Global Coding Foils & Tapes Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hot Stamping Foils, Metallic Foils, Pigment Foils, Pearl Foils, Holographic Foils, and Cold Stamping Foils), By Substrate (Plastic, Paper & Paperboard, Wood, Glass, Metal, and Textile (Fiber)), By End Use (Cosmetics, Food &, Beverages, E-Commerce & Logistics, Packaging, Automotive, Electronics, Textiles, and Other Consumer Goods), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Coding Foils & Tapes Market Insights Forecasts to 2035

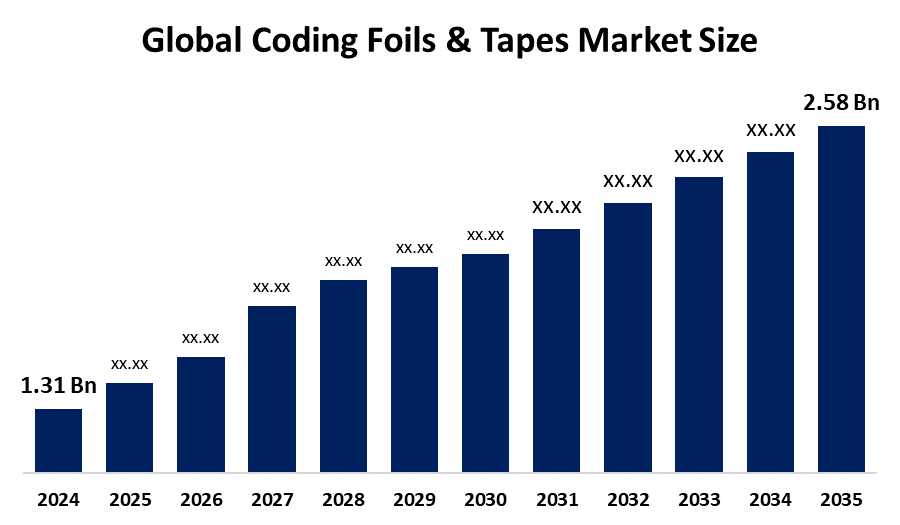

- The Global Coding Foils & Tapes Market Size Was Estimated at USD 1.31 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.36% from 2025 to 2035

- The Worldwide Coding Foils & Tapes Market Size is Expected to Reach USD 2.58 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Coding Foils & Tapes Market Size was worth around USD 1.31 Billion in 2024 and is predicted to grow to around USD 2.58 Billion by 2035 with a compound annual growth rate (CAGR) of 6.36% from 2025 to 2035. The development in the coding coils & tapes market is fueled by rising demand for product traceability, anti-counterfeiting, and attractive packaging, particularly within the e-commerce, pharmaceutical, and food industries.

Market Overview

The coding foils and tapes market refers to different thermal transfer ribbons, hot stamping foils, and pressure-sensitive tapes used primarily for product labeling, packaging, and identification in industries such as food and beverages, pharmaceuticals, cosmetics, motor vehicles, and electronics. These items are essential in producing batch numbers, expiry dates, barcodes, and logos on pack surfaces for traceability, regulatory requirements, and brand identity. The market is driven by increasing demand for packaged and branded products, and strict labeling and traceability requirements, particularly within the food and pharmaceutical sectors. Also, the growth of the e-commerce business and the shift towards automated packaging operations propel market expansion. Market opportunities emerge from developing sustainable and biodegradable tapes and foils in response to increasing demand for environmentally friendly packaging solutions.

The developments in smart packaging and integrated digital printing technologies are also promising growth opportunities. Market leaders such as ITW Foils, DIC Corporation, Armor Group, Ricoh Company, Ltd., and TTS (Thermal Transfer Solutions) continuously innovate in the life of a product, print quality, and greenness. On 31 December 2024, the European Commission published Regulation (EU) 2024/3190, banning bisphenol A (BPA) in food contact materials due to health reasons. The regulation incorporates goods such as plastics, coatings, adhesives, printing inks, silicones, rubber, and ion-exchange resins. The regulation centers on chemicals that are thought to be hazardous under EU standards, and the primary goal is to eradicate BPA in products that come into contact with food.

Report Coverage

This research report categorizes the coding foils & tapes market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the coding foils & tapes market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the coding foils & tapes market.

Global Coding Foils and Tapes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.31 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.36% |

| 2035 Value Projection: | USD 2.58 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product Type, By Substrate, By End Use and By Region |

| Companies covered:: | 3M, Saint-Gobain, Scapa Group Ltd., Avery Dennison Corporation, KURZ Group, Nitto Denko Corporation, tesa SE, AG Foil s.r.o., Shurtape Technologies, LLC, KOLON Industries, Inc., PB Holotech (I) Pvt. Ltd., UNIVACCO Foils Corporation, Advance Tapes International, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for coding foils and tapes is driven by increasing demand for traceability, product authentication, and regulatory compliance in industries such as food, pharmaceuticals, and cosmetics. E-commerce and automated packaging solution growth also drives market demand. Greater awareness of anti-counterfeiting technologies, as well as the development of thermal transfer and hot stamping technologies, also contributes. In addition, the trend toward sustainable packaging and regulatory requirements for clear identification and traceability are forcing producers to consider high-quality, long-lasting coding foils and tapes.

Restraining Factors

The coding foils and tapes market is confronted with limitations such as high raw materials pricing, low recyclability of some foils, and increasing concerns related to environmental protection. Furthermore, the movement toward digital printing technologies and the regulation of plastic-based products might restrain market growth.

Market Segmentation

The coding foils & tapes market share is classified into product type, substrate, and end use.

- The hot stamping foils segment dominated the market in 2024, approximately 41% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the coding foils & tapes market is divided into hot stamping foils, metallic foils, pigment foils, pearl foils, holographic foils, and cold stamping foils. Among these, the hot stamping foils segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The hot stamping foils market segment is dominated due to its superior print quality, tenacity, and adaptability in different substrates. Its capacity to provide crisp, colorful codes and designs for branding, anti-counterfeiting, and product identification in the packaging, cosmetics, and pharmaceutical industries generates high demand.

- The plastic segment accounted for the largest share in 2024, approximately 46% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the substrate, the coding foils & tapes market is divided into plastic, paper & paperboard, wood, glass, metal, and textile (fiber). Among these, the plastic segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is attributed to plastic packaging is used extensively in the food, pharmaceutical, and personal care sectors. It is durable, flexible, and economical to use, making it perfect for coding purposes. The growth is further pushed by the growth of flexible packaging and heightened needs for clear, readable codes on plastic surfaces.

- The food & beverages segment accounted for the highest market revenue in 2024, approximately 38% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the coding foils & tapes market is divided into cosmetics, food & beverages, e-commerce & logistics, packaging, automotive, electronics, textiles, and other consumer goods. Among these, the food & beverages segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The food & beverage industry is growing due to stricter regulatory compliance regarding product traceability, safety, and date coding. Furthermore, the increasing demand for processed and packaged food across the globe, coupled with end-user demand for explicit, lasting coding and branding, fuels robust implementation of coding foils and tapes in the food & beverage industry.

Regional Segment Analysis of the Coding Foils & Tapes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the coding foils & tapes market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the coding foils & tapes market over the predicted timeframe. Asia Pacific is leading the coding foils & tapes market with approximately 38% of market share, due to high industrial growth and growing packaging industries in prime countries such as China, India, Japan, and South Korea. The high demand from the food & beverage, pharmaceutical, cosmetics, and e-commerce industries propels the demand for sophisticated coding and labeling solutions. In addition, government initiatives to drive manufacturing development, growth in urbanization, and growing disposable incomes create momentum for the market's expansion. Automation and advanced packaging technologies' adoption across the region also enables continued expansion in the coding foils & tapes market.

North America is expected to grow at a rapid CAGR in the coding foils & tapes market during the forecast period, with approximately 26% of market share. Advanced manufacturing and automation are North America's strongest areas, particularly in food, healthcare, and industrial packaging. High standards of regulation create demand for high-performance, long-lasting coding and labeling solutions. Its huge pharmaceuticals and processed food industries make the U.S. the top driver. Thermal transfer and hot stamping technologies dominate, complemented by rapid packaging lines. High R&D efforts and early adoption of sustainable foils favor the market. Canada and Mexico have consistent growth through cross-border production and supply chain integration, with a keen focus on secure labeling and traceability influencing material and technology decisions.

Europe is witnessing consistent growth in the coding foils & tapes market, attributed to stringent regulations on labeling, traceability, and sustainability. Major nations such as Germany, France, the UK, and Italy are leading the demand, particularly in the sectors of pharmaceuticals, food & beverages, and cosmetics. Growing concern for green packaging, innovative printing technologies, and automation in production processes also stimulates market growth. Firm government efforts and consumer consciousness around product safety also help fuel growth across the continent.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the coding foils & tapes market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Saint-Gobain

- Scapa Group Ltd.

- Avery Dennison Corporation

- KURZ Group

- Nitto Denko Corporation

- tesa SE

- AG Foil s.r.o.

- Shurtape Technologies, LLC

- KOLON Industries, Inc.

- PB Holotech (I) Pvt. Ltd.

- UNIVACCO Foils Corporation

- Advance Tapes International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Avery Dennison announced a $390 million agreement to acquire the U.S.-based flooring adhesives business of Meridian Adhesives Group. The deal strengthens Avery Dennison’s adhesives portfolio and is subject to customary closing and post-closing adjustments.

- In January 2025, Tesa introduced a major innovation in its Tesafilm range, Tesafilm Paper, featuring a paper-based carrier material. Offering high transparency, familiar quality, and easy hand-tear functionality, this eco-friendly, single-sided adhesive tape is ideal for everyday tasks, office use, and home DIY projects.

- In November 2024, Kurz India launched the Silver Line at Labelexpo India 2024. This sustainable foil enhances packaging and labels with metallic, holographic, and 3D effects. It suits various substrates and is optimized for high-speed printing applications.

- In August 2024, Shurtape Technologies LLC launched its Shurtape Recycled Series Packaging Tapes, made from 90% post-consumer recycled polyester sourced from PET bottles and containers. This eco-friendly line aims to reduce virgin plastic use in end-of-line packaging applications.

- In February 2024, Avery Dennison Performance Tapes launched a new range of pressure-sensitive adhesive (PSA) tapes for the appliance industry, designed to simplify assembly, enhance durability, and improve noise, vibration, and harshness (NVH) control in appliances.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the coding foils & tapes market based on the below-mentioned segments:

Global Coding Foils & Tapes Market, By Product Type

- Hot Stamping Foils

- Metallic Foils

- Pigment Foils

- Pearl Foils

- Holographic Foils

- Cold Stamping Foils

Global Coding Foils & Tapes Market, By Substrate

- Plastic

- Paper & Paperboard

- Wood

- Glass

- Metal

- Textile (Fiber)

Global Coding Foils & Tapes Market, By End Use

- Cosmetics

- Food & Beverages

- E-Commerce & Logistics

- Packaging

- Automotive

- Electronics

- Textiles

- Other Consumer Goods

Global Coding Foils & Tapes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the coding foils & tapes market over the forecast period?The global coding foils & tapes market is projected to expand at a CAGR of 6.36% during the forecast period.

-

2. What is the market size of the coding foils & tapes market?The global coding foils & tapes market size is expected to grow from USD 1.31 billion in 2024 to USD 2.58 billion by 2035, at a CAGR of 6.36% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the coding foils & tapes market?Asia Pacific is anticipated to hold the largest share of the coding foils & tapes market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global coding foils & tapes market?The major players operating in the coding foils & tapes market are 3M, Saint-Gobain, Scapa Group Ltd., Avery Dennison Corporation, KURZ Group, Nitto Denko Corporation, tesa SE, AG Foil s.r.o., Shurtape Technologies, LLC, KOLON Industries, Inc., PB Holotech (I) Pvt. Ltd., UNIVACCO Foils Corporation, Advance Tapes International, and Others.

-

5. What factors are driving the growth of the coding foils & tapes market?Growth in the coding foils & tapes market is driven by the increasing demand for high-quality product labeling and anti-counterfeiting measures, especially in the food, beverage, and pharmaceutical industries.

-

6. What are the market trends in the coding foils & tapes market?Key market trends in coding foils & tapes include rising demand for high-quality, durable, and sustainable solutions driven by e-commerce and anti-counterfeiting needs, alongside technological innovations like RFID and QR codes for improved traceability.

-

7. What are the main challenges restricting wider adoption of the coding foils & tapes market?The main challenges restricting wider adoption of the coding foils and tapes market include intense competition from alternative marking technologies, evolving and stringent environmental regulations, and fluctuating raw material costs.

Need help to buy this report?