China Prebiotics Market Size, Share, By Dosage Form (Powder, Liquid, Capsules, And Tablets), By Source (Plant-Based, Animal-Based, Microbial-Derived), By End Use (Food & Beverages, Pharmaceuticals, And Personal Care), By Application (Functional Foods, Dietary Supplements, Nutraceuticals, And Animal Feed), And China Prebiotics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareChina Prebiotics Market Insights Forecasts to 2035

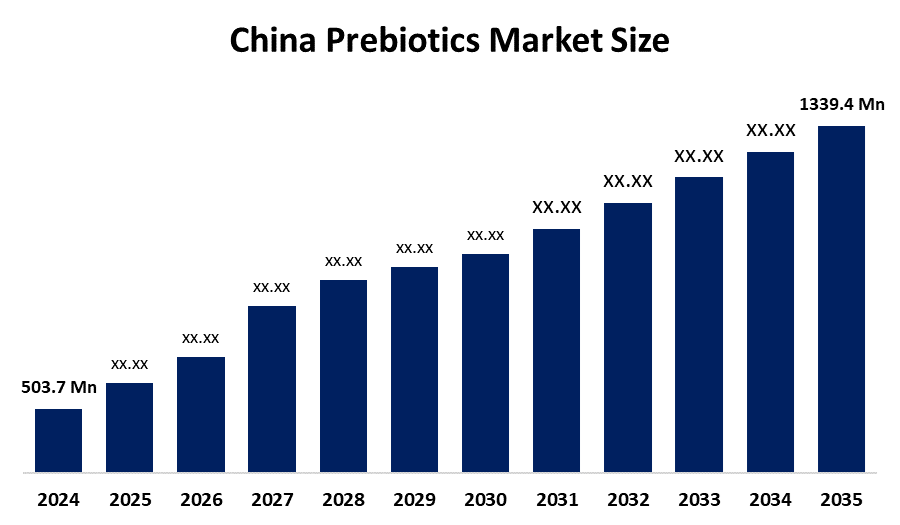

- China Prebiotics Market Size 2024: USD 503.7 Mn

- China Prebiotics Market Size 2035: USD 1339.4 Mn

- China Prebiotics Market CAGR 2024: 9.3%

- China Prebiotics Market Segments: Dosage Form, Source, End Use, and Application.

Get more details on this report -

The China prebiotics market includes all businesses that manufacture and distribute prebiotic ingredients and promote the growth of good bacteria in the colon. Many product categories have entered this space, including foods, drinks, dietary supplements, and functional nutrition products. The perception of prebiotics as necessary components of preventive nutrition and gut health strategies points to their importance to public health. With Chinese consumers becoming more health-conscious, prebiotics plays a crucial role in overall wellbeing. There is rapid increase in demand for prebiotic-enhanced products that are included in a person's diet on a daily basis. Factors driving this growth include growing income levels, increasing urbanisation, and the rapid increase of e-commerce platforms that have helped to make functional foods and supplements more available to the general population.

The prebiotics in China are backed by government support, including the Health and Nutrition Initiatives designed to improve public awareness of health and nutrition and to encourage the growth of the health food industry, including the functional food component, which includes functional foods containing bioactive ingredients, prebiotics. In the year 2024, approximately 30% of the Asia Pacific prebiotic market was attributed to China, demonstrating that a high degree of fortification with prebiotics within dairy and infant Products is indicative of an overall increase in acceptance within the Chinese probiotic market.

As technology advances, Chinese prebiotics support providers are now using new developments in extraction methods and formulation through ingredient stabilization techniques such as prebiotic delivery systems, have enhanced the functional usage of prebiotics, creating broader opportunities for their application across food categories and increasing the attractiveness of prebiotics, both to Chinese consumers as well as their suppliers.

China Prebiotics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 503.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.3% |

| 2035 Value Projection: | USD 1339.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Source, By Dosage Form, By End Use, By Application |

| Companies covered:: | Cargill, Incorporated, DSM-Firmenich, Kerry Group plc, International Flavors & Fragrances, Nestle S.A., Archer Daniels Midland Company, Roquette Freres, DuPont, Novonesis A/S, Tate & Lyle PLC, Angel Yeast Co., Ltd., BioGrowing Co., Ltd, Qingdao Vland Biotech Inc., Beijing Sunhy Group Co., Ltd., and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the China Prebiotics Market:

The China prebiotics market is driven by the increasing health awareness and safety among consumers, aging population, demand for prebiotic-enriched products that support gut health and wellness, rise in disposable Income levels, urbanisation and lifestyle changes, rise of e-commerce platforms for easier consumers access, technological advancements, and strong government support increasing the attractiveness of prebiotics market

The China prebiotics market is restrained by the high cost of raw materials, complex compliance requirements for regulatory safety and health claims, long time frame to gain product approval before, competition from other ingredients, and changing consumer preferences regarding taste, convenience and nutrition.

The future of China’s prebiotics market is bright and promising, with versatile opportunities emerging from the growing use of applications such as baby formula, fermented foods, healthy drinks, and tailored diets, as well as the combination of digital health information and microbiome studies in the development of new products creates opportunities for differentiated products and for businesses that will grow and sell overseas.

Market Segmentation

The China Prebiotics Market share is classified into dosage form, source, end use, and application.

By Dosage Form:

The China prebiotics market is divided by dosage form into powder, liquid, capsules, tablets. Among these, the powder segment holds the largest revenue market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Cost effective, versatile in incorporating into infant formula, used in various application, easy to consume, and ranging from dietary supplements to functional foods all contribute to the powder segment's largest share and higher spending on prebiotics when compared to other dosage form.

By Source:

The China prebiotics market is divided by source into plant-based, animal-based, and microbial-derived. Among these, the plant-based segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The plant-based segment dominates because of increasing consumer demand for natural, healthy, and clean-labelled products, food safety concerns among consumers, aging population, and rise of veganism and flexitarianism in China.

By End Use:

The China prebiotics market is divided by end use into food & beverages, pharmaceutical, and personal care. Among these, the food & beverages segment accounted for highest share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Urbanization and lifestyle changes, rise in health consciousness among consumers, strong influence from traditional fermented foods, and strategic product development by Chinese companies using prebiotics all contribute to the food & beverages segment's dominance and higher spending on prebiotics when compared to other end use.

By Application:

The China prebiotics market is divided by application into functional foods, dietary supplements, nutraceuticals, and animal feed. Among these, the dietary supplements segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dietary supplements segment dominates because of high consumer demand, aging population, strong consumer awareness of preventive healthcare, urbanization and lifestyle changes, and dominance of e-commerce which strongly influences purchasing decisions.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China prebiotics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in China Prebiotics Market:

- Cargill, Incorporated

- DSM-Firmenich

- Kerry Group plc

- International Flavors & Fragrances

- Nestle S.A.

- Archer Daniels Midland Company

- Roquette Freres

- DuPont

- Novonesis A/S

- Tate & Lyle PLC

- Angel Yeast Co., Ltd.

- BioGrowing Co., Ltd

- Qingdao Vland Biotech Inc.

- Beijing Sunhy Group Co., Ltd.

- Others

Recent Developments in China Prebiotics Market:

In September 2025, Junlebao Dairy Group and Jiangnan University established a Joint Innovation Center for prebiotics to focus on strain research, functional evaluation, and industrial applications.

In August 2025, Chayan Yuese launched its “Changyijun Series” of instant prebiotics, featuring six scientifically proven strains, including a patented Chinese strain, Bifidobacterium animalis sudsp. Lactis V9.

In April 2024, ADM announced that its spore-forming prebiotic DE111 (Bacillus subtilis) was officially approved as a new food ingredient by the National Health Commission in China.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical insights has segmented the China prebiotics market based on the below-mentioned segments:

China Prebiotics Market, By Dosage Form

- Powder

- Liquid

- Capsules

- Tablets

China Prebiotics Market, By Source

- Plant-Based

- Animal-Based

- Microbial-Derived

China Prebiotics Market, By End Use

- Food & Beverages

- Pharmaceuticals

- Personal Care

China Prebiotics Market, By Application

- Functional Foods

- Dietary Supplements

- Nutraceuticals

- Animal Feed

Frequently Asked Questions (FAQ)

-

Q: What is the China prebiotics market size?A: China prebiotics market is expected to grow from USD 503.7 million in 2024 to USD 1339.4 million by 2035, growing at a CAGR of 9.3% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing health awareness and safety among consumers, aging population, demand for prebiotic-enriched products that support gut health and wellness, rise in disposable Income levels, urbanisation and lifestyle changes, rise of e-commerce platforms for easier consumers access, technological advancements, and strong government support increasing the attractiveness of prebiotics market

-

Q: What factors restrain the China prebiotics market?A: Constraints include the high cost of raw materials, complex compliance requirements for regulatory safety and health claims, long time frame to gain product approval before, competition from other ingredients, and changing consumer preferences regarding taste, convenience and nutrition.

-

Q: How is the market segmented by dosage form?A: The market is segmented into powder, liquid, capsules, and tablets.

-

Q: Who are the key players in the China prebiotics market?A: Key companies include Cargill, Incorporated, DSM-Firmenich, Kerry Group plc, International Flavors & Fragrances, Nestle S.A., Archer Daniels Midland Company, Roquette Freres, DuPont, Novonesis A/S, Tate & Lyle PLC, Angel Yeast Co., Ltd., BioGrowing Co., Ltd, Qingdao Vland Biotech Inc., Beijing Sunhy Group Co., Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?