Global Cooking Wine Market Size, Share, and COVID-19 Impact Analysis, By Product (Dessert Wine, White Wine, Red Wine, and Others), By Application (B2B and B2C), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Cooking Wine Market Insights Forecasts to 2033

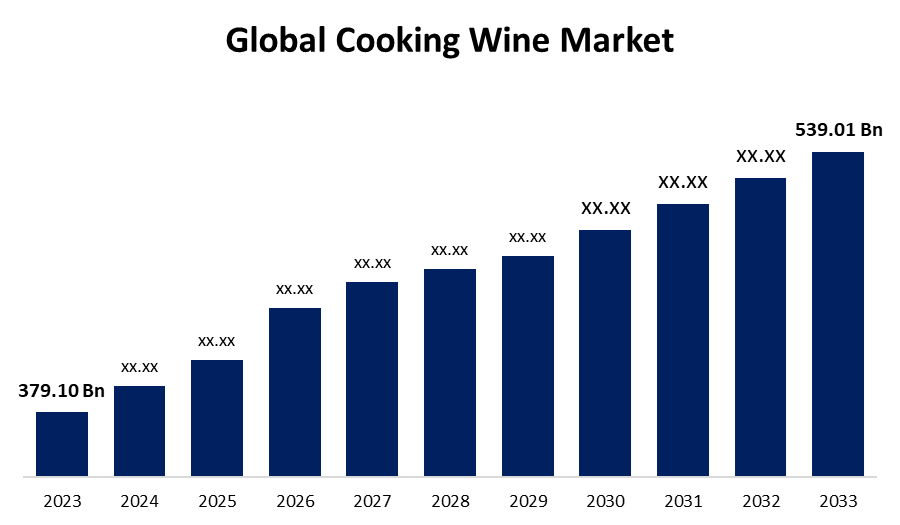

- The Global Cooking Wine Market Size was Estimated at USD 379.10 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 3.58% from 2023 to 2033

- The Worldwide Cooking Wine Market Size is Expected to Reach USD 539.01 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global cooking wine market size was Worth around USD 379.10 Billion in 2023 and is predicted to grow to around USD 539.01 Billion by 2033 with a compound annual growth rate (CAGR) of 3.58% between 2023 and 2033. The world market for cooking wine is witnessing consistent growth as the demand for gourmet cooking rises, food service industries continue to expand, and consumer interest in foreign cuisines grows. Cooking wine adds depth of flavor to food and is found commonly in restaurants, homes, and food manufacturing. Market expansion is driven by the popularity of Asian and Mediterranean foods, as well as the trend towards home cooking. Major players emphasize product innovation, organic versions, and premium products to appeal to consumers.

Market Overview

The global market for cooking wines involves the production and supply of wines specially designated for use in cooking. It involves wines intended for use during cooking, in sauces, marinades, and other culinary preparations, rather than wines to be consumed mainly as drinks. With urbanization and rising disposable incomes, demand for some of the more exotic flavor-enhancers, like rice wine, sherry, and marsala wine, has increased, particularly among restaurant chefs and domestic cooks. More expansion in hospitality and food services has also played a major role in driving growth. Furthermore, the use of cooking wine has gained broader acceptance in a number of other cooking applications, including meat, stews, marinades, and stir-fry food. Greater availability through websites and specialist food retailers has expanded distribution, fuelling overall industry growth. Another significant driver for growth, though, is the accelerating trend towards clean-label and health-focused food. Additionally, as consumers' demand for organic, low-sodium, and alcohol-free products grows, producers are working to develop and introduce goods that meet these shifting dietary preferences. These developments have encouraged product diversity to cater to a range of consumer demographics.

Report Coverage

This research report categorizes the cooking wine market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cooking wine market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cooking wine market.

Global Cooking Wine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 379.10 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.58% |

| 2033 Value Projection: | USD 539.01 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Application and By Region |

| Companies covered:: | Eden Foods, AAK AB, Batory Foods, ECOVINAL, S.L.U., Elegre, Marina Foods, Inc., Stratas Foods, The Kroger Co., Mizkan America Inc., Roland Foods, LLC, Kayco Co., LinChen Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The international cooking wine market is becoming more competitive, with more companies competing for consumers' attention through online advertising. This competition is both a driver and a restraint, as firms attempt to gain an advantage over their competitors. Additionally, the innovation in new technologies, including machine learning tools and natural language algorithms, is propelling growth in the cooking wine market. Nevertheless, the speed of technological change can itself also be a limitation, with companies struggling to cope with new trends and technologies. Furthermore, as wine production and consumption have expanded exceedingly in the last few decades, leading to a growing consumption trend. Modernization, social interactions, and growing acceptance of Western culture are some of the factors that are influencing alcohol socialization among consumers.

Restraining Factors

There are various underdeveloped nations across the globe where the people have a low disposable income, and they are also less literate about the new & rising cooking ideas. Therefore, the cooking wines exhibit low penetration within these nations and hence restrain the growth of the overall cooking wine market. Apart from this, the cooking wines need to be handled with extreme care, otherwise the entire food recipe would get spoiled and consumers would have a bad experience.

Market Segmentation

The cooking wine market share is classified into product and application.

- The dessert segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the cooking wine market is categorized into dessert wine, white wine, red wine, and others. Among these, the dessert segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Increased consumer demand for gourmet cooking and home preparation of restaurant-quality meals has generated a consistent demand for dessert wines like Sauternes, Port, Moscato, and Sherry. Such products are extensively employed in recipes to contribute richness, sweetness, and depth to flavors. Dessert wines are particularly deemed to be worth their weight in sauces, dessert fillings, and caramel reductions. They are sweet and possess intricate flavor profiles, which makes them a great ingredient to introduce richness to foods. They are utilized in sauces as a reduction of wine, as well as in caramel, ice creams, and custards. The proportion of sweetness and acidity in such items enhances the flavor profile of different culinary preparations, supporting their demand.

- The B2B segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the cooking wine market is categorized into B2B and B2C. Among these, the B2B segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Firms operating in these industries buy cooking wines to flavor their meals and for convenience, cost-saving reasons. Restaurants and catering operations find cooking wines attractive since they lower the ingredient costs. Additionally, the ingredients used in cooking wines have a longer lifespan than those used for drinking because they contain added preservatives and high levels of salt. This makes them a convenient option for business kitchens, which might not go through a lot of wine every day. The longer shelf life therefore, minimizes waste and assists food service businesses in managing their stock better. Cooking wines are a pantry staple among companies dealing in French, Italian, Spanish, or other Mediterranean cuisines.

Regional Segment Analysis of the Cooking Wine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

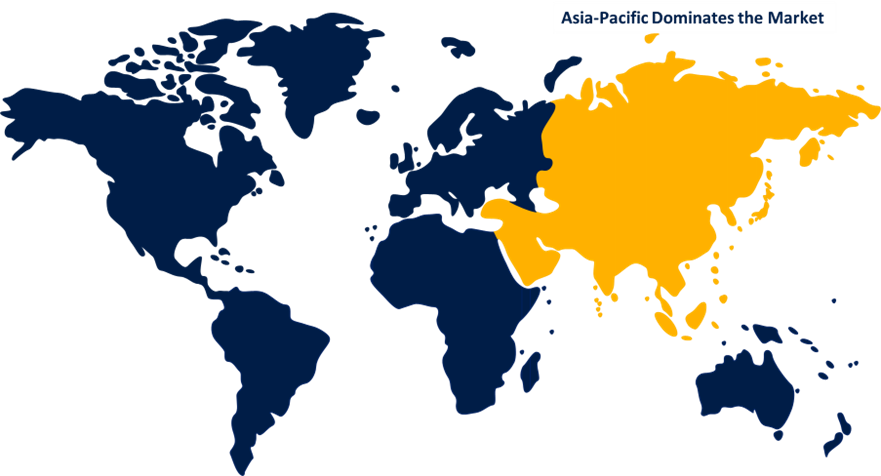

Asia Pacific is anticipated to hold the largest share of the cooking wine market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the cooking wine market over the predicted timeframe. The growing availability of Western culture-influenced restaurants and hotels in rapidly growing economies like India and China helped build a consistent demand for products like cooking wines. In addition, Asian economies also possess a well-established culture of incorporating wines, like Chinese Shaoxing wine and sake and mirin in Japan, into food preparation. These wines are used widely in marinades, stir-fries, sauces, and soups to impart depth of flavor, tenderize meat, and balance flavors in the dish. The rise of the middle-class and high-income population poses encouraging opportunities for market players to market their cooking wines in this region.

Europe is expected to grow at the fastest CAGR in the cooking wine market during the forecast period. Europe's strong consumer appreciation of gourmet cuisine and desire for organic, premium, and older-style cooking wines further reinforce its market leadership. The existence of prime wine-producing areas guarantees a consistent supply of high-quality raw materials to fuel B2B and retail demand. In addition, growth in e-commerce and private-label brands increased accessibility, further reinforcing Europe's market leadership. With ongoing innovation in wine-making and eco-friendly packaging, Europe is likely to continue leading the cooking wine market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cooking wine market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eden Foods

- AAK AB

- Batory Foods

- ECOVINAL, S.L.U.

- Elegre

- Marina Foods, Inc.

- Stratas Foods

- The Kroger Co.

- Mizkan America Inc.

- Roland Foods, LLC

- Kayco Co.

- LinChen Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, AAK declared the sale of its Foodservice plant in New Jersey, U.S., with the firm having entered into an agreement with Stratas Foods for the purchase. This was part of AAK's long-term plan to streamline its operations in the Foodservice business, which produced over 300 specialty items, such as condiments, dressings, sauces, frying oils, cooking wines, and ingredients. The firm also announced that it would invest substantially in its European Foodservice business, thereby reinforcing its position in the Nordic countries and the UK.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the cooking wine market based on the below-mentioned segments:

Global Cooking Wine Market, By Product

- Dessert Wine

- White Wine

- Red Wine

- Others

Global Cooking Wine Market, By Application

- B2B

- B2C

Global Cooking Wine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cooking wine market over the forecast period?The global cooking wine market is projected to expand at a CAGR of 3.58 % during the forecast period.

-

2. What is the market size of the cooking wine market?The Global Cooking Wine Market Size is expected to grow from USD 379.10 Billion in 2023 to USD 539.01Billion by 2033, at a CAGR of 3.58% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the cooking wine market?Asia Pacific is anticipated to hold the largest share of the cooking wine market over the predicted timeframe.

Need help to buy this report?