Global CNS Treatment and Therapy Market Size, Share, and COVID-19 Impact Analysis, By Drug (Biologics and Non Biologics), By Drug Class (Antidepressant, Analgesics, Immunomodulators, Interferons, Decarboxylase Inhibitors, and Others), By Disease (Neurovascular Disease, Degenerative Disease, Infectious Disease, Mental Health, and Others), By Distribution Channel (Hospital Based Pharmacies, Retail Pharmacies, and Online Pharmacies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal CNS Treatment and Therapy Market Size Insights Forecasts to 2035

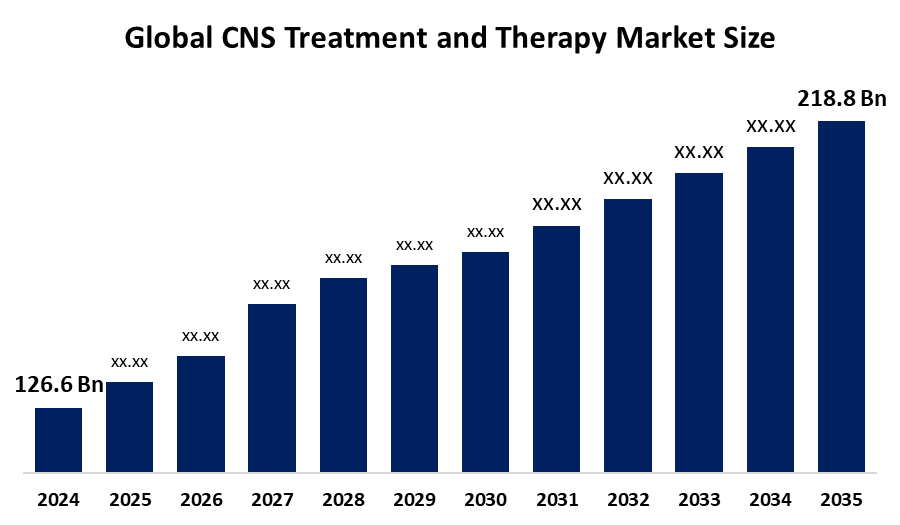

- The Global CNS Treatment and Therapy Market Size Was Estimated at USD 126.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.1% from 2025 to 2035

- The Worldwide CNS Treatment and Therapy Market Size is Expected to Reach USD 218.8 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global CNS Treatment and Therapy Market Size was worth around USD 126.6 billion in 2024 and is predicted to grow to around USD 218.8 billion by 2035 with a compound annual growth rate (CAGR) of 5.1% from 2025 to 2035. The CNS space is experiencing growth owing to the rising incidence of neurodegenerative disorders such as Alzheimer's and Parkinson's disease, awareness regarding mental health issues, and investments made in gene therapies. Targeted drug delivery and AI-based diagnostic platforms are also driving the growth.

Market Overview

The international CNS treatment & therapy market refers to the industry related to the R&D, manufacture, and supply of biological products such as drugs, biologics, and therapies that are focused on the prevention, diagnosis, and treatment of central nervous system disorders. Such treatments are predominantly utilized to enhance cognitive abilities, movement capabilities, and the overall health of the patient. The primary driving force behind the growth of the CNS treatments and therapy market is the increased occurrence of neurological disorders, as well as the aging population.

In July 2025, the WHO found the leading cause of disability to be neurological disorders such as Alzheimer’s disease, glioblastoma, ALS, depression, strokes, and epilepsy. Breakthroughs in technologies are fueling advancements in CNS therapies, from innovative biologics to new platforms and next-generation SMs, with the market rising from $144.3 million to $410 million in 2035. Opportunities lie in the developing countries where the healthcare infrastructure is being developed, and the per capita incomes are increasing. The main key players in the industry, such as Pfizer, Johnson & Johnson, Novartis, Roche, Eli Lilly, focus on R&D work, partnerships, and technological advancements, in order to develop their product lines, boost their presence in the global market, etc.

Report Coverage

This research report categorizes the CNS Treatment and Therapy Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the CNS Treatment and Therapy Market Size. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the CNS Treatment and Therapy Market Size.

CNS Treatment and Therapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 126.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.1% |

| 2035 Value Projection: | 218.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Drug, By Drug Class |

| Companies covered:: | Roche Holding AG, AbbVie Inc, GlaxoSmithKline plc, Merck & Co., Inc., AstraZeneca plc, Pfizer Inc., Johnson & Johnson, Eli Lilly, Biogen Inc, UCB S.A., Novartis AG, F. Hoffmann-La Roche Ltd, Neurocrine Biosciences, Teva Pharmaceutical Industries Ltd, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The worldwide CNS (central nervous system) treatment & therapy market is fueled by the increasing cases of CNS diseases such as Alzheimer’s, Parkinson’s, epilepsy, and multiple sclerosis. The increasing older population, stress related to lifestyle factors, as well as the rising consciousness of mental issues, boost the demand for effective treatments for CNS disorders. New research in medication technologies, biologics, and novel treatments for CNS disorders, such as targeted therapies, miniblog, and neurostimulation therapies, is fueling the growth of the CNS treatment and therapies industry worldwide. The improvement in healthcare infrastructure, increased healthcare spending, and increased ability to diagnose CNS ailments also support the growth of the CNS treatment and therapies industry worldwide.

Restraining Factors

The CNS Treatment and Therapy Market Size worldwide is challenged by restraints such as the cost of drug development, tough government approvals, and clinical trials. Side effects, ineffectiveness, and patient compliance also act as barriers to growth. Moreover, the absence of awareness and inaccessibility of medical treatment in the unexplored areas of emerging countries also create hassles.

Market Segmentation

The CNS Treatment and Therapy Market Size share is classified into drug, drug class, disease, and distribution channel.

- The biologics segment dominated the market in 2024, approximately 36% and is projected to grow at a substantial CAGR during the forecast period.

Based on the drug, the CNS Treatment and Therapy Market Size is divided into biologics and non biologics. Among these, the biologics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This dominant share has been accounted for by better efficacy in dealing with complex neuroinflammatory and neurodegenerative diseases, where small-molecule drugs have shown less efficacy. The increased approvals in monoclonal antibody (mAb) therapy in cases of multiple sclerosis, Alzheimer’s disease, and neuromyelitis optica have been a contributing factor in this growth.

- The antidepressant segment accounted for the largest share in 2024, approximately 30% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the drug class, the CNS Treatment and Therapy Market Size is divided into antidepressant, analgesics, immunomodulators, interferons, decarboxylase inhibitors, and others. Among these, the antidepressant segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This type of antidepressant market growth has also benefited from the increase in awareness campaigns and the decline of stigmatized views of mental health issues and higher levels of screening and diagnoses for both developed and emerging markets. Second-generation antidepressants such as SSRIs and SNRIs have also emerged as preferred choices due to better safety and efficacy profiles and patient compliance.

- The neurovascular disease segment accounted for the largest share in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the disease, the CNS Treatment and Therapy Market Size is divided into neurovascular disease, degenerative disease, infectious disease, mental health, and Others. Among these, the neurovascular disease segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment is growing due to the high incidence and prevalence rate of conditions such as stroke, cerebral aneurysm, and vascular dementia in the global arena. The growth in this market is driven by an ageing population, an increased incidence rate of hypertension and diabetes, and advances in neuro-interventional techniques. Technological advances in devices for clot retrievals, thrombolysis, and cerebral protection systems are also contributing factors in this market.

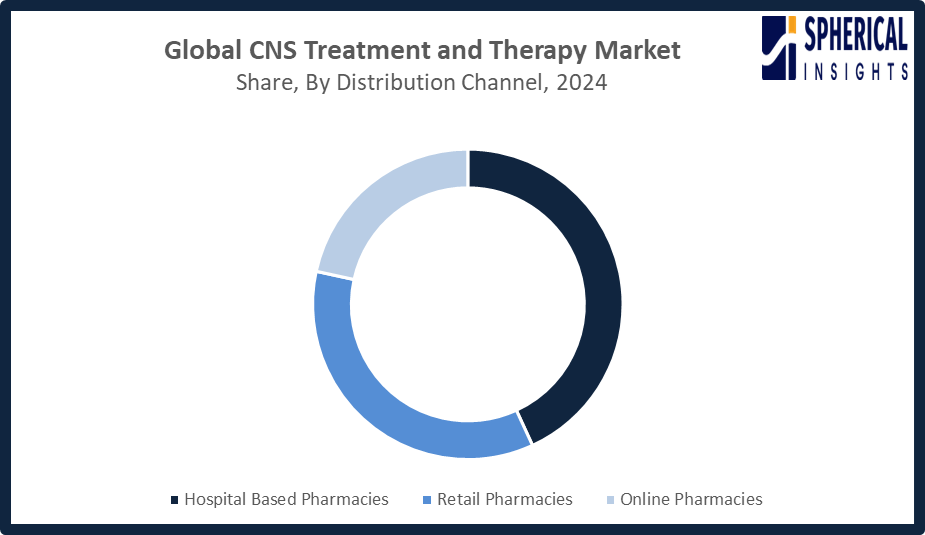

- The hospital based pharmacies segment accounted for the highest market revenue in 2024, approximately 43% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the CNS Treatment and Therapy Market Size is divided into hospital based pharmacies, retail pharmacies, and online pharmacies. Among these, the hospital based pharmacies segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is attributed to centralized dispensing of high-risk CNS drugs requiring clinical supervision. These have been preferred due to their integration with neurologists and psychiatrists for on-site prescribing of specialized biologics, antipsychotics, and intrathecal medications. Most of the CNS disorders, such as acute psychosis, stroke, and epilepsy, require immediate intervention, hence making the hospital pharmacies the most reliable and efficient distribution channel.

Get more details on this report -

Regional Segment Analysis of the CNS Treatment and Therapy Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the CNS Treatment and Therapy Market Size over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the CNS Treatment and Therapy Market Size over the predicted timeframe. North America is expected to account for the 46% share in the market for CNS treatment and therapy, owing to the large prevalence of neurological disorders in this region. The leading share in the United States is accounted for by the NIH funding, FDA approvals, rapid acceptance of biologic therapeutics and genetic therapy, and an active clinical trial scenario. Canada also makes an important contribution because of improved access to healthcare. In June 2025, the NINDS reviewed its strategic plans related to prevention, cures, and improved quality of life. HEAL, BRAIN programs, the promotion of BRAIN Initiative spending, and ARPA-H projects such as ACTR and RNA-based ‘Curing the Uncurable’ represent important strategies.

Asia Pacific is expected to grow at a rapid CAGR in the CNS Treatment and Therapy Market Size during the forecast period. The Asia Pacific region is anticipated to have a 20% market share of the CNS Treatment and Therapy Market Size owing to an upsurge in neurological and psychiatric disorders, improved healthcare awareness, and an increase in healthcare infrastructure. The growth of this market may be attributed to countries like China, India, and Japan. At the same time, the introduction of innovative biologics, gene therapy, and an influx of new patient populations with CNS diseases also drive the market growth in the region.

The European market is experiencing a positive growth rate in the treatment and therapy of CNS conditions because of a higher prevalence rate of neurological disorders, a sound healthcare infrastructure, and increased governmental support in innovative R&D works. The top-most markets in this region are contributed by Germany, the UK, and France because of an advanced R&D infrastructure, increased uptake of innovative technologies, a favorable reimbursement system, and greater patient awareness in these markets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the CNS Treatment and Therapy Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roche Holding AG

- AbbVie Inc

- GlaxoSmithKline plc

- Merck & Co., Inc.

- AstraZeneca plc

- Pfizer Inc.

- Johnson & Johnson

- Eli Lilly

- Biogen Inc

- UCB S.A.

- Novartis AG

- F. Hoffmann-La Roche Ltd

- Neurocrine Biosciences

- Teva Pharmaceutical Industries Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, SciNeuro Pharmaceuticals announced a global licensing and collaboration agreement with Novartis to advance its amyloid beta-targeted antibody program for Alzheimer’s Disease. The program features de novo antibodies with SciNeuro’s proprietary blood-brain barrier shuttle technology, offering potential advantages over existing amyloid beta-targeted therapies.

- In November 2025, Biogen completed its acquisition of Alcyone Therapeutics, a biotech focused on CNS therapy delivery. The deal includes Alcyone’s investigational ThecaFlex DRx implantable device, designed to replace repeated lumbar punctures for chronic intrathecal treatments, improving patient experience and accessibility for people with neurological disorders.

- In September 2025, Eli Lilly announced FDA Breakthrough Therapy designation for olomorasib combined with KEYTRUDA for first-line treatment of unresectable advanced or metastatic NSCLC patients with KRAS G12C mutation and PD-L1 ≥50%. Olomorasib is a selective second-generation KRAS G12C inhibitor showing potential CNS activity.

- In May 2025, Sanofi announced the acquisition of Vigil Neuroscience, strengthening its neurology pipeline. The deal includes VG-3927, an oral TREM2 agonist advancing to phase 2 trials for Alzheimer’s disease, designed to enhance microglial neuroprotective functions.

- In April 2025, GSK licensed ABL Bio’s Grabody-B technology to advance treatments for brain diseases. The platform, designed to cross the blood-brain barrier using a natural protein, follows Sanofi’s 2022 collaboration with ABL for Parkinson’s therapies, highlighting its potential to revolutionize neurological drug delivery.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the CNS Treatment and Therapy Market Size based on the below-mentioned segments:

Global CNS Treatment and Therapy Market Size, By Drug

- Biologics

- Non Biologics

Global CNS Treatment and Therapy Market Size, By Drug Class

- Antidepressant

- Analgesics

- Immunomodulators

- Interferons

- Decarboxylase Inhibitors

- Others

Global CNS Treatment and Therapy Market Size, By Disease

- Neurovascular Disease

- Degenerative Disease

- Infectious Disease

- Mental Health

- Others

Global CNS Treatment and Therapy Market Size, By Distribution Channel

- Hospital Based Pharmacies

- Retail Pharmacies

- Online Pharmacies

Global CNS Treatment and Therapy Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the CNS Treatment and Therapy Market Size over the forecast period?The global CNS Treatment and Therapy Market Size is projected to expand at a CAGR of 5.1% during the forecast period.

-

2. What is the market size of the CNS Treatment and Therapy Market Size?The global CNS Treatment and Therapy Market Size is expected to grow from USD 126.6 billion in 2024 to USD 218.8 billion by 2035, at a CAGR of 5.1% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the CNS Treatment and Therapy Market Size?North America is anticipated to hold the largest share of the CNS Treatment and Therapy Market Size over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global CNS Treatment and Therapy Market Size?Roche Holding AG, AbbVie Inc, GlaxoSmithKline plc, Merck & Co., Inc., AstraZeneca plc, Pfizer Inc., Johnson & Johnson, Eli Lilly, Biogen Inc, UCB S.A., and Others.

-

5. What factors are driving the growth of the CNS Treatment and Therapy Market Size?Key drivers include the rising prevalence of neurodegenerative/mental disorders, an aging population, increased R&D investments, advancements in precision medicine, and higher demand for novel disease-modifying therapies.

-

6. What are the market trends in the CNS Treatment and Therapy Market Size?Key trends include AI-driven drug discovery, surging demand for neurodegenerative therapies (Alzheimer’s), personalized medicine, digital therapeutics, gene therapy, and increased mental health focus.

-

7. What are the main challenges restricting wider adoption of the CNS Treatment and Therapy Market Size?The challenges include the blood-brain barrier restricting drug delivery, high R&D failure rates, complex disease pathophysiology, high therapy costs, and limited insurance reimbursement, hindering adoption of novel CNS treatments.

Need help to buy this report?