China Smart TV Market Size, Share, By Resolution (4k UHD TV, HDTV, Full HD TV, 8K TV), By Operating System (Android TV, Tizen, WebOS, Roku, and Others), By Screen Shape (Flat, Curved), and China Smart TV Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsChina Smart TV Market Insights Forecasts to 2035

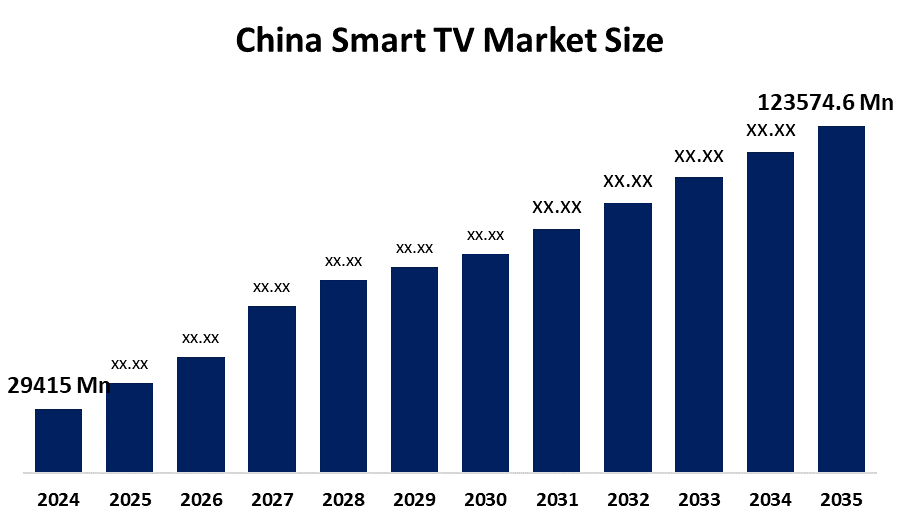

- China Smart TV Market Size 2024: USD 29415.2 Mn

- China Smart TV Market Size 2035: USD 123574.6 Mn

- China Smart TV Market CAGR: 13.94%

- China Smart TV Market Segments: Resolution, Operating System, and Screen Shape

Get more details on this report -

The manufacturing, distribution, and consumption of televisions with internet connectivity and cutting-edge technologies like streaming apps, AI-based interfaces, and smart home integration are all included in the China smart TV market. It comprises several operating systems Android TV, Tizen, WebOS, Roku, screen types (flat and curved), and screen resolutions HD, Full HD, 4K, 8K. The market has grown rapidly as customers use large-screen, high resolution, feature rich smart TVs for entertainment and connectivity due to increased disposable incomes, urbanization, and shifting lifestyles.

In order to assist the electronics and smart home industries, the Chinese government has launched a number of efforts. These include laws that encourage local manufacture and R&D in display technologies, subsidies for technological innovation, and promotion of IoT ecosystem integration. These steps aim to boost China’s position in the global consumer electronics market while upholding quality and security standards.

Technological improvements are altering the industry, with breakthroughs such as Mini LED and OLED displays, AI powered picture enhancement, high dynamic range HDR and smart voice controls. Additionally, the deployment of IoT integration, cloud-based streaming platforms, and digital ecosystems boosts user experience, efficiency, and interconnectivity, driving long-term market growth.

Market Dynamics of the China Smart TV Market:

The China smart TV market continues to grow fast as rising disposable incomes, rapid urbanization, and expanding digital lifestyles fuel high consumer demand for innovative home entertainment solutions. Key factors include the growing popularity of large-screen displays, greater resolutions like 4K and 8K, and integrated smart features like AI voice control, video streaming, and IoT connectivity. Smart TVs are now more accessible and reasonably priced in China's urban and developing rural markets due to the growth of contemporary retail channels and e commerce platforms.

However, the market is constrained by factors including fierce price competition between domestic and foreign firms, which puts pressure on margins. Wider adoption among price-conscious consumers may be slowed by fragmented consumer preferences and the exorbitant cost of cutting-edge technologies like 8K displays and sophisticated AI functions. In a highly competitive industry, supply chain limitations and component pricing changes can present operational issues.

The market offers substantial prospects in spite of these difficulties. Demand for next-generation smart TVs is being driven by ongoing advancements in display technologies (such as QLED, OLED, and Mini-LED), the growth of 5G and broadband infrastructure, and integration with smart home platforms. It is anticipated that strategic alliances, mergers, and partnerships like the Sony-TCL joint venture will change the dynamics of competition and open up new growth opportunities. In the upcoming years, the market will continue to grow due to the growing demand for localized smart features and premium content offerings.

China Smart TV Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 29415.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 13.94% |

| 2035 Value Projection: | USD 123574.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Resolution, By Screen Shape |

| Companies covered:: | Hisense Group,Sony,Xiaomi Corporation,Skyworth Group,Coocaa Skyworth subsidiary,Haier Consumer Electronics Group,Konka Group,Changhong Group,Huawei And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The China smart TV market share is classified into resolution, operating system, and screen shape

By Resolution:

On the basis of resolution, the China smart TV market is categorized into 4k UHD TV, HDTV, Full HD TV, 8K TV. Among these, the 4k UHD TV segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. This dominance is driven by declining costs, better image quality, growing 4K content availability, and robust consumer demand for improved home entertainment experiences

By Operating System:

Based on the operating system, the China smart TV market is divided into Android TV, Tizen, WebOS, Roku, and others. Among these, the Android TV segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. This dominance is attributed to its robust app ecosystem, easy connection with Google services, and widespread use by top TV brands. Consumer preference is further enhanced by its adaptability, frequent software updates, and compatibility for localized Chinese content.

By Screen Shape:

The China smart TV market is classified by screen shape into flat and curved. Among these, the flat segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to its affordability, wider availability across screen sizes, better wall-mount compatibility, and strong consumer preference for practical home entertainment solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China smart TV market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Smart TV Market:

- Hisense Group

- Sony

- Xiaomi Corporation

- Skyworth Group

- Coocaa (Skyworth subsidiary)

- Haier Consumer Electronics Group

- Konka Group

- Changhong Group

- Huawei

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Frequently Asked Questions (FAQ)

-

1. What is the current and projected size of the China smart TV market?The market was valued at USD 29,415.2 million in 2024 and is expected to reach USD 123,574.6 million by 2035, growing at a CAGR of 13.94% during the forecast period.

-

2. What factors are driving the growth of the China smart TV market?Key drivers include rising disposable incomes, urbanization, increasing demand for large-screen and high-resolution TVs, advanced smart features such as AI voice control and IoT integration, and growing accessibility through e-commerce and modern retail channels

-

3. Who are the key players in the China smart TV market?Major companies include Hisense Group, Sony, Xiaomi Corporation, Skyworth Group, Coocaa, Haier, Konka, Changhong, Huawei, and others.

-

4. What opportunities exist in the China smart TV market?Opportunities include growth in premium and large-screen TVs, OLED/Mini-LED displays, AI-enabled features, smart home integration, and expansion of localized content and cloud-based streaming services.

Need help to buy this report?