Global Commercial Aircraft Leasing Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Narrow-Body Aircrafts, Wide-Body Aircrafts, Others), By Leasing Type (Dry Leasing, Wet Leasing), By Security Type (Asset-Backed Security (ABS), Non-Asset Backed Security (Non-ABS)), By Application (long haul aircraft, and medium distance aircraft), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Industry: Aerospace & DefenseGlobal Commercial Aircraft Leasing Market Insights Forecasts to 2033

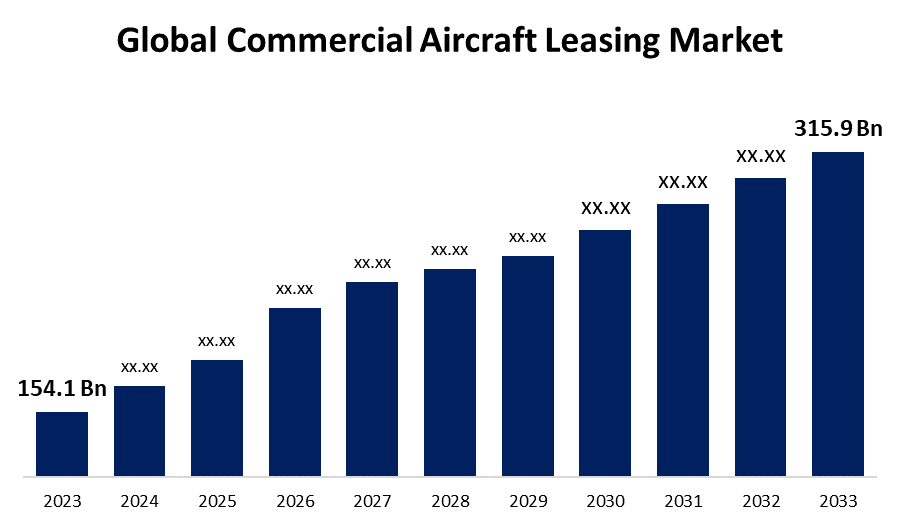

- The Global Commercial Aircraft Leasing Market Size was Valued at USD 154.1 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.3% from 2023 to 2033

- The Worldwide Commercial Aircraft Leasing Market Size is Expected to Reach USD 315.9 Billion by 2033

- Asia-Pacific expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Commercial Aircraft Leasing Market Size is Anticipated to Exceed USD 315.9 Billion by 2033, Growing at a CAGR of 7.3% from 2023 to 2033.

Market Overview

An aircraft lease is a legal agreement between two parties, typically a lessor and a lessee. The lessor agrees to provide the aircraft to the lessee for a specified period of time in exchange for periodic payments known as lease payments. Airlines sometimes lease planes rather than purchase them. The leasing company uses its capital to purchase the aircraft and rents it to the operator in exchange for a monthly or annual fee for its use. Ownership is held by the tenant. As previously stated, the airline pays a fixed monthly or annual rent to use the jet under its own brand and, in most cases, in its own color. There are five major advantages to leasing an aircraft rather than purchasing one. These include financial liquidity, capacity flexibility, rapid expansion, fleet consistency, and lower maintenance costs. Under its initial terms, leasing enables airlines to reduce their debt. This promotes better cash flow and financial agility. Airlines and cargo operators lease aircraft from other airlines or leasing companies for two primary reasons: to operate the aircraft without incurring the financial burden of purchasing them, and to provide a temporary increase in capacity. The growing popularity of low-cost airlines is a major factor driving the aircraft leasing market forward.

Report Coverage

This research report categorizes the market for the global commercial aircraft leasing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global commercial aircraft leasing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global commercial aircraft leasing market.

Global Commercial Aircraft Leasing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 154.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.3% |

| 2033 Value Projection: | USD 315.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Aircraft Type, By Leasing Type, By Security Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | SMBC Aviation Capital, AerCap, ALAFCO Aviation Lease and Finance Company K.S.C.P, CIT Commercial Air, Boeing Capital Corporation, GE Capital Aviation Service, AerCap Holdings N.V., BOC Aviation, SAAB Aircraft Leasing, Ansett Worldwide Aviation Services and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for air travel as disposable incomes rise, the opening of new routes, and the introduction of low-cost carriers are all key drivers of global commercial aircraft leasing market growth. Furthermore, rising demand for aircraft leasing services among airlines seeking to reduce operating costs is expected to drive market growth. Furthermore, the need to reduce operational costs and the growing demand for environmentally friendly aircraft are expected to open up new market opportunities. Aviation has truly been the most dependable and safest mode of transportation in the world today. Airplanes take off all over the world at a rate of approximately 400 departures per hour, and this is only for scheduled commercial flights. One of the market's concerns is the increase in passenger air traffic. The expanding airline industry and the emergence of new airlines around the world have resulted in an increase in aircraft leasing, as these new airlines prefer to lease aircraft rather than own them.

Restraining Factors

The lack of modern airport infrastructure poses a significant challenge for aircraft lessors, as newly leased aircraft must be located and stored in the proper location. The availability of efficient airports is one of the most important requirements for an investor or lessor looking to invest in the aircraft leasing business. Airport infrastructure, including the need for new aircraft, necessitates improvements and expansion of airfields.

Market Segmentation

The global commercial aircraft leasing market share is classified into aircraft type, leasing type, security type, and application

- The narrow-body aircrafts segment is expected to hold the largest share of the global commercial aircraft leasing market during the forecast period.

Based on the aircraft type, the global commercial aircraft leasing market is categorized into narrow-body aircrafts, wide-body aircrafts, and regional aircrafts. Among these, the narrow-body aircrafts segment is expected to hold the largest share of the commercial aircraft leasing market during the forecast period. Narrow-body aircraft are the most common type of commercial aircraft, primarily used for short- to medium-range flights. These smaller aircraft typically have a single aisle configuration and limited passenger seating. They are used for flights lasting less than three hours and have a maximum seating capacity of 230 passengers. Narrow-body aircraft include the Airbus A320 and Boeing 737 families.

- The wet leasing segment is expected to hold the largest share of the global commercial aircraft leasing market during the forecast period.

Based on the leasing type, the global commercial aircraft leasing market is categorized into dry leasing and wet leasing. Among these, the wet leasing segment is expected to hold the largest share of the commercial aircraft leasing market during the forecast period. Wet leasing is a type of aircraft leasing in which the lessee obtains the right to use the aircraft as if it were their own, as well as the pilot and ground crew. In this case, the lessor not only provides the aircraft, but also handles all operational services such as maintenance, insurance, and crew hire. The wet leasing arrangement provides the lessee with immediate access to the aircraft and provisional coverage, regardless of their own certification status or commercial arrangements.

- The non-asset backed security (non-ABS) segment is expected to hold the largest share of the global commercial aircraft leasing market during the forecast period.

Based on the security type, the global commercial aircraft leasing market is divided into asset-backed security (ABS) and non-asset backed security (non-ABS). Among this the non-asset backed security (non-ABS) segment is expected to grow at fastest pace in the commercial aircraft leasing market during the forecast period. Investors can obtain principal and interest payments on a variety of assets using asset-backed securities without having to generate them themselves. Owing to the small number of underlying assets at each security level, the likelihood of default and other credit concerns is extremely low.

- The long-haul aircraft segment is expected to hold the largest share of the global commercial aircraft leasing market during the forecast period.

Based on the application, the global commercial aircraft leasing market is divided into long haul aircraft, and medium distance aircraft. Among this the long-haul aircraft segment is expected to grow at greatest pace in the commercial aircraft leasing market during the forecast period. Long haul aircraft are typically large aircraft that fly over long distances, such as international trips. These planes are typically larger in size and weight than other types of aircraft. These planes are preferred for longer trips because they have a significant impact on airlines' operating costs and occupancy rates.

Regional Segment Analysis of the Global Commercial Aircraft Leasing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global commercial aircraft leasing market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global commercial aircraft leasing market over the predicted years. This is owing to increased demand for air travel, the rise of low-cost carriers, and airlines' need to replace aging fleets. The region is also home to some of the world's largest aircraft leasing companies, including GECAS and AerCap. The United States is North America's largest market for aircraft leasing, accounting for more than half of total leasing activity. This is due to the country's large population, robust economy, and presence of major airlines.

Asia Pacific is projected to hold the significant share of the global commercial aircraft leasing market over the forecast period. This is because the region's demand for air travel is increasing, as is the number of airlines. The region also houses some of the world's largest aircraft leasing companies, including Air Lease Corporation and GECAS. Asia is also home to some of the world's fastest-growing economies, including China and India. This has resulted in an increase in the number of people traveling by air, increasing demand for aircraft leasing services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global commercial aircraft leasing along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SMBC Aviation Capital

- AerCap

- ALAFCO Aviation Lease and Finance Company K.S.C.P

- CIT Commercial Air

- Boeing Capital Corporation

- GE Capital Aviation Service

- AerCap Holdings N.V.

- BOC Aviation

- SAAB Aircraft Leasing

- Ansett Worldwide Aviation Services

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, AerCap Holdings has placed an order for five more Boeing 787-9 Dreamliners, bringing the company's total number of 787 aircraft orders to 125, both owned and on order. The 787 Dreamliner family is helping to sustain and reopen new long-haul routes with high fuel efficiency in the airline and aircraft leasing industries.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global commercial aircraft leasing market based on the below-mentioned segments:

Global Commercial Aircraft Leasing Market, By Aircraft Type

- Narrow-Body Aircrafts

- Wide-Body Aircrafts

- Others

Global Commercial Aircraft Leasing Market, By Leasing Type

- Dry Leasing

- Wet Leasing

Global Commercial Aircraft Leasing Market, By Security Type

- Asset-Backed Security (ABS)

- Non-Asset Backed Security (Non-ABS)

Global Commercial Aircraft Leasing Market, By Application

- Long Haul Aircraft

- Medium Distance Aircraft

Global Commercial Aircraft Leasing Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global commercial aircraft leasing market over the forecast period?The global commercial aircraft leasing market is projected to expand at a CAGR of 7.3% during the forecast period.

-

2. What is the projected market size & growth rate of the global commercial aircraft leasing market?The global commercial aircraft leasing market was valued at USD 154.1 Billion in 2023 and is projected to reach USD 315.9 Billion by 2033, growing at a CAGR of 7.3% from 2023 to 2033.

-

3. Which region is expected to hold the highest share in the global commercial aircraft leasing market?The North America region is expected to hold the highest share of the global commercial aircraft leasing market.

Need help to buy this report?