China Precision Machining Market Size, Share, By Type (Milling Machining, Laser Machining, Electric Discharge Machining (EDM), Turning, Grinding, and Others), By Operations (Manual and CNC) China Precision Machining Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareChina Precision Machining Market Insights Forecasts to 2035

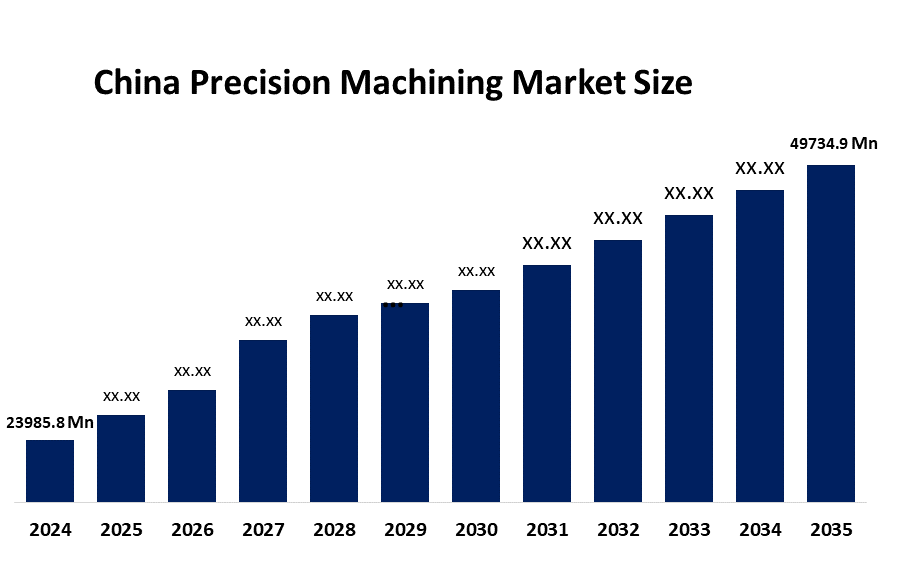

- China Precision Machining Market Size 2024: USD 23985.8 Million

- China Precision Machining Market Size 2035: USD 49734.9 Million

- China Precision Machining Market CAGR: 6.85%

- China Precision Machining Market Segments: Type and Operations

Get more details on this report -

The production of high-accuracy components utilizing techniques like milling, turning, grinding, EDM, and laser machining is part of the precision machining market in China. It supports vital sectors where precise tolerances and intricate geometries are crucial, such as automotive, aircraft, electronics, medical devices, and industrial equipment.

Through programs like "Made in China 2025" and the National Intelligent Manufacturing Strategy, the Chinese government is aggressively pushing advanced manufacturing and smart factories, boosting the use of CNC, automation, and robotics in precision machining. Industry growth is being driven by R&D-supporting policies, subsidies for high-tech equipment, and skill-development initiatives for sophisticated manufacturing workers.

Precision machining is changing in China thanks to technological advancements, including CNC machining, laser-assisted machining, AI-powered predictive maintenance, IoT-enabled smart factories, and 5-axis milling machines. Higher accuracy, quicker production, less waste, and real-time manufacturing process monitoring are made possible by these developments, which boost productivity and competitiveness in both domestic and foreign markets.

Market Dynamics of the China Precision Machining Market:

Growing demand from the automotive, aerospace, electronics, and industrial equipment industries is the main driver of the robust expansion of the precision machining market in China. High-precision, complicated component manufacture is made possible by the growing use of CNC and sophisticated milling equipment, which improves manufacturing productivity and shortens lead times. Precision machining technology adoption is being accelerated by growing investments in Industry 4.0, automation, and smart manufacturing.

However, the market is confronted with obstacles, including high upfront expenditures for sophisticated CNC equipment and a lack of skilled workers in highly specialized processes. For small and medium-sized businesses, fluctuating raw material prices, especially those of metals and alloys, can also have an impact on operating expenses and profit margins.

On the opportunity front, there is significant potential in developing advanced precision machining solutions integrating AI, IoT, and robotics to optimize production efficiency and predictive maintenance. Precision machining service providers have potential due to the increasing need for lightweight and high-performance components in medical devices, EVs, and aerospace. Additionally, increasing China's exports of precision-engineered parts to international markets may spur market expansion in the years to come.

China Precision Machining Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 23985.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.85% |

| 2035 Value Projection: | USD 49734.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Operations |

| Companies covered:: | Lens Technology Co., Ltd., Qinchuan Machine Tool & Tool Group Co., Ltd., Dalian Machine Tool Group Co., Ltd. (DMTG), Shenyang Machine Tool Co., Ltd., Ningbo Haitian Precision Machinery Co., Ltd., Neway CNC Equipment (Suzhou) Co., Ltd., RapidDirect, Star Rapid, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The China precision machining market share is classified into type and operations.

By Type:

On the basis of type, the China precision machining market is categorized into milling machining, laser machining, electric discharge machining (EDM), turning, grinding, and others. Among these, the milling machining segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. Because of its great adaptability and accuracy in creating intricate components with strict tolerances, the milling machining sector dominated the market in 2024. Furthermore, the growing application of CNC milling technology has improved cost-effectiveness, repeatability, and production efficiency, making it appropriate for both mass production and bespoke products.

By Operations:

Based on Operations, the China precision machining market is divided into manual and CNC. Among these, the CNC segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. This dominance is driven by the growing need for large-scale production, automation, and high precision in the automotive, aerospace, electronics, and industrial manufacturing industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China precision machining market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China Precision Machining Market:

- Lens Technology Co., Ltd.

- Qinchuan Machine Tool & Tool Group Co., Ltd.

- Dalian Machine Tool Group Co., Ltd. (DMTG)

- Shenyang Machine Tool Co., Ltd.

- Ningbo Haitian Precision Machinery Co., Ltd.

- Neway CNC Equipment (Suzhou) Co., Ltd.

- RapidDirect

- Star Rapid

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China precision machining market based on the following segments:

China Precision Machining Market, By Type

- Milling Machining

- Laser Machining

- Electric Discharge Machining (EDM)

- Turning, Grinding

- Others

China Precision Machining Market, By Operations

- Manual

- CNC

Frequently Asked Questions (FAQ)

-

1.What is the China precision machining market?The China precision machining market involves the production of high-accuracy components using techniques such as milling, turning, grinding, EDM, and laser machining. It serves industries like automotive, aerospace, electronics, medical devices, and industrial equipment, where precise tolerances and complex geometries are critical.

-

2.What was the market size of China precision machining in 2024?The market size was USD 23,985.8 million in 2024.

-

3.What is the expected China precision machining market size by 2035?It is projected to reach USD 49,734.9 million by 2035, growing at a CAGR of 6.85% during 2025–2035.

-

4.What are the key drivers of the China precision machining market?Rising demand from automotive, aerospace, electronics, and industrial sectors, the adoption of CNC and advanced milling machines for high-precision component production, investments in Industry 4.0, automation, and smart manufacturing are major drivers of the China precision machining market.

-

5.What technological advancements are shaping the China precision machining market?CNC machining, Laser-assisted machining, 5-axis milling machines, AI-powered predictive maintenance, and IoT-enabled smart factories.

-

1.What is the China precision machining market?The China precision machining market involves the production of high-accuracy components using techniques such as milling, turning, grinding, EDM, and laser machining. It serves industries like automotive, aerospace, electronics, medical devices, and industrial equipment, where precise tolerances and complex geometries are critical.

-

2.What was the market size of China precision machining in 2024?The market size was USD 23,985.8 million in 2024.

-

3.What is the expected China precision machining market size by 2035?It is projected to reach USD 49,734.9 million by 2035, growing at a CAGR of 6.85% during 2025–2035.

-

4.What are the key drivers of the China precision machining market?Rising demand from automotive, aerospace, electronics, and industrial sectors, the adoption of CNC and advanced milling machines for high-precision component production, investments in Industry 4.0, automation, and smart manufacturing are major drivers of the China precision machining market.

-

5.What technological advancements are shaping the China precision machining market?CNC machining, Laser-assisted machining, 5-axis milling machines, AI-powered predictive maintenance, and IoT-enabled smart factories.

Need help to buy this report?