China Premium Bottled Water Market Size, Share, By Product (Spring Water, Sparkling Water, Mineral Water, and Others), By Distribution Channel (Supermarkets, Hypermarkets, Specialty Stores, Online, and Others), By End User (Household Consumption, Commercial Institutional, and Others), and China Premium Bottled Water Market Industry Trend, Forecasts to 2035

Industry: Consumer GoodsChina Premium Bottled Water Market Insights Forecasts to 2035

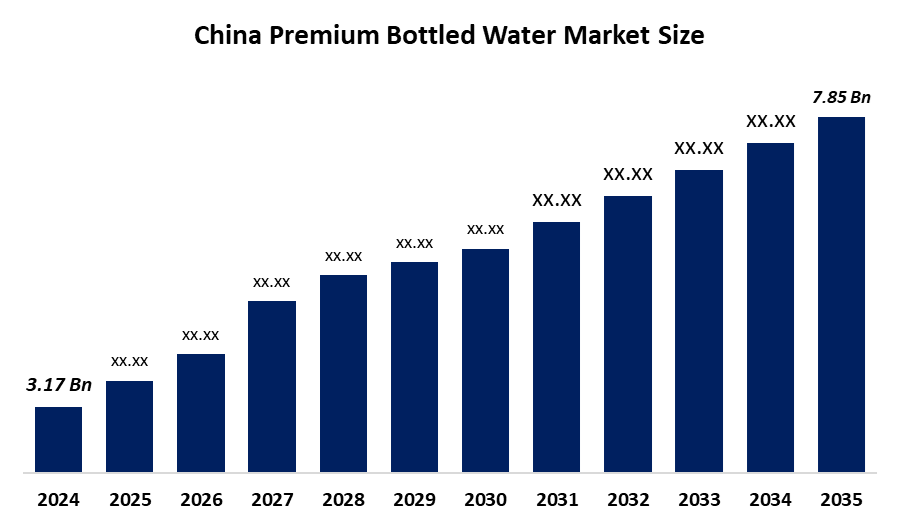

- China Premium Bottled Water Market Size 2024: USD 3.17 Billion

- China Premium Bottled Water Market Size 2035: USD 7.85 Billion

- China Premium Bottled Water Market CAGR 2024: 8.59%

- China Premium Bottled Water Market Segments: Product, Distribution Channel, and End User.

Get more details on this report -

The premium bottled water segment in China includes premium priced packaged drinking water, marketed as high quality, pure, and having a strong brand image. The products sold are often spring, mineral, glacier and imported bottled waters packaged in glass or molded PET bottles. Demand is created by urban consumers, gifting habits, the hospitality industry, health consciousness and consumers who want a better tasting and safer option for hydration every day. The growth in the Chinese market for premium bottled water is fueled by an increase in disposable incomes, particularly in large cities, where consumers are willing to pay a higher price for quality and safety. Another major reason for the growth of the premium bottled water market is health awareness, as consumers in China are preferring natural mineral and spring water over other sweet beverages.

China supports the premium bottled water sector through tighter drinking water safety rules, licensing of natural spring sources, and regular quality inspections. Recycling mandates and plastic reduction campaigns also encourage eco friendly packaging, helping trusted brands stand out while reassuring consumers about purity and environmental responsibility.

Premium bottled water in China increasingly represents lifestyle choices over basic hydration needs for consumers. The majority of consumers select bottled water based on its mineral composition, geographic location of origin, and the narrative behind the brand that produces it. Elegant packaging, small size and convenience of the bottle, and limited editions available as gifts are popular choices, and online marketplaces and cafes are becoming more likely to sell high end domestic and imported bottled water.

Market Dynamics of the China Premium Bottled Water Market:

The growth of urban consumer incomes has fueled an increase in the bottled water business due to this demographic's high per capita consumption of products that are regarded as healthy and safe to consume. Historically, consumers viewed bottled water as an inferior source of hydration when compared to tap water. However, as bottled water has transitioned to be regarded as a superior source of hydration by parents for their children, as well as when travelling, many additional factors have contributed to the continued growth of the bottled water business, including: fitness trends, dining out trends, gift giving cultures and others. Not to mention that the appeal of bottled water has been magnified by packaging, branding and other promotional activities creating a status symbol or lifestyle icon associated with bottled water.

The premium price of bottled water as a daily product is holding back sales in the industry. Some consumers are returning to cheaper alternatives like bottled and filtered water due to these high costs and the increased social consciousness of plastic waste particularly amongst younger consumers. Additionally, there is increased competition for sales by domestic brands and private label products which have kept the price of bottled water sales low improved filtration systems at home further eliminate the need for high price purchases of bottled water.

With increased health consciousness levels, higher disposable incomes and a growing demand for both imported water and mineral water, China’s premium bottled water market is a strong growth area. Expansion of ecommerce and premium retail channels enables access to a wider audience. Urban middle, and upper-class consumers who seek quality and lifestyle products will be attracted to premium bottled water brands that use purity, natural source and sustainability as branding elements.

China Premium Bottled Water Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.17 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.59% |

| 2035 Value Projection: | USD 7.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | Nongfu Spring, China Resources C’estbon, Ganten, Tibet Glacier Mineral Water Co Ltd, Kunlun Mountains Mineral Water, Hangzhou Wahaha Group, Tingyi Cayman Islands Holding Corp, Evergrande Spring, Danone, Nestlé, and Other key players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The China premium bottled water market share is classified into product, distribution channel, and end user

By Product:

The China premium bottled water market is divided by product into spring water, sparkling water, mineral water, and others. Among these, the mineral water segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The mineral water segment leads due to strong consumer preference for natural mineral content, perceived health benefits, trusted source authenticity, and premium positioning. Rising disposable incomes and growing focus on quality drinking water further support its sustained market growth.

By Distribution Channel:

The China premium bottled water market is divided by distribution channel into supermarkets, hypermarkets, specialty stores, online, and others. Among these, the supermarkets, and hypermarkets segment is projected to hold the largest share during the forecast period. This dominance is driven by their extensive reach, strong consumer trust, and ability to provide high visibility for premium brands through dedicated shelf space and, enabling physical verification of products.

By End User:

The China Premium Bottled Water Market is divided by end user into household consumption, commercial institutional, and others. Among these, the household consumption segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Households lead because families increasingly avoid tap water due to safety concerns and prefer trusted premium brands for daily hydration. Rising income, health awareness, and at home consumption habits after the pandemic support repeat purchases. Bulk home delivery subscriptions, ecommerce availability, and demand for mineral and functional water further strengthen household demand, ensuring steady long-term growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China premium bottled water market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Premium Bottled Water Market:

- Nongfu Spring

- China Resources C'estbon

- Ganten

- Tibet Glacier Mineral Water Co Ltd

- Kunlun Mountains Mineral Water

- Hangzhou Wahaha Group

- Tingyi Cayman Islands Holding Corp

- Evergrande Spring

- Danone

- Nestlé

- Others

Recent Developments in China Premium Bottled Water Market:

In February 2025, Nongfu Spring introduced edible ice made from natural water, creating a new consumption format aimed at younger consumers and expanding product differentiation across convenience stores and modern retail outlets.

In December 2024, Nongfu Spring launched 380 ml changbai mountain natural mineral water in premium glass packaging, targeting high-end retail channels and strengthening brand positioning in China’s growing premium hydration segment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China premium bottled water market based on the below-mentioned segments:

China Premium Bottled Water Market, By Product

- Spring Water

- Sparkling Water

- Mineral Water

- Others

China Premium Bottled Water Market, By Distribution Channel

- Supermarkets

- Hypermarkets

- Specialty Stores

- Online

- Others

China Premium Bottled Water Market, By End User

- Household Consumption

- Commercial Institutional

- Others

Frequently Asked Questions (FAQ)

-

What is the size of the China premium bottled water market?China premium bottled water market is expected to grow from USD 3.17 billion in 2024 to USD 7.85 billion by 2035, growing at a CAGR of 8.59% during the forecast period 2025-2035.

-

What are the key growth drivers of the China premium bottled water market?The key growth drivers of the China premium bottled water market include increasing health awareness, rising disposable incomes, concerns over tap water quality, urbanization, lifestyle changes, expanding ecommerce and retail channels, product innovation like functional and glass packaged water, and growing demand from hospitality and gifting segments.

-

What factors restrain the China premium bottled water market?Key factors restraining the China premium bottled water market include high prices that limit consumer affordability, intense competition among brands, environmental concerns over plastic packaging, strict regulatory standards, rising production costs, and growing use of home water filtration systems.

-

Who are the key players in the China premium bottled water market?nongfu spring, china resources cestbon, ganten, tibet glacier mineral water co ltd, kunlun mountains mineral water, hangzhou wahaha group, tingyi cayman islands holding corp, evergrande spring, danone, and nestlé are the key companies operating in the China premium bottled water market.

-

Who are the target audiences for the China premium bottled water market?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Need help to buy this report?