electrical Applications, CCA Wire for Telecommunications, CCA Wire for Automotive, and Others), By Application (Power Transmission, Data Transmission, Automotive, Electronics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Semiconductors & ElectronicsGlobal Copper-Clad Aluminium Wire Market Size Insights Forecasts to 2035

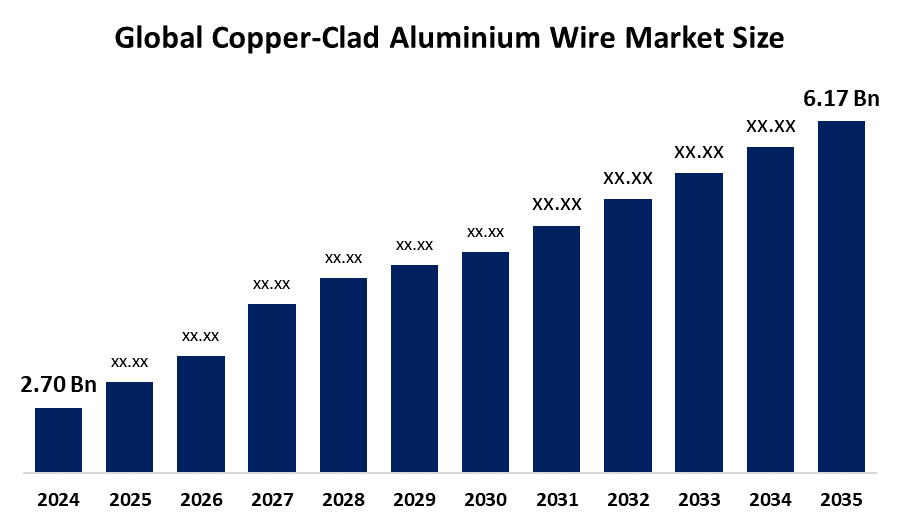

- The Global Copper-Clad Aluminium Wire Market Size Was Estimated at USD 2.70 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.8 % from 2025 to 2035

- The Worldwide Copper-Clad Aluminium Wire Market Size is Expected to Reach USD 6.17 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Copper-Clad Aluminium Wire Market Size was valued at around USD 2.70 Billion in 2024 and is predicted to Grow to around USD 6.17 Billion by 2035 with a compound annual growth rate (CAGR) of 7.8 % from 2025 to 2035. Opportunities in the market for copper-clad aluminum wire are fueled by factors like cost-effectiveness, lightweight characteristics, rising demand in power transmission, telecommunications, and automotive applications, as well as the worldwide trend toward energy-efficient electrical solutions.

Market Overview

The production, distribution, and use of composite electrical conductors with a lightweight aluminum core covered in a thin layer of copper are all included in the copper-clad aluminium wire (CCA) Market. These conductors provide an affordable substitute for pure copper wiring with similar conductivity and corrosion resistance. These wires are made to combine the lightweight and affordable qualities of aluminum with the high electrical conductivity and corrosion resistance of copper. Copperweld's declaration that it will produce 250,000 miles of CCA building wire by the end of 2025 is one of the breakthroughs that will improve sustainability in commercial construction. For Instance, in July 2025, India launched aluminium and copper vision documents in Hyderabad, boosting Copper-Clad Aluminium Wire prospects, targeting six-fold aluminium output and copper demand growth by 2047, with smelting and refining capacity additions. The development is driven by rising demand in a variety of industries, including the automotive, electrical, and telecommunications sectors, where the advantages of CCA wire, such as its affordability and lightweight characteristics, are becoming more widely acknowledged.

Report Coverage

This research report categorizes the copper-clad aluminium wire market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the copper-clad aluminium wire market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the copper-clad aluminium wire market.

Global Copper-Clad Aluminium Wire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.70 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.8% |

| 2035 Value Projection: | USD 6.17 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 89 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | AFL Global, Belden Inc., CommScope Holding Company, Inc., Encore Wire Corporation, Finolex Cables Ltd., Fujikura Ltd., Furukawa Electric Co., Ltd., General Cable Corporation, Hengtong Group Co., Ltd., Hitachi Metals, Ltd., Jiangsu Zhongtian Technology Co., Ltd., KEI Industries Limited, Leoni AG, LS Cable & System Ltd., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The substantial global shift in telecommunications infrastructure, with a particular focus on the construction of 5G networks, is one of the main growth factors propelling the copper-clad aluminium wire market. Market expansion is further accelerated by the rising need for effective power transmission and telecommunication infrastructure, including data centers and broadband development. Aluminum's small weight significantly lowers installation and transportation costs, especially in automotive and aerospace applications. The necessity for such creative wiring solutions has also been increased by the growing global trend of smart city projects and the growing requirements for data transmission. The continuous transformation of the automotive industry, especially with the increase in electric vehicle (EV) production, is another important growth driver of copper-clad aluminium wire market.

Restraining Factors

Lower conductivity than pure copper, restricted acceptance in high-load applications, strict regulations, worries about long-term durability, and technical difficulties with joining, termination, and quality consistency are some of the factors limiting the copper-clad aluminum wire market.

Market Segmentation

The copper-clad aluminium wire market share is classified into product type and application.

- The CCA wire for electrical applications segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the copper-clad aluminium wire market is divided into CCA wire for electrical applications, CCA wire for telecommunications, CCA wire for automotive, and others. Among these, the CCA wire for electrical applications segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The need for CCA wires made for electrical applications is further fueled by the need for effective wiring solutions during building construction and refurbishment, particularly in developing urban regions.

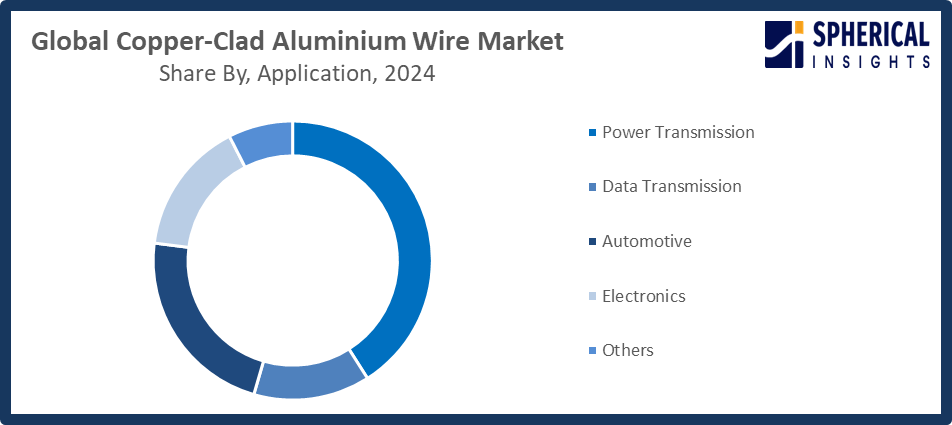

- The power transmission segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the copper-clad aluminium wire market is divided into power transmission, data transmission, automotive, electronics, and others. Among these, the power transmission segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Copper-clad aluminum wires are perfect for overhead lines and long-distance power transmission since they are more affordable and lightweight than pure copper. Demand is further fueled by increased expenditures in renewable energy infrastructure, smart grid growth, and rapid urbanization.

Get more details on this report -

Regional Segment Analysis of the Copper-Clad Aluminium Wire Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the copper-clad aluminium wire market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the copper-clad aluminium wire market over the predicted timeframe. The Asia Pacific region is primarily driven by rapid infrastructural development, industrialization, and urbanization in countries like China and India. Government initiatives promoting electrification, smart cities, and energy-efficient technology also have an impact on sustained demand. Market expansion in this area is further supported by the need for effective wiring solutions in the development of new smart cities and the modernization of current infrastructure. China's 2025-2026 Action Plan for the Non-Ferrous Metals Industry, which was unveiled on September 30, 2025, aims to increase added value by 5% annually through innovations in the exploration and processing of copper and aluminum, encouraging the use of CCA in renewable energy systems.

North America is expected to grow at a rapid CAGR in the copper-clad aluminium wire market during the forecast period. The market's expansion in this area is also being aided by the continuous improvements in the automotive sector, particularly in the manufacturing of electric vehicles. Market expansion is further fueled by the region's focus on modernizing outdated power infrastructure and increasing the capacity of renewable energy sources. The U.S. Presidential Proclamation on July 30, 2025, which unintentionally increased CCA's status as a tariff-mitigating conductor by imposing 50% duties on imports of semi-finished copper to protect local supply chains and national security. Additionally, the use of copper-clad aluminum wires is being encouraged by the automobile industry's transition to electric vehicles and lightweight components.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the copper-clad aluminium wire market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AFL Global

- Belden Inc.

- CommScope Holding Company, Inc.

- Encore Wire Corporation

- Finolex Cables Ltd.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- General Cable Corporation

- Hengtong Group Co., Ltd.

- Hitachi Metals, Ltd.

- Jiangsu Zhongtian Technology Co., Ltd.

- KEI Industries Limited

- Leoni AG

- LS Cable & System Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Copper Weld launched 14 AWG Copper-Clad Aluminium Wire as NEC-approved for 10-amp branch circuits, expanding residential and commercial applications, enhancing safety, efficiency, and cost-effectiveness in construction wiring.

- In September 2024, Rea Magnet Wire launched expanded Copper-Clad Aluminium Wire production at the Lafayette plant, boosting capacity for North America’s electric vehicle and energy markets, supporting advanced motors, transformers, and high-performance electrical applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the copper-clad aluminium wire market based on the below-mentioned segments:

Global Copper-Clad Aluminium Wire Market, By Product Type

- CCA Wire for Electrical Applications

- CCA Wire for Telecommunications

- CCA Wire for Automotive

- Others

Global Copper-Clad Aluminium Wire Market, By Application

- Power Transmission

- Data Transmission

- Automotive

- Electronics

- Others

Global Copper-Clad Aluminium Wire Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the copper-clad aluminium wire market over the forecast period?The global copper-clad aluminium wire market is projected to expand at a CAGR of 7.8% during the forecast period.

-

2. What is the market size of the copper-clad aluminium wire market?The global copper-clad aluminium wire market size is expected to grow from USD 2.70 billion in 2024 to USD 6.17 billion by 2035, at a CAGR of 7.8 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the copper-clad aluminium wire market?Asia Pacific is anticipated to hold the largest share of the copper-clad aluminium wire market over the predicted timeframe.

-

4. Who are the top companies operating in the global copper-clad aluminium wire market?AFL Global, Belden Inc., CommScope Holding Company, Inc., Encore Wire Corporation, Finolex Cables Ltd., Fujikura Ltd., Furukawa Electric Co., Ltd., General Cable Corporation, Hengtong Group Co., Ltd., Hitachi Metals, Ltd., Jiangsu Zhongtian Technology Co., Ltd., KEI Industries Limited, Leoni AG, LS Cable & System Ltd., and Others.

-

5. What factors are driving the growth of the copper-clad aluminium wire market?Growth is driven by rising copper prices, demand for cost-effective conductors, lightweight advantages, expanding telecommunications and power infrastructure, automotive electrification, and increasing focus on energy-efficient and sustainable wiring solutions.

-

6. What are the market trends in the copper-clad aluminium wire market?The trends include adoption in telecommunications and automotive sectors, technological advancements in cladding processes, growing use in renewable energy systems, increased infrastructure investments, and preference for lightweight, cost-efficient electrical materials.

-

7. What are the main challenges restricting the wider adoption of the copper-clad aluminium wire market?The major challenges include lower conductivity than pure copper, limited acceptance in high-load applications, regulatory constraints, durability concerns, technical installation complexities, and lack of awareness among end users and installers.

Need help to buy this report?