Global Cloud-native Application Protection Platform Market Size, Share, and COVID-19 Impact Analysis, By Offering (Platform and Services), By Deployment (Private, Public, and Hybrid), By Enterprise Size (SMEs and Large Enterprises), By End-use (BFSI, Healthcare, Retail & E-commerce, Telecom, IT & ITES, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023-2033

Industry: Information & TechnologyGlobal Cloud-native Application Protection Platform Market Insights Forecasts to 2033

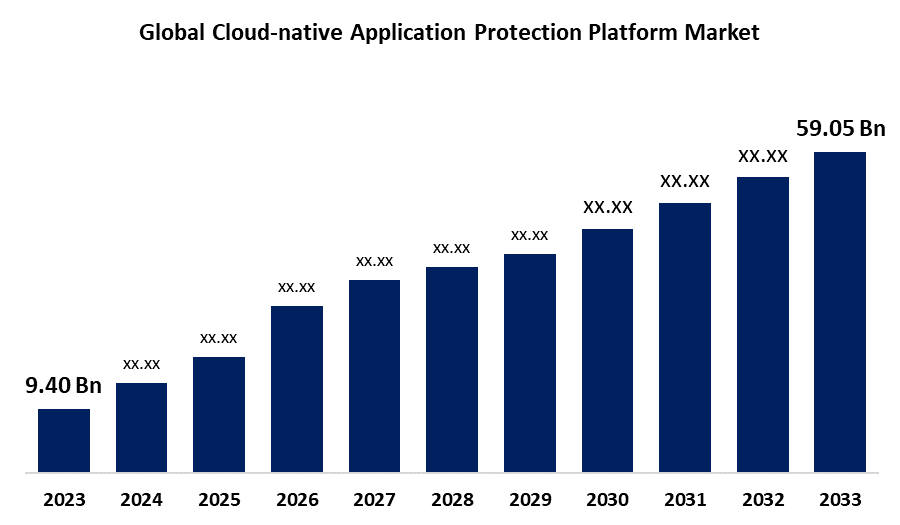

- The Global Cloud-native Application Protection Platform Market Size Was Estimated at USD 9.40 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 20.17% from 2023 to 2033

- The Worldwide Cloud-native Application Protection Platform Market Size is Expected to Reach USD 59.05 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Cloud-native Application Protection Platform Market Size is anticipated to exceed USD 59.05 Billion by 2033, growing at a CAGR of 20.17% from 2023 to 2033. The market growth is rising due to the organizations seek robust, unified security for complex cloud-native environments. Growing cyber threats and regulatory pressures are making CNAPPs essential for secure and compliant operations.

Market Overview

The cloud-native application platform market refers to a security and compliance solution that supports teams in creating, implementing, and operating safe cloud-native apps in the highly automated, ever-changing public cloud environments of today. Additionally, CNAPPs facilitate better security team collaboration with DevOps and developers. Combining CSPM, CIEM, IAM, CWPP, data protection, and other features, CNAPP is a new class of cloud security platform.

CNAPPs are crucial for protecting contemporary cloud environments. They are employed to safeguard cloud workloads, data, and apps, enforce compliance, and identify and correct misconfigurations. CNAPPs are incorporated into CI/CD pipelines in DevOps and DevSecOps workflows to identify security threats early, particularly through IaC scanning and posture management. They also manage rights across multi-cloud infrastructures, automate threat response, and facilitate real-time monitoring. By guaranteeing end-to-end cloud protection, CNAPPs simplify, boost security, and increase development efficiency for businesses of all sizes.

Report Coverage

This research report categorizes the cloud-native application protection platform market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cloud-native application protection platform market. Recent market developments and competitive strategies such as expansion, Type of Software launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cloud-native application protection platform market.

Global Cloud-native Application Protection Platform Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.40 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 20.17% |

| 2033 Value Projection: | USD 59.05 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Offering, By Deployment, By Enterprise Size, By End-use, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Check Point, Trend Micro, Accuknox, Palo Alto Networks, Banyan Cloud, Palo Alto Networks, Ermetic, CrowdStrike, Wiz.io, Fortinet, Caveonix, Radware, Tigera, and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The cloud-native application protection platform market is experiencing rapid growth, driven by the expanding demand for all-encompassing security and the growing use of cloud-native technology. These solutions offer complete protection for dispersed settings, cloud workloads, and containers. Organizations are turning to CNAPPs due to the intricacy of protecting contemporary applications, as conventional approaches prove inadequate. Businesses are being forced to give security priority to protect data and win over customers due to an increase in cyber threats. CNAPP integration is further supported across development cycles by the use of DevSecOps. Organizations are also using CNAPPs to maintain compliance and avoid penalties as a result of regulatory demands.

Restraining Factors

The market growth is hindered by the significant obstacle to successfully adopting CNAPP systems. The talent gap impedes the advancement of cloud transformation initiatives, even in the face of growing demand. Organizations face operational, security, and compliance issues as a result of this imbalance. Adoption of CNAPP may encounter ongoing delays and difficulties until this gap is closed.

Market Segmentation

The global cloud-native application protection platform market is classified intooffering, deployment, enterprise size, and end use.

- The platform segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the offering, the cloud-native application protection platform market is categorized into platform and services. Among these, the platform segment accounted for the largest share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the combination of several security solutions onto one platform, CNAPP simplifies cloud security. All across the CI/CD lifecycle, it promotes secure development, improves visibility, and lowers misconfigurations. By integrating reaction and monitoring, CNAPP reduces operational complexity. Consequently, it fortifies cloud-native environments against dynamic dangers.

- The public segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the deployment, the cloud-native application protection platform market is categorized into private, public, and hybrid. Among these, the public segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the strong, comprehensive security solutions are becoming more and more necessary as public cloud adoption increases. To protect data, businesses are adopting automation, zero-trust models, and real-time threat detection. In dynamic cloud environments, these innovations guarantee improved protection and compliance.

- The large enterprises segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the enterprise size, the cloud-native application protection platform market is categorized into SMEs and large enterprises. Among these, the large enterprises segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The SMEs segmental growth can be attributed to the need for CNAPP solutions has grown dramatically as more big businesses move to cloud settings. Security has become a primary responsibility due to increased susceptibility to cyber threats and the development of remote work practices. CNAPP solutions provide affordable, scalable security that is adapted to changing cloud infrastructures. FortiCNP and other solutions show how integrated tools improve operating efficiency and security.

- The BFSI segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the end use, the cloud-native application protection platform market is categorized into BFSI, healthcare, retail & e-commerce, telecom, IT & ITES, and others. Among these, the BFSI segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be propagated to the cloud-based solutions are being quickly adopted by financial institutions due to their scalability, flexibility, and cost-effectiveness. Strong security measures are now more important than ever as a result of this change, which has been hastened by tendencies toward remote work. CNAPPs guarantee regulatory compliance while providing crucial defense against online attacks. Consequently, in the BFSI industry, CNAPPs are increasingly essential to cloud environment security.

Regional Segment Analysis of the Cloud-native Application Protection Platform Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the cloud-native application protection platform market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the cloud-native application protection platform market over the predicted timeframe. The regional growth can be attributed to the growing use of cloud computing by businesses in a variety of sectors. Strong cloud security solutions are in great demand due to the region's sophisticated IT infrastructure and rapid digital transformation activities. Strict legislative frameworks that require strict data protection procedures, such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR), are important elements impacting the market.

Asia Pacific is expected to grow at the fastest CAGR of the cloud-native application protection platform market during the forecast period. In these regions, the growing use of cloud computing and digitization is seen in emerging economies. Leading the way in this expansion are nations like China, India, and Japan, which are being driven by growing IT industries and large expenditures in cloud infrastructure. A growing number of small and medium-sized businesses (SMEs) are using cloud services to improve operational efficiency, and cybersecurity is becoming more and more important.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cloud-native application protection platform market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Check Point

- Trend Micro

- Accuknox

- Palo Alto Networks

- Banyan Cloud

- Palo Alto Networks

- Ermetic

- CrowdStrike

- Wiz.io

- Fortinet

- Caveonix

- Radware

- Tigera

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Palo Alto Networks, a global cybersecurity business, established a strategic relationship with IBM Corporation, a developer of hybrid cloud and AI technology. According to the transaction, Palo Alto Networks would purchase IBM Corporation's QRadar SaaS assets, allowing clients to migrate to its sophisticated Cortex XSIAM platform. This collaboration emphasizes the necessity of comprehensive security measures in modern companies, supplementing Palo Alto Networks' Cloud Native Application Protection Platform (CNAPP) with robust, AI-driven threat protection and automated security operations for customers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the cloud-native application protection platform market based on the below-mentioned segments:

Global Cloud-native Application Protection Platform Market, By Offering

- Platform

- Services

Global Cloud-native Application Protection Platform Market, By Deployment

- Private

- Public

- Hybrid

Global Cloud-native Application Protection Platform Market, By Enterprise Size

- SMEs

- Large Enterprises

Global Cloud-native Application Protection Platform Market, By End-use

- BFSI

- Healthcare

- Retail & E-commerce

- Telecom

- IT & ITES

- Others

Global Cloud-native Application Protection Platform Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cloud-native application protection platform market over the forecast period?The cloud-native application protection platform market is projected to expand at a CAGR of 20.17% during the forecast period.

-

2. What is the market size of the cloud-native application protection platform market?The Global Cloud-native Application Protection Platform Market Size is expected to grow from USD 9.40 Billion in 2023 to USD 59.05 Billion by 2033, at a CAGR of 20.17% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the cloud-native application protection platform market?North America is anticipated to hold the largest share of the cloud-native application protection platform market over the predicted timeframe.

Need help to buy this report?