China Serviced Apartment Market Size, Share, By Type (Long-Term, Short-Term), By End Use (Corporate/Business Traveller, Leisure Travelers), China Serviced Apartment Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingChina Serviced Apartment Market Insights Forecasts to 2035

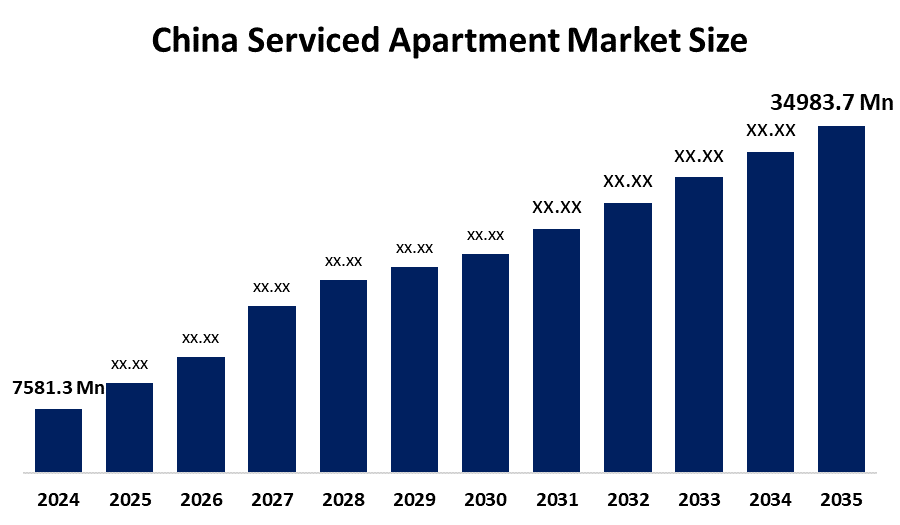

- China Serviced Apartment Market Size 2024: USD 7581.3 Mn

- China Serviced Apartment Market Size 2035: USD 34983.7 Mn

- China Serviced Apartment Market CAGR 2024: 14.91%

- China Serviced Apartment Market Segments: Type and End-Use

Get more details on this report -

The China Serviced Apartments Market Size is a large and steadily expanding sector, which is driven by the rapid urbanization, corporate mobility, and the rising demand for flexible long-stay accommodation from expatriates, business travelers, and the relocating professionals. The market is transitioning from traditional extended-stay housing toward premium, smart, and lifestyle-oriented serviced apartments featuring digital access, integrated property management systems, and personalized services the strong governmental monitoring of the real estate industry, significant financial investment, and fierce competition between institutional investors, foreign hospitality brands, and local developers are its defining characteristics. Additionally, China’s serviced apartments market benefits from large-scale property development capabilities, growing mixed-use urban projects, and increasing integration with co-living concepts, sustainability standards, and smart-city infrastructure under a distinctive regulatory and economic framework.

China’s serviced apartment market is expanding steadily, supported by urbanization and corporate mobility. Government data show China’s urbanization rate reached 66.2% in 2023 (National Bureau of Statistics), boosting demand for flexible long-stay housing. Commercial serviced apartments benefit indirectly from rental-housing reforms, smart-city development, and foreign investment inflows.

The China serviced apartment market is witnessing strong growth, which is driven by the rapid urbanization, rising business travel, and increasing demand for flexible long-stay accommodation from expatriates, corporate employees, and relocating professionals. With the help of contactless services, digital property management, and sustainable building designs, the industry is moving away from typical extended-stay housing and toward high-end, smart, and lifestyle-focused serviced apartments. High-end and mid-scale serviced apartments incorporated into mixed-use projects and urban business districts, as well as collaborations between local developers and international hospitality brands, are showing promise for growth the key trends include smart-home integration, co-living concepts, and ESG-aligned construction, supported indirectly by government policies promoting rental housing stability, urban renewal, and talent attraction, despite ongoing real estate financing constraints.

China Serviced Apartment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7581.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 14.91% |

| 2035 Value Projection: | USD 34983.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By End Use |

| Companies covered:: | Base Apartment Group, Lanson Place Hospitality, Stanford Residences (K. Wah Group), IFC Residence (Sun Hung Kai Properties), The Ascott Limited, Frasers Hospitality, Oakwood, Marriott International, Inc., Shama, Jinqiao Incorporated Company, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Serviced Apartment Market

The China serviced apartments market is driven by rapid urbanization, rising corporate mobility, and increasing demand for flexible long-stay accommodation from expatriates, business travelers, and relocating professionals. Strong government focus on urban renewal, rental-housing development, and smart-city initiatives is accelerating the shift from traditional extended-stay housing to high-quality, digitally enabled serviced apartments the industry is shifting toward higher-value services because to the growing acceptance of smart access systems, integrated property management platforms, and sustainability-oriented designs. China is increasingly positioning itself as a regional hub for serviced apartment development and operations, attracting investment from domestic real estate groups and international hospitality brands while expanding its presence across major Tier-1 and emerging Tier-2 cities.

The China serviced apartment market faces restraints such as intense price competition due to oversupply in major cities, regulatory restrictions on property use, and differing local policies across regions. High operating costs, rising labor expenses, and quality expectations from international tenant’s pressure margins, while limited talent in professional property management affects service consistency.

The future of China’s serviced apartment market appears strong, driven by continued urbanization, rising corporate and expatriate mobility, and growing demand for flexible, long-stay accommodation. Digital property management, smart-home features, and sustainability-focused designs are creating new growth opportunities. Additionally, government assistance for smart-city projects, urban regeneration, and rental-housing construction is enhancing asset utilization, operational effectiveness, and service quality. The market's long-term prospects will be further strengthened by partnerships between domestic developers and foreign hospitality brands, mixed-use developments, and expansion into Tier-2 and Tier-3 cities.

Market Segmentation

The China serviced apartment market share is classified into type and end-use.

By Type

The China serviced apartment market is divided by type into long-term, short-term. Among these, the short-term segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because it offers greater flexibility, convenience, and a more cost-effective alternative to hotels for transient needs.

By End-User

The China serviced apartment market is divided by end-user into corporate/business traveller, leisure travelers. Among these, the power utilities segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the serviced apartments are often more cost-effective for companies compared to traditional hotel bookings, which usually involve higher nightly rates for long durations.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the China serviced apartment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Serviced Apartment Market

- Base Apartment Group

- Lanson Place Hospitality

- Stanford Residences (K. Wah Group)

- IFC Residence (Sun Hung Kai Properties)

- The Ascott Limited

- Frasers Hospitality

- Oakwood

- Marriott International, Inc.

- Shama

- Jinqiao Incorporated Company

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the China serviced apartment market based on the below-mentioned segments:

China Serviced Apartment Market, By Type

- Long-Term

- Short-Term

China Serviced Apartment Market, By End-Use

- Corporate/Business Traveller

- Leisure Travelers.

Frequently Asked Questions (FAQ)

-

What is the China serviced apartment market size?China serviced apartment market is expected to grow from USD 7581.3 million in 2024 to USD 34983.7 million by 2035, growing at a CAGR of 14.91% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?What are the key growth drivers of the market?

-

What factors restrain the China serviced apartment market?Constraints include the intense price competition due to oversupply in major cities, regulatory restrictions on property use, and differing local policies across regions.

-

Constraints include the intense price competition due to oversupply in major cities, regulatory restrictions on property use, and differing local policies across regions.The market is segmented into long-term, short-term.

-

Who are the key players in the China serviced apartment market?Key companies include Base Apartment Group, Lanson Place Hospitality, Stanford Residences (K. Wah Group), IFC Residence (Sun Hung Kai Properties), The Ascott Limited, Frasers Hospitality, Oakwood, Marriott International, Inc., Shama, Jinqiao Incorporated Company.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?