Global Construction Repair Composites Market Size, Share, and COVID-19 Impact Analysis, By Fiber Type (Glass Fiber, Carbon Fiber, and Others), By Resin Type (Vinyl Easter, Epoxy, and Others), By Product Type (Textile / Fabric, Plate, Rebar, Mesh, and Adhesive), By Application (Residential, Commercial, Bridge, Silo Flue Pipe, Oil & Natural Gas Pipeline, Water Structure, Industrial Structure, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Construction Repair Composites Market Insights Forecasts to 2033

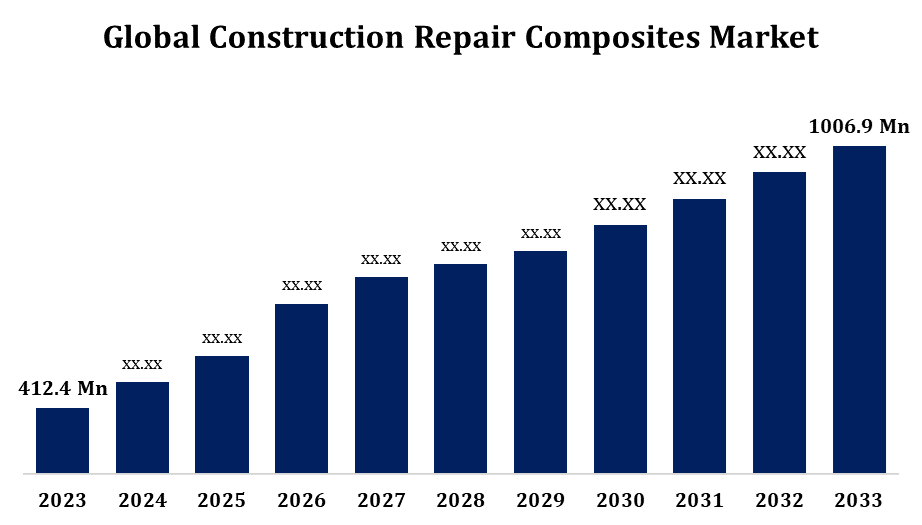

- The Global Construction Repair Composites Market Size was valued at USD 412.4 Million in 2023.

- The Market is Growing at a CAGR of 9.34% from 2023 to 2033.

- The Worldwide Construction Repair Composites Market Size is Expected to reach USD 1006.9 Million by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Construction Repair Composites Market Size is Expected to reach USD 1006.9 Million by 2033, at a CAGR of 9.34% during the forecast period 2023 to 2033.

The construction repair composites market is experiencing steady growth, driven by the increasing demand for durable, lightweight, and corrosion-resistant materials in infrastructure rehabilitation. These composites primarily carbon fiber, glass fiber, and other advanced materials are used to restore and reinforce aging buildings, bridges, roads, and other critical infrastructure without significant structural alteration. Rising investments in infrastructure modernization across both developed and emerging economies are fueling market expansion. Additionally, stringent environmental regulations and the growing need for sustainable construction solutions are promoting the adoption of composite repair systems over traditional methods. North America and Asia-Pacific lead the market due to ongoing infrastructure upgrades and urban development. Technological advancements in composite formulations and installation techniques further enhance their appeal, ensuring long-term performance and reduced maintenance costs.

Construction Repair Composites Market Value Chain Analysis

The construction repair composites market value chain comprises several interconnected stages, beginning with raw material suppliers providing resins, fibers (carbon, glass, aramid), and additives. These materials are then processed by composite manufacturers to produce fabrics, wraps, laminates, and pre-impregnated systems tailored for structural repair applications. Product formulators and system integrators play a key role in customizing solutions to meet specific construction needs. Distributors and suppliers ensure the delivery of these materials to contractors, engineers, and infrastructure owners. End users—primarily in sectors like civil infrastructure, buildings, and industrial facilities—apply these solutions for strengthening and rehabilitating structures. The value chain is supported by testing agencies, certification bodies, and regulatory authorities to ensure compliance with safety and performance standards. Innovation and collaboration across the chain drive product effectiveness and market growth.

Construction Repair Composites Market Opportunity Analysis

The construction repair composites market offers strong growth potential, fueled by increasing infrastructure investments and the growing shift toward advanced materials. Regions like Asia-Pacific and North America show significant opportunity due to rapid urbanization, renewable energy projects, and the need to rehabilitate aging infrastructure. The expanding wind energy sector, which requires efficient repair solutions for turbine blades, is also boosting demand for composites. Innovations in high-performance resins, self-healing materials, and smart composites with IoT integration are creating new applications, especially in predictive maintenance. Automation and robotics are enhancing repair efficiency and addressing labor shortages. Emerging markets such as India, China, Brazil, and Southeast Asia present vast opportunities due to rising retrofitting needs. Additionally, the focus on sustainability is driving demand for eco-friendly, bio-based composite solutions.

Global Construction Repair Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 412.4 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.34% |

| 2033 Value Projection: | USD 1006.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Fiber Type, By Resin Type, By Product Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Sika AG, BASF SE, Arkema SA, Owens Corning, Saint-Gobain S.A., S&P Inc., DuPont de Nemours, Inc., Ashland Holdings Inc., Henkel AG & Co. KGaA, W.R. Grace & Co., PPG Industries, Inc., Mapei S.p.A., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Construction Repair Composites Market Dynamics

The increasing demand from commercial end-use sectors is propelling market growth

The increasing demand from commercial end-use sectors is a major driver of growth in the construction repair composites market. Commercial buildings such as offices, malls, hospitals, hotels, and educational institutions are increasingly adopting composite repair solutions to enhance structural integrity, extend building lifespan, and meet evolving safety regulations. These composites offer advantages such as high strength-to-weight ratio, corrosion resistance, and ease of installation, making them ideal for repairing concrete, steel, and masonry structures without major reconstruction. As aging commercial infrastructure requires cost-effective, durable repair systems, the appeal of fiber-reinforced polymers and advanced composite wraps continues to grow. Additionally, rising awareness about sustainability and energy efficiency in commercial construction further accelerates adoption. Ongoing urbanization and infrastructure modernization projects globally are expected to strengthen this demand in the years ahead.

Restraints & Challenges

One major hurdle is the high upfront cost of advanced materials like fiber-reinforced polymers, which can limit adoption, particularly among smaller contractors and budget-sensitive projects. Additionally, the installation of these materials requires specialized knowledge and skilled labor, which are not always readily available, increasing the risk of improper application and reduced effectiveness. Another challenge is the lack of standardized regulations and certification frameworks, which creates uncertainty and hinders broader acceptance in infrastructure repair. Traditional repair methods using concrete and steel still dominate due to familiarity and cost-effectiveness, making it harder for composites to gain widespread traction. Furthermore, concerns over the environmental impact of composite production often involving energy-intensive processes and petroleum-based resins pose challenges in an increasingly sustainability-focused market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Construction Repair Composites Market from 2023 to 2033. North America represents a significant share of the construction repair composites market, driven by aging infrastructure, stringent building codes, and a strong focus on sustainability. The region faces a growing need to rehabilitate aging bridges, highways, commercial buildings, and public utilities, prompting the adoption of advanced composite materials for long-lasting, cost-effective repair solutions. The U.S. leads the market with substantial federal and state investments in infrastructure modernization, supported by initiatives like the Bipartisan Infrastructure Law. Canada also shows rising demand, particularly in urban centers and industrial sectors. The region benefits from a well-developed supply chain, technological innovation, and a high level of awareness regarding the advantages of fiber-reinforced composites. Moreover, increasing emphasis on energy-efficient, low-maintenance solutions continues to boost the market’s expansion across North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growth is fueled by rapid urbanization, industrialization, and ongoing infrastructure development across countries like China, India, and those in Southeast Asia. The demand for durable, lightweight, and low-maintenance repair materials is rising due to the increasing need to upgrade aging infrastructure, including bridges, highways, tunnels, and public buildings. China leads the regional market with large-scale urban renewal and transportation projects, while India is witnessing strong growth driven by initiatives focused on smart cities and affordable housing. Favorable government policies, growing awareness of advanced construction technologies, and the presence of cost-effective labor and raw materials contribute to regional market expansion. Additionally, global players are investing in local production and partnerships to tap into Asia-Pacific’s high-growth potential.

Segmentation Analysis

Insights by Fiber Type

The glass fiber segment accounted for the largest market share over the forecast period 2023 to 2033. The glass fiber segment is experiencing strong growth in the construction repair composites market due to its cost-effectiveness, durability, and excellent strength-to-weight ratio. Known for its corrosion resistance and ease of handling, glass fiber is widely used in repairing structural elements such as beams, columns, bridges, and pipelines. Its lightweight nature simplifies installation, reduces labor requirements, and supports faster project completion. Ongoing advancements in manufacturing techniques, such as pultrusion and resin infusion, are enhancing the performance and reliability of glass fiber composites. As infrastructure repair demands continue to rise across both developed and emerging regions, glass fiber remains a preferred choice for engineers and contractors seeking long-lasting, low-maintenance solutions. Its versatility and economic advantages are key factors driving its widespread adoption in the market.

Insights by Resin Type

The epoxy segment accounted for the largest market share over the forecast period 2023 to 2033. Epoxy-based composites are widely used in structural reinforcement projects involving bridges, columns, beams, and industrial infrastructure. Their ability to bond effectively with various surfaces makes them ideal for long-term durability and structural integrity. Advancements in epoxy formulations such as faster curing times, improved flexibility, and reduced shrinkage are enhancing application efficiency and performance. These properties make epoxy resins a preferred choice for seismic retrofitting, corrosion protection, and complex repair environments. Additionally, the integration of epoxy systems into smart and automated repair technologies is expanding their applications. As infrastructure ages, demand for epoxy composites in repair and rehabilitation projects is expected to remain strong.

Insights by Product Type

The construction repair composites segment accounted for the largest market share over the forecast period 2023 to 2033. As infrastructure across the globe continues to age, there is an increasing demand for reliable, high-performance repair solutions such as fiber-reinforced fabrics, meshes, plates, and rebars. These composites offer enhanced structural strength, corrosion resistance, and ease of installation, making them ideal for repairing bridges, tunnels, buildings, and industrial assets. Innovations like vacuum-infused fabrics and precision-placed composites are improving durability and reducing downtime. Additionally, the growing emphasis on sustainability and the need for long-lasting repair methods are accelerating their adoption in both mature and developing markets. Integration with smart technologies and automated application techniques is further expanding the segment's role in predictive maintenance and infrastructure modernization efforts worldwide.

Insights by Application

The industrial structure segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the need to maintain and upgrade aging infrastructure in sectors such as manufacturing, oil and gas, and warehousing. These environments often face harsh conditions, including exposure to chemicals, moisture, and temperature extremes, making composites an ideal solution due to their strength, durability, and corrosion resistance. Fiber-reinforced materials, particularly glass and carbon fibers, are widely used to reinforce and repair structural components without major downtime. Advanced application techniques like vacuum infusion and spray systems enhance coverage and performance. Additionally, the integration of automation and IoT technologies enables more precise repair and real-time monitoring. With ongoing industrial expansion and increasing maintenance demands, this segment continues to play a vital role in market growth.

Recent Market Developments

- In June 2024, Saint-Gobain has acquired Fosroc, a leading construction chemical company in the Asia-Pacific region. This strategic acquisition will enable Saint-Gobain to broaden its footprint in high-growth emerging markets and reinforce its presence in key regions such as India and the Middle East.

Competitive Landscape

Major players in the market

- Sika AG

- BASF SE

- Arkema SA

- Owens Corning

- Saint-Gobain S.A.

- S&P Inc.

- DuPont de Nemours, Inc.

- Ashland Holdings Inc.

- Henkel AG & Co. KGaA

- W.R. Grace & Co.

- PPG Industries, Inc.

- Mapei S.p.A.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Construction Repair Composites Market, Fiber Type Analysis

- Glass Fiber

- Carbon Fiber

- Others

Construction Repair Composites Market, Resin Type Analysis

- Vinyl Easter

- Epoxy

- Others

Construction Repair Composites Market, Product Analysis

- Textile / Fabric

- Plate

- Rebar

- Mesh

- Adhesive

Construction Repair Composites Market, Application Analysis

- Residential

- Commercial

- Bridge

- Silo Flue Pipe

- Oil & Natural Gas Pipeline

- Water Structure

- Industrial Structure

- Others

Construction Repair Composites Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Construction Repair Composites Market?The Global Construction Repair Composites Market Size is expected to grow from USD 412.4 million in 2023 to USD 1006.9 million by 2033, at a CAGR of 9.34% during the forecast period 2023-2033.

-

2. Who are the key market players of the Construction Repair Composites Market?Some of the key market players of the market are Sika AG, BASF SE, Arkema SA, Owens Corning, Saint-Gobain S.A., S&P Inc., DuPont de Nemours, Inc., Ashland Holdings Inc., Henkel AG & Co. KGaA, W.R. Grace & Co., PPG Industries, Inc., Mapei S.p.A.

-

3. Which segment holds the largest market share?The epoxy segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?