Global Connected Aircraft Market Size, By Type (System and Solutions), By Connectivity (In-flight Connectivity, Air-to-Air Connectivity, and Air-to-Ground Connectivity), By Frequency (Ka-Band, KuBand, and L-Band), By Application (Commercial and Military), By Region, And Segment Forecasts, By Geographic Scope And Forecasts to 2033

Industry: Aerospace & DefenseGlobal Connected Aircraft Market Insights Forecasts to 2033

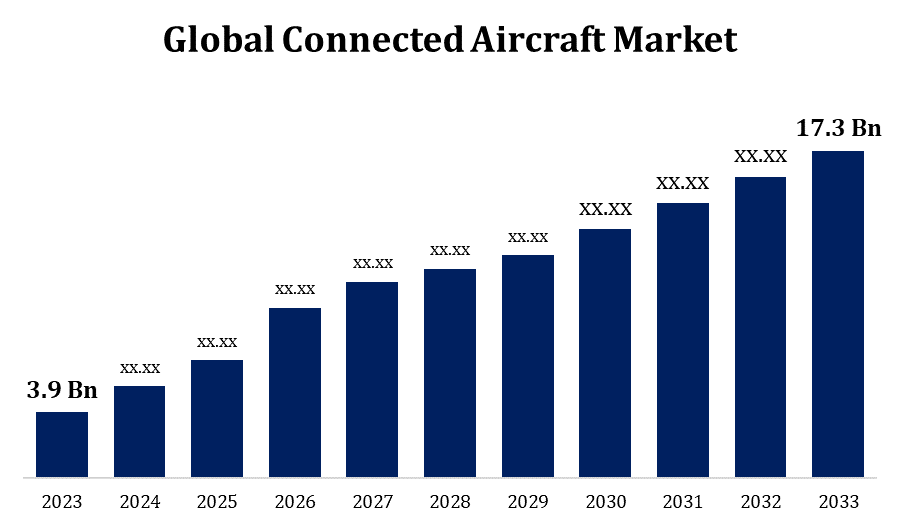

- The Connected Aircraft Market Size was valued at USD 3.9 Billion in 2023.

- The Market is Growing at a CAGR of 16.06% from 2023 to 2033

- The Worldwide Connected Aircraft Market Size is Expected to reach USD 17.3 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Connected Aircraft Market Size is expected to reach USD 17.3 Billion by 2033, at a CAGR of 16.06% during the forecast period 2023 to 2033.

Airlines have been investing in connectivity technologies to improve the passenger experience as a result of the increasing demand from customers for in-flight Wi-Fi services. This includes providing streaming services, high-speed internet access, and more entertainment alternatives for travellers while in flight. Airlines are using linked aircraft technologies to cut expenses and increase operational effectiveness. Real-time monitoring of aircraft health, predictive maintenance, fuel optimisation, and crew management are made possible by connected systems, which improves resource efficiency and reduces operating costs. Through capabilities including real-time data transfer, weather monitoring, and aircraft tracking, connected aircraft systems improve safety and security. These capabilities support proactive decision-making and emergency response for airlines and aviation authorities.

Connected Aircraft Market Value Chain Analysis

The technologies and hardware required for onboard connectivity, such as satellite communication systems, antennas, routers, modems, and wireless access points, are supplied by avionics suppliers. The satellite network infrastructure and services required to provide aeroplanes with high-speed internet connectivity are provided by satellite communication companies. The software platforms, apps, and analytics tools that enable connected aircraft features are created by software businesses. Predictive maintenance systems, passenger entertainment platforms, flight operations software, and cybersecurity solutions are some of these options. The enormous volumes of data produced by networked aviation systems require processing and analysis, which is where data analytics companies come in. They create machine learning models and algorithms to enhance decision-making, maximise performance, and glean insights from operational data. The final consumers of networked aircraft systems are airlines and aircraft operators. They implement these systems to guarantee safety and adherence to legal standards, as well as to increase operational effectiveness and improve the traveller experience.

Connected Aircraft Market Opportunity Analysis

Passengers' need for seamless connectivity during flights is growing. By providing high-speed internet access, streaming services, and other entertainment alternatives, airlines may take advantage of this trend and improve the overall traveller experience while also perhaps generating more cash through value-added services. Real-time monitoring of aircraft health, predictive maintenance, fuel optimisation, and crew management are all made possible by connected aircraft. By utilising these capabilities, airlines may increase operational effectiveness, decrease downtime, and save maintenance expenses, all of which will increase their profitability and competitiveness. Through capabilities including real-time data transfer, weather monitoring, and aircraft tracking, connected aircraft systems contribute to enhanced safety and security. Innovative applications for connected aircraft, such as smart cabins, predictive maintenance, condition-based monitoring, and passenger analytics, are made possible by the use of IoT technologies in the aviation industry.

Global Connected Aircraft Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.06% |

| 2033 Value Projection: | USD 17.3 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Connectivity, By Connectivity, By Application, By Region. |

| Companies covered:: | Honeywell, Gogo, Panasonic Avionics, Inmarsat, Global Eagle Entertainment, BAE Systems PLC, Panasonic Avionics Corporation, Zodiac Aerospace, Thales Group, Burrana Inc., Viasat SpA, Cobham PLC., Rockwell Collins, Inc., Kontron S&T AG, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Connected Aircraft Market Dynamics

An increase in airlines' purchases of cutting-edge aircraft is expected to boost product demand

Advanced communication technologies are becoming standard on more and more modern aircraft. The need for connected aircraft solutions will naturally increase as a result of airlines purchasing these state-of-the-art aircraft. Real-time monitoring systems, predictive maintenance features, in-flight Wi-Fi, and other features are examples of these solutions. Airlines frequently replace their fleets of older, less technologically advanced aircraft with newer, more advanced models. Aircraft with the newest connectivity features are probably going to be given priority when they make these replacements and upgrades. As airlines look to improve operational efficiency and passenger experience, this will fuel demand for connected aircraft solutions. On flights, passengers are expecting more and more digital amenities and connectivity. When airlines invest in new aircraft, they probably give priority to amenities that improve the traveller experience.

Restraints & Challenges

Flight data, passenger information, and operational metrics are just a few examples of the sensitive data that connected aircraft generate and transmit. It is extremely difficult to ensure the security and privacy of this data because it is susceptible to hackers, cyberattacks, and illegal access. Interoperability issues may arise from the integration of multiple onboard systems and components from different vendors. For linked aircraft to operate efficiently, compatibility and smooth communication across systems, interfaces, and protocols must be guaranteed. The resolution of interoperability problems and the advancement of compatibility among various platforms and suppliers require industry cooperation and standardisation initiatives. Satellite and air-to-ground communication networks are necessary for in-flight connectivity, however they may have capacity constraints, especially in crowded airspace or rural areas.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Connected Aircraft Market from 2023 to 2033. North American travellers have high standards for digital amenities and in-flight connectivity. In order to meet this demand and improve the customer experience, airlines operating in the region are spending more and more in connection solutions. The increasing availability of in-flight Wi-Fi, streaming services, and personalised content on numerous North American airlines is propelling the uptake of connected aircraft technologies. North America is home to a sizable number of commercial airlines, business aviation operators, and aircraft manufacturers, making it one of the world's largest and most developed aviation markets.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region's technology firms, avionics suppliers, and aircraft manufacturers are actively working on creating and implementing linked aircraft solutions. The Asia-Pacific region is leading the way in the adoption of connected aircraft technology thanks to developments in data analytics, IoT, satellite communication, and wireless technologies. The demand for air travel is rising quickly in Asia-Pacific's emerging economies, including Vietnam, Indonesia, and India, and these nations are investing in growing their aviation infrastructure. In order to keep up with the increasing demand from passengers, airlines are looking to modernise their fleets and increase operational efficiency. These countries provide substantial potential opportunities for connected aircraft technologies.

Segmentation Analysis

Insights by Type

The system segment accounted for the largest market share over the forecast period 2023 to 2033. Passengers may utilise high-speed internet, streaming services, and other digital amenities while on flights thanks to in-flight connectivity systems. This comprises onboard routers, wireless access points, air-to-ground networks, and satellite communication systems. As travellers anticipate seamless connectivity and entertainment options while travelling, the demand for in-flight connectivity is expanding quickly. aviation systems, parts, and performance metrics may all be monitored in real time thanks to aviation health monitoring systems. Health management systems, sensors, diagnostic instruments, and software for predictive maintenance fall under this category. By proactively identifying and addressing maintenance issues, these solutions help airlines maximise fleet safety and reliability while minimising downtime.

Insights by Connectivity

The in-flights connectivity segment accounted for the largest market share over the forecast period 2023 to 2033. Passengers now anticipate more connectivity and digital conveniences on flights, especially business and frequent flyers. While in flight, they want to be able to chat with friends and family, use social media, stay connected to work, and stream entertainment content. Airlines are thus under pressure to provide dependable in-flight internet in order to live up to passenger expectations and improve the overall travel experience. Airlines throughout the globe are making investments to modernise their fleets by adding entertainment systems and in-flight Wi-Fi to set themselves apart from competitors and draw customers. Numerous airlines provide a range of connectivity packages, such as premium high-speed internet, free basic Wi-Fi, and video streaming alternatives. Partnerships with streaming services and content creators also improve the entertainment options offered to passengers.

Insights by Frequency

The Ka-band segment accounted for the largest market share over the forecast period 2023 to 2033. When compared to conventional Ku-band systems, Ka-band satellite communication technologies offer noticeably better data rates. The increased demand from customers for seamless internet access and content streaming during flights is met by this, which offers faster internet connections, reduced latency, and enhanced performance for in-flight connectivity services. Compared to Ku-band satellites, Ka-band satellites offer a larger bandwidth capacity, which enables higher data throughput and more capacity for in-flight connectivity services. Because of its expanded capacity, airlines are able to provide high-speed internet access to a greater number of passengers on board their aircraft. Multiple passengers can connect at the same time. Global coverage is offered by Ka-band satellite networks, which guarantee uninterrupted access for planes travelling through various geographical regions and over isolated locations with sparse terrestrial infrastructure.

Insights by Application

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. Customers anticipate seamless connectivity and digital amenities on flights more and more, especially regular flyers and business travellers. In order to improve the whole travel experience, in-flight Wi-Fi, streaming services, and email and social media access have become necessities. In order to meet passenger demand and set themselves apart in a crowded industry, airlines are investing in connected aircraft technologies. Airlines have the chance to increase operational effectiveness, lower expenses, and improve fleet management with connected aircraft technologies. Airlines are able to optimise flight schedules, fuel usage, and maintenance procedures through the use of data analytics, predictive maintenance, and real-time aircraft system monitoring. Commercial airlines are investing in new ways to improve the customer experience, including as interactive services, seatback screens, personalised content, and in-flight entertainment (IFE) systems, in addition to connectivity.

Recent Market Developments

- In November 2021, Collins Aerospace and Japan Airlines (JAL) have an agreement for Collins Aerospace to assist the Boeing 787 fleet of JAL via the dispatchSM flight programme.

Competitive Landscape

Major players in the market

- Honeywell

- Gogo

- Panasonic Avionics

- Inmarsat

- Global Eagle Entertainment

- BAE Systems PLC

- Panasonic Avionics Corporation

- Zodiac Aerospace

- Thales Group

- Burrana Inc.

- Viasat SpA

- Cobham PLC.

- Rockwell Collins, Inc.

- Kontron S&T AG

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Connected Aircraft Market, Type Analysis

- System

- Solutions

Connected Aircraft Market, Connectivity Analysis

- In-flight Connectivity

- Air-to-Air Connectivity

- Air-to-Ground Connectivity

Connected Aircraft Market, Frequency Analysis

- Ka-Band

- KuBand

- L-Band

Connected Aircraft Market, Application Analysis

- Commercial

- Military

Connected Aircraft Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Connected Aircraft Market?The global Connected Aircraft Market is expected to grow from USD 3.9 billion in 2023 to USD 17.3 billion by 2033, at a CAGR of 16.06% during the forecast period 2023-2033.

-

2. Who are the key market players of the Connected Aircraft Market?Some of the key market players of the market are Honeywell, Gogo, Panasonic Avionics, Inmarsat, Global Eagle Entertainment, BAE Systems PLC, Panasonic Avionics Corporation, Zodiac Aerospace, Thales Group, Burrana Inc., Viasat SpA, Cobham PLC., Rockwell Collins, Inc., and Kontron S&T AG. And others.

-

3. Which segment holds the largest market share?The commercial segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Connected Aircraft Market?North America is dominating the Connected Aircraft Market with the highest market share.

Need help to buy this report?