Global Cholesterol Testing Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Test Kits & Reagents, Cholesterol Analyzers, Cholesterol Test Strips, Lipid Profile Panels, and Lancets & Capillary Tubes), By Test Type (Total Cholesterol Test, High-Density Lipoprotein (HDL) Test, Low-Density Lipoprotein (LDL) Test, Triglycerides Test, and Comprehensive Lipid Panel (CLP)), By Mode of Testing (Home-Based Testing, Point-Of-Care Testing (POCT), and Laboratory-Based Testing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Cholesterol Testing Products Market Insights Forecasts to 2035

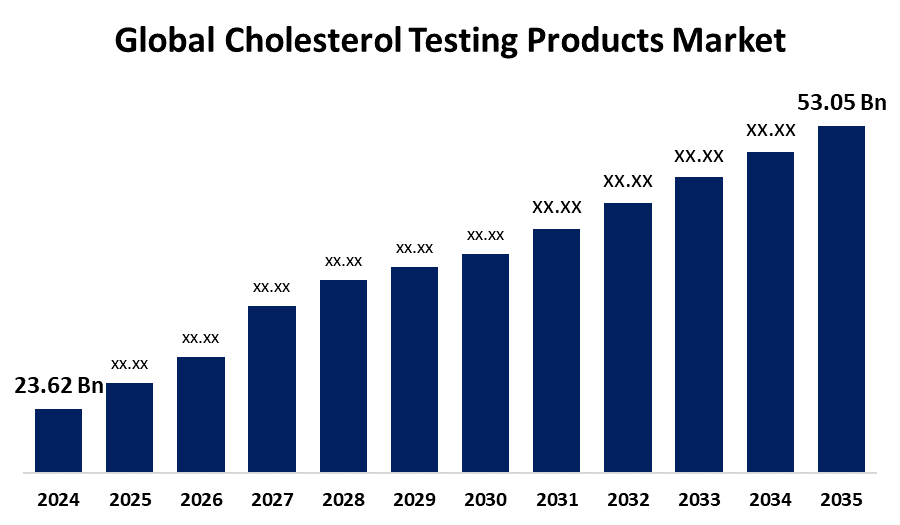

- The Global Cholesterol Testing Products Market Size Was Estimated at USD 23.62 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.63% from 2025 to 2035

- The Worldwide Cholesterol Testing Products Market Size is Expected to Reach USD 53.05 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global cholesterol testing products market size was worth around USD 23.62 billion in 2024 and is predicted to grow to around USD 53.05 billion by 2035 with a compound annual growth rate (CAGR) of 7.63% from 2025 to 2035. The increasing prevalence of cardiovascular diseases, rising awareness about regular cholesterol testing, as well as government initiatives and health screening programs, are driving the global cholesterol testing products market.

Market Overview

The cholesterol testing products market is the industry encompassing the diagnostic tools, reagents, consumables, and devices used for measuring cholesterol levels in blood samples. Cholesterol testing products are the devices and kits that are used for measuring the level of types of cholesterol, including total cholesterol, HDL, LDL, and triglycerides, in the blood. Introduction of PoC testing diagnostic devices, home test kits for cholesterol testing, is enhancing the accessibility for patients to preventative healthcare. Trend towards integration of AI into the diagnostic process aids in improving the identification the heart disease, leading to better patient care. Furthermore, supportive government regulations aid in assisting early diagnosis and treatment of cardiovascular diseases by encouraging regular cholesterol screening as a standard practice. The integration of digital health in the cholesterol testing products is creating new market growth opportunity.

Report Coverage

This research report categorizes the cholesterol testing products market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the cholesterol testing products market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the cholesterol testing products market.

Cholesterol Testing Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 1 |

| Market Size in 1: | USD 23.62 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.63% |

| 2035 Value Projection: | USD 53.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product Type, By Test Type, By Mode of Testing and COVID-19 Impact Analysis |

| Companies covered:: | Abbott Laboratories, Thermo Fisher Scientific, F. Hoffmann-La Roche AG, Roche Diagnostics, Siemens Healthineers, Danaher Corporation (Beckman Coulter), Bio-Rad Laboratories, Randox Laboratories, Nova Biomedical, PTS Diagnostics, ACON Laboratories, Bioptik Technology Inc., Sekisui Diagnostics, Alere Inc. (now part of Abbott), ARKRAY Inc, Bayer AG, Jant Pharmacal Corporation, Trividia Health, Quest Diagnostics, LabCorp, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of cardiovascular diseases is driving the demand for cholesterol testing products, as it plays a significant role in reducing cardiovascular deaths by enabling early detection and management of high cholesterol. High cholesterol is a major risk factor for heart disease and stroke in both high- and low-income countries, causing 3.6 million deaths every year. It was estimated that 24% of CVD-related deaths are attributed to high LDL cholesterol according to the World Heart Federation. Thus, an increasing cardiovascular disease cases, along with an increasing awareness about regular cholesterol testing, is driving the cholesterol testing products market. Further, government initiatives and the implementation of health screening programs for addressing leading public health crises by improving accessibility to cholesterol testing are escalating the market growth.

Restraining Factors

The lack of awareness about the significance of cholesterol testing, especially in rural areas, is restraining the cholesterol testing products market. Further, the limited accessibility of the device hinders the market growth.

Market Segmentation

The cholesterol testing products market share is classified into product type, test type, and mode of testing.

- The test kits & reagents segment dominated the market with the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the cholesterol testing products market is divided into test kits & reagents, cholesterol analyzers, cholesterol test strips, lipid profile panels, and lancets & capillary tubes. Among these, the test kits & reagents segment dominated the market with the largest share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Cholesterol testing products, including reagent kits (for instance, CHOD-PAP method), are used for in vitro quantitative determination of total cholesterol in human serum and plasma. They can be used for routine lipid profile testing and general health assessment, and are available in ready-to-use packs. An increased use of test kits and reagents in clinics and home-based settings for cholesterol testing is driving the market growth.

- The total cholesterol test segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the test type, the cholesterol testing products market is divided into total cholesterol test, high-density lipoprotein (HDL) test, low-density lipoprotein (LDL) test, triglycerides test, and comprehensive lipid panel (CLP). Among these, the total cholesterol test segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The total cholesterol blood test includes the measurement of all types of cholesterol in blood, including blood fats as a part of a lipid profile, in order to aid in determining the risk of developing heart disease. The increasing preference for total cholesterol tests among the majority of professionals due to their comprehensive coverage is driving the market growth.

- The laboratory-based testing segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the mode of testing, the cholesterol testing products market is divided into home-based testing, point-of-care testing (POCT), and laboratory-based testing. Among these, the laboratory-based testing segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Laboratory-based testing methods are based on established scientific principles and encompass all aspects of clinical laboratory, including testing the amount of cholesterol in the blood. Patient’s increasing reliance on laboratory-based tests, offering comprehensive testing capability and availability of skilled expertise, is propelling the cholesterol testing products market.

Regional Segment Analysis of the Cholesterol Testing Products Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the cholesterol testing products market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the cholesterol testing products market over the predicted timeframe. The growing awareness about routine checkups, with an increasing concern regarding the high prevalence of cardiovascular diseases, is propelling the cholesterol testing products market demand. Promoting miniaturized electronics and their positive role in developing self-testing kits, as well as increasing the need for OTC cholesterol test kits, are propelling the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the cholesterol testing products market during the forecast period. An increasing demand for better cholesterol management, including at-home cholesterol testing, is driving the market growth. Further, the presence of healthcare infrastructure and technology advancements enhancing the accessibility of testing services, along with the promotion of preventive healthcare practices supported by government initiatives, is promoting the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the cholesterol testing products market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Thermo Fisher Scientific

- F. Hoffmann-La Roche AG

- Roche Diagnostics

- Siemens Healthineers

- Danaher Corporation (Beckman Coulter)

- Bio-Rad Laboratories

- Randox Laboratories

- Nova Biomedical

- PTS Diagnostics

- ACON Laboratories

- Bioptik Technology Inc.

- Sekisui Diagnostics

- Alere Inc. (now part of Abbott)

- ARKRAY Inc

- Bayer AG

- Jant Pharmacal Corporation

- Trividia Health

- Quest Diagnostics

- LabCorp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Binah.ai, the leading provider of software-based, artificial intelligence (AI)-powered health and wellness checks, announced the addition of new critical health risk indicators, such as High Total Cholesterol, to its health and wellness check software.

- In January 2025, Ultrahuman, a pioneer in advanced health optimization technology, announced a strategic partnership with InsideTarcker, a personalized health platform supported by peer-reviewed research. InsideTracker Heart Category Test is a scientifically validated blood testing panel, assesses critical cardiovascular biomarkers, including lipid profiles, offering personalized recommendations based on the latest longevity research.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cholesterol testing products market based on the below-mentioned segments:

Global Cholesterol Testing Products Market, By Product Type

- Test Kits & Reagents

- Cholesterol Analyzers

- Cholesterol Test Strips

- Lipid Profile Panels

- Lancets & Capillary Tubes

Global Cholesterol Testing Products Market, By Test Type

- Total Cholesterol Test

- High-Density Lipoprotein (HDL) Test

- Low-Density Lipoprotein (LDL) Test

- Triglycerides Test

- Comprehensive Lipid Panel (CLP)

Global Cholesterol Testing Products Market, By Mode of Testing

- Home-Based Testing

- Point-Of-Care Testing (POCT)

- Laboratory-Based Testing

Global Cholesterol Testing Products Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the cholesterol testing products market over the forecast period?The global cholesterol testing products market is projected to expand at a CAGR of 7.63% during the forecast period.

-

2. What is the market size of the cholesterol testing products market?The global cholesterol testing products market size is expected to grow from USD 23.62 Billion in 2024 to USD 53.05 Billion by 2035, at a CAGR of 7.63% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the cholesterol testing products market?North America is anticipated to hold the largest share of the cholesterol testing products market over the predicted timeframe.

Need help to buy this report?