China Reverse Osmosis Membrane Market Size, Share, By Type (Thin-Film Composite Membranes and Cellulose-Based Membranes), By Application (Industrial Water Treatment, Desalination, Residential Water Purification, and Others), And India Reverse Osmosis Membrane Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsChina Reverse Osmosis Membrane Market Size Insights Forecasts to 2035

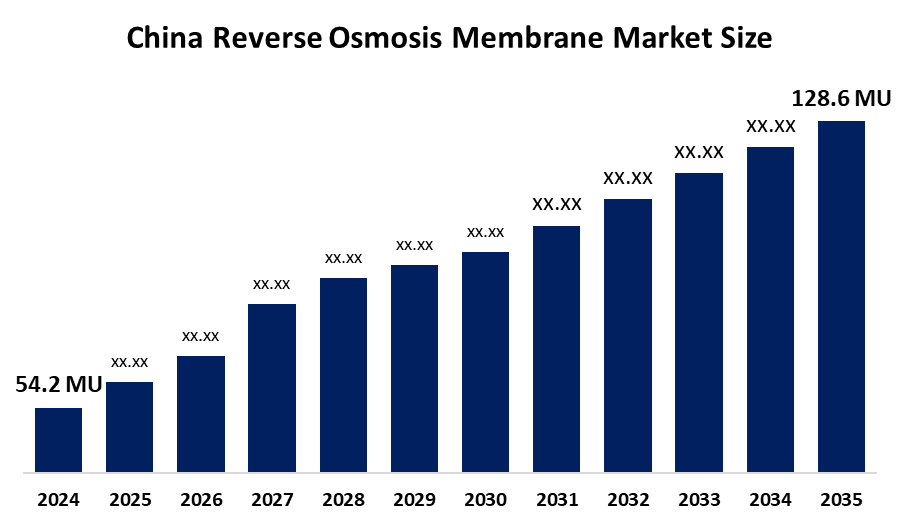

- China Reverse Osmosis Membrane Market Size 2024: 54.2 Million Units

- China Reverse Osmosis Membrane Market Size 2035: 128.6 Million Units

- China Reverse Osmosis Membrane Market Size CAGR 2024: 8.17%

- China Reverse Osmosis Membrane Market Size Segments: Type and Application

Get more details on this report -

The China Reverse Osmosis (RO) Membrane Market Size operates as a market for membrane technologies, which enable seawater desalination and the treatment of brackish water and industrial water, because of increasing water demand and the construction of large desalination plants and the execution of government water sustainability initiatives.

Toray Industries introduced the TLF-400ULD reverse osmosis membrane to the market during the last months of 2025. This product serves global markets but maintains strong importance for China's industrial reverse osmosis sector, which will receive local distribution after its domestic market competition intensifies.

The Chinese government allocated more than RMB 26 billion, approximately 3.6 billion US dollars, to water pollution control measures during the 2024 fiscal year.

China's Reverse Osmosis Membrane Market Size will experience future growth through the establishment of new desalination facilities, domestic membrane manufacturing, energy-efficient technologies and expanded industrial and municipal wastewater recycling initiatives.

China Reverse Osmosis Membrane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 54.2 Million Units |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.17% |

| 2035 Value Projection: | 128.6 Million Units |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Vontron Technology Co., Ltd., Beijing Originwater Technology Co., Ltd., Keensen Technology Co., Ltd., Hunan Keensen Technology Co., Ltd., Suzhou Runmo Water Treatment Technology Co., Ltd., Bluestar (Hangzhou) Membrane Technology Co., Ltd., Shanghai Cm Environmental Technology Co., Ltd., Jiuwu Hi-Tech Co., Ltd., Suntar Environmental Technology Co., Ltd., Hid Membrane Co., Ltd., Tianjin Motimo Membrane Technology Co., Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Reverse Osmosis Membrane Market Size:

The China Reverse Osmosis Membrane Market Size is driven by rapid industrialization, growing municipal water demand, and severe water scarcity, supported by government initiatives promoting seawater desalination, wastewater reuse, and zero liquid discharge policies, along with rising investments in advanced water treatment infrastructure and domestic membrane manufacturing.

The China Reverse Osmosis Membrane Market Size is restrained by the high initial installation and replacement costs, membrane fouling and maintenance challenges, energy-intensive operations, and price competition from low-cost domestic suppliers, affecting profit margins.

The future of China's Reverse Osmosis Membrane Market Size is bright and promising, with the rising desalination capacity, stricter water reuse regulations, continued government support for domestic membrane innovation, and growing demand from industrial and municipal water treatment sectors.

Market Segmentation

The China Reverse Osmosis Membrane Market Size share is classified into type and application.

By Type:

The China Reverse Osmosis Membrane Market Size is divided by type into thin-film composite membranes and cellulose-based membranes. Among these, the thin-film composite membranes segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The thin-film composite membranes segment holds the largest share due to its superior durability in saline water conditions, cost-effectiveness, and high energy efficiency across industrial and residential applications. Additionally, increased investment in reverse osmosis systems further strengthens its market dominance compared to other membrane types.

By Application:

The China Reverse Osmosis Membrane Market Size is divided by application into industrial water treatment, desalination, residential water purification, and others. Among these, the industrial water treatment segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The industrial water treatment segment leads the market due to stringent wastewater discharge regulations, rising demand for high-purity water in manufacturing processes, and the growing need for water recycling solutions amid severe water scarcity in China.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China Reverse Osmosis Membrane Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Reverse Osmosis Membrane Market Size:

- Vontron Technology Co., Ltd.

- Beijing Originwater Technology Co., Ltd.

- Keensen Technology Co., Ltd.

- Hunan Keensen Technology Co., Ltd.

- Suzhou Runmo Water Treatment Technology Co., Ltd.

- Bluestar (Hangzhou) Membrane Technology Co., Ltd.

- Shanghai Cm Environmental Technology Co., Ltd.

- Jiuwu Hi-Tech Co., Ltd.

- Suntar Environmental Technology Co., Ltd.

- Hid Membrane Co., Ltd.

- Tianjin Motimo Membrane Technology Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- Applicationrs

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Reverse Osmosis Membrane Market Size based on the below-mentioned segments:

China Reverse Osmosis Membrane Market Size, By Type

- Thin-Film Composite Membranes

- Cellulose-Based Membranes

China Reverse Osmosis Membrane Market Size, By Application

- Industrial Water Treatment

- Desalination

- Residential Water Purification

- Others

Frequently Asked Questions (FAQ)

-

What is the China Reverse Osmosis Membrane Market Size?China Reverse Osmosis Membrane Market Size is expected to grow from 54.2 million units in 2024 to 128.6 million units by 2035, growing at a CAGR of 8.17% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rapid industrialization, growing municipal water demand, and severe water scarcity, supported by government initiatives promoting seawater desalination, wastewater reuse, and zero liquid discharge policies, along with rising investments in advanced water treatment infrastructure and domestic membrane manufacturing.

-

What factors restrain the China Reverse Osmosis Membrane Market Size?Constraints include the high initial installation and replacement costs, membrane fouling and maintenance challenges, energy-intensive operations, and price competition from low-cost domestic suppliers, affecting profit margins.

-

Who are the key players in the China Reverse Osmosis Membrane Market Size?Key companies include Vontron Technology Co., Ltd., Beijing Originwater Technology Co., Ltd., Keensen Technology Co., Ltd., Hunan Keensen Technology Co., Ltd., Suzhou Runmo Water Treatment Technology Co., Ltd., Bluestar (Hangzhou) Membrane Technology Co., Ltd., Shanghai Cm Environmental Technology Co., Ltd., Jiuwu Hi-Tech Co., Ltd., Suntar Environmental Technology Co., Ltd., Hid Membrane Co., Ltd., Tianjin Motimo Membrane Technology Co., Ltd. and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, Applicationrs, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?