China Transformer Market Size, Share, By Power Rating (Large, Medium, and Small), By End-User (Power Utilities, Industrial, Commercial, and Residential). China Transformer Market Insights, Industry Trend, Forecasts to 2035.

Industry: Energy & PowerChina Transformer Market Insights Forecasts to 2035

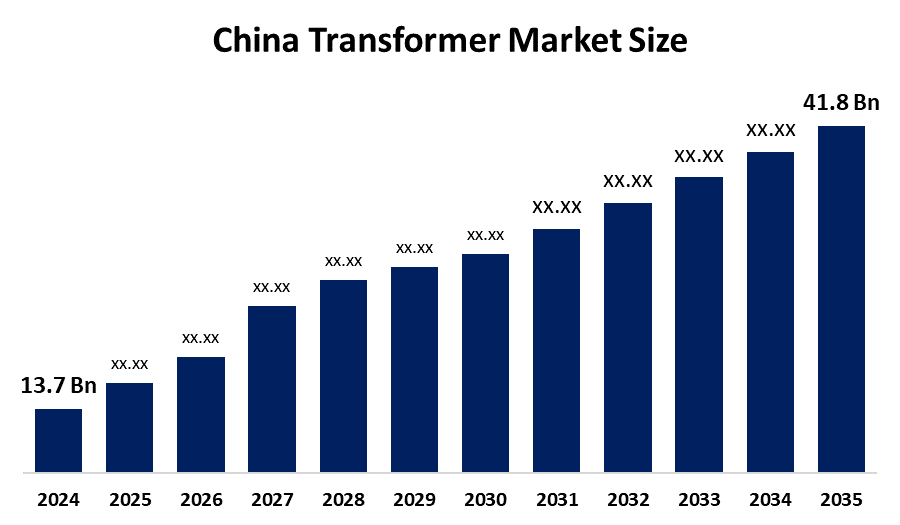

- China Transformer Market Size 2024: USD 13.7 Bn

- China Transformer Market Size 2035: USD 41.8 Bn

- China Transformer Market CAGR 2024: 10.67%

- China Transformer Market Segments: Power Rating and End-User

Get more details on this report -

The China transformer market is a large and rapidly expanding sector covering power, distribution, and specialty transformers, shifting from conventional manufacturing to high-efficiency, smart, and digital transformer technologies. It is characterized by massive electricity demand, strong government regulation and grid investment, and intense competition between domestic leaders and global players driven by energy transition needs and power sector reforms. Additionally, China’s transformer market blends its strength in large-scale manufacturing with strategic innovation in ultra-high-voltage systems, renewable energy integration, and smart grids under a unique regulatory and economic framework.

China has been heavily investing in Ultra-High Voltage (UHV) transmission lines, led by the State Grid Corporation of China, to transport large amounts of power across long distances from energy-rich regions to demand centers. This build-out includes both UHV AC and UHV DC projects spanning thousands of kilometres, forming one of the world’s largest high-voltage grids. These developments drive demand for high-capacity transformers and related electrical equipment within China’s transformer market.

The China transformer market offers the strong growth which is driven by rising electricity demand, rapid urbanization, and the expansion of renewable energy, smart grids, and the electric vehicle infrastructure. This creates the opportunities in high-efficiency, digital, and ultra-high-voltage transformers, with a shift toward higher-value manufacturing and global partnerships. Power transformers for UHV transmission, the integration of renewable energy sources, and grid modernization are the main topics, all of which are backed by the government's emphasis on energy security and carbon-reduction objectives in spite of financial constraints. Large-scale wind, solar, and energy storage projects that call for sophisticated, dependable transformer technology are another factor driving rapid expansion.

China Transformer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 10.67% |

| 2035 Value Projection: | USD 41.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 155 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Power Rating, By End-User |

| Companies covered:: | TBEA Co.,Ltd., China XD Group, JSHP Transformer / Huapeng, Baoding Tianwei Baobian, Sunten Electric Equipment, CHINT Group, Shandong Taikai Power Engineering, Huapeng Transformer, ABB / Hitachi Energy, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Transformer Market

The China transformer market is driven by the massive electricity demand, rapid urbanization, and the strong government support through grid investment and energy transition policies. The funding for ultra-high-voltage transmission, renewable integration, and the smart grids is shifting the industry from conventional equipment to high-value, efficient, and digital transformers. The need for innovative transformer solutions is increasing due to rising power consumption, electrification of industry and transportation, and increased investment on dependable energy infrastructure. China is moving from being primarily a low-cost manufacturer to a global leader in transformer technology, attracting significant investment and emerging as a key supplier to international power and grid projects.

The China transformer market faces restraints such as intense price competition driven by state-led tenders, intellectual property concerns, and varying technical standards across regions. Quality and reliability requirements for high-voltage equipment, talent gaps in advanced power electronics, supply dependence on certain core components, and geopolitical tensions further pressure innovation, margins, and profitability despite the market’s strong long-term potential.

The future of China’s transformer market looks bright and promising, which is driven by rapid technological innovation, supportive government power-sector reforms, and the rising electricity demand. Smart and digital transformers, ultra-high-voltage transmission, and renewable energy integration are creating the new growth opportunities. Additionally, China's growing power and grid infrastructure ecosystem is seeing improvements in efficiency, dependability, and system management because to developments in automation, smart manufacturing, grid digitalization, and energy storage integration.

Market Segmentation

The China Transformer Market share is classified into power rating and end-user.

By Power Rating

The China transformer market is divided by power rating into large, medium, and small. Among these, the medium segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. These transformers are critical components in high-voltage transmission and distribution networks, connecting large power plants to urban and industrial load centers.

By End-User

The China transformer market is divided by end-user power utilities, industrial, commercial, and residential. Among these, the power utilities segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Power utilities are the main entities responsible for the planning, operation, expansion, and maintenance of the national and regional electricity transmission and distribution grids.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China transformer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Transformer Market

- TBEA Co.,Ltd.

- China XD Group

- JSHP Transformer / Huapeng

- Baoding Tianwei Baobian

- Sunten Electric Equipment

- CHINT Group

- Shandong Taikai Power Engineering

- Huapeng Transformer

- ABB / Hitachi Energy

- Others

Recent Developments in China Transformer Market

In June 2025, Hitachi Energy delivered HVDC equipment for the Gansu–Zhejiang ±800 kV UHVDC transmission project, supporting China’s cross-regional power highways and driving demand for advanced HVDC transformers and ultra-high-voltage grid infrastructure.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China transformer market based on the below-mentioned segments:

China Transformer Market, By Power Rating

- Large

- Medium

- Small

China Transformer Market, By End-User

- Power Utilities

- Industrial

- Commercial

- Residential.

Frequently Asked Questions (FAQ)

-

Q: What is the China transformer market size?A: China Transformer Market is expected to grow from USD 13.7 billion in 2024 to USD 41.8 billion by 2035, growing at a CAGR of 10.67% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the massive electricity demand, rapid urbanization, and the strong government support through grid investment and energy transition policies.

-

Q: What factors restrain the China transformer market?A: Constraints include the intense price competition driven by state-led tenders, intellectual property concerns, and varying technical standards across regions.

-

Q: How is the market segmented by power rating?A: The market is segmented into large, medium, and small.

-

Q: Who are the key players in the China transformer market?A: Key companies include TBEA Co., Ltd.; China XD Group; JSHP Transformer / Huapeng; Baoding Tianwei Baobian; Sunten Electric Equipment; CHINT Group; Shandong Taikai Power Engineering; Huapeng Transformer; Siemens; ABB / Hitachi Energy and others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?