Global Container Handling Equipment Market Size, Share, and COVID-19 Impact Analysis, By Propulsion (Diesel, Electric, Hybrid), By Capacity (Up to 10 tons, 10-50 tons, 50 tons and above), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Container Handling Equipment Market Insights Forecasts to 2033

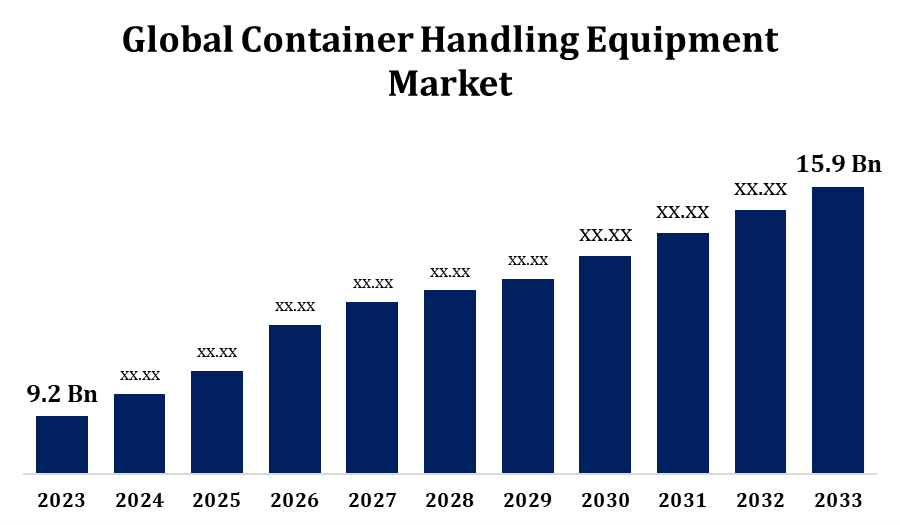

- The Global Container Handling Equipment Market Size was valued at USD 9.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.62% from 2023 to 2033.

- The Worldwide Container Handling Equipment Market Size is Expected to reach USD 15.9 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Container Handling Equipment Market Size is Expected to reach USD 15.9 Billion By 2033, at a CAGR of 5.62% during the Forecast Period 2023 to 2033.

The container handling equipment market is experiencing steady growth, driven by the increasing volume of global trade and the expanding operations of ports and terminals. Advancements in automation and the integration of smart technologies are enhancing the efficiency and safety of cargo handling operations. Environmental concerns and stricter emission regulations are also encouraging the adoption of electric and hybrid equipment. Key players in the industry are focusing on innovation, fleet modernization, and improved fuel efficiency to meet evolving customer needs. The demand for container handling equipment is particularly strong in emerging economies, where infrastructure development and trade activities are expanding rapidly. Overall, the market is becoming more competitive, with a growing emphasis on operational optimization, cost-efficiency, and sustainability across the logistics and transportation sectors.

Container Handling Equipment Market Value Chain Analysis

The container handling equipment market value chain comprises several interconnected stages, starting with raw material suppliers who provide steel, electronics, and hydraulic components. Manufacturers then design and assemble various equipment types, such as cranes, forklifts, and reach stackers. These products are often enhanced with automation and telematics by technology providers. Distributors and dealers play a key role in marketing and delivering the equipment to end users, including ports, terminals, shipping companies, and logistics providers. Aftermarket services, such as maintenance, spare parts, and operator training, ensure long-term equipment performance and customer satisfaction. Regulatory bodies influence the value chain by setting safety and emissions standards, prompting innovation and sustainable practices. Collaboration among stakeholders across the chain is essential to meeting market demands and ensuring efficient, compliant operations.

Container Handling Equipment Market Opportunity Analysis

The container handling equipment market is poised for growth due to rising global trade, technological advancements, and increasing focus on sustainability. Automation, IoT, and robotics are revolutionizing port operations by improving efficiency and reducing dependency on manual labor. This trend is helping address workforce shortages and meet the demands of round-the-clock operations. The shift towards electric and hybrid equipment is gaining momentum as ports and terminals aim to comply with stricter environmental regulations. Emerging economies, particularly in Asia-Pacific, are investing significantly in port infrastructure, driving demand for modern, efficient handling systems. Additionally, the surge in e-commerce is accelerating the need for faster, automated cargo movement solutions. These developments create promising opportunities for equipment manufacturers and technology providers seeking to innovate and expand within the evolving logistics landscape.

Global Container Handling Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.2 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.62% |

| 2033 Value Projection: | USD 15.9 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Propulsion, By Capacity, By Region. |

| Companies covered:: | Ambergate Invest Sverige AB, PALFINGER AG, Hyster-Yale Materials Handling, Inc., Liebherr Group, Sany Group Co., Ltd., Toyota Industries Corporation, CVS ferrari S.P.A., China Communications Construction Company, Ltd., Tadano Ltd., Cargotec Corporation, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Container Handling Equipment Market Dynamics

Implementation of automated systems and digital innovations

The implementation of automated systems and digital innovations is significantly propelling growth in the container handling equipment market. Automation technologies, including autonomous guided vehicles (AGVs), remote-controlled cranes, and AI-driven logistics software, enhance operational efficiency, reduce human error, and optimize container stacking and retrieval processes. These systems enable real-time data analysis, predictive maintenance, and streamlined workflow management, leading to reduced downtime and improved throughput. Digital innovations such as IoT integration and cloud-based monitoring support smarter fleet management and improved safety. Additionally, the shift towards smart ports and green logistics is encouraging investments in advanced, eco-friendly handling equipment. As global trade volumes rise, ports and terminal operators increasingly adopt these technologies to remain competitive, scalable, and compliant with environmental and operational standards. This trend continues to drive market expansion.

Restraints & Challenges

High initial investment costs for advanced automated systems and digital technologies can be a barrier, especially for small and medium-sized ports. Integration of new technologies with legacy infrastructure often requires complex retrofitting and skilled labor, which may not be readily available. Equipment maintenance and downtime issues also impact operational efficiency and profitability. Additionally, fluctuations in global trade, driven by geopolitical tensions, economic uncertainty, or supply chain disruptions, can affect demand for container handling equipment. Environmental regulations are becoming stricter, pushing manufacturers to develop eco-friendly solutions, which can increase R&D costs. Limited standardization across ports and equipment types can further complicate interoperability. These challenges require strategic planning and investment to ensure sustained market growth.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Container Handling Equipment Market from 2023 to 2033. The container handling equipment market in North America is driven by the push for infrastructure modernization, automation, and sustainability. Ports are increasingly adopting advanced technologies like electric and hybrid equipment to comply with stricter environmental regulations and enhance operational efficiency. Automation plays a key role, with the implementation of systems such as automated stacking cranes and electric rubber-tired gantry cranes, which help improve throughput while reducing labor costs. However, challenges remain, including the high capital investment required for these technologies, integration complexities with existing infrastructure, and concerns over labor displacement due to automation. Despite these hurdles, ongoing investments in port modernization, the shift toward sustainable operations, and the expansion of smart port initiatives are expected to continue fostering growth in the region's container handling equipment market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific container handling equipment market is witnessing strong growth, fueled by rapid industrialization, expanding global trade, and significant investments in port infrastructure. Leading countries like China, India, Japan, and South Korea are adopting automation technologies such as automated guided vehicles (AGVs), automated stacking cranes, and hybrid cranes to improve operational efficiency and reduce turnaround times. For example, China’s Qingdao Qianwan Container Terminal is the first fully automated terminal in the region, utilizing IoT, big data, and cloud technologies. India’s Outer Harbor Project at Chidambaranar Port is also enhancing capacity with substantial investments, driving demand for advanced equipment. Despite challenges like high initial costs, integration issues, and skilled labor shortages, the region’s focus on modernization and sustainability continues to propel market expansion.

Segmentation Analysis

Insights by Propulsion

The diesel segment accounted for the largest market share over the forecast period 2023 to 2033. Diesel engines are particularly suited for heavy-duty operations in environments with limited electric infrastructure, making them ideal for equipment like reach stackers, rubber-tired gantry cranes, and mobile harbor cranes. Despite the growing trend toward electrification driven by environmental concerns and regulatory pressures, diesel-powered systems remain essential in high-capacity operations, especially in regions with underdeveloped electric infrastructure. Additionally, advancements in cleaner diesel technologies and improvements in fuel efficiency are helping maintain the relevance of diesel-powered equipment as the industry shifts towards more sustainable propulsion systems. Diesel engines continue to offer proven performance and adaptability, ensuring their presence in the market for the foreseeable future.

Insights by Capacity

The 10 tons capacity segment accounted for the largest market share over the forecast period 2023 to 2033. This equipment is especially popular in warehouses, mid-sized manufacturing units, and ports dealing with moderate cargo volumes. Its affordability compared to larger-capacity machines makes it an attractive choice for operators with budget constraints. These systems are valued for their ability to perform multiple tasks—such as lifting, moving, and stacking—in compact and space-limited environments. Their adaptability and ease of use make them ideal for businesses seeking efficient yet flexible material handling solutions. As industries continue to prioritize space optimization and operational efficiency, the demand for equipment in this capacity range is expected to remain strong, reinforcing its market relevance.

Recent Market Developments

- In November 2024, ZPMC has supplied three ship-to-shore (STS) cranes to the Hateco Hai Phong International Container Terminal (HHIT) in Vietnam, marking their first partnership with HHIT.

Competitive Landscape

Major players in the market

- Ambergate Invest Sverige AB

- PALFINGER AG

- Hyster-Yale Materials Handling, Inc.

- Liebherr Group

- Sany Group Co., Ltd.

- Toyota Industries Corporation

- CVS ferrari S.P.A.

- China Communications Construction Company, Ltd.

- Tadano Ltd.

- Cargotec Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Container Handling Equipment Market, Propulsion Analysis

- Diesel

- Electric

- Hybrid

Container Handling Equipment Market, Capacity Analysis

- Up to 10 tons

- 10-50 tons

- 50 tons and above

Container Handling Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Container Handling Equipment Market?The global Container Handling Equipment Market is expected to grow from USD 9.2 billion in 2023 to USD 15.9 billion by 2033, at a CAGR of 5.62% during the forecast period 2023-2033.

-

2. Who are the key market players of the Container Handling Equipment Market?Some of the key market players of the market are Ambergate Invest Sverige AB, PALFINGER AG, Hyster-Yale Materials Handling, Inc.,, Liebherr Group, Sany Group Co., Ltd., Toyota Industries Corporation, CVS ferrari S.P.A., China Communications Construction Company, Ltd., Tadano Ltd., Cargotec Corporation.

-

3. Which segment holds the largest market share?The up to 10 tons segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?