China Processed Meat Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Poultry, Pork, Beef, Mutton & Goat, and Others), By End-User (Food Processing Industry, HoReCa/Food Service, and Retail/Household), and China Processed Meat Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesChina Processed Meat Market Size Insights Forecasts to 2035

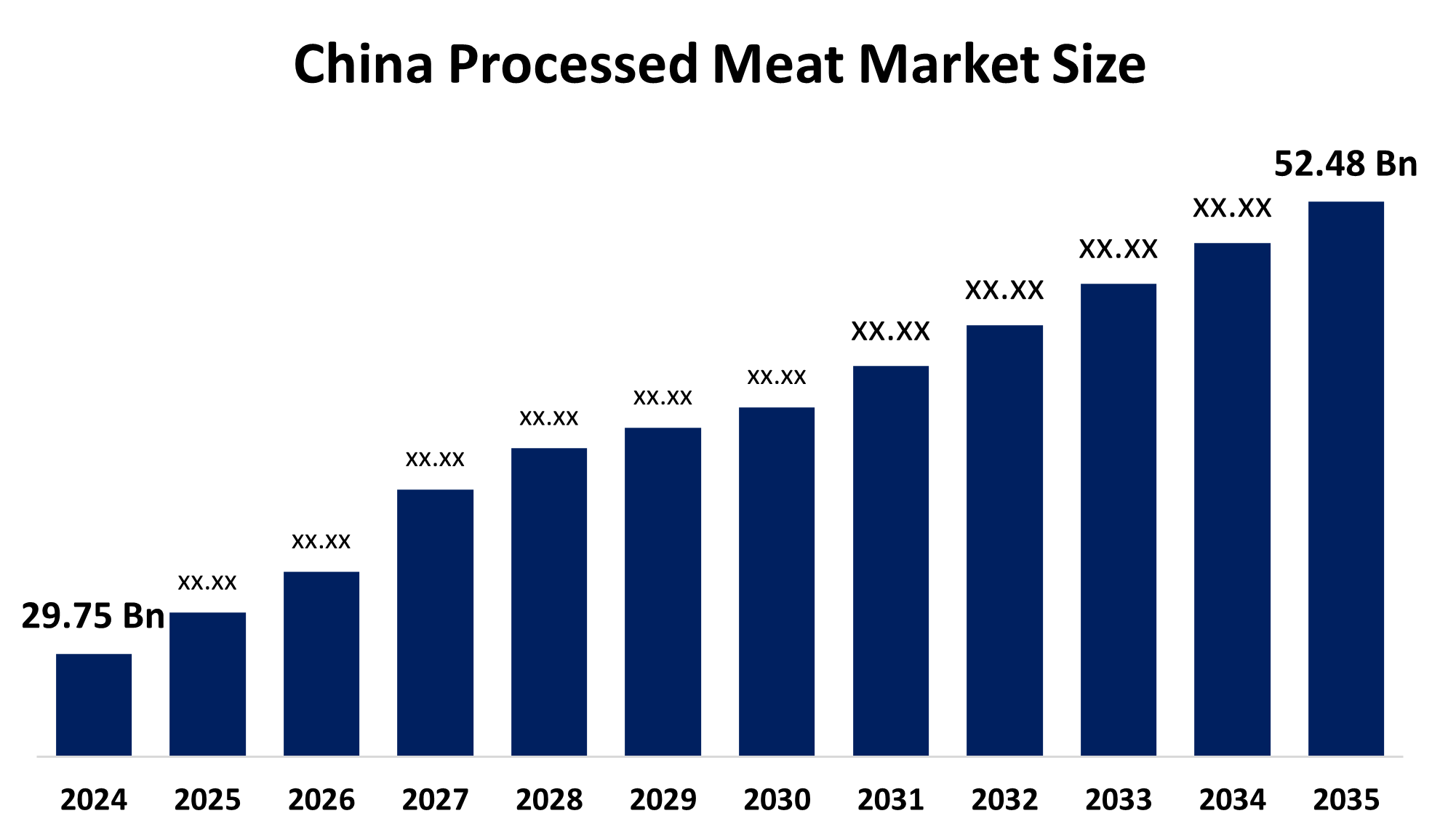

- The China Processed Meat Market Size Was Estimated at USD 29.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.3% from 2025 to 2035

- The China Processed Meat Market Size is Expected to Reach USD 52.48 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The China Processed Meat Market Size is Anticipated to Reach USD 52.48 Billion by 2035, Growing at a CAGR of 5.3% from 2025 to 2035. The processed meat market in China is driven by rising demand for ready-to-eat protein snacks among urban millennials, domestic brand premiumisation targeting lower-tier cities, and the government's push for cold chain infrastructure expansion.

Market Overview

The China Processed Meat Market involves production, distribution, and consumption of cured, smoked, or ready-to-eat meat products like sausages, ham, and bacon. The Chinese processed meat market applies to chilled and frozen pork/beef, snack foods, ready-to-eat/cook meals, and institutional catering. The market is growing due to rising demand for ready-to-eat protein snacks among urban millennials, domestic brand premiumisation targeting lower-tier cities, and the government's push for cold chain infrastructure expansion.

Opportunities in the China Processed Meat Market include the rising demand for ready-to-eat and convenience foods, expansion of retail and e-commerce channels, growth in restaurants and catering, product innovation (healthier or premium meats), and potential for exports to international markets. In June 2025, China authorized 106 U.S. meat-processing plants, 23 pork plants, and 83 poultry plants to export products.

Report Coverage

This research report categorizes the market for the China Processed Meat Market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China processed meat market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China processed meat market.

China Processed Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 29.75 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.3% |

| 2035 Value Projection: | USD 52.48 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product Type, By End-User |

| Companies covered:: | Tyson Foods, Inc., WH Group Limited, Hormel Foods Corporation, NH Foods Ltd., CHERKIZOVO GROUP, China Yurun Food Group Ltd., China Xiangtai Food Co., Ltd., Shandong Delisi Group Co., Ltd., Zhucheng Waimao Co. Ltd., and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The China Processed Meat Market is driven by urban millennials are increasingly driving demand for convenient, ready-to-eat protein snacks as fast-paced lifestyles reshape food consumption habits. At the same time, government initiatives to expand cold-chain infrastructure are strengthening supply reliability and reducing wastage. Domestic brands are moving toward premiumisation, especially while targeting growth opportunities in lower-tier cities. Innovations in fresh-food e-commerce logistics are cutting delivery costs and improving efficiency. Additionally, automation and AI adoption in slaughtering processes are enhancing yield, optimizing operations, and significantly lowering overall production costs.

Restraining Factors

The processed meat market in China is mostly constrained by repeated ASF outbreaks are disrupting pork supply, while stricter sodium and nitrate rules raise compliance burdens. Growing consumer preference for plant-based proteins is shifting demand, and carbon-neutral targets are increasing overall operating and regulatory costs.

Market Segmentation

The China processed meat market share is classified into product type and end-user.

- The poultry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The China Processed Meat Market is segmented by product type into poultry, pork, beef, mutton & goat, and others. Among these, the poultry segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to strong price competitiveness, shifting consumer preference toward leaner and healthier protein sources, and extensive versatility across processed formats such as nuggets and sausages. The category continues to gain traction. Its cost advantage over red meat, combined with efficient, high-speed production capabilities, supports scalable supply. These factors position it well to capture demand from health-conscious consumers and the rapidly expanding convenience food segment.

- The HoReCa /food service segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The China Processed Meat Market is segmented by end-user into the food processing industry, HoReCa /food service, and retail/household. Among these, the HoReCa /food service segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to the rapid expansion of chain restaurants and quick-service outlets, coupled with the strong growth of food delivery platforms. Increasing urbanization, rising disposable incomes, and busier consumer lifestyles have accelerated out-of-home dining frequency, supporting large-scale procurement of standardized processed meat products. Food service operators favor processed meat due to its longer shelf life, portion control, operational efficiency, and reduced wastage, all of which contribute to better cost management and margin stability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China Processed Meat Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tyson Foods, Inc.

- WH Group Limited

- Hormel Foods Corporation

- NH Foods Ltd.

- CHERKIZOVO GROUP

- China Yurun Food Group Ltd.

- China Xiangtai Food Co., Ltd.

- Shandong Delisi Group Co., Ltd.

- Zhucheng Waimao Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, Tyson Foods announced network optimization measures as part of restructuring its beef and processed meat business to improve long- term competitiveness.

- In March 2025, Smithfield Foods, a WH Group subsidiary, is boosting its focus on packaged meats, introducing innovations such as premium lunch meats and thicker smoked bacon. The company highlighted emphasizing expansion of its value-added product portfolio to meet growing consumer demand for convenient, high-quality protein options.

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Processed Meat Market based on the below-mentioned segments:

China Processed Meat Market, By Product Type

- Poultry

- Pork

- Beef

- Mutton & Goat

- Others

China Processed Meat Market, By End-User

- Food Processing Industry

- HoReCa/Food Service

- Retail/Household

Frequently Asked Questions (FAQ)

-

Q: What is the China processed meat market?A: The China processed meat market comprises all meat products that are processed for preservation, convenience, or value addition, including sausages, ham, bacon, nuggets, and ready-to-eat formats, serving retail, HoReCa/food service, and industrial food processing segments.

-

Q: What is the market size and expected growth of China’s processed meat market?A: The market is projected to grow from USD 29.75 billion in 2024 to USD 52.48 billion by 2035, registering a CAGR of 5.3% during 2025–2035. Growth is driven by convenience demand, urbanization, premiumisation, and the expansion of cold-chain infrastructure.

-

Q: What government initiative is supporting the growth of the China processed meat market?A: The Chinese government is supporting market growth by promoting cold-chain infrastructure expansion. This improves supply reliability, reduces food wastage, and enhances the efficiency of distribution networks, particularly for chilled and frozen processed meat products across urban and lower-tier cities.

-

Q: What are the market opportunities in China processed meat market?A: Opportunities include rising demand for ready-to-eat convenience foods, expansion of retail and e-commerce distribution channels, and product innovation such as healthier or premium meat options. These factors enable market players to capture growing consumer preferences and urban demand.

-

Q: What are the growth drivers of China processed meat market?A: Growth is supported by the adoption of automation and AI in slaughtering processes, which optimize operations and reduce costs, alongside innovations in fresh-food e-commerce logistics that lower delivery expenses, improve efficiency, and strengthen the overall supply chain for processed meats.

Need help to buy this report?