Global Chondroitin Sulfate Market Size, By Source (Bovine, Swine, Poultry, Shark, Synthetic, Others), By Form (Powder, Capsules), By Application (Nutraceuticals, Pharmaceuticals, Animal Feed, Personal Care & Cosmetics, Others), By Distribution Channel (Direct/B2B, Indirect/B2C, Drug Stores, Pharmacies, Online Retail, Others), By Geographic Scope and Forecast, 2023 - 2032

Industry: Specialty & Fine ChemicalsGlobal Chondroitin Sulfate Market Insights Forecasts to 2032

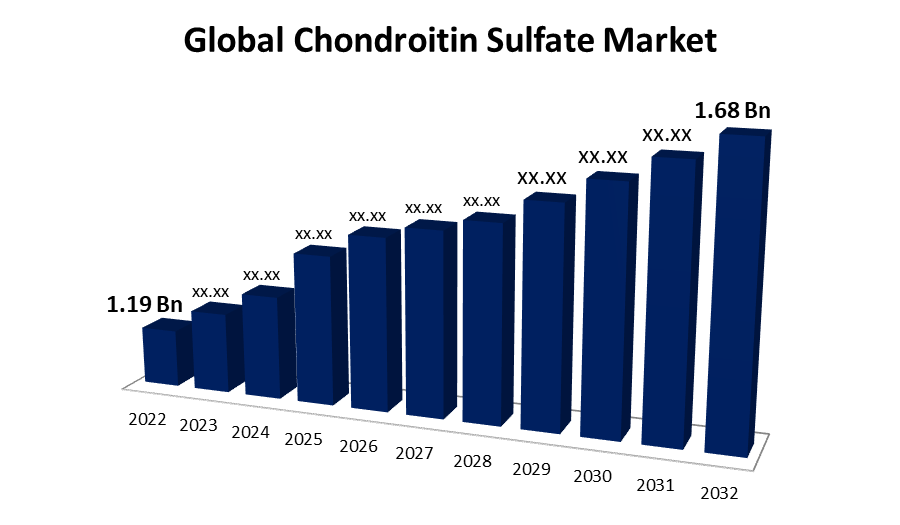

- The Chondroitin Sulfate Market Size was valued at USD 1.19 Billion in 2022.

- The Market Size is Growing at a CAGR of 3.5% from 2022 to 2032

- The Global Chondroitin Sulfate Market is expected to reach USD 1.68 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Chondroitin Sulfate Market Size is expected to reach USD 1.68 Billion by 2032, at a CAGR of 3.5% during the forecast period 2022 to 2032.

Chondroitin sulfate is a naturally occurring chemical that can be found in joint cartilage and connective tissues throughout the body. A glycosaminoglycan is a complex carbohydrate that assists in providing elasticity and resistance to compressive stresses. Chondroitin sulfate is a dietary supplement that is often used to treat osteoarthritis. It is occasionally combined with glucosamine. It is proposed to aid in cartilage regeneration by enhancing water retention and suppleness. This helps to cushion the joints and relieve pain. Aside from being utilized as a supplement, chondroitin sulfate is also used in certain eye procedures to assist keep the eye shape during the process. It has also been explored for its use in wound healing and skin repair. In recognition of its moisturizing characteristics, chondroitin sulfate is occasionally utilized in cosmetic products, notably in skincare formulas where it aids in moisture retention. Furthermore, the efficacy of chondroitin sulfate in the treatment of osteoarthritis has been debated, with research yielding conflicting results. However, numerous individuals claim symptom relief when using it. As the world's population ages, the prevalence of joint-related problems such as osteoarthritis rises, fueling demand for supplements that offer treatment. With the improved availability of knowledge and medical treatment, there is a growing awareness of the importance of joint health and preventive care, which is expected to boost the chondroitin sulfate market. Moreover, increased demand for nutraceutical offerings in emerging nations prompted by rising health concerns is also expected to drive market expansion.

Market Outlook

Chondroitin Sulfate Market Price Analysis

The pricing trends of the chondroitin sulfate market are driven by a combination of supply chain complexities, raw material availability, and worldwide demand developments. On the supply side, the key sources of chondroitin sulfate, such as bovine, porcine, and marine cartilage, have a significant impact on pricing. Fluctuations in the livestock industry, fishing laws, or outbreaks of animal-related diseases can all have an impact on the cost of raw materials and, as a result, end product pricing. Given the stringent criteria necessary for nutritional supplements or pharmaceutical purposes, the processing, purification, and certification of chondroitin sulfate adds additional layers of cost. On the demand spectrum, the increasing global awareness about joint health, coupled with an aging population seeking osteoarthritis relief, underpins a robust market appetite. This strong demand, especially from dominant markets like North America and Europe, are expected to drive prices upwards.

Chondroitin Sulfate Market Growth Analysis

The chondroitin sulfate market has grown significantly, owing to its therapeutic benefits for improving the condition of the joints. Its popularity as a component of dietary supplements for osteoarthritis management has skyrocketed, particularly among the world's elderly population. This generational transition, marked by an increase in the number of people suffering from joint disorders, gives an enormous boost to market expansion. Furthermore, technological advances in extraction and purification processes have increased manufacturing efficiency, resulting in larger yields and higher product quality. Such breakthroughs, when combined with strong R&D, are critical to generating market expansion. Furthermore, increased consumer understanding and instruction regarding osteoarthritis and joint health, driven by healthcare campaigns and professionals, has increased chondroitin's market share. The proliferation of distribution channels, particularly e-commerce platforms, has increased the accessibility of chondroitin sulfate goods to a global audience, facilitating the growth of the chondroitin sulfate market.

Global Chondroitin Sulfate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.19 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.5% |

| 2032 Value Projection: | USD 1.68 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Source, By Application, By Distribution Channel and By Geographic Scope |

| Companies covered:: | TSI Group Ltd., Qingdao Wan Toulmin Biological Sources Co., Ltd., Hebei SanXin Industrial Group, Bioiberica SAU, Sigma Aldrich, Inc., ZPD, Sino Siam Biotechnique Company Ltd., BRF, Bio-gen Extracts Pvt. Ltd., Seikagaku Corp., Pacific Rainbow International, Inc., Sichuan Biosyn Pharmaceutical Co., Ltd., Inter Farma, Jiaxing Hengjie Bio-pharmaceutical LLC, Bioibérica S.A., Dextra Laboratories Limited and Others. |

| Growth Drivers: | Rising prevalence of joint-related ailments in aging population |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Chondroitin Sulfate Market Dynamics

Rising prevalence of joint-related ailments in aging population

As the world's population ages, there is an increase in age-related health concerns, primarily those relating to joint health, such as osteoarthritis. Osteoarthritis, characterized by the breakdown of cartilage in joints, can cause pain, stiffness, and decreased mobility. Chondroitin sulfate has become a popular supplement for treating and potentially alleviating these symptoms, primarily due to its potential benefits in cartilage repair and joint lubrication. Increased demand for chondroitin sulfate products is directly related to this demographic and rising health trends. As more individuals seek ways to relieve joint pain while further enhancing joint function, the market for chondroitin sulfate is expanding rapidly.

Restraints & Challenges

Scientific Controversy and Inconsistent Clinical Study Results

The health advantages of chondroitin sulfate, particularly its usefulness in the treatment of osteoarthritis, have been a source of contention in the medical and scientific communities. While some studies demonstrate that the practice has a beneficial impact on joint health, others fail to uncover any substantial benefits. The market for chondroitin sulfate may be hampered by conflicting scientific evidence. Healthcare providers that rely on evidence-based practices may be hesitant to recommend chondroitin sulfate to their patients. Similarly, savvy consumers who are aware of the inconclusive data may choose alternative therapies or supplements thought to be more successful, influencing market demand for chondroitin sulfate.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the chondroitin sulfate market from 2023 to 2032. The United States, in particular, is a major consumer base for chondroitin sulfate. The growing older demographics, increased knowledge of joint health, and the broad availability of joint health nutritional supplements all contribute to its demand. In addition, the increasing frequency of osteoarthritis in the United States has resulted in an increase in the usage of joint health supplements such as chondroitin sulfate. Furthermore, robust distribution channels, such as online platforms and drug stores, have made available easy access for customers, driving market chondroitin sulfate expansion in this region even further.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. With nations such as China, India, and Japan, Asia Pacific is growing as a major player in the chondroitin sulfate market. China, in particular, is a major consumer as well as an exporter and manufacturer of chondroitin sulfate. The region's growing middle-class population, combined with rising disposable incomes, has increased demand for high-quality healthcare items and nutritional supplements. Furthermore, the historic preference for natural medicines in countries such as India and China support the industry. With an elderly population and a sophisticated healthcare system, Japan is a significant user of chondroitin sulfate products.

Segmentation Analysis

Insights by Source

The bovine segment accounted for the largest market share over the forecast period 2023 to 2032. This is due to the rising use of the source in a number of application industries around the world, including medicinal products, personal-care products & cosmetics, and nutraceuticals. Bovine chondroitin sulfate is a common source of this chemical and is obtained from bovine cartilage. It is frequently utilized in medications and dietary supplements. It is widely used in the nutritional supplement industry, notably in products intended to enhance joint health. Furthermore, bovine chondroitin sulfate is a well-established market ingredient that is frequently regarded as a dependable and effective source. It also has a variety of uses in joint health products and is well-known among end users, which drives demand.

Insights by Form

The capsules segment accounted for the largest market share over the forecast period 2023 to 2032. Chondroitin sulfate capsules are made out of chondroitin sulfate powder encapsulated in a soluble gelatin or cellulose shell. Capsules are designed to be taken orally and dissolve in the stomach, releasing chondroitin sulfate. Capsules provide consumers with convenience because they give pre-measured quantities, are easy to swallow, and may be used on the move. It also provides some protection for chondroitin sulfate, keeping its potency. These are mostly in the dietary supplement industry, namely in the joint health area. Given that they are easy to include in a person's routine, capsules are a popular choice for daily vitamins.

Insights by Application

The nutraceutical segment accounted for the largest market share over the forecast period 2023 to 2032, primarily because of the widespread consumption of chondroitin as a dietary supplement for joint health. Chondroitin sulfate is a popular dietary supplement, particularly in joint health formulations. It is commonly combined with glucosamine to promote joint function and reduce osteoarthritis symptoms. The nutraceutical sector regards chondroitin sulfate for its ability to promote joint health, reduce pain, and improve mobility. The increased global incidence of osteoarthritis, as well as an older population concerned with joint health, are contributing to its use in the nutraceutical sector.

Insights by Distribution Channel

The online retail segment accounted for the largest market share over the forecast period 2023 to 2032. Because of the ease it provides to consumers, the online retail category, which includes e-commerce platforms, has experienced substantial expansion in recent years. The commercialization of chondroitin sulfate via e-commerce platforms and websites is accounted for in the online retail section. Customers can explore, buy, and have the product delivered to their homes.

Competitive Landscape

Major players in the market

- TSI Group Ltd.

- Qingdao Wan Toulmin Biological Sources Co., Ltd.

- Hebei SanXin Industrial Group

- Bioiberica SAU

- Sigma Aldrich, Inc.

- ZPD

- Sino Siam Biotechnique Company Ltd.

- BRF

- Bio-gen Extracts Pvt. Ltd.

- Seikagaku Corp.

- Pacific Rainbow International, Inc.

- Sichuan Biosyn Pharmaceutical Co., Ltd.

- Inter Farma

- Jiaxing Hengjie Bio-pharmaceutical LLC

- Bioibérica S.A.

- Dextra Laboratories Limited

Recent Market Developments

- On June 2022, Eggnovo (Navarro, Spain) has inked an agreement with Nutralliance (Yorba Linda, CA) to represent and promote the company's Ovoderm and Ovomet components in the United States. The ingredients' principal purpose is to be used as a vegetarian collagen. Eggnovo's focuses on useful chicken eggshell components that can be used in the nutraceutical, cosmetic, and pharmaceutical industries.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Chondroitin Sulfate Market, Source Analysis

- Bovine

- Swine

- Poultry

- Shark

- Synthetic

- Others

Chondroitin Sulfate Market, Form Analysis

- Powder

- Capsules

Chondroitin Sulfate Market, Application Analysis

- Nutraceuticals

- Pharmaceuticals

- Animal Feed

- Personal Care & Cosmetics

- Others

Chondroitin Sulfate Market, Distribution Channel Analysis

- Direct/B2B

- Indirect/B2C

- Drug Stores

- Pharmacies

- Online Retail

- Others

Chondroitin Sulfate Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the chondroitin sulfate market?The global chondroitin sulfate market is expected to grow from USD 1.19 Billion in 2023 to USD 1.68 Billion by 2032, at a CAGR of 3.5% during the forecast period 2023-2032.

-

2.Who are the key market players of the chondroitin sulfate market?TSI Group Ltd., Qingdao Wan Toulmin Biological Sources Co., Ltd., Hebei SanXin Industrial Group, Bioiberica SAU, Sigma Aldrich, Inc., ZPD, Sino Siam Biotechnique Company Ltd., BRF, Bio-gen Extracts Pvt. Ltd., Seikagaku Corp., Pacific Rainbow International, Inc., Sichuan Biosyn Pharmaceutical Co., Ltd., Inter Farma, Jiaxing Hengjie Bio-pharmaceutical LLC, Bioibérica S.A., Dextra Laboratories Limited

-

3.Which segment holds the largest market share?Deep learning segment holds the largest market share and is going to continue its dominance.

-

4.Which region is dominating the chondroitin sulfate market?North America is dominating the chondroitin sulfate market with the highest market share.

Need help to buy this report?