Global Commercial Vacuum Cleaner Market Size, Share, and COVID-19 Impact Analysis, By Power Source (Corded and Cordless), By Product (Upright Vacuum Cleaners, Canister Vacuum Cleaners, Robotic Vacuum Cleaners, Wet & Dry Vacuum Cleaners, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal Commercial Vacuum Cleaner Market Insights Forecasts to 2035

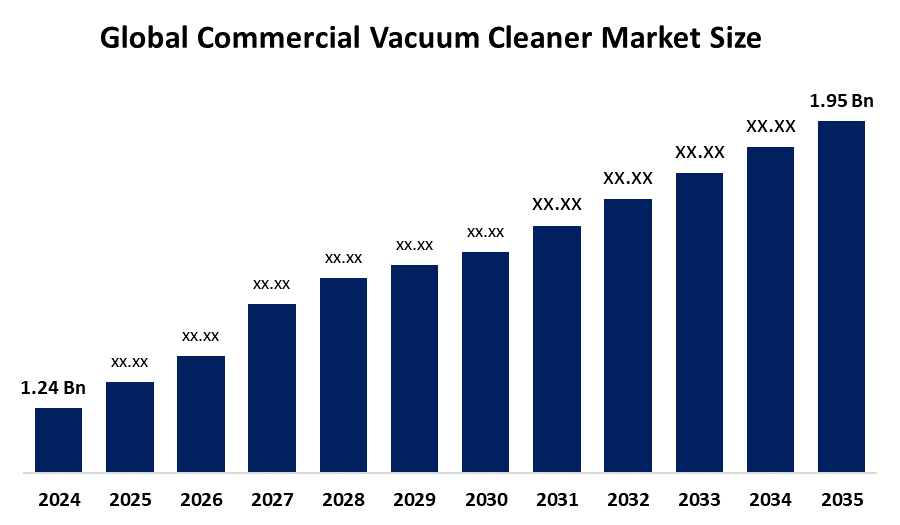

- The Global Commercial Vacuum Cleaner Market Size Was Estimated at USD 1.24 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.2 % from 2025 to 2035

- The Worldwide Commercial Vacuum Cleaner Market Size is Expected to Reach USD 1.95 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Commercial Vacuum Cleaner Market Size was worth around USD 1.24 Billion in 2024 and is predicted to Grow to around USD 1.95 Billion by 2035 with a compound annual growth rate (CAGR) of 4.2% from 2025 to 2035. The commercial vacuum cleaner market offers growth through smart, IoT-enabled units, energy-efficient models, robotics automation, expanding service sectors, and demand in healthcare, hospitality, and industrial cleaning, driven by hygiene standards and sustainability.

Market Overview

The Commercial Vacuum Cleaner Market Size includes robust cleaning machines used in offices, hospitals, hotels, airports, and retail environments to uphold hygiene and safety standards. Governments and regulatory bodies are strengthening cleanliness and indoor air quality requirements, leading businesses to adopt advanced vacuum solutions that meet sanitation protocols and energy-efficiency guidelines. For example, energy efficiency standards in the U.S. mandate higher appliance performance, prompting manufacturers to innovate eco-friendly models. Key drivers include rising awareness of health and hygiene post-pandemic, stringent sanitation regulations in sectors like healthcare and food services, and rapid urbanization with expanding commercial infrastructure. Technological advancements such as HEPA filtration and robotic or autonomous vacuum cleaners enhance cleaning efficacy and operational efficiency, boosting adoption across industries globally.

Report Coverage

This research report categorizes the commercial vacuum cleaner market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the commercial vacuum cleaner market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the commercial vacuum cleaner market.

Global Commercial Vacuum Cleaner Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.24 Billion |

| Forecast Period: | 2025 – 2035 |

| Forecast Period CAGR 2025 – 2035 : | CAGR of 4.2% |

| 025 – 2035 Value Projection: | USD 1.95 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Power Source, By Product |

| Companies covered:: | Nilfisk Group, Alfred Kärcher SE & Co. KG, Makita Corporation, Tennant Company, Dyson Limited, Hako Group, Techtronic Industries Co. Ltd., Numatic International Ltd., Tacony Corporation, Solenis LLC, BISSEL Group, ProTeam, Inc., SEBO America, LLC, Pacvac Pty. Ltd., SPRiNTUS GmbH, And Other Players, |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The commercial vacuum cleaner market is driven by rising hygiene and sanitation awareness across workplaces, healthcare facilities, hospitality, and public infrastructure. Stricter government cleanliness regulations and indoor air quality standards are accelerating adoption of advanced cleaning equipment. Growth in urbanization, commercial construction, and outsourced facility management services further supports demand. Additionally, technological advancements such as HEPA filtration, energy-efficient designs, cordless operation, and robotic vacuum cleaners enhance operational efficiency, reduce labor dependency, and improve cleaning performance, encouraging widespread adoption across diverse commercial environments.

Restraining Factors

High initial investment and maintenance costs of commercial vacuum cleaners limit adoption, particularly among small businesses. Limited awareness of advanced features, along with operational complexity and availability of low-cost manual cleaning alternatives, further restrain market growth.

Market Segmentation

The commercial vacuum cleaner market share is classified into power source and product.

- The corded segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the power source, the commercial vacuum cleaner market is divided into corded and cordless. Among these, the corded segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The corded segment led in 2024 due to uninterrupted power, higher suction strength, and suitability for continuous, heavy-duty cleaning in large commercial facilities. Meanwhile, the cordless segment is growing rapidly owing to improved battery performance, portability, and enhanced operational convenience.

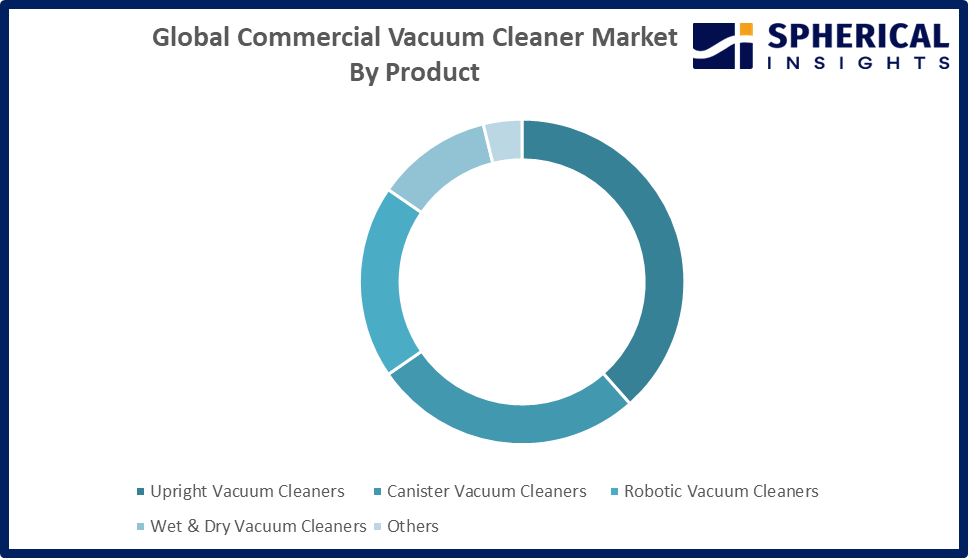

- The upright vacuum cleaners segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the commercial vacuum cleaner market is divided into upright vacuum cleaners, canister vacuum cleaners, robotic vacuum cleaners, wet & dry vacuum cleaners, and others. Among these, the upright vacuum cleaners segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The upright vacuum cleaners segment led revenue in 2024 due to strong suction power, durability, and efficiency in cleaning large, high-traffic commercial areas. Meanwhile, robotic vacuum cleaners are growing rapidly owing to automation benefits, labor cost reduction, and smart navigation technologies.

Get more details on this report -

Regional Segment Analysis of the Commercial Vacuum Cleaner Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the commercial vacuum cleaner market over the predicted timeframe.

North America is anticipated to hold the largest share of the commercial vacuum cleaner market over the predicted timeframe. North America is expected to dominate the commercial vacuum cleaner market due to strict workplace hygiene regulations, high adoption of advanced cleaning technologies, and a well-established facility management industry. Strong commercial infrastructure, rising demand from healthcare and hospitality sectors, and early adoption of robotic and energy-efficient solutions further support market leadership.

Asia Pacific is expected to grow at a rapid CAGR in the commercial vacuum cleaner market during the forecast period. Asia Pacific is projected to grow at a rapid CAGR due to rapid urbanization, expanding commercial infrastructure, and increasing investments in healthcare, hospitality, and retail sectors. Rising hygiene awareness, growth of organized facility management services, and improving affordability of advanced cleaning equipment further accelerate market expansion across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the commercial vacuum cleaner market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies In Global Commercial Vacuum Cleaner Market

- Nilfisk Group

- Alfred Kärcher SE & Co. KG

- Makita Corporation

- Tennant Company

- Dyson Limited

- Hako Group

- Techtronic Industries Co. Ltd.

- Numatic International Ltd.

- Tacony Corporation

- Solenis LLC

- BISSEL Group

- ProTeam, Inc.

- SEBO America, LLC

- Pacvac Pty. Ltd.

- SPRiNTUS GmbH

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, LG has launched a new commercial-grade robotic vacuum cleaner for hotels, developed in partnership with Marriott Design Lab. The autonomous device uses LiDAR mapping and smart navigation to clean large spaces like corridors and meeting rooms efficiently, enhancing operational insights and reducing disruption.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the commercial vacuum cleaner market based on the below-mentioned segments:

Global Commercial Vacuum Cleaner Market, By Power Source

- Corded

- Cordless

Global Commercial Vacuum Cleaner Market, By Product

- Upright Vacuum Cleaners

- Canister Vacuum Cleaners

- Robotic Vacuum Cleaners

- Wet & Dry Vacuum Cleaners

- Others

Global Commercial Vacuum Cleaner Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the commercial vacuum cleaner market over the forecast period?The global commercial vacuum cleaner market is projected to expand at a CAGR of 4.2% during the forecast period.

-

2. What is the market size of the commercial vacuum cleaner market?The global commercial vacuum cleaner market size is expected to grow from USD 1.24 billion in 2024 to USD 1.95 billion by 2035, at a CAGR of 4.2 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the commercial vacuum cleaner market?North America is anticipated to hold the largest share of the commercial vacuum cleaner market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global commercial vacuum cleaner market?Nilfisk Group, Alfred Kärcher SE & Co. KG, Makita Corporation, Tennant Company, Dyson Limited, Hako Group, Techtronic Industries Co. Ltd., Numatic International Ltd., Tacony Corporation, Solenis LLC, BISSELL Group, ProTeam, Inc., SEBO America, LLC, Pacvac Pty. Ltd., and SPRiNTUS GmbH.

-

5. What factors are driving the growth of the commercial vacuum cleaner market?Rising hygiene awareness, stringent sanitation regulations, technological advancements, urbanization, expanding commercial infrastructure, and growing demand in healthcare, hospitality, and retail sectors drive market growth.

-

6. What are the market trends in the commercial vacuum cleaner market?Key trends include automation with robotic vacuums, IoT connectivity, energy‑efficient designs, cordless models, HEPA filtration, and demand for smart, sustainable cleaning solutions.

-

7. What are the main challenges restricting the wider adoption of the commercial vacuum cleaner market?High initial costs, maintenance complexity, limited awareness of advanced features, and preference for manual or low-cost cleaning alternatives restrict market adoption.

Need help to buy this report?