China Yacht Market Size, Share, By Type (Motor Yachts, Sailing Yachts, Others), By Length (Up to 20 Meters, 20-40 Meters, above 40 Meters), By Application (Private Use, Commercial Charter), China Yacht Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationChina Yacht Market Insights Forecasts to 2035

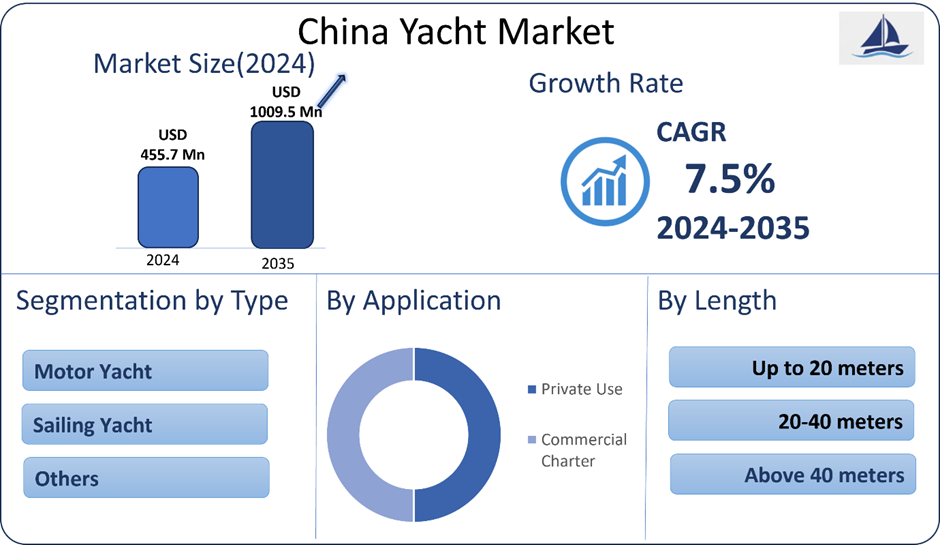

- China Yacht Market Size 2024: USD 455.7 Million

- China Yacht Market Size 2035: USD 1009.5 Million

- China Yacht Market CAGR 2024: 7.5%

- China Yacht Market Segments: By Type, By Length, and By Application

Get more details on this report -

The yacht market in China encompasses luxury motor and sailboats utilised for pleasure boating, cruising, and recreational purposes. The market has evolved from being a small importer within China into a mature domestic market supported by domestic boat building and ownership.

Yachts serve as both indicators of personal wealth and luxury experiences for the rapidly growing number of people with high net worth in china. Demand increasing for yachts in coastal areas, stimulated by a consumer-driven desire for leisure time, comparative yacht tourism, and water-related sports. An area of significant opportunity within this sector is Hainan Island, which is establishing itself as a central hub of yacht activity and has beneficial government policies and supporting infrastructure in place.

Recent advancements include hybrid or electric engines, smart devices put aboard boats, and the use of sustainable materials in boat building, all of which improve the environmental friendliness and efficiency of yacht operations. Numerous government entities control this sector, the most important of which are the Ministry of Transportation and different customs departments, which regulate yacht imports into China and enforce import fees, importation safety requirements, and environmental rules. The government's investment in the creation of a Hainan Free Trade Port, as well as tax breaks and marine tourism promotion, will continue to support the long-term expansion of the Hainan yacht industry.

Market Dynamics of the China Yacht Market:

The China yacht market is experiencing growth driven by rising disposable income and an increasing number of high-net-worth individuals, which are supporting both yacht ownership and chartering demand. Additionally, the expansion of coastal tourism, particularly in Hainan, has significantly boosted demand for luxury yachts across personal and commercial applications. The recent liberalization of Hainan's policy, i.e. tax exemption, easier imports into the province, along with domestic shipyards improving their capabilities, should continue to decrease the costs and timelines associated with yacht purchases. Additionally, the overall growth of the water sports segment, family leisure/activities, and social media is leading to increased purchases of yachts.

High import tax and duty rates outside of Hainan, limited marina space in major cities, and high maintenance costs are preventing wider-spread adoption of luxury yachts. Navigational regulations, environmental regulations, and luxury taxes are creating additional complexity to the purchase of luxury yachts. Adding to these issues is the competitive environment created by European brands as well as established domestic manufacturers affecting pricing and customization.

The overall outlook remains positive with an abundance of opportunity for larger vessels (greater than 40 meters), electric/hybrid powered vessels, chartering services, and opportunities outside of Hainan in coastal provinces. The expanding middle-class desire for luxury experiences and the expected continuing growth of infrastructure investments will continue supporting the growth of luxury yachts.

Market Segmentation

The China Yacht Market share is classified into type, length, and application.

By Type:

The China yacht market is divided by type into motor yachts, sailing yachts, and other types. While motor yachts accounted for the largest portion of the market in 2024, because they are easier to operate, go faster, perform better, are larger than sailing yachts in terms of luxury, and appeal to time-pressured high-net-worth owners who want to have convenience and prestige motor yachts continue to grow and have a strong appeal to environmentally and eco-friendly yacht buyers who want an authentic maritime experience.

By Length:

The China yacht market is classified by length into three segments: up to 20 meters, 20–40 meters, and above 40 meters. The segment of vessels between 20 and 40 meters long accounted for the largest share of the market in 2024. This dominance is driven by their combination of being large enough to provide a luxurious experience for the user, having reasonable operating and docking costs, having a layout that is suitable for use by families, and being accessible to China’s new wealth class, while not having the very high level of maintenance costs associated with larger command vessels.

By Application:

The China yacht market by application is segmented into private use and commercial charter. Private use captured the largest share of the market in 2024, as rapid growth in yacht ownership among China’s high-net-worth population continued to strengthen demand. This is linked to their desire for leisure by family, private entertainment, and vacations, as well as viewing yachts as lifestyle assets rather than purely recreational vehicles.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China Yacht Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Yacht Market:

- Sunseeker

- Azimut-Benetti

- Ferretti Group

- Princess Yachts

- Sanlorenzo

- Heysea Yachts

Recent Developments in China Yacht Market:

- In March 2024, Heysea Yachts expanded its luxury motor yacht portfolio in China, targeting demand for larger vessels from domestic high-net-worth individuals and strengthening its position as a leading local yacht builder.

- In April 2024, Azimut-Benetti Group introduced updated luxury yacht models in the China market through its regional dealer network, focusing on customization and premium onboard features to attract Chinese buyers

- In June 2024, Ferretti Group enhanced its presence in China by showcasing new-generation yachts via local distribution partners, reinforcing its focus on the growing luxury leisure and chartering segments

- In August 2024, Princess Yachts strengthened collaboration with Chinese yacht dealers and marina operators to improve sales reach and after-sales service support across major coastal provinces.

- In October 2024, Sanlorenzo presented advanced luxury yacht models in Greater China, highlighting efficient design and high-end interiors aligned with evolving customer preferences.

- In December 2024, Sunseeker continued its collaboration with local Chinese distributors to support yacht ownership and chartering demand, particularly in key coastal tourism hubs such as Hainan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Yacht Market based on the following segments

China Yacht Market, By Type

- Motor Yachts

- Sailing Yachts

- Others

China Yacht Market, By Length

- Up to 20 Meters

- 20-40 Meters

- Above 40 Meters

China Yacht Market, By Application

- Private Use

- Commercial Charter

Frequently Asked Questions (FAQ)

-

1. What is the current size of the China yacht market?The China yacht market was valued at approximately USD 455.7 million in 2024 and is expected to reach around USD 1009.5 million by 2035.

-

2. What is the growth rate of the China yacht market?The market is projected to grow at a CAGR of about 7.5% during the 2025–2035 forecast period.

-

3. How is the China yacht market defined?The China yacht market comprises luxury motor and sailing yachts used for private leisure activities, charter operations, and recreational purposes by affluent consumers.

-

4. Which type dominates the China yacht market?Motor yachts dominate the market due to their convenience, performance advantages, and strong luxury appeal.

Need help to buy this report?