Global Closed Molding Composites Market Size, Share, and COVID-19 Impact Analysis, By Application (Aerospace, Automotive, Marine, Wind Energy, Consumer Goods), By Resin Type (Epoxy, Polyester, Vinyl Ester, Phenolic, Polyurethane), By Manufacturing Process (Vacuum Infusion, Resin Transfer Molding, Compression Molding, Filament Winding), By End Use Industry (Transportation, Construction, Electrical Electronics, Sporting Goods), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Closed Molding Composites Market Insights Forecasts to 2033

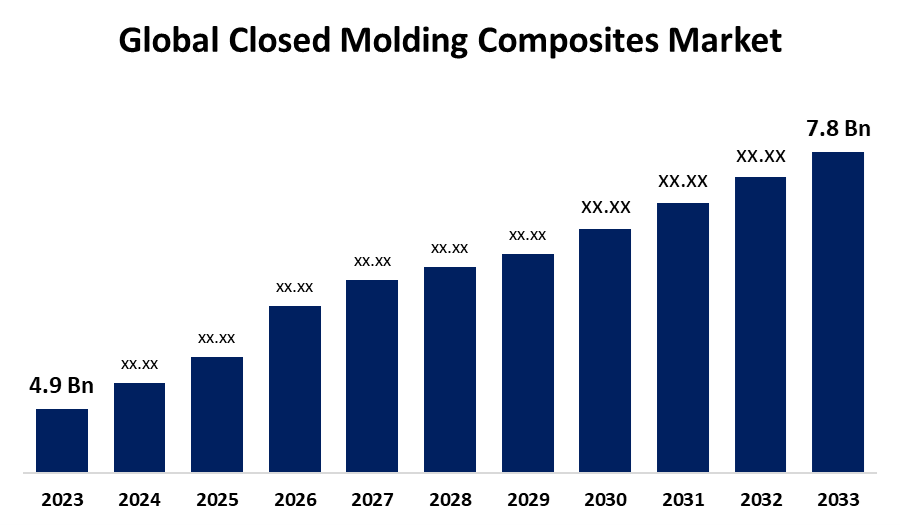

- The Global Closed Molding Composites Market was valued at USD 4.9 billion in 2023.

- The Market is Growing at a CAGR of 4.76% from 2023 to 2033.

- The Worldwide Closed Molding Composites Market is expected to reach USD 7.8 billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Closed Molding Composites Market Size is expected to reach USD 7.8 billion by 2033, at a CAGR of 4.76% during the forecast period 2023 to 2033.

The closed molding composites market is witnessing robust growth, driven by demand for lightweight, durable, and high-performance materials across industries such as automotive, aerospace, construction, and wind energy. This manufacturing process, which includes techniques like resin transfer molding (RTM) and vacuum infusion, offers advantages such as reduced material waste, lower emissions, and superior surface finishes compared to traditional open molding. Increasing focus on sustainability and energy efficiency further boosts its adoption. Advanced materials like carbon fiber-reinforced composites enhance the market’s appeal for high-strength and lightweight applications. Key regions, including North America, Europe, and Asia-Pacific, are seeing heightened adoption due to advancements in composite technologies and growing industrialization. Continuous innovation and partnerships among manufacturers drive market competitiveness and expansion.

Closed Molding Composites Market Value Chain Analysis

The closed molding composites market value chain encompasses raw material suppliers, composite manufacturers, distributors, and end-users. It begins with suppliers providing essential materials such as resins, fibers (glass, carbon, aramid), and additives, which are critical for performance and sustainability. Composite manufacturers employ closed molding processes like resin transfer molding (RTM) and vacuum infusion to produce high-quality, low-emission composite products. These are then distributed through channels that cater to industries such as automotive, aerospace, construction, and wind energy. End-users demand lightweight, durable, and sustainable solutions, driving innovation across the value chain. Integration of digital tools and automation enhances production efficiency, while partnerships and collaborations among stakeholders ensure supply chain optimization, cost-effectiveness, and the development of advanced composite technologies.

Closed Molding Composites Market Opportunity Analysis

The closed molding composites market presents significant growth opportunities driven by rising demand for lightweight, high-strength materials across industries such as automotive, aerospace, and renewable energy. Increasing environmental regulations and the need for low-emission production methods favor the adoption of closed molding techniques like resin transfer molding (RTM) and vacuum infusion. The wind energy sector, in particular, offers lucrative prospects due to the growing installation of large-scale wind turbines requiring durable and lightweight components. Emerging markets in Asia-Pacific and Latin America provide untapped potential, fueled by rapid industrialization and infrastructure development. Advances in material science, including bio-based and recyclable composites, open avenues for sustainable innovation. Additionally, collaborations between manufacturers and technology providers enable the development of cost-effective, high-performance solutions, further expanding market opportunities.

Global Closed Molding Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.9 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.76% |

| 2033 Value Projection: | USD 7.8 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Application, By Resin Type, By Manufacturing Process, By End Use Industry, By Region |

| Companies covered:: | Some of the key market players of the market are Hexcel, Royal DSM, Sika, Fiberline, BASF, AOC Aliancys, Polymer Composites, Composites One, Olin Corporation, Corteva, Scott Bader, Hexion, Gurit, Showa Denko, Mitsubishi Chemical. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Market Dynamics

Closed Molding Composites Market Dynamics

Growing Demand for Lightweight Materials

The growing demand for lightweight materials is a key driver of growth in the closed molding composites market. Industries such as automotive, aerospace, and wind energy increasingly prioritize weight reduction to improve fuel efficiency, performance, and sustainability. Closed molding processes, including resin transfer molding (RTM) and vacuum infusion, are ideal for producing lightweight composites with superior strength and durability. These materials enable manufacturers to meet stringent environmental regulations and achieve energy efficiency goals. In the automotive sector, lightweight composites help reduce emissions, while in aerospace, they enhance fuel economy and load capacity. The wind energy sector benefits from lightweight yet strong materials for turbine blades.

Restraints & Challenges

The closed molding composites market faces several challenges despite its growth potential. High initial investment costs for equipment and tooling pose a barrier, particularly for small and medium-sized manufacturers. The complexity of closed molding processes, such as resin transfer molding (RTM) and vacuum infusion, requires skilled labor and advanced technology, limiting adoption in regions with insufficient technical expertise. Raw material costs, including resins and fibers like carbon and glass, fluctuate, impacting overall production costs and pricing. Sustainability concerns also pressure manufacturers to adopt recyclable or bio-based materials, which may not always match the performance or cost-efficiency of traditional composites. Additionally, competition from alternative materials, such as metals and thermoplastics, challenges market penetration. Addressing these obstacles through innovation, cost optimization, and skill development is critical for market growth.

Regional Forecasts

North America Market Statistics

Get more details on this report -

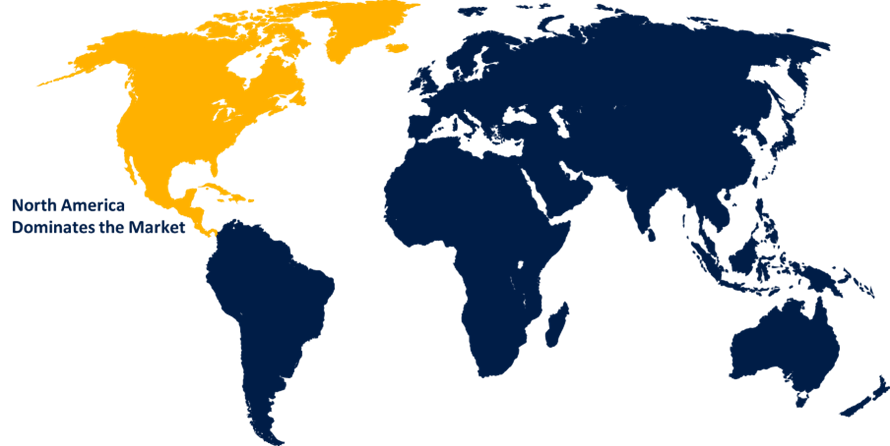

North America is anticipated to dominate the Closed Molding Composites Market from 2023 to 2033. North America is a significant market for closed molding composites, driven by advanced industrial sectors such as automotive, aerospace, and wind energy. The region's focus on lightweight and high-performance materials aligns with the benefits of closed molding processes, including reduced waste, lower emissions, and superior product quality. The U.S. leads in adoption, supported by investments in aerospace innovations and renewable energy projects, such as wind turbine installations. The automotive industry emphasizes lightweight composites to meet stringent fuel efficiency and emissions standards. Additionally, the region benefits from a well-established supply chain, advanced manufacturing infrastructure, and a skilled workforce. The push toward sustainability and the development of bio-based and recyclable composites further bolster market growth. Collaboration among stakeholders enhances innovation and strengthens North America's leadership in the global closed molding composites market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific region is a rapidly growing market for closed molding composites, fueled by expanding automotive, construction, and wind energy industries. Countries like China, India, and Japan are driving demand, leveraging industrial growth, urbanization, and renewable energy initiatives. The region’s automotive sector increasingly adopts lightweight composites to enhance fuel efficiency and reduce emissions, while the construction industry benefits from durable and corrosion-resistant materials for infrastructure projects. Asia-Pacific’s strong presence in wind turbine manufacturing supports the use of closed molding processes for producing robust and lightweight components. Cost-effective manufacturing and abundant raw material availability further boost regional growth. However, challenges such as limited technical expertise and environmental concerns prompt manufacturers to invest in skill development and sustainable composite solutions, positioning Asia-Pacific as a key player in the global market.

Segmentation Analysis

Insights by Product

The aerospace segment accounted for the largest market share over the forecast period 2023 to 2033. The aerospace segment is a major driver of growth in the closed molding composites market, fueled by the industry’s demand for lightweight, high-strength materials to enhance fuel efficiency and performance. Closed molding techniques, such as resin transfer molding (RTM) and vacuum infusion, are ideal for producing complex, high-quality composite components with precision and minimal waste. These materials are extensively used in aircraft structures, including fuselages, wings, and interiors, to reduce weight without compromising strength or safety. The rise of next-generation aircraft, including electric and unmanned aerial vehicles, further boosts demand for advanced composites. Stringent regulations on emissions and increasing focus on sustainability encourage the adoption of bio-based and recyclable composites in aerospace applications, making the segment a critical contributor to market growth.

Insights by Resin Type

The epoxy segment accounted for the largest market share over the forecast period 2023 to 2033. The epoxy segment is witnessing significant growth in the closed molding composites market due to its exceptional mechanical properties, versatility, and strong adhesion. Epoxy resins are widely used in industries such as automotive, aerospace, wind energy, and construction for their superior strength-to-weight ratio, chemical resistance, and durability. In closed molding processes like resin transfer molding (RTM) and vacuum infusion, epoxy resins deliver precise and high-quality results, making them ideal for complex and demanding applications. The wind energy sector particularly drives demand, with epoxy-based composites used in manufacturing lightweight and durable wind turbine blades. Additionally, advancements in epoxy formulations, including bio-based and recyclable options, align with sustainability goals, further boosting adoption. Rising industrialization in emerging economies adds to the epoxy segment's growth potential.

Insights by Manufactuing Process

The vacuum infusion segment accounted for the largest market share over the forecast period 2023 to 2033. The vacuum infusion segment is experiencing robust growth within the closed molding composites market, driven by its ability to produce high-quality, lightweight, and cost-effective composite parts. This process is particularly favored for large, complex structures, such as automotive body panels, marine components, and wind turbine blades, due to its ability to uniformly distribute resin and minimize voids in the final product. Vacuum infusion’s efficiency and low emissions make it an environmentally friendly alternative to traditional molding techniques, aligning with the growing demand for sustainable manufacturing processes. Additionally, its compatibility with advanced materials like carbon fiber and epoxy resins further fuels its adoption across industries like aerospace and automotive. As the demand for high-performance and lightweight composites continues to rise, the vacuum infusion segment is poised for continued growth, especially in regions like North America and Europe.

Insights by End Use Industry

The transportation segment accounted for the largest market share over the forecast period 2023 to 2033. The transportation segment is a key growth driver in the closed molding composites market, particularly in automotive, rail, and marine industries. Increasing demand for lightweight materials to enhance fuel efficiency, reduce emissions, and improve performance is propelling the use of closed molding composites in transportation applications. In the automotive industry, composites help reduce vehicle weight, leading to better fuel economy and lower carbon footprints, in line with stringent emission regulations. Similarly, marine and rail sectors benefit from composites’ resistance to corrosion, durability, and lightweight characteristics. Closed molding techniques, such as resin transfer molding (RTM) and vacuum infusion, are particularly valuable for manufacturing complex, high-strength parts with precision. As the transportation industry continues to prioritize sustainability and efficiency, the adoption of closed molding composites is expected to grow steadily across all sub-sectors.

Recent Market Developments

- In May 2020, Huntsman Advanced Materials has finalized its acquisition of CVC Thermoset Specialties, a US-based company specializing in industrial composites.

Competitive Landscape

Major players in the market

- Hexcel

- Royal DSM

- Sika

- Fiberline

- BASF

- AOC Aliancys

- Polymer Composites

- Composites One

- Olin Corporation

- Corteva

- Scott Bader

- Hexion

- Gurit

- Showa Denko

- Mitsubishi Chemical

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Closed Molding Composites Market, Application Analysis

- Aerospace

- Automotive

- Marine

- Wind Energy

- Consumer Goods

Closed Molding Composites Market, Resin Type Analysis

- Epoxy

- Polyester

- Vinyl Ester

- Phenolic

- Polyurethane

Closed Molding Composites Market, Manufacturing Process Analysis

- Vacuum Infusion

- Resin Transfer Molding

- Compression Molding

- Filament Winding

Closed Molding Composites Market, End Use Industry Analysis

- Transportation

- Construction

- Electrical Electronics

- Sporting Goods

Closed Molding Composites Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Closed Molding Composites Market?The global Closed Molding Composites Market is expected to grow from USD 4.9 billion in 2023 to USD 7.8 billion by 2033, at a CAGR of 4.76% during the forecast period 2023-2033.

-

Who are the key market players of the Closed Molding Composites Market?Some of the key market players of the market are Hexcel, Royal DSM, Sika, Fiberline, BASF, AOC Aliancys, Polymer Composites, Composites One, Olin Corporation, Corteva, Scott Bader, Hexion, Gurit, Showa Denko, Mitsubishi Chemical.

-

Which segment holds the largest market share?The aerospace segment holds the largest market share and is going to continue its dominance.

-

Which region dominates the Closed Molding Composites Market?North America dominates the Closed Molding Composites Market and has the highest market share.

Need help to buy this report?