China Polyamide Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyamide 6, Polyamide 66, Bio-based Polyamide, Specialty Polyamides, and Others), By End Use (Engineering Plastics and Fibers), and China Polyamide Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingChina Polyamide Market Size Insights Forecasts to 2035

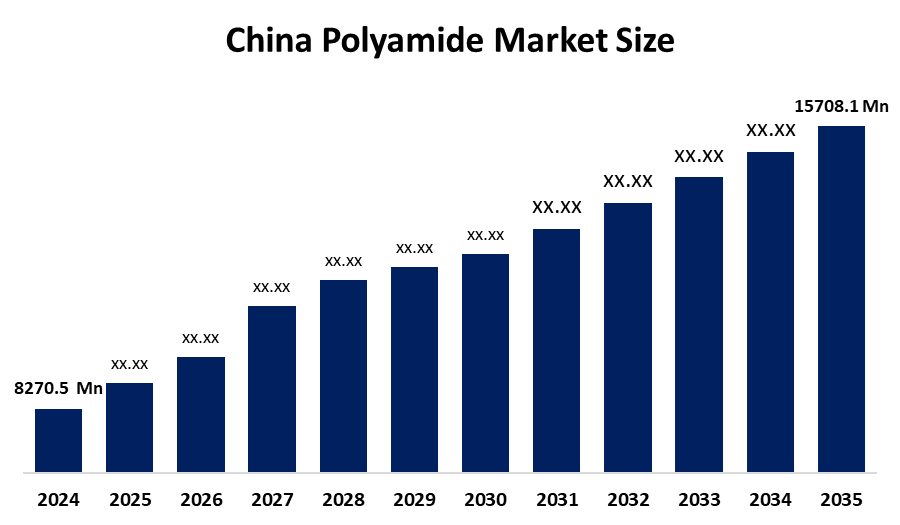

- The China Polyamide Market Size Was Estimated at USD 8,270.05 Million in 2024

- The China Polyamide Market Size is Expected to Grow at a CAGR of Around 6.01% from 2025 to 2035

- The China Polyamide Market Size is Expected to Reach USD 15,708.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The China Polyamide Market Size is anticipated to reach USD 15,708.1 million by 2035, growing at a CAGR of 6.01% from 2025 to 2035. The China Polyamide Market Size is driven by rising demand in the automotive, textile, and electronics industries; growth of electric vehicles and consumer electronics; and strong government support and technological advancements in high-performance and specialty polyamide materials.

Market Overview

The China Polyamide Market Size is an industry that deals with the manufacture, sale, and usage of polyamides. Polyamides are a class of high-performance polymers that are characterized by their mechanical strength, resistance to chemicals, and ability to withstand heat. The main uses of polyamides are automotive components, electrical and electronics parts, industrial machinery, textiles, and packaging materials, which are beneficial for lightweight and high-performance applications. The market includes engineering, grade, specialty, and bio-based polyamides and covers production of raw materials, compounding, processing, and application to final products, thus reflecting China's growing industrial and manufacturing base.

China’s adoption of the polyamide (PA) market is driven by its massive population of over 1.4 billion, rapidly expanding urbanization, and rising consumer demand for automobiles, electronics, and industrial products. The country produces over 25 million vehicles annually, with an increasing focus on electric and lightweight vehicles, creating high demand for polyamide-based components such as engine parts, wiring, and structural polymers. Additionally, growing production of textiles, consumer electronics, and industrial machinery requires durable, high-performance materials, highlighting the strategic importance of polyamides to support China’s industrial growth, efficiency, and technological advancement.

The Chinese government actively supports the polyamide industry through initiatives such as the Made in China 2025 plan, which promotes high-performance materials and advanced polymers for automotive, aerospace, and electronics applications. Funding programs such as the National Key R&D Program have allocated over CNY 3 billion (approximately USD 450 million) for polymer research, including engineering plastics and bio-based polyamides. Tax incentives, subsidies for domestic production facilities, and encouragement of industry–academia collaboration further drive innovation and commercialization. This combination of strong industrial demand, policy support, and sustained research funding positions China’s polyamide market as a high-growth, strategically important sector aligned with national economic development goals and global competitiveness.

Report Coverage

This research report categorizes the market for the China Polyamide Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the China Polyamide Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the China Polyamide Market Size.

China Polyamide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8270.05 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.01% |

| 2035 Value Projection: | USD 15708.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End Use |

| Companies covered:: | Zhejiang Huafon Nylon, Zhejiang Jinsheng New Materials, Xiamen Keyuan Plastic Co., Ltd., Zhejiang Cenway New Material Co., Ltd., Guangdong Xinhui Meida Nylon Co., Ltd., Sinopec Yizheng Chemical Fiber Co., Ltd., Jiangsu Junsheng Engineering Plastic Co., Ltd., Shenma Industrial Co., Ltd., Jiangsu Huayang Nylon Co., Ltd., Ascend Performance Materials, BASF SE, DuPont de Nemours, Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The China Polyamide Market Size is driven by strong demand from automotive, electronics, textile, and industrial sectors, supported by rapid urbanization and infrastructure development. Growth in electric vehicles, lightweight engineering plastics, and consumer electronics, along with government support under initiatives like Made in China 2025, rising domestic manufacturing capacity, and advancements in high-performance and bio-based polyamides, continues to accelerate market growth.

Restraining Factors

The China Polyamide Market Size is restrained by volatile raw material prices, particularly caprolactam and adipic acid, and high energy and production costs. Additionally, stringent environmental regulations, rising compliance costs, and intense competition leading to price pressure can limit profit margins and slow market growth.

Market Segmentation

The China Polyamide Market Size share is classified into product and end use.

- The polyamide 6 segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The China Polyamide Market Size is segmented by product into polyamide 6, polyamide 66, bio-based polyamide, specialty polyamides, and others. Among these, the polyamide 6 segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The polyamide 6 segment is growing because it offers excellent mechanical strength, flexibility, and cost-effectiveness compared to other polyamides. Its wide use in automotive components, textiles, electrical & electronics, and industrial applications, along with strong domestic production capacity and rising demand for lightweight and durable materials in China, drives its market dominance and growth.

- The fibers segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The China Polyamide Market Size is segmented by end use into engineering plastics and fibers. Among these, the fibers segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The fibers segment is growing because of strong demand from China’s large textile and apparel industry, where polyamide fibers are widely used for their high strength, elasticity, and abrasion resistance. Rising consumption of sportswear, functional textiles, industrial fabrics, and automotive textiles, along with growth in domestic manufacturing and exports, supports the dominance and continued growth of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the China Polyamide Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zhejiang Huafon Nylon

- Zhejiang Jinsheng New Materials

- Xiamen Keyuan Plastic Co., Ltd.

- Zhejiang Cenway New Material Co., Ltd.

- Guangdong Xinhui Meida Nylon Co., Ltd.

- Sinopec Yizheng Chemical Fiber Co., Ltd.

- Jiangsu Junsheng Engineering Plastic Co., Ltd.

- Shenma Industrial Co., Ltd.

- Jiangsu Huayang Nylon Co., Ltd.

- Ascend Performance Materials

- BASF SE

- DuPont de Nemours, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In November 2025, Evonik announced it had expanded its polyamides production capacity in China by doubling long-chain polyamides output at its Shanghai facility to better meet rising local demand for high-performance polymers in automotive, consumer goods, and energy applications.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China Polyamide Market Size based on the below-mentioned segments:

China Polyamide Market Size, By Product

- Polyamide 6

- Polyamide 66

- Bio-based Polyamide

- Specialty Polyamides

- Others

China Polyamide Market Size, By End Use

- Engineering Plastics

- Fibers

Frequently Asked Questions (FAQ)

-

1. What is the China Polyamide Market Size in 2024?The China Polyamide Market Size was estimated at USD 8,270.05 million in 2024.

-

2. What is the projected market size of the China Polyamide Market Size by 2035?The China Polyamide Market Size is expected to reach USD 15,708.1 million by 2035.

-

3. What is the CAGR of the China Polyamide Market Size?The China Polyamide Market Size is expected to grow at a CAGR of around 6.01% from 2024 to 2035.

-

4. What are the key growth drivers of the China Polyamide Market Size?The China Polyamide Market Size is driven by the high prevalence of gastrointestinal disorders, growing consumer awareness of digestive health, easy availability of over-the-counter antacid products, and an increase in lifestyle-related factors like unhealthy diets, stress, and alcohol consumption that trigger gastric acidity.

-

5. Who are the key players in the China Polyamide Market Size?Key companies include Zhejiang Huafon Nylon, Zhejiang Jinsheng New Materials, Xiamen Keyuan Plastic Co., Ltd., Zhejiang Cenway New Material Co., Ltd., Guangdong Xinhui Meida Nylon Co., Ltd., Sinopec Yizheng Chemical Fiber Co., Ltd., Jiangsu Junsheng Engineering Plastic Co., Ltd., Shenma Industrial Co., Ltd., Jiangsu Huayang Nylon Co., Ltd., Ascend Performance Materials, BASF SE, DuPont de Nemours Inc., and others.

-

6. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?