Global Construction Lubricants Market Size, Share, and COVID-19 Impact By Base Oil Type (Mineral Oil, Synthetic Oil), By Product (Engine Oil, Gear Oil, Hydraulic Fluid, Grease, Others), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Chemicals & MaterialsGlobal Construction Lubricants Market Insights Forecasts to 2032

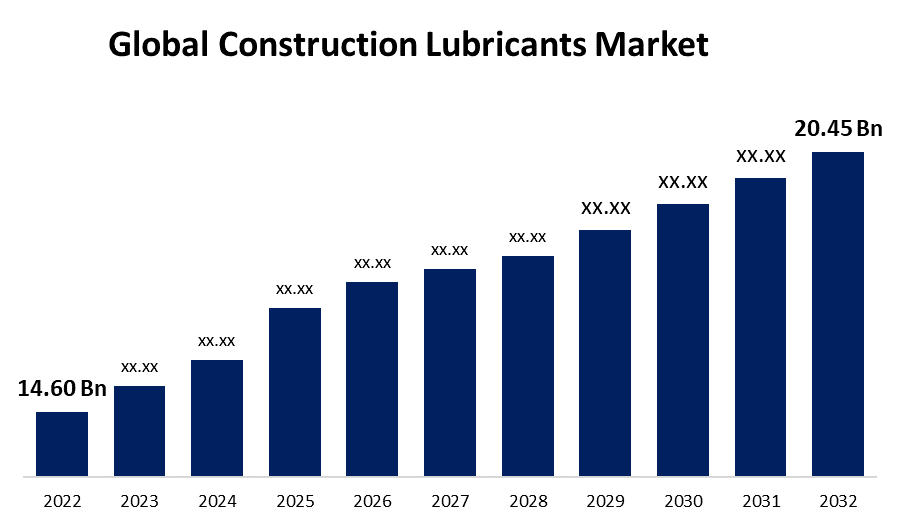

- The Construction Lubricants Market Size was valued at USD 14.60 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.7% from 2022 to 2032

- The Worldwide Construction Lubricants Market Size is expected to reach USD 20.45 Billion by 2032

- North America is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Construction Lubricants Market Size is expected to reach USD 20.45 Billion by 2032, at a CAGR of 4.7% during the forecast period 2022 to 2032.

Construction lubricants are specialty lubricants used in the building sector to lessen wear and friction between moving parts and surfaces. They are essential for guaranteeing smooth operations, extending equipment life, and increasing efficiency in a variety of construction machines and equipment. Heavy loads, extreme heat, and challenging working conditions are all prevalent on construction sites, and construction lubricants are made to endure them.

Impact of COVID 19 On Global Construction Lubricants Market

Many building projects were put on hold or postponed during the early phases of the COVID-19 pandemic because of lockdowns, travel restrictions, and safety worries. As a result, there was a reduction in the market for construction machinery and equipment, which in turn affected the need for construction lubricants. Sales of lubricants used in construction machines were adversely impacted by the decline in construction activities. The pandemic also affected the manufacture and distribution of construction lubricants by upsetting global supply lines. Raw material supplies were delayed as a result of lockdown procedures and transit limitations, which also hampered the manufacturing and delivery processes. This then had an impact on the market's supply of construction lubricants. The pandemic's altered demands caused some building projects to be delayed, while the pandemic also caused other projects to continue or even accelerate. For instance, there was a rise in the need for healthcare facilities and infrastructure for remote work, which prompted the building of these types of facilities. The effect on the market for construction lubricants could differ depending on the region and governmental legislation.

Global Construction Lubricants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 14.60 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.7% |

| 2032 Value Projection: | USD 20.45 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Base Oil Type, By Product, by Region, and COVID-19 Impact Analysis. |

| Companies covered:: | Royal Dutch Shell, ExxonMobil, PetroChina Company, British Petroleum (BP), Chevron Corporation, Sinopec, Indian Oil Corporation, BP, Fuchs Petrolub SE, QALCO, Schaeffer Manufacturing Co., Addinol Lube Oil GmbH, and Other Key Venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

Urbanization, infrastructural expansion, and industrialization in emerging economies have all contributed to the growth of the worldwide construction sector. Construction lubricants were also in higher demand as construction activity raised the need for machinery and equipment. More sophisticated and high-performance machinery has been developed as a result of advancements in construction equipment and machinery. In order to ensure optimal performance, longer equipment life, and decreased downtime, these machines frequently need specialist lubricants. The need for construction equipment and lubricants has increased due to government initiatives and investments in infrastructure projects like roads, bridges, airports, and smart cities. The expansion of the mining and energy industries, which primarily rely on heavy-duty machinery, has also contributed to the rise in demand for construction equipment and lubricants.

Key Market Challenges

The health of the construction industry, which can be cyclical and vulnerable to economic downturns, has a direct impact on the need for construction lubricants. Construction projects may be postponed or abandoned during times of economic instability or recession, which will decrease demand for lubricants. Multiple companies are striving for market share in the competitive market for construction lubricants. Price pressure and smaller profit margins for lubricant distributors and manufacturers can result from fierce competition. Base oil and additive costs that are incorporated into lubricant formulations may vary on the global market. Rapid variations in the price of raw materials can have an effect on how construction lubricants are made and priced overall. Construction lubricants are essential for ensuring the functionality and longevity of large machinery.

Market Segmentation

Base Oil Type Insights

Mineral oil segment is dominating the market over the forecast period

On the basis of base oil type, the global construction lubricants market is segmented into Mineral Oil and Synthetic Oil. Among these, base oil type segment is dominating the market over the forecast period. In general, mineral oil-based lubricants are less expensive than synthetic or bio-based lubricants. Due to their affordable pricing, mineral oil lubricants are frequently used by construction enterprises, especially in cost-sensitive industries. Mineral oil lubricants are widely compatible and can be utilized in a variety of industrial and construction equipment. They are suitable for a variety of building tasks because they offer adequate resistance to wear and friction in heavy-duty applications. Mineral oil-based lubricants have a long history of use and a significant market share in the construction sector. These lubricants and their performance characteristics are known to construction businesses and equipment makers.

Product Insights

Hydraulic Fluid segment holds the highest market share over the forecast period

Based on the product, the global construction lubricants market is segmented into Engine Oil, Gear Oil, Hydraulic Fluid, Grease, and Others. Among these, hydraulic fluid segment holds the highest market share over the forecast period. Construction equipment that uses hydraulic systems are in increased demand as a result of the expansion of the construction sector, which is being fueled by infrastructure development, urbanization, and industrialisation. The demand for hydraulic fluids has increased as a result of this. Government programs and expenditures on infrastructure projects have helped the construction industry grow. Construction of airports, bridges, and other infrastructure projects is a major driver of the need for hydraulic fluids and construction machinery. Construction equipment's technological growth has resulted in the creation of more complex hydraulic systems. For these systems to work as intended, specific hydraulic fluids are frequently needed. The hydraulic fluids aftermarket is essential to the market's expansion.

Regional Insights

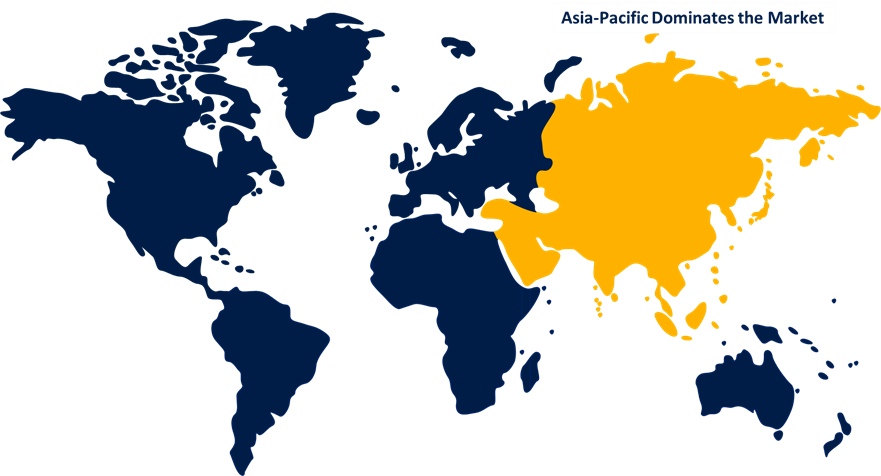

Asia Pacific region is dominating the market with the largest market share

Get more details on this report -

Asia Pacific is dominating the market with the largest market share over the forecast period. Rapid urbanization is taking place in several Asia-Pacific nations, which are also making significant investments in infrastructure projects like building new highways, bridges, airports, and mass transit systems. This has boosted the demand for construction machinery and equipment, which has increased the demand for construction lubricants. Construction equipment is needed for a variety of applications in the region's expanding industrialization and manufacturing sectors, which is what is driving up demand for construction lubricants. The Asia-Pacific area has seen strong economic growth in a number of nations, luring foreign capital and boosting building projects. The growing commercial and industrial sectors help to drive up demand for construction lubricants.

North America is witnessing the fastest market growth over the forecast period. Infrastructure improvement, commercial building, and residential projects have all contributed to the rise of the construction sector in North America. This has boosted the demand for construction machinery and equipment, which has increased the demand for construction lubricants. High-performance construction lubricants are now required to ensure optimum performance and prolonged equipment life due to the use of sophisticated construction machines and equipment with intricate hydraulic systems. Demand for construction equipment and lubricants for use in these industries has also increased as a result of the expansion of other industries, including manufacturing, mining, and energy. Because of their improved performance and capacity to withstand harsh conditions, synthetic lubricants have gradually gained popularity in the construction sector in North America.

Recent Market Developments

- In February 2020, Delo 600 ADF, a new diesel engine oil from Chevron, is intended to help diesel engines used in construction equipment emit fewer particulates.

List of Key Companies

- Royal Dutch Shell

- ExxonMobil

- PetroChina Company

- British Petroleum (BP)

- Chevron Corporation

- Sinopec

- Indian Oil Corporation

- BP

- Fuchs Petrolub SE

- QALCO

- Schaeffer Manufacturing Co.

- Addinol Lube Oil GmbH

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Construction Lubricants Market based on the below-mentioned segments:

Construction Lubricants Market, Base Oil Type Analysis

- Mineral Oil

- Synthetic Oil

Construction Lubricants Market, Product Analysis

- Engine Oil

- Gear Oil

- Hydraulic Fluid

- Grease

- Others

Construction Lubricants Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of Construction Lubricants Market?The global Construction Lubricants Market is expected to grow from USD 14.60 Billion in 2022 to USD 20.45 Billion by 2032, at a CAGR of 4.7% during the forecast period 2022-2032.

-

2.Who are the key market players of Construction Lubricants Market?Some of the key market players of Royal Dutch Shell, ExxonMobil, PetroChina Company, British Petroleum (BP), Chevron Corporation, Sinopec, Indian Oil Corporation, BP, Fuchs Petrolub SE, QALCO, Schaeffer Manufacturing Co., Addinol Lube Oil GmbH.

-

3.Which segment hold the largest market share?Hydraulic Fluid segment holds the largest market share is going to continue its dominance.

-

4.Which region is dominating the Construction Lubricants Market?Asia Pacific is dominating the Construction Lubricants Market with the highest market share.

Need help to buy this report?