Global Contract Management Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Software and Services), By Deployment Type (On-premises and Cloud), By Organization Size (SMEs and Large Enterprises), By Vertical (Government, Retail and eCommerce, Healthcare and Life Sciences, BFSI, Transportation and Logistics, Telecom and IT, Manufacturing, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Contract Management Software Market Insights Forecasts to 2033

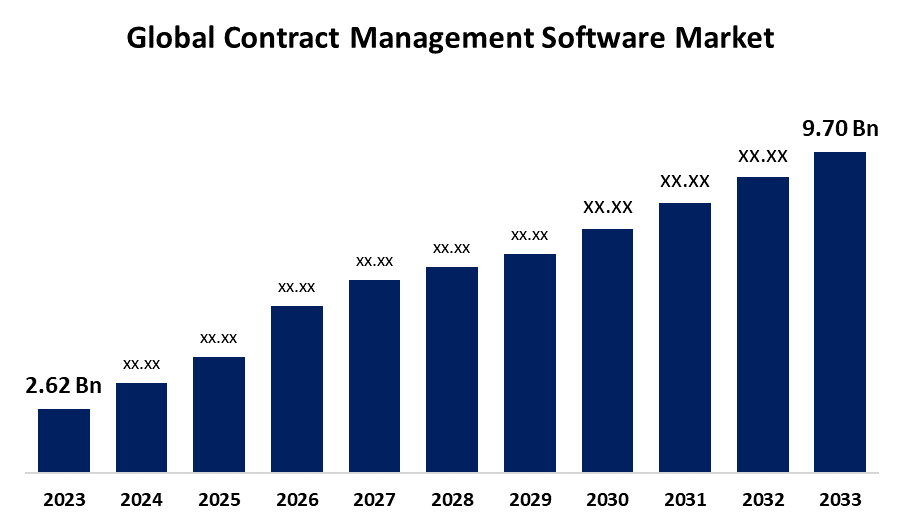

- The Global Contract Management Software Market Size Was Estimated at USD 2.62 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 13.98% from 2023 to 2033

- The Worldwide Contract Management Software Market Size is Expected to Reach USD 9.70 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Contract Management Software Market Size is anticipated to exceed USD 9.70 billion by 2033, growing at a CAGR of 13.98% from 2023 to 2033. The market growth is rising due to the increasing digital transformation, compliance needs, and remote work trends. Cloud-based flexibility and regulatory pressures continue to drive widespread adoption across industries.

Market Overview

The contract management software market refers to the digital system that automates, centralizes, and simplifies the whole contract lifecycle, from design and negotiation to execution, compliance, and renewal. With capabilities like automated workflows, audit trails, e-signatures, and connection with other enterprise systems, it assists businesses in managing contract papers, monitoring commitments and due dates, guaranteeing compliance, and enhancing operational efficiency.

Promoting fair competition, automating compliance, and improving transparency, CobbleStone Software brings innovations that simplify government procurement. Its sophisticated features, such as FAR/DFAR clause management, a public-facing interface, and intelligent workflows, streamline intricate contracting procedures while guaranteeing regulatory compliance. CobbleStone assists public agencies in modernizing procurement with efficiency and equity at its core by encouraging accountability and inclusion, particularly for small and minority-owned businesses.

Specialized software is needed for government contract management to manage the intricacies of stakeholder coordination, performance monitoring, and compliance. ContractWorks and Icertis Contract Intelligence (ICI) for Government Contractors are two well-known systems in this field, each with special capabilities catered to the requirements of the public sector.

A growing need for companies to automate and optimize their contract administration procedures. The need for effective, centralized, and compliant contract management systems is expanding as businesses deal with increasingly complicated contract management, especially in sectors like government, healthcare, and finance. The industry is anticipated to grow quickly through advantages like increased transparency, better compliance, lower risks, and improved decision-making.

Report Coverage

This research report categorizes the contract management software market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the contract management software market. Recent market developments and competitive strategies such as expansion, Type of Software launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the contract management software market.

Global Contract Management Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.62 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Component, By Deployment Type, By Vertical and COVID-19 Impact Analysis |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The contract management software market is experiencing rapid growth, driven by the need for digital efficiency, automation, and compliance. These solutions are being used by organizations more and more to handle intricate agreements and reduce legal risks. Cloud-based solutions appeal to both small and large businesses because they are accessible and flexible. The need for more efficient contract oversight is further increased by regulatory requirements and the growth of remote work settings. As a result, the market is expected to expand with the help of regulatory trends and technology developments.

Restraining Factors

The market growth is hindered by the widespread use of contract management software, high installation costs, difficulties with integration, and data security issues. The financial and technical requirements of these solutions may be too much for SMEs in particular. Compatibility with current systems frequently necessitates considerable adaptation. Organizations are also wary about privacy threats, particularly when thinking about cloud-based solutions.

Market Segmentation

The global contract management software market is classified into components, deployment type, organization size, and vertical.

- The software segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the component, the contract management software market is categorized into software and services. Among these, the software segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the automation and simplification of contract generation, negotiation, approval, execution, compliance management, and renewal processes. This automation improves productivity, guarantees uniformity, and lowers human error, all of which are very helpful when handling complicated contracts and large numbers. Furthermore, developments in machine learning (ML) and artificial intelligence (AI) are expanding the functionality of contract management software, making it more intelligent and effective.

- The cloud segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the deployment type, the contract management software market is categorized into on-premises and cloud. Among these, the cloud segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to its cost-effectiveness, scalability, and remote accessibility, which make it especially desirable to small and medium-sized businesses (SMEs). Additionally, cloud solutions eliminate the need for a large IT infrastructure and enable real-time collaboration.

- The large enterprise segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the organization size, the contract management software market is categorized into SMEs and large enterprises. Among these, the large enterprise segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to these companies' overseeing large and intricate contract portfolios, which call for sophisticated features like automated processes, in-depth analytics, and smooth interaction with other business systems like CRM and ERP. They are the main users of contract management software due to their substantial operational scale and resources.

- The healthcare and life science segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the vertical, the contract management software market is categorized into government, retail and ecommerce, healthcare and life sciences, BFSI, transportation and logistics, telecom and IT, manufacturing, and others. Among these, the healthcare and life science segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the use of hospitals more and more to guarantee compliance, lower operational risks, and boost productivity. By supporting compliance with HIPAA and international data privacy regulations, these technologies guarantee the safe management of private data. Hospitals may cut expenses and stay out of trouble by reducing manual errors and optimizing procedures. Therefore, in now healthcare operations, contract management software is growing indispensable.

Regional Segment Analysis of the Contract Management Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the contract management software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the contract management software market over the predicted timeframe. The regional growth can be attributed to the organizations in these regions are required to keep a systematic record of their contracts. These firms can increase the openness of their contract management by putting in place clear regulations and utilizing efficient contract management systems. Additionally, the region's use of contract management software is aided by advantageous laws like the Health Insurance Portability & Accountability Act (HIPAA).

Asia Pacific is expected to grow at the fastest CAGR of the contract management software market during the forecast period. In these regions, the increased complexity of regulations and digitization. Demand is being driven by tech innovation and pro-business government policies in nations like China, India, and Japan. The demand for effective contract solutions is rising as a result of growing e-commerce and cross-border business expansion. Consequently, the area has emerged as a significant contract management technology industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the contract management software market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DocuSign

- Proposify

- Adobe Sign

- GEP Worldwide

- Agiloft

- CobbleStone Software

- ContractWorks

- Mitratech

- Icertis

- Contract Logix

- Coupa Software

- VersaSuite

- SAP Ariba

- Onit

- JAGGAER

- Conga

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2025, Adobe's Acrobat AI Assistant now include a new generative AI contract management tool to help organizations and consumers analyze contracts, legal repercussions, risk management, and make decisions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the contract management software market based on the below-mentioned segments:

Global Contract Management Software Market, By Component

- Software

- Services

Global Contract Management Software Market, By Deployment Type

- On-premises

- Cloud

Global Contract Management Software Market, By Organization Size

- SMEs

- Large Enterprises

Global Contract Management Software Market, By Vertical

- Government

- Retail and eCommerce

- Healthcare and Life Sciences

- BFSI

- Transportation and Logistics

- Telecom and IT

- Manufacturing

- Others

Global Contract Management Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the contract management software market over the forecast period?The contract management software market is projected to expand at a CAGR of 13.98% during the forecast period.

-

2. What is the market size of the contract management software market?The Global Contract Management Software Market Size is expected to grow from USD 2.62 Billion in 2023 to USD 9.70 Billion by 2033, at a CAGR of 13.98% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the contract management software market?North America is anticipated to hold the largest share of the contract management software market over the predicted timeframe.

Need help to buy this report?