Global Clinical Trial Supply and Logistics for Pharmaceutical Market Size, Share, and COVID-19 Impact Analysis, By Clinical Trial Phase (Phase I, Phase II, Phase III, and Phase IV), By Product Type (Biologics, Synthetic Pharmaceuticals, Vaccines, and Combination Products), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Clinical Trial Supply and Logistics for Pharmaceutical Market Insights Forecasts to 2035

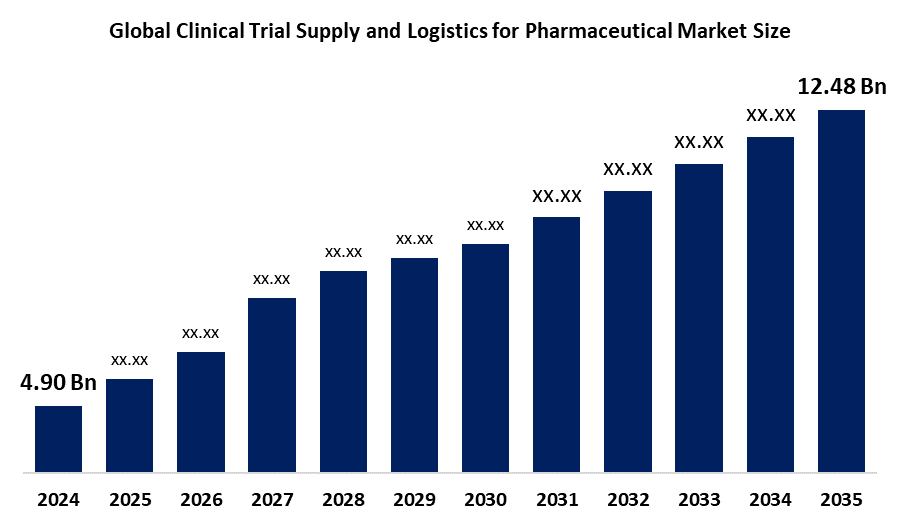

- The Global Clinical Trial Supply and Logistics for Pharmaceutical Market Size Was Estimated at USD 4.90 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.87% from 2025 to 2035

- The Worldwide Clinical Trial Supply and Logistics for Pharmaceutical Market Size is Expected to Reach USD 12.48 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Clinical Trial Supply and Logistics for Pharmaceutical Market Size was worth around USD 4.90 Billion in 2024 and is predicted to grow to around USD 12.48 Billion by 2035 with a compound annual growth rate (CAGR) of 8.87% from 2025 and 2035. The market for clinical trial supply and logistics for pharmaceuticals has several opportunities to grow due to the strict cold chain, specialized packaging, real time tracking, and global regulatory compliance, which are required due to the growing volume and complexity of drug development, especially in biologics, precision medicines, gene treatments, and rare diseases.

Market Overview

The clinical trial supply and logistics for pharmaceutical market is a critical sector in the pharmaceutical industry, focused on the timely and efficient delivery of investigational drugs and materials needed for clinical trials. This market is critical to ensuring clinical trial sites, pharmaceutical companies, and contract research organizations have the required supplies at all times during the clinical trial process. The U.S. Food and Drug Administration reports that there are over 7,000 clinical trials conducted in the U.S. each year, which reflects the growing demand for robust and effective clinical research supply chain management. An important trend in this market is the growth in the adoption of end-to-end clinical trial logistics solutions. These solutions provide comprehensive services and integrate multiple supply chain components from procurement to delivery, and guarantee that the clinical trial material will arrive in full and on time at the appropriate location, complete and intact. An essential part of this development is the management of the supply chain in clinical trials, which ensures that there is increased control and visibility of all operations in the supply chain.

Government programs for clinical trial supply and logistics frequently concentrate on supply chain security, transparency, regulatory harmonization, and expediting authorizations. To streamline multinational studies, for instance, the Clinical Studies Regulation in the EU created a single gateway for trial applications and uniform guidelines throughout member states. This is enhanced by the Accelerating Clinical Trials in the EU program, which assists with training, regulatory assistance, and administrative burden reduction. Enhancing supply chain resilience for medicines and APIs in the United States is the goal of Executive Order 14017 and other FDA measures. This includes improved import monitoring, domestic manufacture, and flexibility in handling shortages.

Report Coverage

This research report categorizes the clinical trial supply and logistics for pharmaceutical market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the clinical trial supply and logistics for pharmaceutical market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the clinical trial supply and logistics for pharmaceutical market.

Clinical Trial Supply and Logistics for Pharmaceutical Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.90 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.87% |

| 2035 Value Projection: | USD 12.48 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Clinical Trial Phase, By Product Type and By Region |

| Companies covered:: | Thermo Fisher Scientific, Catalent Pharma Solutions, Marken, UPS Healthcare, PAREXEL, Almac Group, WuXi AppTec, Lonza, Nagel, World Courier, Biocair, DHL Life Sciences, DB Schenker, Celerion, World Logistics Cargo, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The clinical trial supply and logistics for pharmaceutical market is driven by its contribution to the clinical trial supply and logistics markets. Extensive research and development of novel medications is required due to the growing prevalence of chronic diseases, such as diabetes, cancer, and cardiovascular issues. Noncommunicable diseases are responsible for 71% of deaths globally, according to the World Health Organization. As a result, the urgency for treatment options is paramount. Additionally, the COVID-19 pandemic has increased clinical trials generally, but particularly in vaccine research, demonstrating the importance of robust supply chain logistics in meeting previously unheard-of demand. Additionally, emerging technologies, such as AI and real time tracking systems, are facilitating supply chain logistics, reducing risk for errors, and are a positive contributor to market growth.

Restraining Factors

The clinical trial supply and logistics for pharmaceutical market are restricted by factors like compliance with regulations. As a result, failure to comply can result in costly delays or penalties that may prevent the company from launching clinical trials. Additionally, global supply chain disruption due to events like natural disasters or geopolitical conflict can delay trial timelines and potentially disrupt the availability of materials used in trials.

Market Segmentation

The clinical trial supply and logistics for pharmaceutical market share is classified into clinical trial phase and product type.

- The phase III segment dominated the market in 2024, accounting for approximately 43.64% and is projected to grow at a substantial CAGR during the forecast period.

Based on the clinical trial phase, the clinical trial supply and logistics for pharmaceutical market are divided into phase I, phase II, phase III, and phase IV. Among these, the phase III segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven due to the utilization and complexity, which can include thousands of individuals at numerous sites and multiple countries. For such large studies, thoughtful planning of the supply chain is required to ensure consistency and compliance at each trial site. For example, an investigational drug and supporting components must be provided in a timely and reliable manner. Additionally, as Phase III studies are an important part of the drug development process, they account for a major portion of clinical trial budgets, approximately 40% of global budgets.

- The biologics segment accounted for the largest share in 2024, accounting for approximately 7.5% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the clinical trial supply and logistics for pharmaceutical market are divided into biologics, synthetic pharmaceuticals, vaccines, and combination products. Among these, the biologics segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the uptick of products that require sophisticated types of treatment, such as gene therapies, monoclonal antibodies, and precision medicine. These products often require complicated storage requirements, specialized packaging, and regulated temperature-controlled logistics. Supply chain efficiencies are being developed through medical cryopreservation systems, just in time deliveries, and real time monitoring.

Regional Segment Analysis of the Clinical Trial Supply and Logistics for Pharmaceutical Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share and capture 38.33% of the clinical trial supply and logistics for pharmaceutical market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share and capture 38.33% of the clinical trial supply and logistics for pharmaceutical market over the predicted timeframe. In the North America market, the rise is due to the region's robust healthcare system, high concentration of biotechnology and pharmaceutical companies, and substantial investment in research and development, which provides the driving force behind this expansion. Market expansion is also supported through the use of advancements in technology, such as digital supply chain advancements, decentralized trials, and cold chain solutions.

Asia Pacific is expected to grow at a rapid CAGR and capture 8.5% in the clinical trial supply and logistics for pharmaceutical market during the forecast period. The Asia Pacific area has a thriving market for clinical trial supply and logistics for pharmaceutical due to the expanding pharmaceutical industries in countries like China and India, increasing biopharmaceutical investment, and increasing demand for cold chain logistics to support temperature sensitive product clinical trials. The rise of clinical research centers in cities like Beijing, Shanghai, and Guangzhou, as well as favorable regulatory changes, also assists market growth in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the clinical trial supply and logistics for pharmaceutical market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Recent Development

- In May 2023, Thermo Fisher Scientific partnered with Pfizer in January 2025 to implement blockchain based traceability across 10,000 clinical trial shipments, enhancing supply chain transparency.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the clinical trial supply and logistics for pharmaceutical market based on the below-mentioned segments:

Global Clinical Trial Supply and Logistics for Pharmaceutical Market, By Clinical Trial Phase

- Phase I

- Phase II

- Phase III

- Phase IV

Global Clinical Trial Supply and Logistics for Pharmaceutical Market, By Product Type

- Biologics

- Synthetic Pharmaceuticals

- Vaccines

- Combination Products

Global Clinical Trial Supply and Logistics for Pharmaceutical Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the clinical trial supply and logistics for pharmaceutical market over the forecast period?The global clinical trial supply and logistics for pharmaceutical market is projected to expand at a CAGR of 8.87% during the forecast period.

-

2. What is the market size of the clinical trial supply and logistics for pharmaceutical market?The global clinical trial supply and logistics for pharmaceutical market size is expected to grow from USD 4.90 Billion in 2024 to USD 12.48 Billion by 2035, at a CAGR of 8.87% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the clinical trial supply and logistics for pharmaceutical market?North America is anticipated to hold the largest share of the Clinical Trial Supply and Logistics for Pharmaceutical market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global clinical trial supply and logistics for pharmaceutical market?Thermo Fisher Scientific, Catalent Pharma Solutions, Marken, UPS Healthcare, PAREXEL, Almac Group, WuXi AppTec, Lonza, Nagel, World Courier, Biocair, DHL Life Sciences, DB Schenker, Celerion, World Logistics Cargo, and Others.

-

5. What factors are driving the growth of the clinical trial supply and logistics for pharmaceutical market?The clinical trial supply and logistics for pharmaceutical market growth are driven by the growing complexity of contemporary treatments, such as gene and biologic therapies, which require for specialized packaging and strict temperature control. In order to handle a variety of regulatory requirements and guarantee the timely delivery of clinical supplies, the globalization of clinical trials calls on effective logistics.

-

6. What are the market trends in the clinical trial supply and logistics for pharmaceutical market?The clinical trial supply and logistics for pharmaceutical market trends include decentralized clinical trials, cold chain optimization, technological integration, sustainability initiatives, and personalized medicine impact.

-

7. What are the main challenges restricting wider adoption of the clinical trial supply and logistics for pharmaceutical market?The clinical trial supply and logistics for pharmaceutical market trends include the high operational expenses of maintaining cold chain logistics for medications that are sensitive to temperature changes, as well as the intricate and dispersed regulatory frameworks in various geographical areas.

Need help to buy this report?