China Radiation Oncology Market Size, Share, By Type (External Beam Radiation Therapy, Internal Radiation Therapy, and Systemic Radiation Therapy), By Technology (Intensity Modulated Radiation Therapy, Image-Guided Radiation Therapy, Stereotactic Body Radiation Therapy, Proton Therapy, and Others), By Application (Breast Cancer, Lung Cancer, Prostate Cancer, Head and Neck Cancer, Colorectal Cancer, and Others), and China Radiation Oncology Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareChina Radiation Oncology Market Size Insights Forecasts to 2035

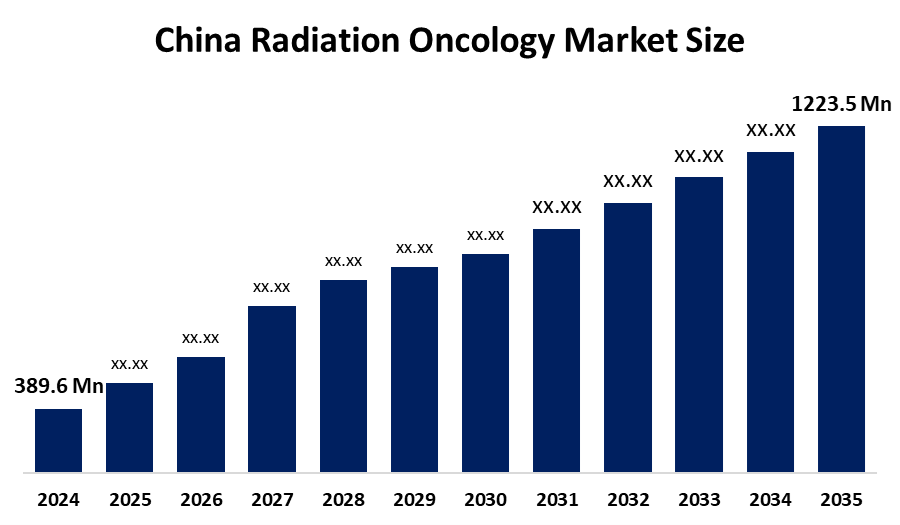

- China Radiation Oncology Market Size 2024: USD 389.6 Mn

- China Radiation Oncology Market Size 2035: USD 1223.5 Mn

- China Radiation Oncology Market CAGR: 10.96%

- China Radiation Oncology Market Segments: Type, Technology, and Application

Get more details on this report -

The market for Radiation Oncology in China, which focuses on using high-energy radiation to treat and manage cancer, is an important part of the nation's oncology care ecosystem. External beam radiation therapy, brachytherapy, and systemic radiation therapy are among the methods used in radiation oncology. These treatments can be used alone or in conjunction with chemotherapy and surgery. China's huge and aging population, rising cancer incidence, and growing desire for cutting-edge, minimally invasive cancer treatment options are all contributing factors to the market's continuous growth.

Government programs are essential to the expansion of the market. Under national healthcare reforms, the Chinese government has made cancer care a priority by boosting financing for oncology infrastructure, growing radiation departments in public hospitals, and promoting fair access to cancer treatment in both urban and rural areas. Adoption is further increased by policies that encourage the production of high-end medical equipment locally and include radiation procedures in public insurance plans.

To improve treatment accuracy and minimize side effects, China is quickly adopting precision radiotherapy technologies such IMRT, IGRT, and SBRT. Along with the integration of artificial intelligence for treatment planning and workflow efficiency, significant investments are also being made in proton and heavy-ion therapy facilities. The long-term expansion of the radiation oncology market in China is being propelled by favorable policies and swift technological advancements.

China Radiation Oncology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 389.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.96% |

| 2035 Value Projection: | 1223.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Technology |

| Companies covered:: | Varian Medical Systems, Elekta, Accuray Incorporated, Siemens Healthineers AG, IBA Worldwide, ViewRay, Inc., Hitachi, Ltd., Mevion Medical Systems, Shanghai United Imaging Healthcare, Shinva Medical Instrument Co., Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Radiation Oncology Market:

The growing demand for efficient treatment alternatives like radiotherapy is due to the increased incidence of cancer, especially in older populations. The advent of more accurate and effective equipment, such as image-guided radiation systems and linear accelerators, is one example of how technological advancements are improving treatment outcomes and promoting wider usage. The expansion of cancer hospitals, supportive healthcare reforms, and increased government investment in oncology infrastructure are all contributing to the growth.

However, there are significant obstacles to the market's widespread acceptance, such as the high initial and ongoing expenses of cutting-edge radiotherapy equipment, the scarcity of qualified radiation oncologists, and the unequal access to treatment in rural and lower-tier areas.

Despite these obstacles, there are significant opportunities due to the precision and proton treatment, which are becoming more widely used, more radiation systems are being manufactured locally, and more public-private partnerships are being formed to increase access to cancer care. Over the course of the projected period, these variables are anticipated to generate significant growth potential. AI integration for treatment planning and workflow efficiency, as well as more public-private collaborations and patient education to enhance radiation awareness and uptake.

Market Segmentation

The China radiation oncology market share is classified into type, technology, and application.

By Type:

On the basis of type, the China radiation oncology market is categorized into external beam radiation therapy, internal radiation therapy, and systemic radiation therapy. Among these, the external beam radiation segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. Due to its high precision, non-invasiveness, and ability to treat a wide range of malignancies, EBRT is widely used in hospitals and cancer treatment facilities. EBRT systems are progressively incorporating cutting-edge technologies, including stereotactic body radiation therapy (SBRT), intensity-modulated radiation therapy (IMRT), and image-guided radiation therapy (IGRT), which greatly improve patient outcomes and treatment accuracy.

By Technology:

Based on technology, the China radiation oncology market is divided into intensity modulated radiation therapy, image-guided radiation therapy, stereotactic body radiation therapy, proton therapy, and others. Among these, the intensity modulated radiation therapy segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The dominance of IMRT is attributed to its capacity to administer extremely accurate radiation dosages while causing the least harm to nearby healthy tissues. Its widespread clinical acceptance, affordability as compared to cutting-edge modalities like proton therapy, and compatibility with the country's current linear accelerator infrastructure have all contributed to its rapid adoption throughout China.

By Application:

The China radiation oncology market is classified by application into breast cancer, lung cancer, prostate cancer, head and neck cancer, colorectal cancer, and others. Among these, the lung cancer segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This dominance of lung cancer is mainly driven by smoking, air pollution, and occupational exposure, is the primary factor driving the segment's domination. The need for sophisticated radiation oncology solutions has grown dramatically as a result of radiation therapy's critical role in the management of lung cancer, especially for incurable cases and patients requiring combined treatment approaches.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China radiation oncology market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Radiation Oncology Market:

- Varian Medical Systems

- Elekta

- Accuray Incorporated

- Siemens Healthineers AG

- IBA Worldwide

- ViewRay, Inc.

- Hitachi, Ltd.

- Mevion Medical Systems

- Shanghai United Imaging Healthcare

- Shinva Medical Instrument Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China radiation oncology market based on the following segments:

China Radiation Oncology Market, By Type

- External Beam Radiation Therapy

- Internal Radiation Therapy

- Systemic Radiation Therapy

China Radiation Oncology Market, By Technology

- Intensity Modulated Radiation Therapy

- Image-Guided Radiation Therapy

- Stereotactic Body Radiation Therapy

- Proton Therapy, and Others

China Radiation Oncology Market, By Application

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Others

Frequently Asked Questions (FAQ)

-

1. What is the China radiation oncology market?The China radiation oncology market focuses on the use of high-energy radiation therapies to treat and manage cancer. It includes technologies such as external beam radiation therapy, internal radiation therapy (brachytherapy), and systemic radiation therapy, used either alone or alongside surgery and chemotherapy.

-

2. What is the market size and growth rate of the China radiation oncology market?The market was valued at USD 389.6 million in 2024 and is projected to reach USD 1,223.5 million by 2035, growing at a CAGR of 10.96% during 2025–2035.

-

3. Which segment dominates the market by type?By type, external beam radiation therapy (EBRT) dominated the market in 2024 due to its non-invasive nature, high precision, and wide applicability across multiple cancer types.

-

4. Which technology holds the largest market share?Intensity-Modulated Radiation Therapy (IMRT) accounted for the largest market share in 2024, driven by its high accuracy, reduced damage to healthy tissues, and compatibility with existing linear accelerator infrastructure.

-

5. Which application segment leads the market?The lung cancer segment led the market in 2024, supported by China’s high lung cancer prevalence linked to smoking, air pollution, and occupational exposure.

Need help to buy this report?