Global Co-Packaged Optics Market Size, Share, and COVID-19 Impact Analysis, By Type (Optical Transceiver/Light Engine, and Electric Chip), By Application (Data Communication, Telecommunications, Information Technology, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Semiconductors & ElectronicsGlobal Co-Packaged Optics Market Insights Forecasts to 2032

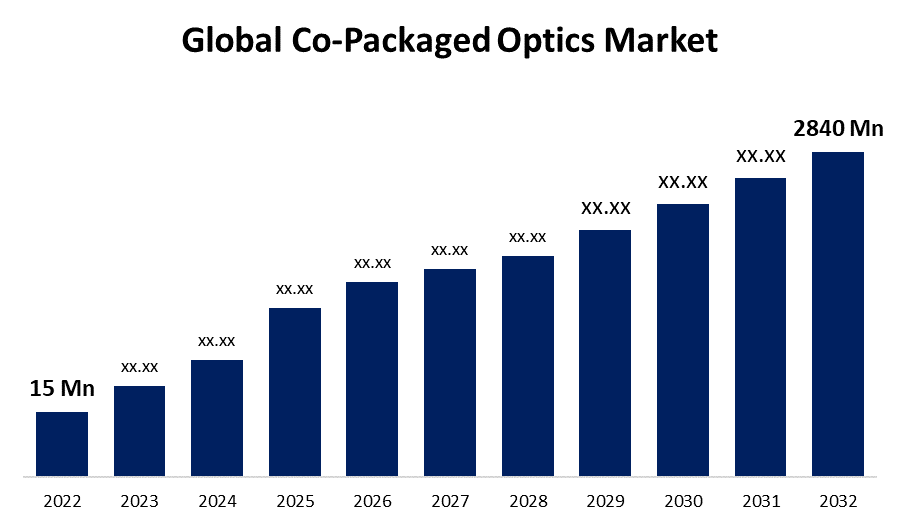

- The Global Co-Packaged Optics Market Size was valued at USD 15 Million in 2022.

- The Market is growing at a CAGR of 68.9% from 2022 to 2032

- The Worldwide Co-Packaged Optics Market is expected to reach USD 2840 million by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Co-Packaged Optics Market Size is expected to reach USD 2840 Million by 2032, at a CAGR of 68.9% during the forecast period 2022 to 2032.

Co-Packaged Optics (CPO) or in-package optics (IPO) is a sophisticated hybrid combination of optics and silicon on a single packaged platform intended at tackling next-generation bandwidth and power concerns. CPO combines technology in optical fiber, digital signal processing (DSP), switch ASICs, and cutting-edge packaging and testing to create innovative system solutions for data centers and cloud-based services. Co-packaged optics technology is regarded as a revolutionary installation model for the entire ecosystem, as well as a viable alternative to widely-established pluggable optics.

The silicon platform is largely recognized as the most promising platform for large-scale integration, and co-packaged optics is widely seen as an ideal option for potential data center interconnections. Leading global business organizations such as Intel, Broadcom, and IBM have conducted extensive research into co-packaged optics technology, an interdisciplinary research field involving photonic devices, integrated circuit design, packaging, photonic device modeling, electronic-photonic co-simulation, applications, and standardization.

RANOVUS Inc. ("RANOVUS"), for example, announced the compatibility of AMD Versal adaptive SoCs with the co-packaged Odin® 800G direct-drive optical engine and third-party 800G DR8+ retimed pluggable modules in March 2023. The compatibility demonstration is part of OFC 2023, North America's biggest optical networking event, and demonstrates the adaptability of RANOVUS' Odin® portfolio for AI/ML and communications applications. Odin® optical modules are ideal for next-generation data center designs based on co-packaged optics, near-packaged optics, and pluggable OSFP/QSFP-DD/OSFP XD optical modules.

Global Co-Packaged Optics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 15 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 68.9% |

| 2032 Value Projection: | USD 2840 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Cisco, Ayar Labs, Facebook, IBM, Intel, Marvell, Lumentum, Ranovus, Microsoft, Rain Tree Photonics, Broadcom, Ranovus, Rockley Photonics, SABIC, SENKO, TE Connectivity |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Data center traffic has increased at an average yearly growth rate of about 30% owing to the increasing popularity of 5G, IoT, AI, and high-performance computing applications. In addition, roughly three-quarters of data center traffic is generated within data centers. The growth of standard pluggable optics is substantially slower than the growth of data center traffic. Co-packaged optics is being driven by the rapid growth in the use of electronic devices, as well as a vast volume of data transfer and increased data traffic.

Growing internet-based service penetration, as well as growing demand for energy-efficient devices, are likely to fuel demand for the co-packaged optics market in the forecast time frame. The demand for data centers to increase their data-handling capacities is growing as a result of technological advancements in information-rich fields like artificial intelligence, driverless vehicles, and digital twins. Furthermore, developments in photonic integrated circuits (PICs) technology provide complex features such as compact footprints, low-loss transmission, large bandwidth, resistance to electric short-circuiting, and resistance to electromagnetic interference (EMI). PICs like these are widely employed in emerging applications such as data center interconnect (DCI), communications, high-performance computing (HPC), and optical computing. Such technological advances are expected to propel the co-packaged optics market forward.

Restraining Factors

However, the complicated design and fabrication process is a major constraint to the growth of the co-packaged optics market. In addition, co-packaged optics are brittle, expensive, and susceptible to loss of signal transmission. The elevated implementation cost of co-packaged optics for data transmission places such as data centers is likely to stymie the expansion of the co-packaged optics industry. As a result, this issue inhibits market growth.

Market Segmentation

By Type Insights

The optical transceiver/light engine segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global co-packaged optics market is segmented into the optical transceiver/light engine and electric chip. Among these, the optical transceiver/light engine segment is dominating the market with the largest revenue share of 68.3% over the forecast period. Lasers in external light sources are used in co-packaged optical transceivers. For optical transceivers that do not include a light source, an external light source supplies optical power. Co-packaged optics is an emerging technology that overcomes some of the issues that small form factor pluggable optical transceivers bring, such as temperature management, power consumption, bandwidth, and port density. Because the optical transceivers are located on the same substrate, all loss and distortion caused by copper traces on the motherboard are eliminated.

By Application Insights

The telecommunication segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of application, the global co-packaged optics market is segmented into data communication, telecommunications, information technology, and others. Among these, the telecommunication segment is dominating the market with the largest revenue share of 57.2% over the forecast period. The growth prospects for co-packaged optics technology from the increasing usage of fiber optics in the telecommunications industry are promising, owing to the technology's increasing acceptability in data transfer and communications services. Furthermore, the rising global deployment of 5G networks has resulted in the use of co-packaged optical components, which aid in the interconnection of 5G base stations to accomplish high-speed data transfer. These considerations are driving the telecommunications industry’s demand for a co-packaged optics market.

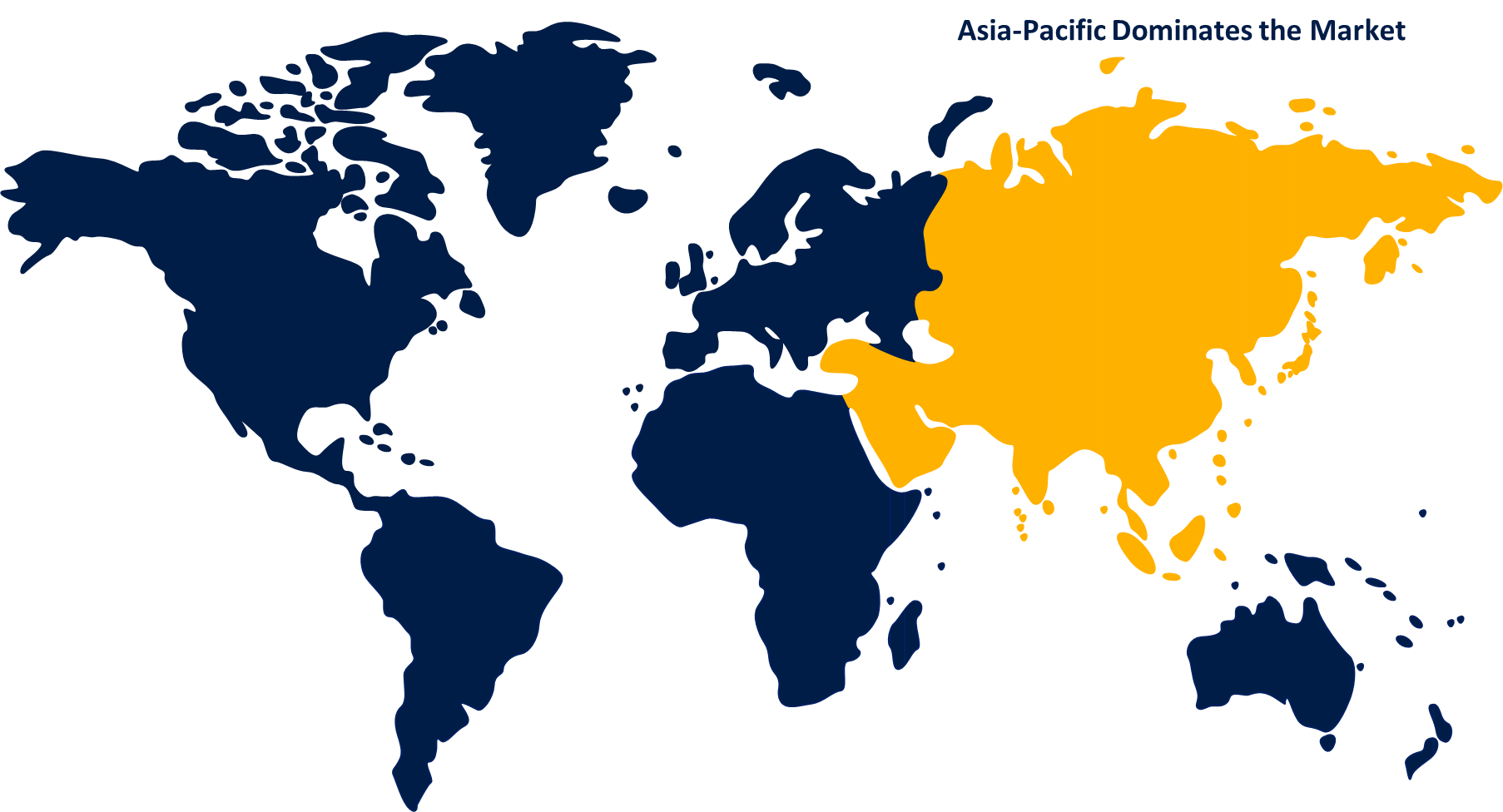

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. This expansion can be linked to a significant increase in internet-enabled gadgets, which has increased demand for high-speed data, shaping the co-packaged optics that enable the high-speed transfer of enormous amounts of data. Furthermore, supportive government initiatives to build high-speed internet infrastructure are propelling the regional co-packaged optics market forward.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. This expansion can be ascribed to rising electronic device utilization, the introduction of cutting-edge technologies, increased consumer awareness, and the expansion of the telecommunications sector in general. Furthermore, encouraging government efforts to expand the region's optical technology and semiconductor sectors is propelling co-packaged optics market expansion.

List of Key Market Players

- Cisco

- Ayar Labs

- IBM

- Intel

- Marvell

- Lumentum

- Ranovus

- Microsoft

- Rain Tree Photonics

- Broadcom

- Ranovus

- Rockley Photonics

- SABIC

- SENKO

- TE Connectivity

Key Market Developments

- On March 2023, I-PEX, a leader in high-frequency and high-speed transmission connectors, and Teramount Ltd, a leader in silicon photonics fiber packaging, announced today that they will work together to advance silicon photonics optical detachable connectivity for data centers and other high-speed datacom and telecom applications. Based on Teramount's self-aligning optics technology and I-PEX's ultra-precision plug and holder systems, the collaboration between I-PEX and Teramount will provide a revolutionary solution for detachable fiber-to-chip communication.

- In August 2022, Broadcom will deploy its 25.6Tbit/sec Humbolt co-packaged optical (CPO) switches in the data centers of China-based cloud provider Tencent in order to expedite the adoption of the upcoming network technology. The switches are based on a design that combines conventional switching with co-packaged optics and was first revealed in early 2021. By packaging them alongside the switch ASIC, the technology effectively moves the optics and digital signal processor from the pluggable. Broadcom claims that by lowering the number of pluggable modules, it can dramatically cut power usage because fiber-optic cables may be connected directly to the switch.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Co-Packaged Optics Market based on the below-mentioned segments:

Global Co-Packaged Optics Market, Type Analysis

- Optical Transceiver/Light Engine

- Electric Chip

Global Co-Packaged Optics Market, Application Analysis

- Data Communication

- Telecommunications

- Information Technology

- Others

Co-Packaged Optics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Co-Packaged Optics market?The Global Co-Packaged Optics Market is expected to grow from USD 15 million in 2022 to USD 2840 million by 2032, at a CAGR of 68.9% during the forecast period 2022-2032

-

2. Which are the key companies in the market?Cisco, Ayar Labs, Facebook, IBM, Intel, Marvell, Lumentum, Ranovus, Microsoft, Rain Tree Photonics, Broadcom, Ranovus, Rockley Photonics, SABIC, SENKO, and TE Connectivity

-

3. Which segment dominated the Co-Packaged Optics market share?The telecommunications segment in end-use type dominated the Co-Packaged Optics market in 2022 and accounted for a revenue share of over 57.2%.

-

4. Which region is dominating the Co-Packaged Optics market?North America is dominating the Co-Packaged Optics market with more than 38.7% market share.

-

5. Which segment holds the largest market share of the Co-Packaged Optics market?The optical transceiver/light engine segment based on type holds the maximum market share of the Co-Packaged Optics market.

Need help to buy this report?