Global Composites Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Carbon Fiber, Glass Fiber, Natural fiber, and Others), By Manufacturing Process (Layup, Filament, Injection Molding, Pultrusion, Compression Molding Process, Resin Transfer Molding Process, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Advanced MaterialsGlobal Composites Market Insights Forecasts to 2035

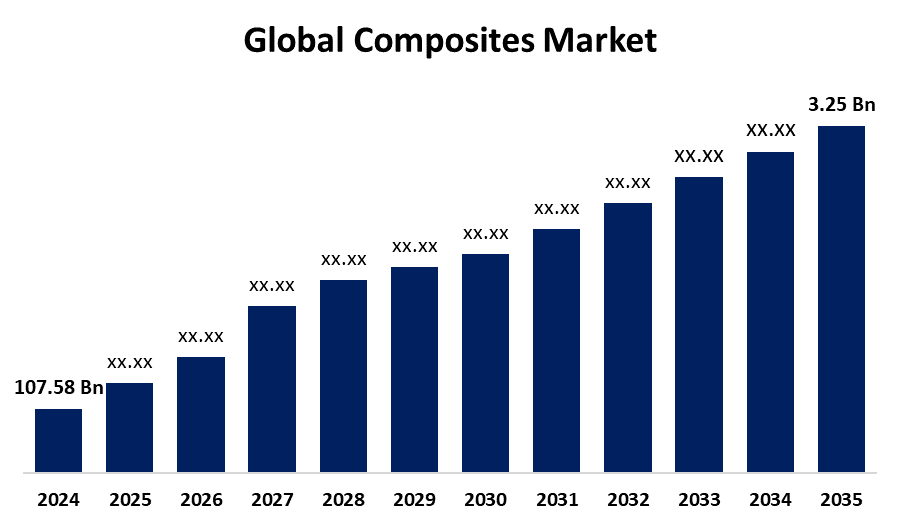

- The Global Composites Market Size Was Estimated at USD 107.58 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.15% from 2025 to 2035

- The Worldwide Composites Market Size is Expected to Reach USD 229.98 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Composites Market Size was worth around USD 107.58 Billion in 2024 and is projected to grow from USD 115.28 Billion in 2025 to around USD 229.98 Billion by 2035 at a compound annual growth rate (CAGR) of 7.15% during the forecast period (2025–2035). One of the key opportunities is the automotive and aerospace manufacturers which are being pushed to switch from metals to lighter composites due to increased regulatory pressure to reduce emissions and improve fuel efficiency the expansion of wind energy and renewable infrastructure necessitates large, durable composite structures manufacturing advancements such as automated fiber placement, resin transfer molding, and 3D printing are reducing costs and sustainability trends are increasing demand for recyclable.

Global Composites Market Forecast and Revenue Size

- 2024 Market Size: USD 107.58 Billion

- 2025 Market Size: USD 115.28 Billion

- 2035 Projected Market Size: USD 229.98 Billion

- CAGR (2025-2035): 7.15%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

A composite is a material created by joining two or more separate constituent materials, each of which maintains its own physical or chemical characteristics, to create a new material with overall qualities that are either better or different from those of the constituent materials alone. Composites are designed to reduce the disadvantages of each component material while enhancing the beneficial characteristics. For instance, fiberglass is a composite of glass fibers and polymer resin and is well suited for applications such as wind turbine blades, auto parts, and boat construction, due to its high strength, impact resistance, corrosion resistance, and light weight. Likewise, carbon fiber reinforced plastics also have impressive strength to weight ratios and are being used in high performance vehicles, sports equipment, and aircraft. Composites can be employed more frequently in a variety of industries based on their adaptable properties to meet the specifications of particular performance requirements and to improve overall product performance. In the analysis assembled in the American Road and Transportation Builders Association Report (2019), the authors cite an estimated 600,000 bridges in the US as in poor condition and in need of repair as a result of rapid scientific research into composites and related products and a consequence of rapidly expanding industrialization advancement, as well as the overall problem the aging infrastructure presents, which is potentially a large market potential in the future. Composites, with their advantages, can make effective materials for infrastructure projects which have long service lives. Composite products in particular are being used to support durable infrastructures in roads, water systems, bridges, and seawalls.

The Indian government is promoting initiatives like Atmanirbhar Bharat and Make in India to promote domestic production and lessen reliance on imports, including composites. The Defence Procurement Policy emphasizes the use of domestically designed and built composite goods. The government has also suggested creating a Center of Excellence for Composites to study cutting edge technologies like high performance carbon fiber composites, smart, nano, and self-healing materials.

Key Market Insights

- North America is expected to account for the largest share in the composites market during the forecast period.

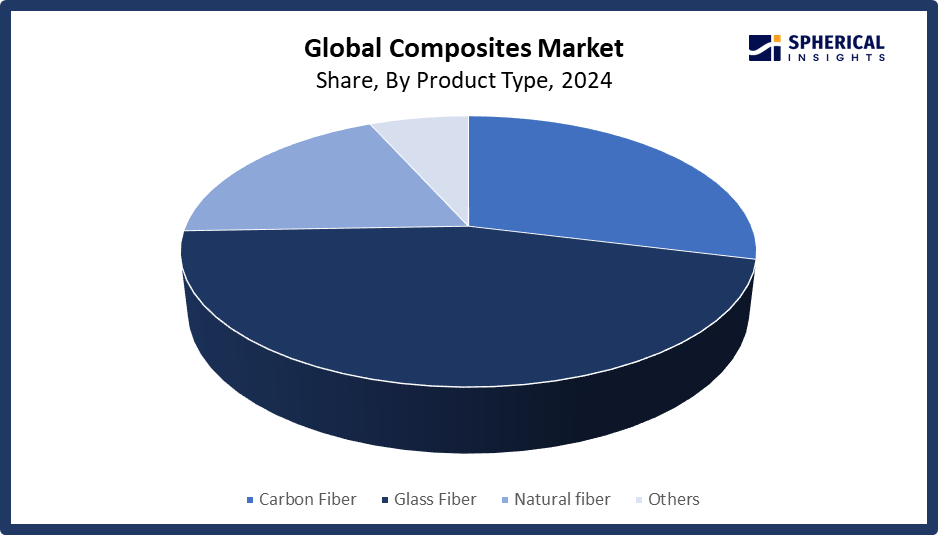

- In terms of product type, the glass fiber segment is projected to lead the composites market throughout the forecast period

- In terms of manufacturing process, the layup segment captured the largest portion of the market

Composites Market Trends

- Lightweighting & high strength materials

- Move toward recyclability, thermoplastics & bio-based composites

- Advanced manufacturing & automation

- Hybrid materials & nanocomposites

- Renewable energy & wind turbine applications

Report Coverage

This research report categorizes the composites market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the composites market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the composites market.

Global Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 107.58 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.15% |

| 2032 Value Projection: | USD 229.98 Billion |

| Historical Data for: | 2020 to 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Product Type, By Manufacturing Process, By Region |

| Companies covered:: | Teijin Ltd., Toray Industries, Inc., Owens Corning, PPG Industries, Inc., Huntsman Corporation LLC, SGL Group, Hexcel Corporation, DuPont, Compagnie de Saint-Gobain S.A., Weyerhaeuser Company, Momentive Performance Materials, Inc., Cytec Industries, China Jushi Co., Ltd., Kineco Limited, Veplas Group, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors: Exceptional performance of composites drives the Composites market.

One major contributing factor to the composites market is that multiple vertical industries rely on composites, like automotive, aerospace, marine, consumer goods, wind power, etc. There is a wide variety of actual and potential applications of composite materials in these industries, all driven by regulation, market demand, and cost. For example, the materials, costs, and process technologies in aerospace are very different from those in automotive. Composite materials can fulfill this demand because they are diverse. For instance, there are resins, numerous fibers, tooling, processes, and finishing choices available that can be fabricated to result in nearly any composite part for nearly any application.

Restraining Factor: Issues related to recycling restrict the market.

The market for composites is restricted by several important factors such as regulations about end-of-life waste management and landfill disposal costs and limitations. As composite materials expand their markets, end of life waste management is further scrutinized, in part as life cycle assessments are gaining traction as a component of material selection in many industries.

Market Segmentation

The global composites market is divided into product type and manufacturing process.

Global Composites Market, By Product Type:

Why does the glass fiber segment hold the largest revenue share in the global Composites market, accounting for approximately 60% of the total market during the forecast period?

The glass fiber segment led the composites market, generating the largest revenue share. The glass fiber is praised for its high tensile strength, stiffness, and low weight. Glass fiber is primarily used in composites because of its high impact resistance.

Get more details on this report -

The carbon fiber segment in the composites market is expected to grow at the fastest CAGR over the forecast period. The carbon fiber segment is a carbon fiber-reinforced polymer made by molding carbon fiber with plastic resin. Carbon fiber reinforced polymer composite sandwich structures are frequently used in the aviation industry and for exterior and interior applications. Because of their high tensile strength and low weight, CFRP composites are more fuel efficient, easier to maintain, and better at helping OEMs meet the stringent environmental regulations that are set in North America and Europe.

Global Composites Market, By Manufacturing Process:

Why does layup represent the largest application segment, capturing approximately 34.9% market share during the forecast period in the global composites market?

The layup segment held the largest market share in the composites market. The layup process component of the worldwide composites industry is expected to grow during the forecast period, as a result of the increasing production of boats, wind turbine blades, and architectural moldings. Wet layup techniques assist in lowering production costs while creating a range of composite products in various sizes and forms that are utilized in various end applications, such as storage tanks and marine prototypes. Preimpregnated fibers, or prepregs, are used in dry layup procedures. These fibers absorb resins and are subsequently molded in a cavity at high pressure and temperature.

The filament segment in the composites market is expected to grow at the fastest CAGR over the forecast period, due to the hollow circular sections manufactured via filament winding techniques, which are utilized to create items like tanks and pipelines. Fibers are continuously coiled over a mandrel after they have been pushed or pulled through a resin bath. These materials are used for consumer products and in power generation.

Regional Segment Analysis of the Global Composites Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Composites Market Trends

Get more details on this report -

What factors contribute to the Asia Pacific region holding the largest share, approximately 45.4%, of the global composites market during the forecast period?

The Asia Pacific is expected to dominate the global composites market, with an estimated 45.4% share during the forecast period. The composites market in the Asia Pacific has expanded greatly in recent years, mainly driven by growing demand in the automotive & transportation, aerospace, building & construction, and electrical & electronics industries, which is expected to provide significant opportunities for market participants. Additionally, the presence of key manufacturers such as Toray Industries Inc. and Mitsubishi Chemical Holdings Corporation, and rapid growth in countries such as China and India, are expected to have a positive impact on the regional market.

North America Composites Market Trends

How is the North America region expected to capture the composites market by 2025, with the fastest growth rate?

North America is expected to capture approximately 19% of the composites market by 2025 with the fastest growth rate due to several key factors. The North American market is increasing rapidly as a result of increasing demand from the defense, aerospace, and automotive industries. Over 50% of the latest Airbus aircraft in the A350XWB series are made of composite materials, whereas approximately 2% to 5% of the previous generation aircraft were made from the material. The usage of products in aerospace has significantly increased in the last few decades.

Europe Composites Market Trends

What factors are contributing to the growth of the composites market in Europe?

Europe is anticipated to have significant growth throughout the course of the projection period. The region's automotive industry is increasingly using lightweight materials as a result of rising expenditure on electric vehicles that are backed by environmental regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global composites market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Composites Market Include

- Teijin Ltd.

- Toray Industries, Inc.

- Owens Corning

- PPG Industries, Inc.

- Huntsman Corporation LLC

- SGL Group

- Hexcel Corporation

- DuPont

- Compagnie de Saint-Gobain S.A.

- Weyerhaeuser Company

- Momentive Performance Materials, Inc.

- Cytec Industries

- China Jushi Co., Ltd.

- Kineco Limited

- Veplas Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In June 2024, Plastics processor Ensinger is investing in production capacity expansion for its composites division. Very soon, a high-performance double belt press will begin operation in Rottenburg-Ergenzingen. The new facility enables the efficient production of thermoplastics composite materials.

- In April 2024, Aurora Flight Sciences (Bridgeport, W.Va., U.S.), a Boeing Company, expanded its manufacturing facility in Bridgeport, West Virginia. The expansion adds almost 50,000 square feet to the facility to support significant growth for building high quality composite components and assemblies across both current production programs and new opportunities in the aerospace industry.

- In March 2024, Toray Advanced Composites launched the new product Toray Cetex TC915 PA+ into its extensive portfolio. Toray Cetex TC915 PA+ is excellent for sporting goods, high performance industrial applications, automotive structures, energy (oil & hydrogen), Urban Air Mobility (UAM), and Unmanned Aerial Systems (UAS) applications.

- In November 2024, Teknor Apex, a trusted provider of custom plastic compounds for the healthcare industry, declared the expansion of its medical grade thermoplastic elastomer portfolio with new grades specifically designed for biopharmaceutical tubing applications.

- In July 2023, Toray Advanced Composites announced the planned expansion of its Morgan Hill (CA, USA) plant operations. The new facility will add 74,000 square feet (6,800 square meters) to the existing campus facilities.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the composites market based on the following segments:

Global Composites Market, By Product Type

- Carbon Fiber

- Glass Fiber

- Natural fiber

- Others

Global Composites Market, By Manufacturing Process

- Layup

- Filament

- Injection Molding

- Pultrusion

- Compression Molding Process

- Resin Transfer Molding Process

- Others

Global Composites Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the composites market over the forecast period?The global composites market is projected to expand at a CAGR of 7.15% during the forecast period.

-

2. What is the market size of the composites market?The global composites market size is expected to grow from USD 107.58 billion in 2024 to USD 229.98 billion by 2035, at a CAGR 7.15% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the composites market?North America is anticipated to hold the largest share of the composites market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global composites market?Teijin Ltd., Toray Industries, Inc., Owens Corning, PPG Industries, Inc., Huntsman Corporation LLC, SGL Group, Hexcel Corporation, DuPont, Compagnie de Saint-Gobain S.A., Weyerhaeuser Company, Momentive Performance Materials, Inc., Cytec Industries, China Jushi Co., Ltd., Kineco Limited, Veplas Group, and Others.

-

5. What factors are driving the growth of the composites market?The composites market growth is driven by the fact that in the automotive, aerospace, and transportation industries, there is a growing need for lightweight, high strength materials to increase fuel efficiency and lower emissions.

-

6. What are market trends in the composites market?The composites market trends include rising demand for synthetic grafts, advancements in biocompatible materials, increasing minimally invasive procedures, and strategic partnerships for innovative product development and distribution.

-

7. What are the main challenges restricting wider adoption of the composites market?The composites market trends include high prices of production and raw materials, particularly for sophisticated resins and carbon fiber.

Need help to buy this report?