Global Cloud Native Applications Market Size, Share, and COVID-19 Impact Analysis, By Component (Platforms and Services), By Deployment Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Organization Size (SMEs and Large Enterprises), By Application (BFSI, Government & Public Sector, Healthcare, IT & Telecom, Manufacturing, Retail and E-commerce, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Cloud Native Applications Market Insights Forecasts to 2035

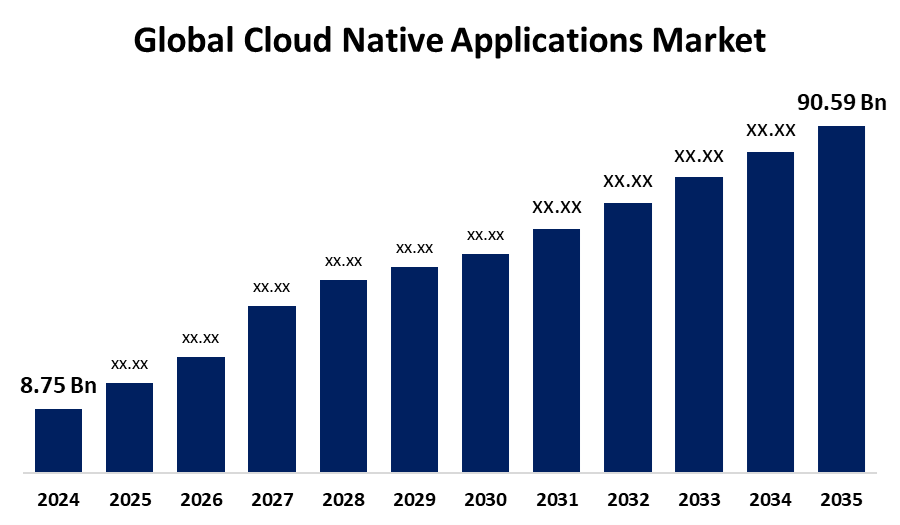

- The Global Cloud Native Applications Market Size Was Estimated at USD 8.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 23.67% from 2025 to 2035

- The Worldwide Cloud Native Applications Market Size is Expected to Reach USD 90.59 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cloud Native Applications Market Size was worth around USD 8.75 Billion in 2024 and is predicted to Grow to around USD 90.59 Billion by 2035 with a Compound Annual Growth rate (CAGR) of 23.67% from 2025 to 2035. The rapid adoption of cloud-native applications is enabling businesses to enhance scalability, flexibility, and development speed. As digital transformation accelerates, these solutions are becoming essential for maintaining competitiveness in a dynamic market.

Market Overview

The cloud native applications market refers to the ecosystem centered on the creation, implementation, and administration of software programs designed especially for cloud settings with cloud-native technology. Usually made up of microservices, these applications are orchestrated using platforms such as Kubernetes, packaged in containers, and maintained according to serverless, CI/CD, and DevOps concepts.

Software solutions created, developed, deployed, and managed specially to take full use of cloud computing environments are known as cloud native apps. These applications enable quick, dependable, and scalable software delivery by embracing contemporary architectural patterns like microservices, containerization, orchestration, automation, and DevOps.

Businesses use cloud-native technology to satisfy the increasing need for cost-effectiveness, scalability, resilience, and quicker application delivery. Businesses have a competitive edge in today's digital-first environment by abandoning monolithic development and adopting a culture of continuous improvement.

Rapid advancements in cloud-native application development are opening up new avenues for software engineers. Two important emerging developments are edge computing, which lowers latency by processing data closer to its source, and serverless computing, which streamlines development by abstracting server management. While service mesh technologies like Istio and Linkerd effectively manage microservices communication, Kubernetes keeps developing, branching out into new use cases like machine learning and serverless deployments. Predictive analytics and problem solving are improved by observability and AIOps, while automation and cooperation are being strengthened by the emergence of DevOps and GitOps. Innovation is also being fueled by the increasing accessibility of integrating AI and machine learning into cloud-native apps. Additionally, stateful applications are becoming more popular because they allow data-intensive workloads to grow in cloud-native settings. While security and compliance remain major objectives, multi-cloud and hybrid systems provide flexibility and risk reduction.

Report Coverage

This research report categorizes the cloud native applications market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cloud native applications market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cloud native applications market.

Global Cloud Native Applications Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.75 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 23.67% |

| 2035 Value Projection: | USD 90.59 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 292 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Component, By Deployment Type, By Organization Size, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Alibaba Cloud, SAP SE, Amazon Web Services, Inc., Red Hat, Inc., Broadcom, Oracle, Google, Microsoft, Infosys Limited, International Business Machines Corporation, VmWare, Cognizant, Other and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A need for IT infrastructure that is both flexible and scalable. Microservices design improves application development's agility, scalability, and modularity. Docker and Kubernetes are two examples of containerization technologies that simplify application management and lower operational complexity. Continuous integration and delivery (CI/CD) and faster development cycles are made possible by DevOps principles. The emergence of hybrid and multi-cloud methods guarantees cost-effectiveness and peak performance. Cloud-native applications are becoming crucial for preserving a competitive edge as companies continue to place a high priority on digital transformation.

Restraining Factors

The market growth is hindered by the financial risk, but cloud-native development offers flexibility and scalability. Unexpected and excessive expenses may result from unmonitored usage. To keep spending under control, accurate budgeting and ongoing oversight are crucial. For adoption to be sustainable, organizations must balance the advantages against potential financial risks.

Market Segmentation

The cloud native applications market share is classified intocomponents, deployment type, organization size, and application.

- The platforms segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the component, the cloud native applications market is categorized into platforms and services. Among these, the platforms segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the growing demand for flexible and scalable IT solutions, the broad use of microservices architecture, and developments in containerization technologies like Docker and Kubernetes are the main drivers of the market expansion for cloud-native application platforms. By fostering agility and shortening the time to market for new features, these platforms help businesses create, implement, and maintain applications more effectively.

- The public cloud segment accounted for the majority of the share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the deployment type, the cloud native applications market is categorized into public cloud, private cloud, and hybrid public cloud. Among these, the cloud segment accounted for the majority of the share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to its affordability, scalability, and availability of cutting-edge technologies. It gives businesses the freedom to develop while upholding strict security and compliance guidelines. Public clouds' worldwide reach and inherent redundancy facilitate disaster recovery and high availability. All of these advantages combine to make the public cloud a wise decision for contemporary businesses.

- The large enterprises segment accounted for the majority of the share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the organization size, the cloud native applications market is categorized into SMEs and large enterprises. Among these, the large enterprises segment accounted for the majority of the share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The SMEs segmental growth can be attributed to the cloud-native apps are being used by big businesses more frequently to improve scalability and operational effectiveness. Dynamically allocating resources aids in cost reduction and performance optimization. Microservices design increases agility by facilitating quicker development and deployment. Maintaining competitiveness in dynamic digital markets requires this acceptance.

- The BFSI segment accounted for the majority of the share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the application, the cloud native applications market is categorized into BFSI, government & public sector, healthcare, IT & telecom, manufacturing, retail and e-commerce, and others. Among these, the BFSI segment accounted for the majority of the share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be propagated to the cloud-native technologies that are used by financial organizations to lower infrastructure costs and improve operational efficiency. Managing fluctuating workloads is made easy by on-demand scalability, particularly during times of high traffic. Strict regulatory standards are supported by built-in security and compliance features. BFSI companies are now more equipped to innovate and react swiftly to client demands through this strategy change.

Regional Segment Analysis of the Cloud Native Applications Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the cloud native applications market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the cloud native applications market over the predicted timeframe. The regional growth can be attributed to the adoption of cloud-native applications is largely fueled by the region's robust cloud ecosystem and solid technological basis. These technologies are being used by businesses to increase innovation, scalability, and agility. This change is also being accelerated by significant cloud investments and ongoing digital transformation projects. Cloud-native solutions are, therefore, becoming essential for preserving competitive advantage.

Asia Pacific is expected to grow at a rapid CAGR in the cloud native applications market during the forecast period. In this region, a rapid digital transformation and a burgeoning startup environment. Government and corporate investments seek to promote innovation, scalability, and efficiency. Widespread adoption across various markets is supported by the requirement for adaptable, mobile-friendly solutions. Cloud-native infrastructure becomes crucial for preserving cost-effectiveness and agility as competition heats up.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cloud native applications market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alibaba Cloud

- SAP SE

- Amazon Web Services, Inc.

- Red Hat, Inc.

- Broadcom

- Oracle

- Microsoft

- Infosys Limited

- International Business Machines Corporation

- VmWare

- Cognizant

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Mavenir announced the signing of a five-year Strategic Collaboration Agreement (SCA) with Amazon Web Services, Inc. (AWS) to improve telecom workload deployment on AWS. This partnership entails jointly architecting Mavenir's technology to maximize cloud-native solution development, testing, integration, and application. This alliance aims to build a new telco-grade deployment strategy by leveraging AWS's high scalability, availability, and security capabilities. The goal is to transform how operators introduce 5G, Radio Access Network (RAN), IP Multimedia Subsystem (IMS), and future network technologies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cloud native applications market based on the below-mentioned segments:

Global Cloud Native Applications Market, By Component

- Platforms

- Services

Global Cloud Native Applications Market, By Deployment Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

Global Cloud Native Applications Market, By Organization Size

- SMEs

- Large Enterprise

Global Cloud Native Applications Market, By Application

- BFSI

- Government & Public Sector

- Healthcare

- IT & Telecom

- Manufacturing

- Retail and E-commerce

- Others

Global Cloud Native Applications Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cloud native applications market over the forecast period?The global cloud native applications market is projected to expand at a CAGR of 23.67% during the forecast period.

-

2. What is the market size of the cloud native applications market?The global cloud native applications market size is expected to grow from USD 8.75 Billion in 2024 to USD 90.59 Billion by 2035, at a CAGR of 23.67% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the cloud native applications market?North America is anticipated to hold the largest share of the cloud native applications market over the predicted timeframe.

Need help to buy this report?